While everyone - from the most clueless and incompetent Fed president and career economist-cum-fax machine expert, to the local hotdog vendor and Uber driver - now has an opinion on when the Fed will cut rates, few are willing to put actual money where their mouth is. So when someone bets a substantial amount of money on a non-consensus forecast for where rates should go, people talk.

And they are talking a lot right now, after Bloomberg pointed out that a mystery trader has put on a huge bet that Fed will cut rates as low as 2.25% - some 300bps of cuts from here - by March 2025, wagering approximately $13 million that the US economy is about to get rugged in the next 9 months.

As Bloomberg's Edward Bolingbroke writes, over the past three sessions positioning in the options market linked to SOFR (the Secured Overnight Financing Rate, aka the new Libor), shows a surge in bets that stand to profit if the Fed slashes its key rate to as low as 2.25% by the first quarter of 2025. Some more details from the Bloomberg trader:

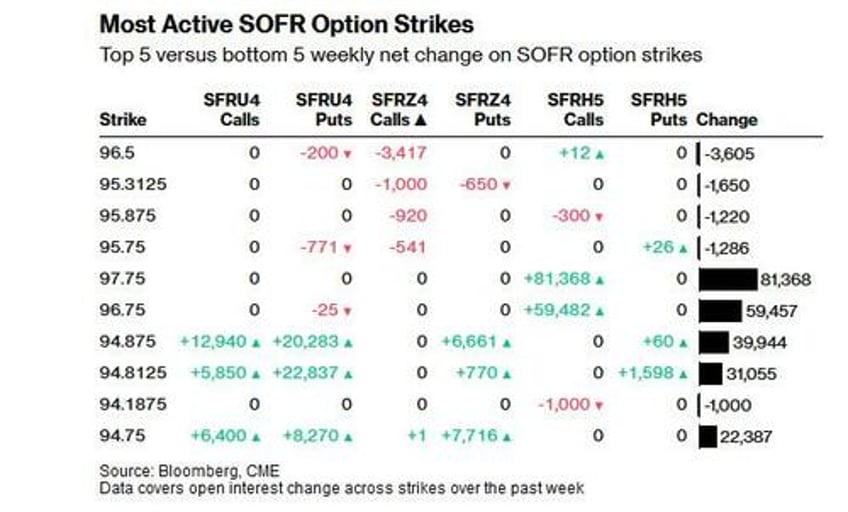

- All session 30,000 SOFR SOFR Mar25 96.75/97.75 call spread bought at 4.75, says US trader

- Open interest in the strikes has risen to 106,201 and 112,496 after the same position was bought Friday in 80,000 paying 4.5 to 4.75. Options expire March 14. Monday’s continued buying sets the size of the position to roughly 110,000 over Friday and Monday session for a premium of approximately $13 million

- The dovish hedge sits at maximum profit with a Fed rate at around 2.25%, implying Fed to cut rates by around 300bp between now and the March policy meeting. Fed-dated OIS for the March meeting is currently around 4.57%, implying around 76bp of rate cuts

Such an outcome which envisions at least 300 basis points of cuts from current levels, appears unlikely "unless the US economy tumbles into a sudden recession" according to Bloomberg.

While the Biden administration has been carefully manipulating the data to make it seem that the economy is far stronger than it is, some have started to read between the lines - and our articles exposing the true state of the economy, such as this one and this one - and are starting to build up bets that hedge tail-risk outcomes, such as rapid and extreme rate cuts.

Of course, since trading in these contracts is anonymous, it is impossible to know just who has put on this bit bet for huge rate cuts.

But it not just bets on a Fed recessionary panic that are rising: traders have also been ramping up buying of August contracts that would pay out if policymakers cut at the July 31 policy meeting. Swaps linked to that meeting date, meanwhile, only price in one basis point of a reduction then.

A dovish stance has emerged in the cash market, too, according to JPMorgan Chase & Co. data. The bank’s latest

survey of clients showed the biggest net long positions in three months in the week ending June 24.

Other markets are also showing telltale signs of increased duration exposure, a signal that many are betting the Fed's hawkish music is almost over:

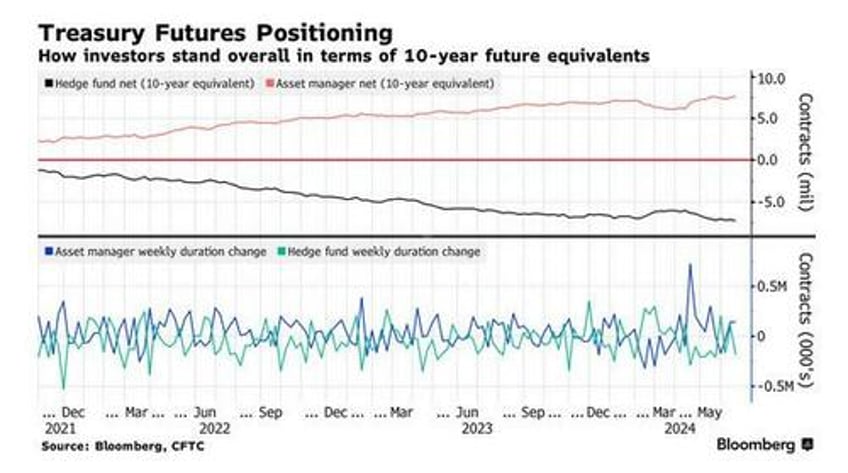

In CFTC data through June 18, asset managers extended their net duration by roughly 141,000 10-year note futures, with overall long duration rising to roughly 7.6 million 10-year note futures equivalents. Hedge funds took the other side, adding around 186,000 10-year note futures to net short duration position. Their extension of net short position in 2-year note futures by $5.6 million per basis point in risk put them at a record net short at over 2 million contracts.

In the past week, the largest positioning add seen in SOFR options have been around the March 2025 calls in the 96.75 and 97.75 strike linked to the dovish call spread wager which has been bought over the past three sessions at a price of 4.75 ticks. Other strikes which have been active on the week include the 94.875 and 94.75 strikes following flows including the Dec25 94.875/94.75 put spread