LVMH Moët Hennessy shares dropped in Paris trading Tuesday after the luxury conglomerate reported Q1 earnings that fell short of Bloomberg Consensus estimates. The miss was driven by softening demand for high-end goods in top markets such as Asia and the U.S., as a deepening trade war pressured consumer sentiment.

LVMH's first-quarter results served as a luxury gut-check for the industry, with a broad-based miss across segments and regions led by sliding demand in key markets, including China and the U.S. Fashion and Leather Goods — the group's growth engine — also stumbled, signaling concerns about a wider slowdown in the high-end consumer space.

Here's a summary of the first quarter results:

Red Flags:

Organic Revenue -3% vs. +1.1% est. (Bloomberg Consensus): A troubling miss, signaling a sharp deterioration in underlying business momentum.

China and U.S. Weakness:

Asia ex-Japan -11% vs. -4.69% est.

U.S. -3% vs. +1.19% est.

These are core markets for LVMH, and their underperformance is very concerning, especially given the exploding trade war in recent weeks.

Fashion & Leather Goods -5% vs. -0.55% est.: This is LVMH's crown jewel segment, and this large miss spooked investors.

Perfumes & Cosmetics -1% vs. +2.1% est. and Selective Retailing -1% vs. +3.69% est.: Both suggest consumers are dialing back on both essentials and discretionary luxury.

Geographic Weakness:

U.S. organic revenue -3%, estimate +1.19%

Asia excluding Japan organic revenue -11%, estimate -4.69%

Japan organic revenue -1%, estimate +4.32%

Europe organic revenue +2%, estimate +3.37%

Revenue Shortfall:

Total Revenue €20.31B vs. €21.14B est. (-1.9% y/y): This reflects how demand erosion is hitting the top line hard.

Fashion & Leather -3.6% y/y vs. €10.56B est.

Perfume & Cosmetics -0.2% y/y vs. €2.26B est.

Softening:

Wines & Spirits -9% vs. -4.49% est.

Watches & Jewelry flat vs. +2.4% est.: Avoided contraction, but still a miss in the context of expected growth.

Commenting on LVMH's first quarter report, Goldman analyst Natasha de la Grense told clients:

The key thing that stood out to me on LVMH's Q1 miss was that the company attributed most of the slowdown to comp effects i.e. Chinese spending in Japan and Sephora in the U.S. This means we haven't yet seen the impact of recent events upon the business. Consensus assumes an acceleration to +1% (from -5%) for F&L in Q2 which won't happen given 1) the April shock to confidence, wealth effects and transatlantic tourist flows; 2) the fact that the comp in Japan gets 25 ppts tougher; 3) the Yen has strengthened vs RMB. Management said U.S. cluster spending was positive in Q1 for F&L but conceded "April might be different". We suspect that was supported by U.S. tourist spending in Europe which has softened given recent USD weakening/anti-US sentiment. GSe F&L -8% in Q2.

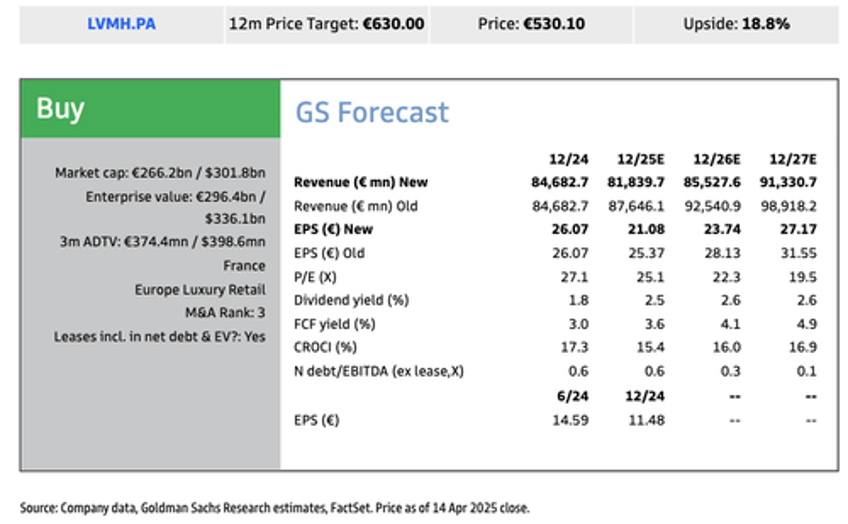

In a separate note, Goldman analysts Louise Singlehurst and others told clients that one key surprise in the earnings report was the "magnitude of the deterioration in the largest division, Fashion and Leather." She lowered her 12-month price target by 13% to 630 euros (from 725 euros).

Here's more from Singlehurst:

Valuation - PT lowered by 13% to PT €630 (from €725): We continue to use a DCF valuation methodology for LVMH (8.5% WACC, 3.0% LT growth; unchanged). Our price target decreases 13% which reflects (i) a -10% decrease in our long-term earnings and FCF forecasts and (ii) a -3% impact from FX. We acknowledge that the lack of visibility around the demand environment for high-end discretionary goods, coupled with the level of operational gearing (manufacturing, distribution) will likely weigh on investor appetite for the luxury peers in the current market backdrop. However, we remain Buy rated on LVMH as we continue to see the group ranking well versus the broader peer group in its ability to demonstrate market-share leadership, pricing power and scale benefits to support free cash flow performance in a tough macro environment.

