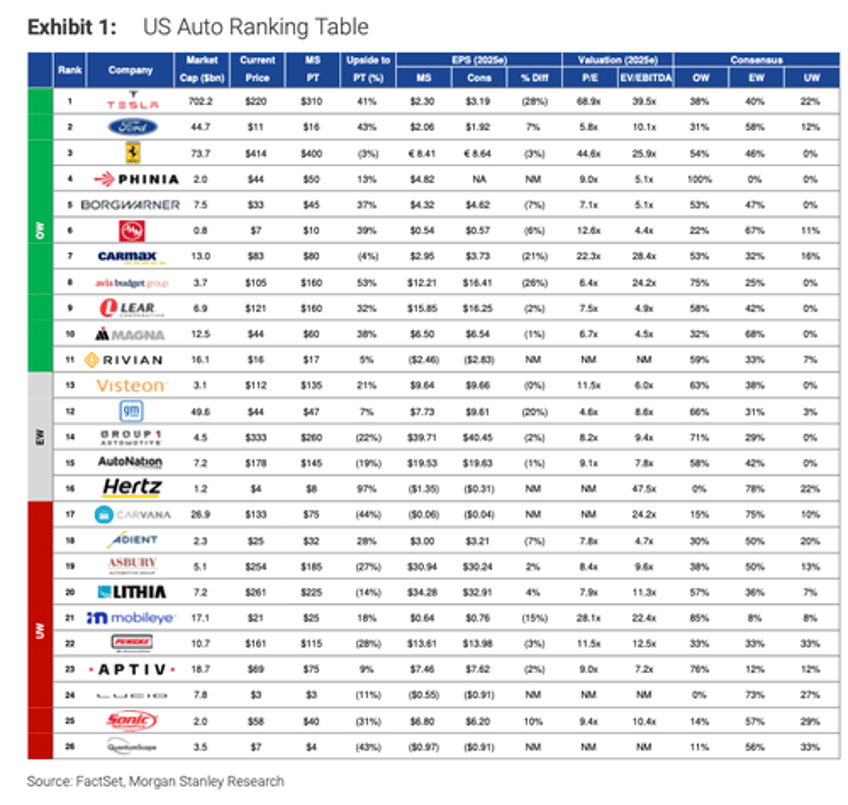

Morgan Stanley's autos guru, Adam Jonas, has just crowned Tesla as the 'Top Pick' for the US auto market, dethroning legacy OEM automaker Ford Motor Company.

Here are the several factors that drove Jonas' decision:

Cost-cutting and restructuring

Dominance in electric vehicle credits

Managing China risks

Robust recurring revenue streams

A booming energy storage business

Major advancements in artificial intelligence and autonomy

A more in-depth understanding of why Jonas upgraded Tesla to number one on 'Top Pick' in US autos and maintained his overweight stance on the company with a price target of $310 that commands a 40% upside from here:

Cost cutting/restructuring has stemmed the downside risk to the EV business. Tesla's 2Q results came within 3 or 4% of consensus expectations (and ahead of our own) when stripping out restructuring charges and regulatory credits. The over $0.6bn of restructuring charges recognized by Tesla in the quarter, combined with other actions, has helped lower the breakeven point to levels where Tesla can still generate positive cash flow at an enterprise level, even with EV capacity utilization at 69% last quarter. While Tesla is still making cars, we note the company is aggressively redeploying incremental resources, technology, people and capital away from the auto side of the house. We found it notable that Ford management spent far more time on its 2Q conference call discussing EVs than Tesla did.

