While the rent component of the consumer price index has shown a strong disinflationary trend since peaking in the summer of 2023, high-frequency data reveals rent prices in key metro areas are moving higher.

Several high-frequency rental data points show that the cost of signing a new lease on a house or apartment is rising again despite decelerating rent component print in the March Consumer Price Index.

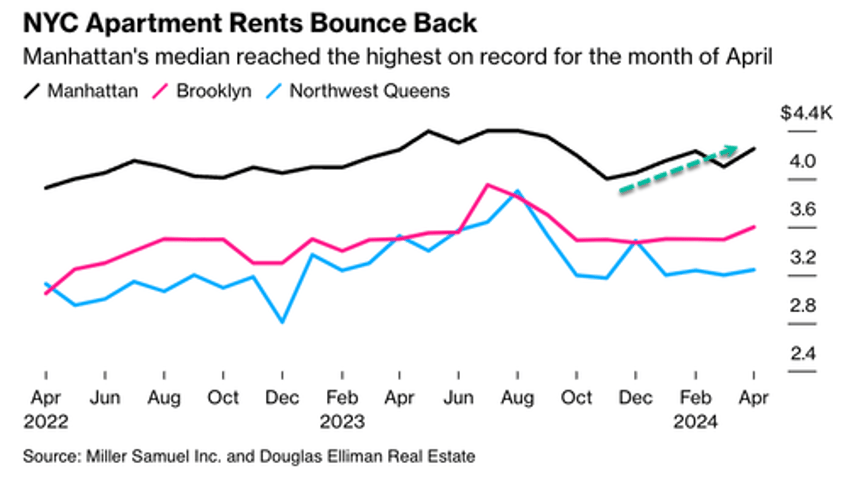

Let's begin with Manhattan apartment rents, hitting a new record for April, Bloomberg reported, citing a new report from appraiser Miller Samuel Inc. and brokerage Douglas Elliman Real Estate.

New leases signed in April topped an average of $4,250, up $9 from last April. Overall, prices peaked at $4,440 last August, sliding marginally in the fall months, and have since moved higher at the start of the year.

"The question is whether we're going to beat last summer's all-time highs," said Jonathan Miller, president of Miller Samuel.

Miller pointed out that rents are likely to "beat last summer's all-time highs" given their current trajectory and momentum.

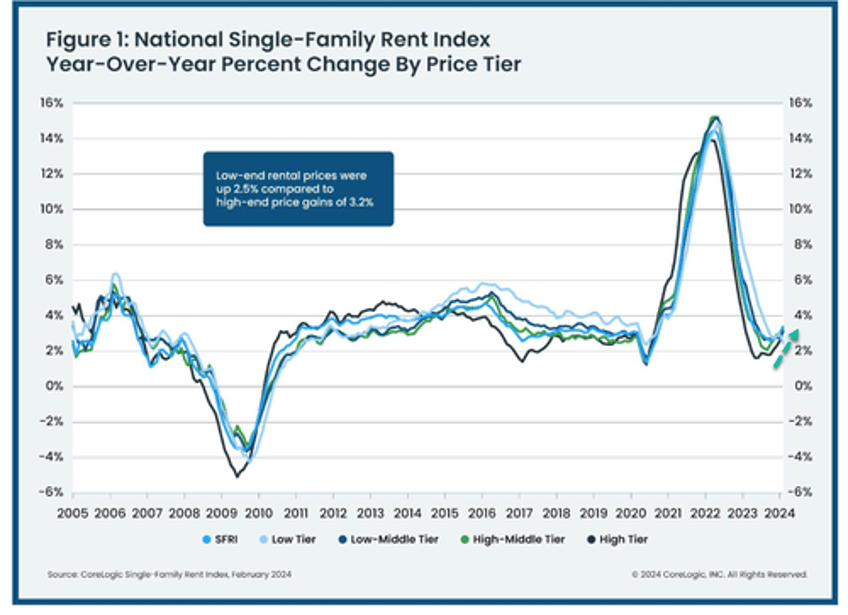

Looking at CoreLogic data, its latest Single-Family Rent Index, which examines single-family rent price changes nationally and across major cities, "regained strength in February, posting the highest annual appreciation since April 2023," according to Molly Boesel, principal economist at CoreLogic.

CPI rents will be deflationary as they catch up to lagged real-time indicators. However, if high-frequency data continues moving upward, there's a risk CPI rents could turn back up later this year.

If this is the case, then potentially more bad news for Bidenomics and Federal Reserve Chairman Jerome Powell, who is enabling this fiscal trainwreck as inflation continues to crush working poor households.

Recall, earlier this week, Stan Druckenmiller told CNBC's Joe Kernen that he rates Bidenomics an "F."