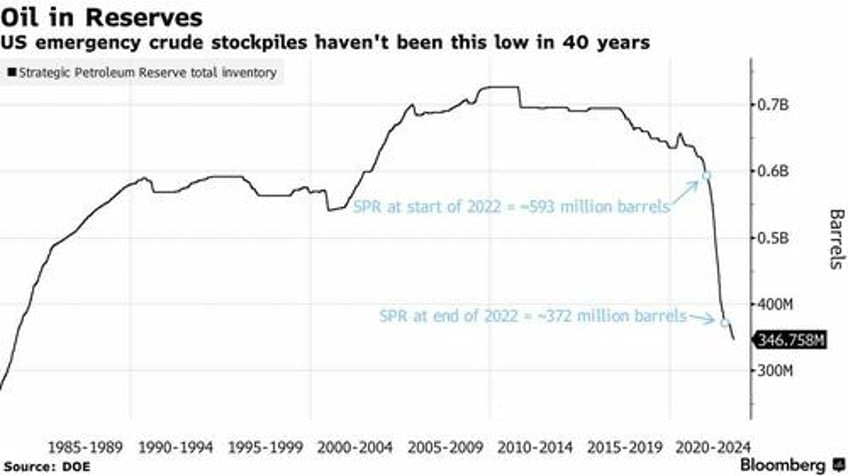

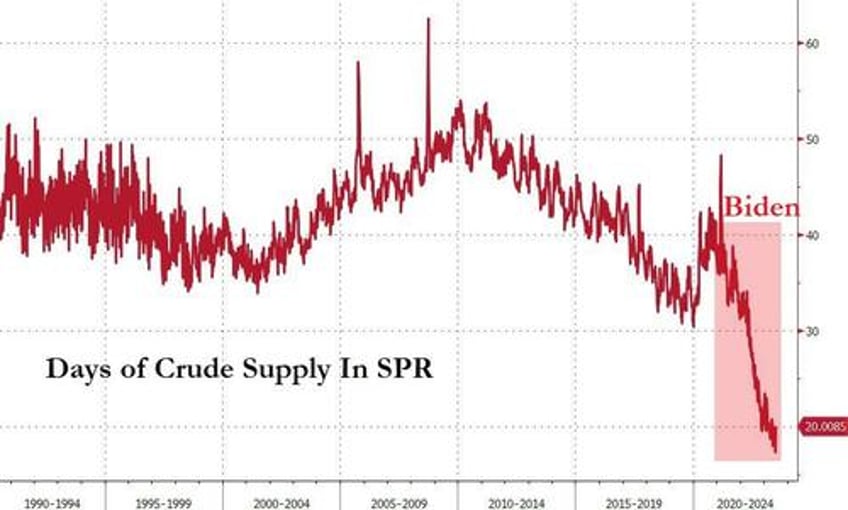

While it took the Biden administration the better part of six months to drain the US oil supply down to a precarious 20-days of emergency reserves (a 40-year low), it will take decades to refill - if that happens at all, Bloomberg reports.

Stroll through the West Hackberry oil facility on the US Gulf Coast and there’s not much to see: some pipelines and other industrial equipment. But buried deep beneath the surface are storage caverns so massive they’re tall enough to house the Empire State Building with plenty of room to spare.

Thanks to the Biden administration, these reserve sites are sitting half empty.

The Strategic Petroleum Reserve (SPR) now sits at 346.8 million barrels - a level unseen since 1983 - out of a total authorized storage capacity of 714 million.

Perhaps even more noteworthy, the emergency reserves are equal to approximately just 20 days worth of supply - an all-time record low...

Replenishing the supply will be a nontrivial and lengthy process according to experts, who say that a lack of funding and ancient infrastructure will hinder the process, despite the Energy Department's vow to keep buying.

Now that energy costs are back down comes the task of refilling the reserve. That will be a complicated, expensive process. Oil prices are now much higher than when most of the inventory was originally bought — the average price paid for oil in the reserve was $29.70 per barrel, which compares with the current benchmark cost for US crude futures at about $75.

And there’s the balance between needing to buy and not purchasing too much at once, lest the oil market gets spooked and prices jump higher. -Bloomberg

"It would be a very slow process even if you had the money and the facilities were are all in good shape," said John Shages, who previously oversaw the oil cache for the Energy Department, adding "It could take decades."

The depleted SPR also means that the US could be vulnerable to oil price shocks. In particular, during domestic supply crunches, America will be left to the mercy of the Saudis, Russia and the rest of the OPEC+ cartel.

They won't make it past a month in the SPR

— Julie Wade (@julie_wade) July 17, 2023

Transportation is the segment that will be affected.

We won't be flying or driving during this time, prices will be astronomical. pic.twitter.com/6arYZdV92f

The SPR was established in the 1970s after the Arab oil embargo resulted in a global energy supply shock and a gasoline shortage in the US, in which Americans lined up for hours, on designated days, to refill their cars. Decades later, the SPR still serves a vital function, providing a safety net against geopolitical turbulence and potential supply disruptions.

The Biden administration's decision to release oil from the SPR has sparked outrage from Republicans - who have accused the admin of manipulating gas prices before the medterm elections last year in November, and have accused them of having no credible plan to refill the reserve.

"DOE’s mismanagement of the SPR has undermined America’s energy security, leaving the nation more vulnerable to energy supply disruptions, and increasing the ability for OPEC and Russia to use energy as a geopolitical weapon," wrote top House and Senate Republicans in a May letter to the Government Accountability Office, asking the federal watchdog for an audit of the reserve, Bloomberg reports.

The pace of refilling the SPR has been sluggish at best. While the Department of Energy (DOE) plans to replace barrels sold last year, it falls far short of the goal to replenish the reserves to its 2009 peak. Congress's decision to strip $12.5 billion earmarked for reserve oil purchases further complicates the situation - as the DOE is now left with a mere $4.3 billion to acquire oil, an insufficient amount to fully restore the SPR.

Aging infrastructure poses additional challenges. The Gulf Coast salt caverns that make up the reserve were initially designed with a 25-year lifespan. As such, the risk of cavern dissolution increases with each drawdown and refill. Maintenance issues, along with the ballooning costs of the $1.4 billion modernization program, add further strain to the already troubled reserve.