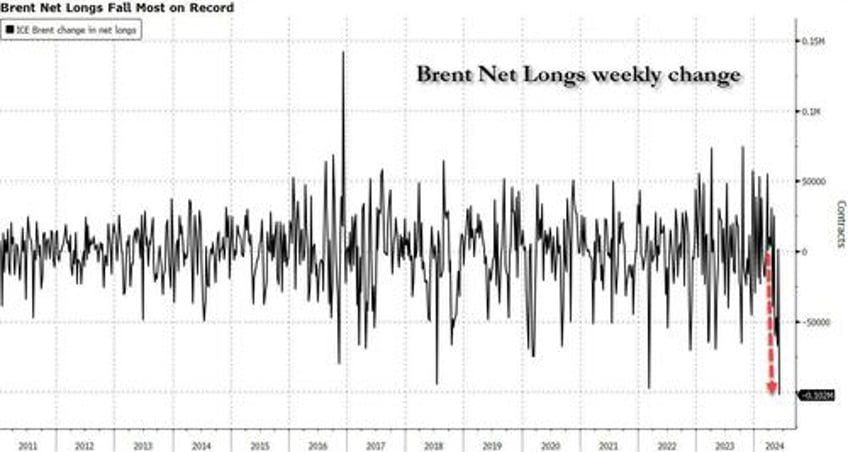

Two weeks ago we observed that with oil prices tumbling, a full-blown capitulation was taking place in the market as the weekly bullish bets on Brent had just plunged the most on record...

... which we said a was "a clear sign of the surge in bearish sentiment and the extent of the technical selling that pressured crude" and which we concluded signaled that "a price rebound was imminent."

We were right: oil proceeded to rip higher in the past two weeks, pushing Brent to $86, the highest since the fake Iran-Israel confrontation in April which ended with a whimper and quickly eliminated the fear of any geopolitical crisis from the oil market.

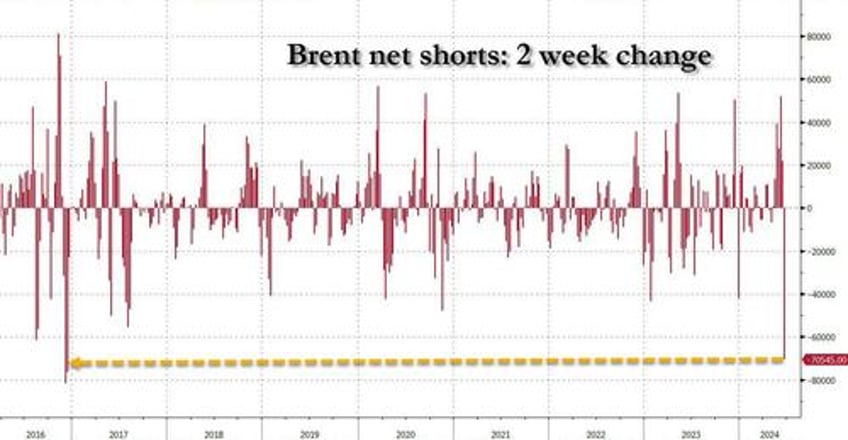

And as the price rose, so did the number of shorts who got steamrolled, and as shown in the next chart, two weeks after the biggest weekly drop in Brent net longs on record, we have just seen the biggest covering of Brent shorts in the past two weeks since 2016!

Money managers cut outright wagers against Brent by the most since 2020 for a second consecutive week, contributing to a big overall gain in net-long positions, just days after prevailing Wall Street consensus was that oil would proceed to plunge to $70 per barrel if not lower. As Bloomberg notes, several Brent spreads were again at the strongest levels since late April on Friday, but it was not just Brent: gasoil net longs jumped by the most on record last week.

And since narrative on the ever-so-clueless Wall Street is always dictated by price, the analyst commentary has flipped a U-turn and seemingly everyone is suddenly bullish, starting with Standard Chartered whose head of commodities research Paul Horsnell writes today in a note that “the rally has significantly further to run” as the oil market heads into a supply deficit of more than 2 million barrels a day in Aug. and Sept. Some more observations from Horsnell:

- “The market is now starting to react to the bullishness of the Q3 balances” while a continuation of inventory draws in 4Q and early 2025 has not been priced in

- “We expect the rally to continue, taking Brent above $90/bbl in early Q3”

- “The increase in demand towards its seasonal peak is the key driver of supply deficits”

- OPEC+’s plans to unwind latest layer of supply curbs from 4Q should result in a balanced market at the end of next year

- “However, should supply and demand conditions turn more bearish, we expect the rolling back of voluntary cuts to take place over a longer time-frame”

