By Dhaval Joshi, Chief Strategist at BCA Research

Summary

The stock market’s pre-eminent growth sector is not US tech, it is French luxuries. No other sector can compare with French luxuries’ massive and sustained pricing power.

The risk for French luxuries is not a China slowdown, the risk is that the structural increase in super-wealth comes to an end. Yet if anything, the coming disruption from generative AI will boost super-wealth.

Own an outright structural exposure to French luxuries. As well as being the pre-eminent growth sector, the very different economics of luxuries gives the sector excellent diversification qualities.

Structurally overweight French luxuries versus US tech. While French luxuries and US tech are trading on broadly similar valuations, the moat around French luxuries profitability is more impregnable than the moat around US tech profitability.

Structurally overweight France (CAC 40) versus the euro area (Eurostoxx 50). The French stock market’s 40 percent exposure to luxuries will continue to give it a big advantage over its euro area peers.

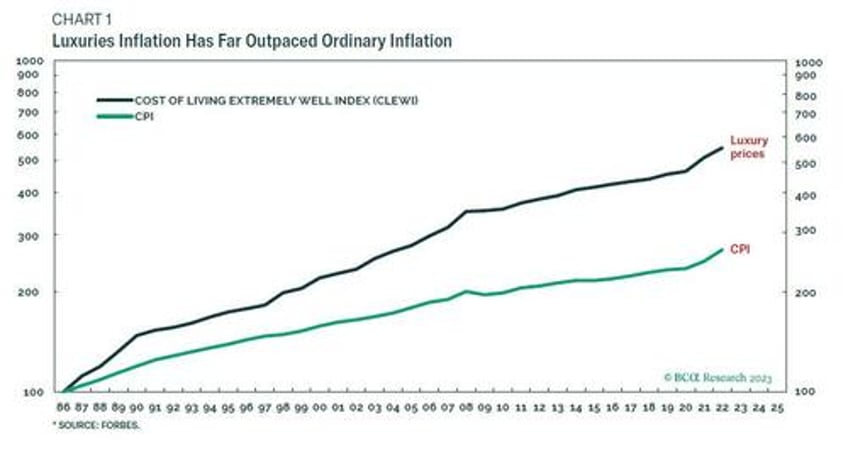

The recent surge in major economy inflation into the mid-single digits has been dubbed the biggest cost of living crisis in a generation, a crisis that is still far from solved. But for the super-wealthy, the cost of living ‘extremely well’ has been inflating in the mid-single digits for decades. Suffice to say, this sustained inflation in luxury prices has not been a crisis!

Every year for the past forty years, Forbes has calculated a ‘cost of living extremely well index’ based on the prices of must have goods and services in a typical billionaire’s spending basket. For example, the current basket includes a black wool and silk Gucci dress priced at $2800, a Hermès Maxi 2.55 black handbag priced at $10,000, and of course the obligatory 1oz. of Chanel no. 5, a snip at just $345. For decades, the price of this luxury basket has inflated at a consistently reliable 5 percent, far outpacing ordinary inflation (Chart 1).

Therein lies the investment case for the luxuries sector. No other industry or sector in the world can boast such a massive and sustained pricing power.