More analyst commentary (courtesy of Bloomberg);

UBS (neutral, PT cut to €569 from €650)

Sales were much weaker than feared, driven by a strong Chinese deceleration, says analyst Zuzanna Pusz

Limited visibility and the high fixed cost nature of the business mean that the end of earnings downgrades is not yet in sight

Stifel (hold, PT €650)

Given magnitude of the first-quarter miss and negative implications for margins, analyst Rogerio Fujimori sees 2025 consensus earnings cut by a mid-single-digit percentage

Earnings visibility remains limited

Kepler Cheuvreux (buy, PT cut to €675 from €750)

LVMH's shortfall was broad-based, with notable weakness in fashion & leather goods and wines & spirits, analysts say

The slowdown is mainly due to softer Chinese spending abroad, especially in Japan, and weaker U.S. demand in aspirational categories

Deutsche Bank (hold, PT cut to €565 from €580)

It is now apparent that the fourth quarter was the anomaly for LVMH, says analyst Adam Cochrane, with slowdown in perfumes & cosmetics and Sephora greater than expected and suggesting some weakness with the more aspirational consumer

Big investor fear that U.S. is slowing for luxury does not appear to be the case in the first quarter; slowdown in fashion & leather mainly due to weakness in Chinese cluster

Bryan Garnier (buy, PT cut to €730 from €810)

LVMH's first quarter was worse than expected, writes analyst Loic Morvan, with sales momentum softer than anticipated

The first quarter faced a still-demanding comparison basis; following the release, analyst sees no 2025 sales growth

Bernstein (outperform, PT €625)

Analyst Luca Solca notes that the investor conference all focused on demand in the U.S. given tariffs, with the company's answers leaving "many disappointed" given it saw no impact on demand in the U.S. in the last weeks of March

Telsey Advisory Group (outperform, PT cut to €715 from €820)

LVMH's first-quarter organic sales decline fell short of the consensus expectation, says analyst Dana Telsey, though Europe was the bright spot

Despite near-term disruptions, LVMH has some of the strongest luxury brands in the world and manages them for their long-term success

RBC (outperform, PT to €680 vs €750)

Analyst Piral Dadhania writes that investor concerns about underlying demand recovery are likely to be "amplified" based on this report

Cuts FY25 Ebit expectations by 8%, including a "more pronounced" reduction in 1H25 * Dadhania expects these softer-than-expected results from "bellwether" LVMH will have negative read-across to the wider luxury sector

Morgan Stanley (equal-weight vs overweight, PT to €590 vs €740)

Softer start to year than expected for key fashion and leather goods division and now model similar full-year contraction to top line as in 2024, analyst Edouard Aubin writes

2Q likely to see another contraction in sales, with China continuing to be a major drag and the industry facing a soft macro environment

Cuts estimates, rating and PT

JPMorgan (neutral, PT €610 vs €650)

Analyst Chiara Battisttini says even the market leader is finding things tough, with a noticeable sequential slowdown vs the previous quarter

Volumes slightly slowed, and it's possible that product mix might have also weighed

Lowers estimate by 7%-8% and says the sector's growth opportunities may have been exhausted

Citi (buy)

"LVMH's ~4% revenue miss will likely set a negative tone for the upcoming reporting season," with sales for both group and fashion and leather division below even the "most conservative buyside expectations," analyst Thomas Chauvet writes

Tough to see a "credible scenario" of sequential top-line improvement for 2Q/3Q (for LVMH and luxury peers) given "highly elevated" economic uncertainty in the U.S. and globally

Bloomberg Intelligence

LVMH's weak start "fuels concern over luxury-market outlook" as uncertainty around tariffs grows, analyst Deborah Aitken writes

"A slowdown in Chinese spending in Japan and Sephora in the US were the main culprits, both vs. big year-ago 1Q gains," she adds

In markets, LVMH shares in Paris are down 7.5%, trading at lows not seen since late 2020 as the luxury bubble unwinds.

Rival Hermès International's market capitalization has surpassed LVMH's, making it the world's most valuable luxury brand — a milestone two decades after LVMH's Bernard Arnault once attempted a takeover of Hermès.

Meanwhile, on TikTok ...

Another Chinese supplier letting TikTok users know what brands they produce for and saying with a wink and a nod that you can get the same product from them for $5.

— Chris (@motomadic) April 13, 2025

This is like my 10th video like this from various factories with various products. pic.twitter.com/Bil0O4CJEH

The Chinese Government has lifted the secrecy clause that the luxury brands had in place the Chinese Manufacturers

— Gerry (@GerryKeogh_) April 13, 2025

and now the manufacturers are exposing your favorite “luxury” brands and letting everyone know it all comes from them. pic.twitter.com/n18jvyBYBv

Chinese manufacturers just hit TikTok and it’s so good. Americans are losing it in the comments. pic.twitter.com/1oVyX8GsUF

— Ashley Werhun (@awerhun) April 12, 2025

. . .