Cornering the market on ZEV credits? Tesla recognized zero emission vehicle (ZEV) credit revenue equating to around $2k/unit in the quarter, more than 2x the recent run-rate. We believe as more legacy OEMs pull back on their EV plans, combined with increasingly stringent EPA standards, that Tesla may achieve an even more dominant position in the market for highly lucrative ZEV credits going forward. In Ford's 2Q24 10Q in 'item 2' of its MD&A section, the company disclosed it entered into agreements to purchase an incremental $3.8bn of regulatory compliance credits in NA and Europe. Combined with previous balances ($700mm) and current period credits used ($100mm) we estimate Ford has a total of $4.4bn of regulatory credits for use in the current and future model years. We anticipate other car companies such as GM and STLA may be wading more deeply into the ZEV market as buyers in the quarters ahead. We estimate Tesla may account for as much as 1⁄2 the credit sales in the market, supporting a 100% margin business for Tesla that may not be anticipated by the investment community at this time.

Managing exposure to China risks. Tesla's China sourced revenues accounted for 18.2% of total Tesla revenues in 2Q24. While this line may exhibit seasonal volatility in the quarters ahead, we expect the long-term trend for Tesla's China exposure to continue to fall systematically. By 2030, we forecast that China accounts for approximately 10% of Tesla auto unit volume and between 6 and 7% of total group revenue.

Increased contribution from recurring services revenue. 'Services & Other' revenue accounted for 10.2% of total company revenue in 2Q24 and 9.7% of sales on a trailing LTM basis. It's notable that the Services & Other revenues increased 21% YoY while automotive revenues decreased during the same period. We note that these 'services' revenues should largely grow in line with the growth of Tesla's installed car population which we forecast rises to 24mm units by 2030 (a 24% CAGR from 2024 through 2030). We also note that the margins derived from after-sales/service of the car fleet are typically far higher than point-of-sale margins.

Strong position in fast growing energy storage portfolio. From our discussions, investors are starting to consider the potential for Tesla to be an expression on the AI theme. But recent indicators of climate change are bringing even greater attention to Tesla's dominant position in energy storage. Severe storms and unusual global weather phenomena (including heat waves) may be focusing investor attention on companies that may be well positioned to address climate- and energy-related problems. We see potential for the Tesla Energy business to be worth more than the autos business. Investors are focusing on the theme of Gen AI acceleration spurring a multigenerational increase in energy demand and a recent ~2x beat in 2Q Tesla Energy storage deployments with gross margins roughly 2x that of the auto business.

Optionality on new 'expressions' in AI and autonomy. As we continue our analysis of the overlap of AI and robotics, it is increasingly clear to us that the commercial opportunity of non-auto expressions of embodied AI is likely far larger and faster-adopting than that of autonomous cars. We believe the humanoids opportunity is far bigger and faster adopting than autonomous cars and will see a greater quantum of capital behind it. Tesla is at the epicenter of the theme. Investors may need to add new tabs to their Excel models.

Given Jonas' bull case, he explained some of the risks that could derail upside price action in Tesla:

We believe near-term expectations around FSD/robotaxi may be too high. We were not terribly surprised to see the original 8/8 'Robotaxi day' be postponed and would not be shocked to see the content of the 10/10 event to include commercial themes far beyond just autonomous cars. In our opinion, the biggest 'tell' as to the governor of AV commercialization at scale is the lack of 3rd party statistically/empirically tested safety data from the likes of IIHS/NHTSA or other respected industry/regulatory bodies. We need something far beyond intervention data and suspect the absence of such a study may reflect that the system does not, at this point, clearly demonstrate beyond doubt the efficacy of the system vs human driving statistics. Autonomous cars are tasked with avoiding objects. There are other use-cases where it may be easier to target objects.

Specifically, we believe expectations around Tesla's ability to commercialize autonomous technology in China are too high. We recently asked the question "What is Tesla's future in China?" In our opinion, if Tesla (or any other US company) were to 'solve' the robotaxi problem, we believe it would be highly unlikely that company would be allowed to offer such technology within the PRC. The dual purpose element of embodied AI carries obvious national security sensitivities.