French Luxuries Trump US Technology

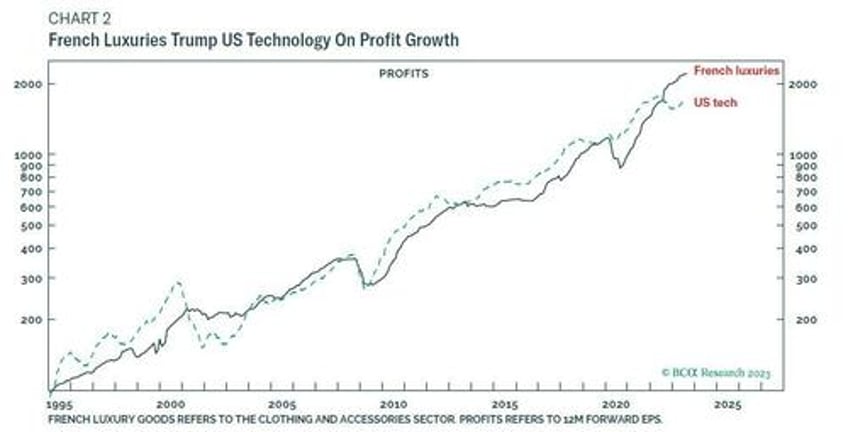

With all the buzz around AI, you could be forgiven for thinking that the stock market’s pre-eminent growth sector is US technology. But you would be wrong. The stock market’s pre-eminent growth sector is French luxury goods.

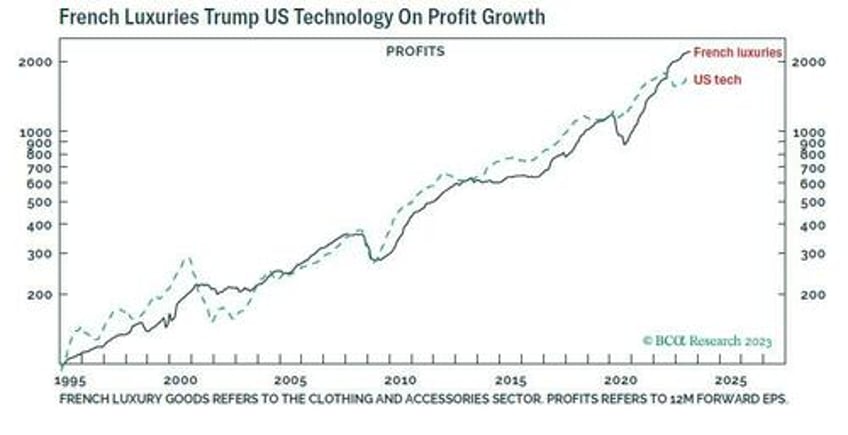

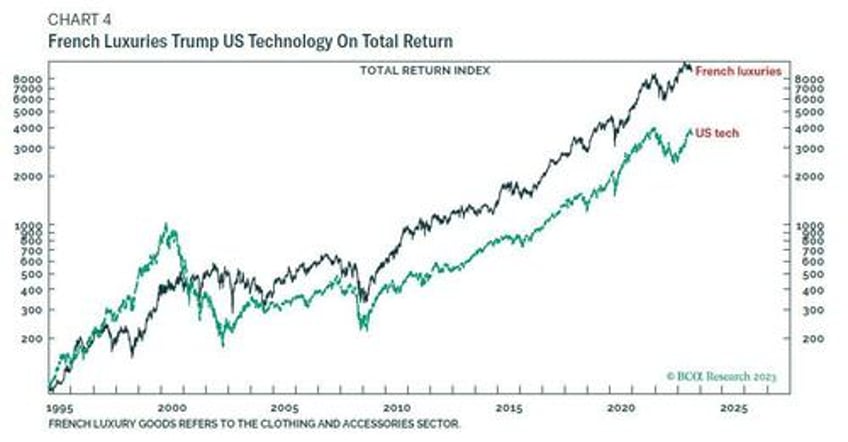

On most time horizons over the past decades, French luxuries have trumped US technology on profit growth, price performance and total return performance. This includes during the first internet revolution (Web 1.0), during the social media revolution (Web 2.0), and even during the post-pandemic recovery (Charts 2-4).

The pre-eminence of the luxuries sector is because its economics differs from other goods and services in three important ways.

First, unlike other goods and services, luxuries have a price elasticity of demand that is greater than one. Meaning that, while for most goods and services, a higher price reduces demand, for luxuries it is the opposite. The higher the price of the luxury, the greater is its cachet, exclusivity, and ultimately demand. This explains luxuries’ massive and sustained pricing power.