Others quickly piled on: here is Macquarie global oil and gas analyst Vikas Dwivedi who just raised his 3Q Brent price forecast to $86/bbl from $83, while WTI is seen at $81.50, up from $78.50 earlier

- Globally, refineries are set to increase processing rates by 2m b/d y/y in the third quarter, with US refineries bouncing back after completing one of longest and heaviest maintenance programs on record

- “Refineries have carried out heavy maintenance and are better prepared to keep running throughout the summer in a sustained manner”

- “The unplanned refinery outages are not expected to repeat with the frequency we’ve seen last year”

- The anticipated strength in the third quarter represents something of a last hurrah for the year

- The fourth quarter is looking gloomier, with OPEC+ poised to reverse its production cuts and US output expected to rise

Next is Sparta Commodities analyst Neil Crosby, who writes that European buying needs to be strong and sustained to keep the North Sea’s recent bullish pricing intact, or else BFOET premiums may have to cool a little

- Broader oil markets have gained on several factors including stronger US seasonal demand, geopolitical risk in the Middle East, a turnaround in managed money positions and expectations of 3Q tightness

- On the physical side, the tightening seems to be focused on the North Sea, leading to a substantial deterioration in arbs out of the region

- “Evidence suggests Brent might have gotten ahead of itself in the very short term and with Chinese crude buying still seemingly tepid”

Turning from Europe to China, OilChem writes that Chinese refiners and fuel suppliers are planning to export 3.19m tons of oil products in July, down from 3.72m tons in June

- Companies plan to export 670K tons of gasoline, -25% m/m; 650k tons of diesel, -9.7% m/m; 1.87m tons of kerosene, -8.3% m/m

Finally, Goldman's iuk abaktst Yulia Grigsby writes that "Brent crude prices continued their advance toward the higher end of our range-bound forecast, with the Q2 average coming in line with our $85/bbl forecast" as US-led strong summer traveling demand continues to support Brent as global jet demand hits a new post-pandemic high. Geopolitical concerns also remain on the market's radar as Houthi's attacks on Red Sea ships and drone attacks on Russia oil infrastructure intensified.

Here are several more reasons why Goldman is sticking with its bullish call for higher prices:

- Our OECD commercial stocks nowcast continues to draw but the pace of the draws has slowed.

- Global visible stocks decreased by 10mb week-on-week, and our tracking of global inventories continues to draw.

- The average crude basis and prompt timespreads both tightened last week.

- The US oil rig count decreased further last week to December 2021 levels.

- Oil net managed money positioning continued recovering last week but still remains at a low 11th percentile (calculated over the distribution since 2017).

- The Red Sea flows decreased by 1.5mb/d from early June high as Houthi's attacks on ships intensified.

- Exports by core OPEC countries have dropped significantly in recent weeks while domestic demand tends to pick up in the summer.

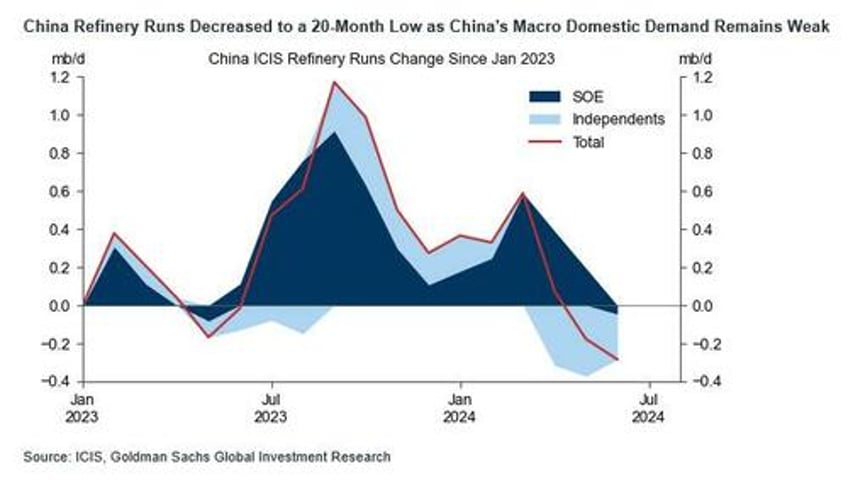

The final reason why Goldman remains rather bullish side is China. Here's why:

- While Brent timespreads tightened meaningfully over the last week and our tracking of global inventories continues to draw, our trackable net supply increased by 1mb/d week-on-week on Russia and Canada liquids supply beats.

- Our tracking of China oil demand continues to decline because refinery runs dropped to a 20-month low as China’s macroeconomic domestic demand remains weak.

And visually: