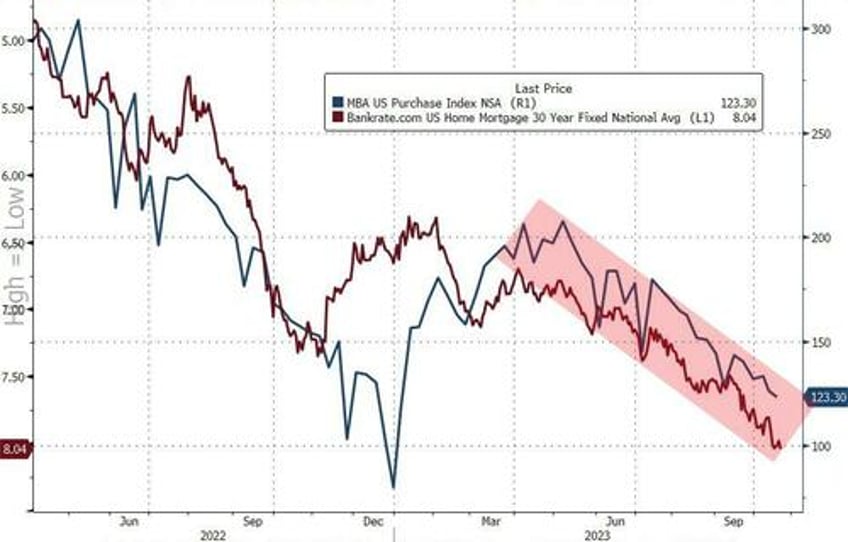

Some background color before the big number - The Mortgage Bankers Association's index of home-purchase applications tumbled 2.2% WoW to 127 - the lowest level since 1995 - as mortgage rates hit 8% for the first time in 23 years.

Source: Bloomberg

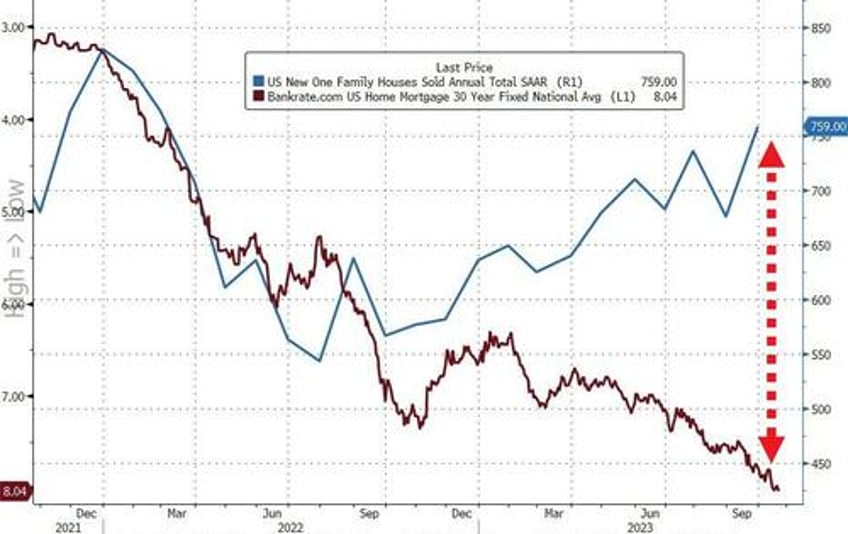

With all that in mind, it was a surprise that new home sales were expected to rise 0.7% MoM (although sales did puke 8.7% MoM in August). Instead - because you just can't make this shit up - new home sales soared 12.3% MoM in September (and August was revised up from -8.7% to -8.2%). That is the biggest MoM rise since August 2022. and smashed YoY sales up 33.9%...

Source: Bloomberg

That is the highest new home sales SAAR since Feb 2022, as existing home sales hit double-decade lows...

Source: Bloomberg

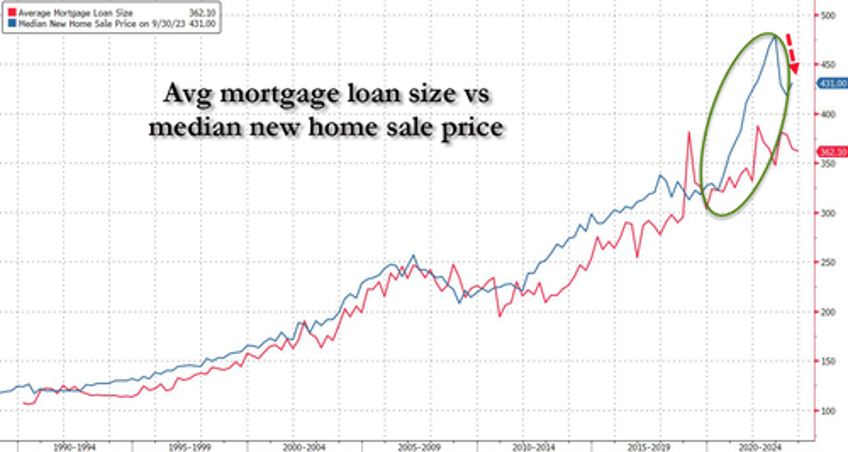

As rates soar, so homebuilders are eating all that cost!!!

Source: Bloomberg

Mortgage loans have been increasing in size linearly but the last 3 years have seen home-prices rising exponentially... until now...

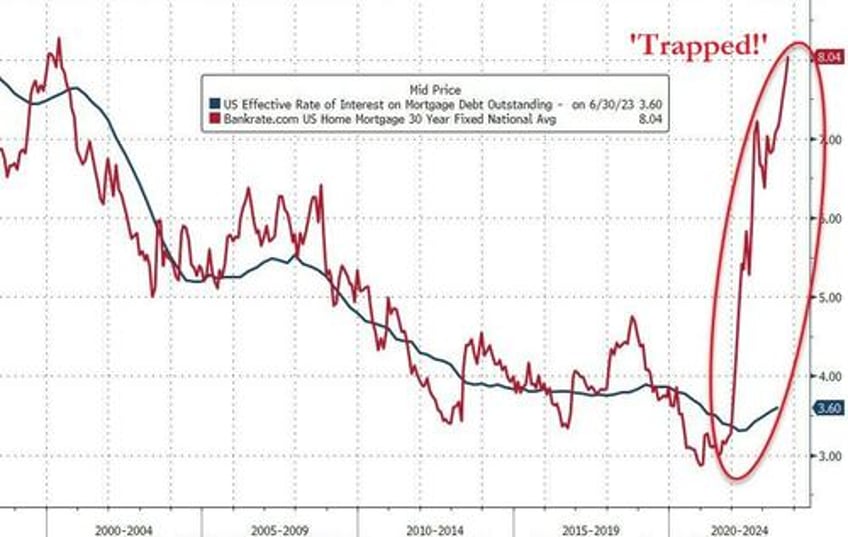

They should, given that homebuilders can't be filling this gap - between the current 30Y mortgage rate and the effective rates that borrowers are currently paying on their home loans - (i.e. subsidizing new home sales) forever...

Source: Bloomberg

Supply is tumbling (from 7.7mths to 6.9mths - the lowest since Feb 2022...

With a lack of home-building (as builders' incentives are crushed), we don't think Powell will be getting his 'affordability crisis' under control (especially if he cuts rates drastically... because imagine what that does to prices).