By Alyce Anders, Bloomberg Markets Live reporter and strategist

Investors are keen to declare victory for the Federal Reserve in the war on inflation. But the June CPI data is only encouraging for bond bulls if you look at the world in a vacuum.

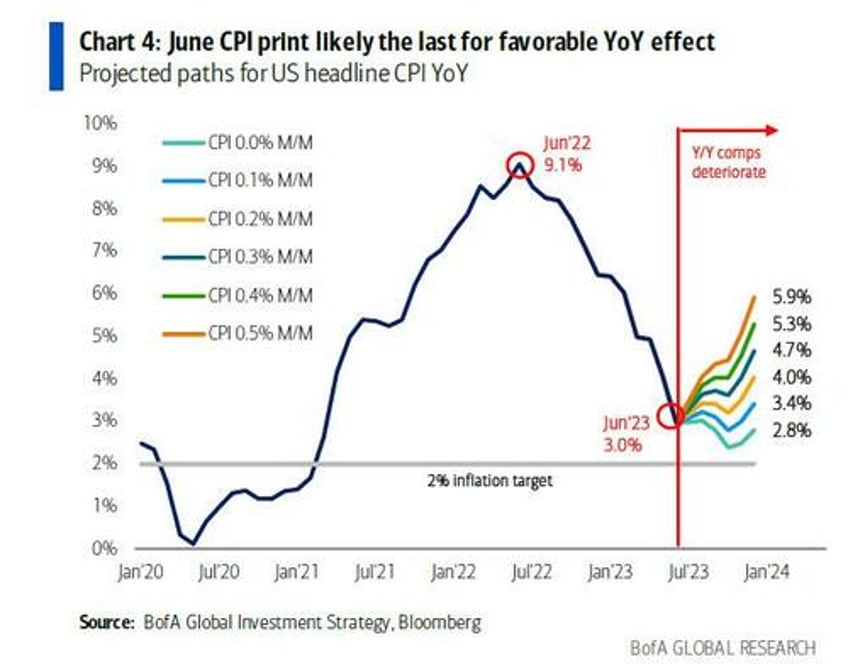

Yes, there was a lot to like in last week’s report: Headline CPI rose just 0.2% and the year-over-year rate fell 1% to 3.0%, the lowest since March 2021. Core inflation rose 0.2%, to 4.8% y/y, down from 5.3% in May and the peak of 6.6% in September 2022.

Not so fast, though. Base effects were huge factor and that means comparisons will be tougher going forward. And the composition of the decline showed volatile categories accounted for the bulk of the drop. That means future inflation relief might not be so linear.

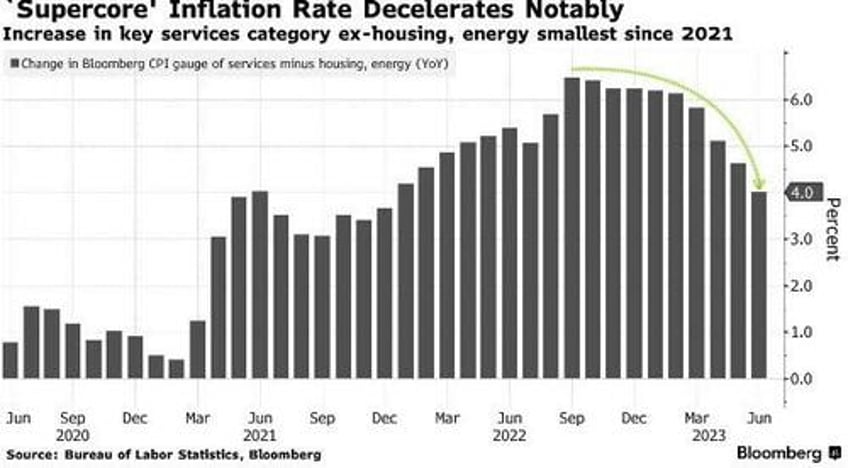

And further improvement in supercore inflation, heavily influenced by the services sector, will be harder, due to its relationship with the labor market and wages.

The problem is that while job growth may become more limited from here, it won’t be for lack of demand — and that can fuel inflation. Demand for labor continues to outstrip supply, firms are still hiring and raising compensation while companies find relative ease in passing price increases to customers.

Since February I have not budged from my thesis that companies expect better business conditions in the second half of the year, in part due to inventory restocking and continued strength in services supported by a healthy consumer and labor markets. That means it’s still full steam ahead for the jobs market — something that won’t spell relief for inflation, in bad news for bond bulls.

Friday’s preliminary July survey report from the University of Michigan showed consumer sentiment shot to the highest since September 2021 amid slower inflation and relative stability in the labor market. Consumers see their finances on the upswing and the lowest percentage in a year-and-a-half blame high prices for eroding their living standards.

That could signal inflation expectations are getting entrenched. At the household level this could influence savings, investment decisions, along with wage- and price-setting behavior — making it harder for the Fed to bring inflation down.

Meanwhile, financial conditions are loosening and that’s keeping consumers spending, according to Bank of America Corp., which reported a 2.2% y/y household spending bump in the week ended July 8, encompassing the July 4 holiday, after a lull in June. Gains were larger than in 2022 and across a wide range of categories. While it is too early to say whether the recent gains portend stronger spending this year, the signs suggest they may.

The consumer and labor markets are strong, and investors know better than to put too much stock in these top-line, potentially one-time inflation metrics, as a good portion of the weakness this month came from out-sized price declines in categories that are not likely to be repeated. And when looking at the core measure of inflation that is most closely linked to labor costs, there is still a significant amount of pressure that threatens to keep inflation above the Fed’s 2% target.