Second, because of this massive and sustained pricing power, the luxury sector is much less reliant on sales volume growth. Yes, luxury brands want to penetrate new markets such as China, but the unrestricted sales growth of a luxury within a market would diminish its key quality – exclusivity. So, while Apple might want everybody to have an iPhone, Hermes certainly doesn’t want everyone to have a Maxi 2.55 black handbag!

Third, the luxury sector has a massive barrier to entry. This is because it takes decades – or even centuries – to build the trusted quality, cachet, and exclusivity required in a luxury brand. Thereby, the leading luxury brands have built a massive moat around their profitability, making it near-impregnable for competitors.

As I explained in BCA Research - Can Tech Supercharge Profits? Don’t Bet On It, the equivalent moat around US tech sector profitability during the social media (Web 2.0) revolution was the so-called ‘network effect’. Once you get networks, the value of a network to a user increases as the number of users increases, resulting in a ‘winner-takes- all’: Amazon for shopping, Google for searching, or Facebook for socialising.

In this way, and helped by lax regulation, a handful of US tech companies became the Web 2.0 oligopolies with large moats around their profitability. The question now is, do the creators of generative AI have a moat around their profitability, as impregnable as the moat around French luxuries.

For Luxuries, The Real Risk Is Not China

For luxury brands, the obvious cloud on the horizon is the slowdown in China, which has been their fastest growing market. Yet as I explained in BCA Research - China’s Engine Is Failing, And The World Economy Is Losing Altitude, China has generated 41 percent of the world’s economic growth through the past ten years. Thereby, China’s stellar growth has made it the fastest growing market for almost all products, not just luxuries.

In fact, French luxuries’ overall sales exposure to Asia ex Japan is only slightly above the region’s 25 percent weight in global GDP – albeit Hermès is overexposed at 48 percent of sales, while LVMH is underexposed at 20 percent.

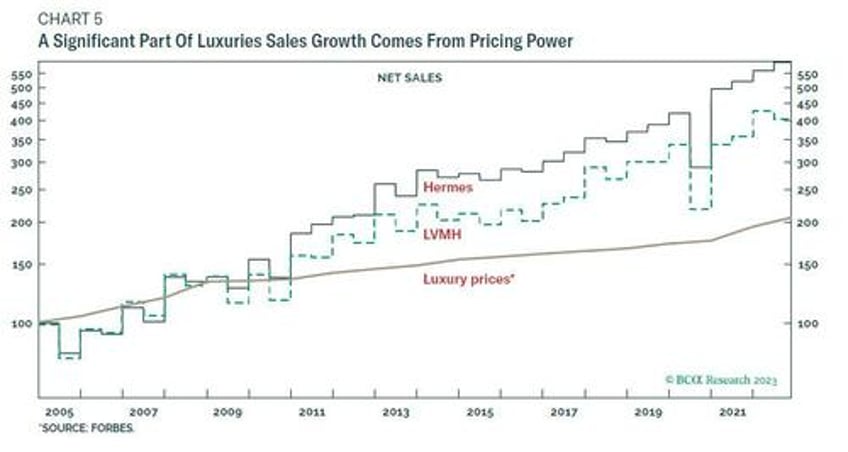

However, to reiterate, luxuries sales and profits growth does not rely on volume growth. A significant part comes from luxuries’ massive and sustained pricing power (Chart 5).

Crucially though, luxuries’ pricing power also depends on the super-wealthy’s ability to absorb it, which it has been doing very easily. The simple reason is that through the past forty years, super-wealth – as measured by Forbes 400 total net worth – has increased at 10 percent a year, far above luxuries inflation.

The real risk for the luxuries sector is not a China slowdown. The real risk is that the structural increase in super-wealth comes to an end. If anything though, the coming disruption from generative AI will boost super-wealth – by hollowing out middle income jobs while enhancing the positions of the superstars. The irony is that the best investment play on generative AI might be French luxuries.