EV' winter' may be prolonged and could still require further steps to mitigate further potential losses. We recently reduced our FY30 US EV penetration forecast to a street-outlier-low of 20% vs. 25% previously driven by a number of factors ranging from sluggish demand, regulatory uncertainty and economic factors.

Other/Governance considerations. Elon still does not have 25% blocking minority of Telsa. Tesla's CEO has clearly expressed his desire to achieve a 25% blocking minority vote position in Tesla to ensure in his view that powerful and potentially dangerous AI technology does not fall into the wrong hands. However, on our calculations, assuming the 2018 CEO compensation package would only take Elon Musk's stake in Tesla to just over 20% (before taxes). How would the extra $40bn to $50bn gap in voting stake (to bridge the gap to 25%) be achieved?

In markets, shares of Tesla were up nearly 6% to $232.5 in the early cash session, while Ford shares were down about 2%.

Last month, Jonas suggested that Tesla could be poised for the powering up America theme ("The Next AI Trade") with its solar energy and storage business

Cathie Wood, head of Ark Investment Management, has been pounding the table about Tesla's technical analysis and explained recently on CNBC: "Longer the base, the bigger the breakout."

The longer the base, the bigger the break out pic.twitter.com/iif4xS5f0s

— Teslaconomics (@Teslaconomics) June 25, 2024

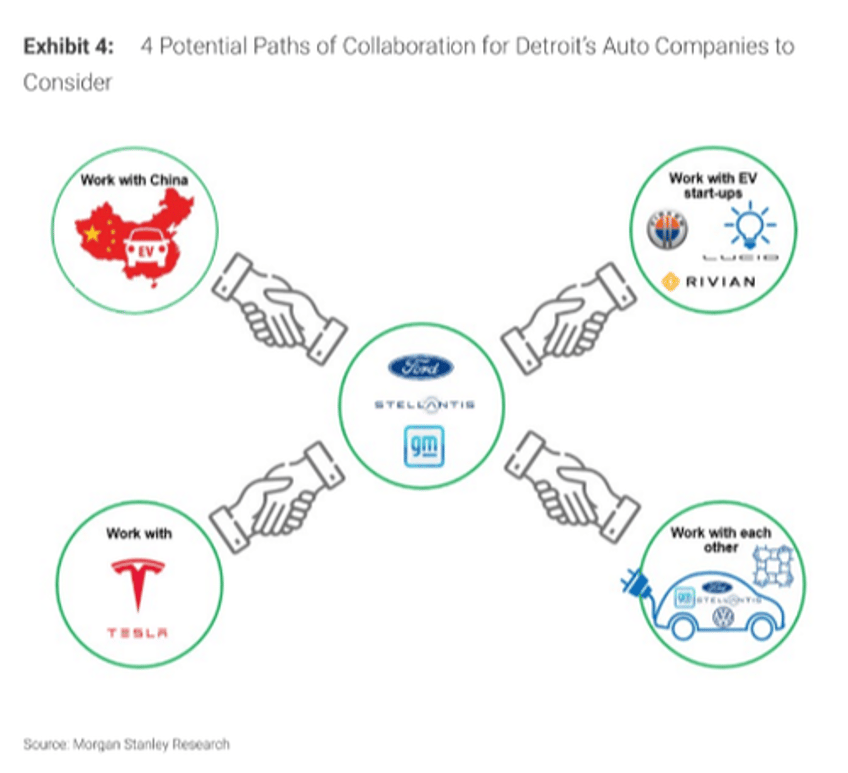

Jonas noted earlier this year that the EV sales slowdown could trigger a consolidation wave across the industry.

The entire industry (excluding Tesla) might face a reckoning next year if Trump wins in November. That's because the former president has stated that EV subsidies will be eliminated. Even Musk supports this move.

Why? Well, as Musk said: "Take away the subsidies. It will only help Tesla. Also, remove subsidies from all industries!"

So, back to what Jonas noted: "...Tesla may achieve an even more dominant position in the market ..."