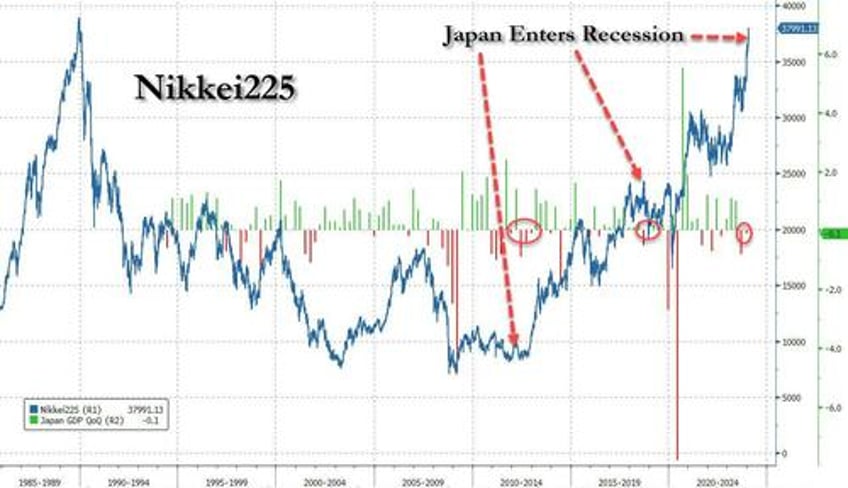

In the past several months, we had been shocked by how much digital ink was spilled to praise Japan's "stock market revival", which according to very serious economists was based on strong fundamentals and was justified by the economy (which recently slumped into recession)...

... when in reality the entire move was driven by the relentless collapse and premeditated destruction of Japan's currency at the hands of the Bank of Japan. So much so that long USDJPY was - together with long Treasuries - the most consensus trade of 2024.

And then overnight we got a reminder of just how little Japanese stock performance is fundamentally driven, and how it is entirely a function of the weak yen, when the latest counter-trend surge in the yen sent the Topix and Nikkei225 both plunging as much as 3%, the biggest drop since October 4, amid growing speculation the Bank of Japan will raise interest rates lifted the yen and hurt exporters, while a report in local press claimed that the BOJ could end Yield Curve Control - which has defined Japan's bond market for the past decade and kept yields from exploding - as soon as this month.

Automakers and banks were among sectors leading the drop on the Topix which closed 2.2% lower at 2,666.83 in Tokyo, with 31 of 33 sub-sectors dropping, after a powerful buying thrust in the last 30 minutes prevented a LOD close. The exporter-heavy Nikkei 225 declined 2.2% to 38,820.49, leading losses in Asia. Tech shares slumped, following US peers lower, as investors took profit from some of the top performers over the past year.

Automobile companies such as Toyota Motor Corp. contributed the most to the Topix’s decline, decreasing 3.1%. Out of 2,150 stocks in the index, 302 rose and 1,807 fell, while 41 were unchanged. Semiconductor companies including Renesas Electronics Corp. dropped after Nvidia Corp. and other US tech stocks fell amid profit-taking. The Philadelphia Semiconductor index tumbled 4% on Friday.

The catalyst for the drop was the surge in the yen which strengthened as much as 0.4% to 146.54 vs the dollar, putting the trade we suggested to our premium subs one month ago deep in the money.

The surge in the yen quickly freaked out all those who said Japanese stocks were rising purely on fundamentals, because... well, the recent record high had absolutely nothing to do with fundamentals.

"Until we see the results of the BOJ’s policy next week, it will be difficult to buy in the stock market due to concerns about the yen’s strength,” Shoji Hirakawa, strategist at Tokai Tokyo. “There are no signs of a USDJPY rally in the currency markets.”

But... but... what does USDJPY have to do with stock markets? Guess the answer is... everything, just ask the Weimar Republic.

Expectations the BOJ will tweak policy at the March 18-19 meeting were further fueled by a report in local Jiji that the bank is considering scrapping its yield curve control program, and that a rising number of policymakers are leaning toward ending negative rates due to expected larger wage increases this year. Data Monday showing the economy avoided falling into a recession at the end of last year also bolstered the case for the BOJ to raise rates for the first time since 2007.

“Today’s sell-off reflects the realization that after many false dawns, the Bank of Japan’s exit from the Negative Interest Rate Policy is now likely just over one week away,” said Tony Sycamore, a market analyst at IG Australia Pty Ltd. “This means that investment decisions made over many years are hastily being re-evaluated to reflect a reality many were thinking was still months away."

Guess "investing" is a little bit more difficult when the central bank isn't doing it for you with endless currency debasement,huh?

The Nikkei recently hit the key 40,000 level for the first time after reclaiming its 1989 peak earlier this year but has since slumped, following the plunge in USDJPY.

The yen edged higher to 146.98 per dollar Monday, after four days of gains. The Nikkei recently hit the key 40,000 level for the first time after reclaiming its 1989 peak earlier this year. Foreign investors had been buying into Japan’s biggest companies on improving shareholder returns and the weak yen.

The yen looks poised to test the 145 level per dollar level and a break of that may prompt a quick move toward 140, said Amir Anvarzadeh, a strategist at Asymmetric Advisors Pte who said that “the market’s reaction to this seems to suggest that a lot has been riding on weak yen to continue to support multinationals rather than bets on changing corporate governance etc. which has been the trigger behind the more positive Japan narrative.”

Just as we have said all along.

Investors will be on the watch for whether the BOJ will buy exchange-traded funds after the Topix fell more than 2%. The last time the central bank purchased ETFs was in October of last year when the index dropped by a similar amount in the morning trading session. That follows an unwritten rule that only a drop of at least 2% in the benchmark gauge in the morning triggers BOJ buying of the funds.

The drop in stocks - and the USDJPY - may now become self-reinforcing because contrary to expectations for the BOJ to step in and save Mrs Watanabe, the Bank of Japan did not buy ETFs during the rout despite the Topix index falling more than 2%, a level widely seen as having been the central bank’s trigger for purchasing the instruments.

Realizing that the yen-devaluation driven party is over, Morgan Stanley strategist Gilbert Wong said that Japan's momentum trade is at risk of unwinding - because that's really all it is, one giant momentum trade - and the bank is “closely monitoring” the US unwinding in the last week because “historically US Momentum stocks have been highly correlated with Japan Momentum stocks."

While Japan’s momentum stocks are still on the rise, with the 6-months rolling factor return approaching extreme territory

MS expects “the seasonality around the Japan dividend ex-date might keep it running into month-end, but the reversal risk in April could be high”, Wong cautioned.