Auto dealers are seeing an uptick in inventory while many consumers remain on the sidelines, deterred by the toxic combination of high interest rates and elevated inflation. In response to what seems to be a more pronounced slowdown, dealers are slashing prices and increasing incentives to stimulate demand this summer.

A new report from the Financial Times, citing data from Motor Intelligence, with manufacturers such as Hyundai, General Motors, and Volkswagen, shows that the average incentive package to sweeten the deal jumped 53% in June, compared with the same month last year.

Anytime manufacturers and dealers increase incentives, such as offering low interest rates, cash back, and price cuts to entice consumers, that's usually an ominous sign of an alarming demand problem.

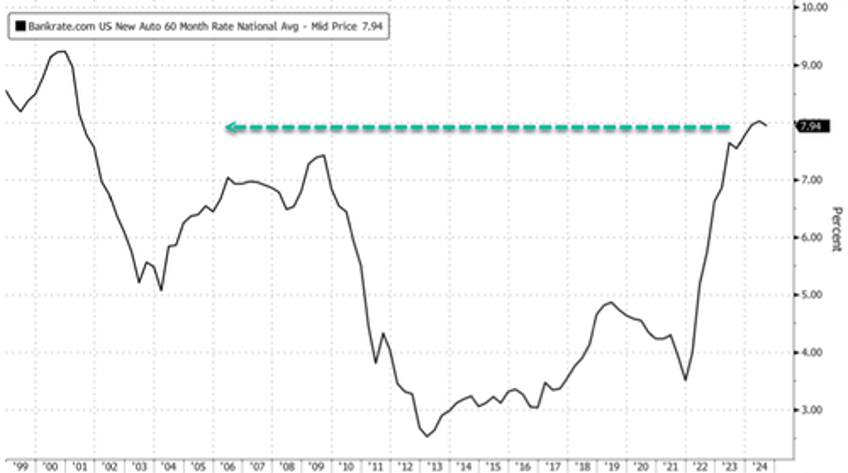

The unaffordability crisis impacting the auto market is straightforward: New car prices still linger at near record highs while the cost of financing is at the highest since the late Dot Com era. Folks still need to drive, so financing the big SUV is no longer possible. Instead, compact SUVs have become in high demand.

"If folks can put off a purchase they're doing that, but when they do need a car, now more so than a year ago, they're looking for ones that are less expensive because they are having to deal with higher interest rates," said Matt Smith, deputy editor, head of automotive insights at digital auto platform CarGurus.

Data from Bankrate shows the new auto 60mo average rate most recently peaked at 8%.

Data from consumer analytics company JD Power shows that in June, new cars sold at a premium versus the manufacturer's suggested retail price were around 16.9%, down from nearly 35% in the same month one year ago.

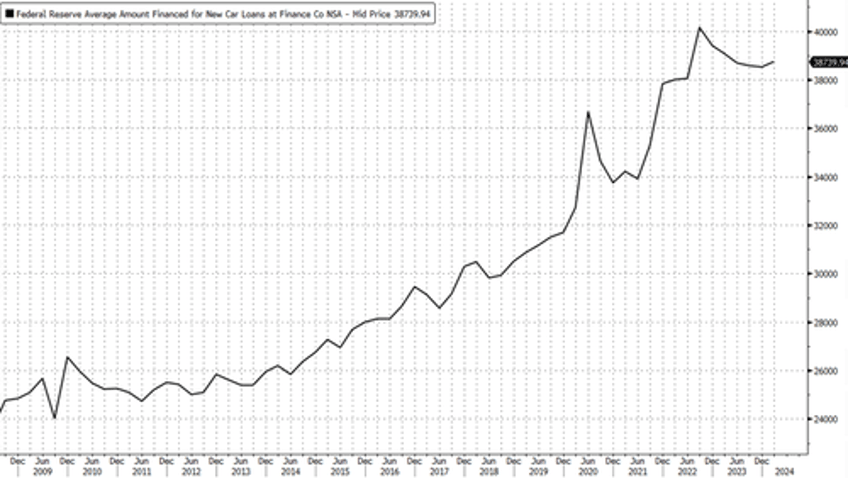

Federal Reserve data shows the average amount consumers financed for a new car is around $38.8k, down from $40k in 2022.

Bank of America economist Stephen Juneau said "rising supplies" and "moderating demand" are some of the reasons why "manufacturers try to get cars off the lot by offering much more attractive deals."

According to Automotive News, dealer inventory has been below 3 million vehicles for over four years. However, that's likely changing, with June data showing inventories climbed to 2.96 million vehicles, or about a 76-day supply, up from 1.95 million one year before.

Even though inventory levels are not back to pre-Covid levels, no dealer wants to sit on many unsold vehicles and will continue offering incentives. If the higher-for-longer interest rate environment continues through the end of the year, this could seriously pressure new auto prices. But as soon as the Federal Reserve begins cutting, which according to rate traders could be as early as September, increased demand will quickly soak up the supply and send prices higher.

Let's not forget there's a perfect storm brewing in the auto market, as the latest data shows auto repossessions are soaring.