Three Investment Conclusions

We reach three structural investment conclusions:

First, own an outright structural exposure to the French luxuries sector. As well as being the pre-eminent growth sector, the very different economics of luxuries gives the sector excellent diversification qualities.

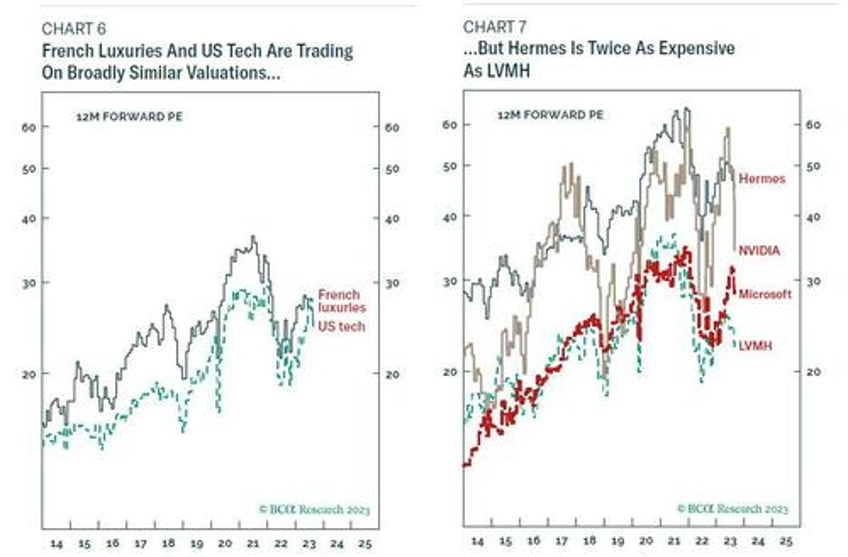

Second, structurally overweight French luxuries versus US tech. While French luxuries and US tech are trading on broadly similar valuations (Chart 6 and Chart 7), the moat around French luxuries profitability is more impregnable than the moat around US tech profitability. Because, as previously discussed, there is no obvious network effect moat around generative AI.

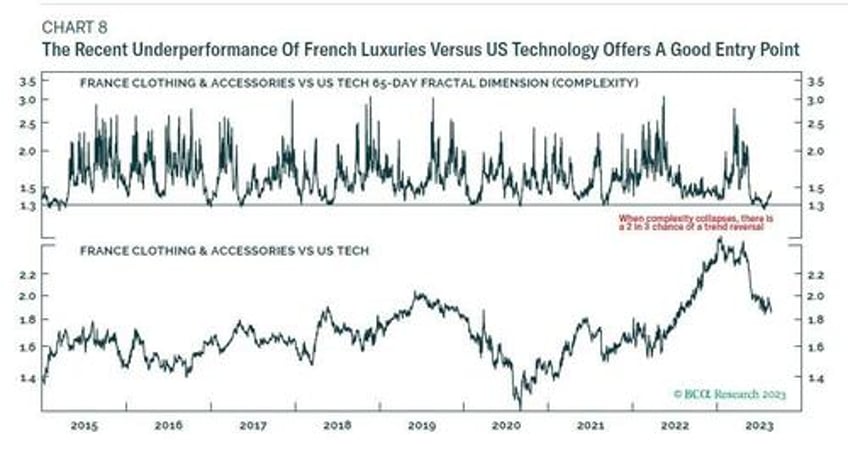

Additionally, the recent underperformance of French luxuries versus US tech has reached a short-term collapsed complexity that signals a good entry point (Chart 8).

Third, structurally overweight France (CAC 40) versus the euro area (Eurostoxx 50). The CAC 40 has a near 40 percent weighting to luxuries (counting L’Oréal as a quasi-luxury company). The large exposure to French luxuries has given, and will continue to give, the French stock market a big advantage over its euro area peers.