Late on Sunday, we warned premium subscribers that according to BofA's CTA model, Monday could get very ugly because any continued selling after Friday's rout threatened to trigger the first CTA sell threshold.

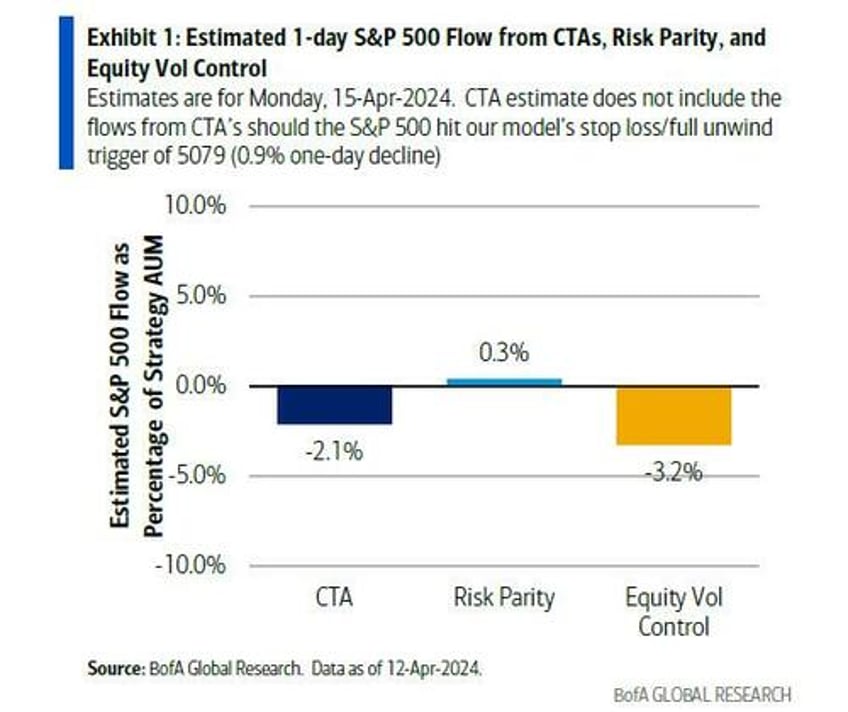

For those who missed it, we reported that in BofA's latest Systematic Flows Monitor note (note available to pro subs), "CTA equity selling could accelerate on Monday" in what could rapidly turn into a self-reinforcing toxic spiral that send stocks sharply lower, just as the stock buyback blackout period kicks in. According to the bank's models, CTA stop loss triggers are close in the US while in Europe, the STOXX 50 closed Friday near the model’s stop-loss level: "This implies that further downside will likely put pressure on CTA US equity longs" the bank warned, before serving the punchline cold: with the BofA CTA model's S&P 500 trigger now only 90bps away, "we could see a scenario of CTA stop loss triggers, vol control leverage unwinds, and levered and inverse ETFs all selling into the close Monday."