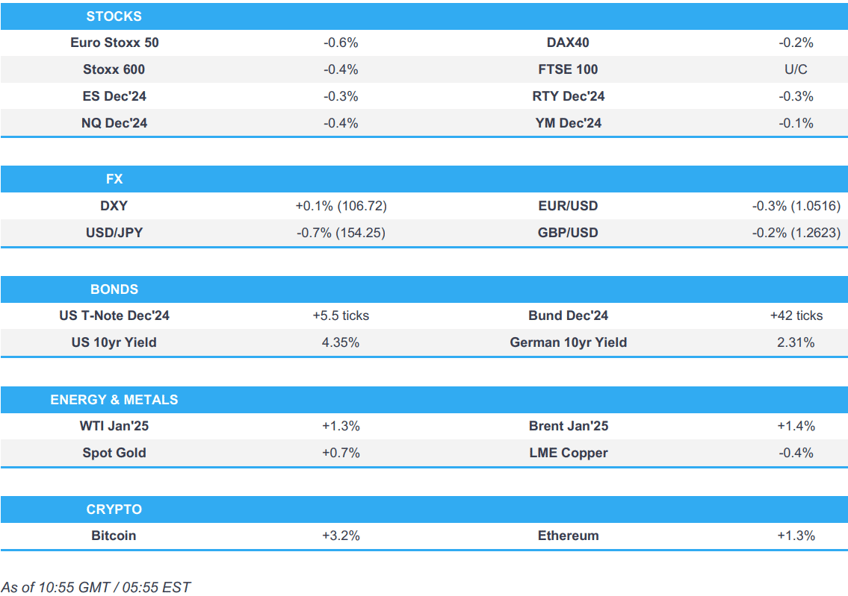

- Equities generally modestly lower; NVDA -3% pre-market despite headline beats as Q4 guidance disappoints.

- Ukraine’s airforce announced that Russia launched an ICBM, Ukrainian media specified it was a RS-26 missile; however, CNN reports that ICBM usage has not been confirmed.

- Dollar is slightly firmer, JPY outperforms benefiting from the risk-aversion triggered by tensions between Russia and Ukraine.

- Bonds are benefiting from the geopolitical risk-premia into numerous central bank speakers.

- Crude is firmer and resides just off session highs, gas outperforms & XAU bid whilst base metals are dented by the risk tone.

- Looking ahead, US Jobless Claims, Philly Fed Index, US Existing Home Sales, SARB Policy Announcement, Speakers including ECB’s Patsalides, Lane, Elderson & Holzmann, Fed’s Hammack, Goolsbee & Barr, SNB’s Tschudin & Moser, BoE's Mann, Earnings from Deere, Gap & Intuit.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses began the session on a mixed footing, but gradually teetered lower soon after the cash open. A further extension of the downside was seen following updates via the Kremlin’s spokesperson who noted that the storm shadow attack at Russia is a new escalation, via TASS. Thereafter, ABC News reported that it is not confirmed that Russia used a ICBM last night, which helped to lift bourses incrementally off lows.

- European sectors opened with a slight positive bias, before sentiment soured to show a strong negative bias in Europe. Insurance manages to stay in mild positive territory, largely attributed to gains in Zurich Insurance after the co. announced their 2025-27 targets. Autos are Europe’s worst sector, joined closely by Consumer Products; seemingly weighed on by the defensive bias.

- US equity futures are modestly lower across the board, and with slight underperformance in the tech-heavy NQ after NVIDIA reported its Q3 results; the Co. is down 3.4% in pre-market trade, despite reporting strong headline metrics, but its Q4 guidance ultimately disappointed on the top-end of analyst expectations.

- NVIDIA (NVDA) - Shares -3% in pre-market trade; despite top- and bottom line beats, some analysts were seeking firmer guidance for Q4, and were disappointed by slowing growth rates, while some also continue to cite production concerns. Nvidia reported Q3 adj. EPS 0.81 (exp. 0.75), Q3 revenue USD 35.08bln (exp. 33.12bln). Q3 adj. gross margin 75% (exp. 75%), Q3 adj. operating expenses USD 3.05bln (exp. 2.99bln), Q3 adj. operating income 23.28bln (exp. 21.9bln). Exec said Blackwell production continue to ramp into fiscal 2026. Ahead, it sees Q4 revenue at around USD 37.5bln+/- 2% (exp. 37.1bln), and sees Q4 adj. gross margins between 73-74% (exp. 73.5%).

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is higher but with the USD showing a mixed performance vs. peers. Fresh macro drivers for the US remain light and as such, risk sentiment may carry sway for the Greenback. Today's US slate sees US Jobless Claims, Philly Fed Index, US Existing Home Sales, Fed’s Hammack, Goolsbee & Barr. DXY has been as high as 106.74 but has stopped shy of Wednesday's 106.91 peak.

- EUR on the backfoot vs. the USD with some modest weakness triggered by geopolitical angst surrounding Russia-Ukraine. EUR/USD has been as low as 1.0515 but is holding above yesterday's 1.0506 floor.

- JPY is firmer vs. the USD in what has been a choppy week for USD/JPY. Fresh macro drivers for the US and Japan have been lacking with JPY instead gaining impetus from some of the risk-aversion triggered by tensions between Russia and Ukraine.

- GBP on the backfoot vs. the USD and extending downside after yesterday's failure to hold above the 1.27 mark post-UK CPI. Fresh macro drivers for the GBP are light and the currency is flat vs. the EUR. Today's docket sees another appearance from BoE's Mann. Cable's low for the session is at 1.2624.

- Mildly diverging fortunes for Antipodeans with the AUD faring better than the Kiwi. AUD/USD has managed to hold above the 0.65 mark after yesterday's session of losses. NZD/USD has extended on yesterday's selling and slid further on a 0.58 handle.

- PBoC set USD/CNY mid-point at 7.1934 vs exp. 7.2482 (prev. 7.1935).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- A contained start for USTs with fresh drivers somewhat light after the 20yr auction on Wednesday (which was weak) and as we await the latest weekly jobs data before the latest wave of Fed speakers. USTs have remained in a narrow 109-20+ to 109-25+ parameters; the high of which printed most recently as Russia described Ukraine’s use of storm shadow missiles as a “new escalation”.

- Bunds are firmer on the session and at highs given the latest geopolitical updates and specifically commentary from the Russian Kremlin on storm shadow. At a 132.52 peak, having comfortably reclaimed the 132.00 handle after languishing just below the mark throughout much of the APAC session. The morning has seen supply from Spain and France, which was somewhat tepid vs recent outings for Spain, though not sufficiently so to spark any reaction, and France thereafter was well received.

- Gilts are bid in tandem with peers but also as the benchmark rebounds from Wednesday’s CPI-induced pressures. However, the odds of a December BoE cut remain stuck at around the 15% mark. Action which has taken Gilts back above the 94.00 handle, surpassing Wednesday’s 93.81 best.

- France sells EUR 11bln vs exp. EUR 9-11bln 2.50% 2027, 0.75% 2028, 2.75% 2030, 0.00% 2030 OAT Auction.

- Spain sells EUR 4.25bln vs exp. EUR 4-5bln 3.10% 2031, 4.20% 2037 Bono & 1.00% 2042 Green Bono.

- UK sells GBP 2bln 0.125% 2026 Gilt via tender: b/c 4.31x and average yield 3.996%.

- Click for a detailed summary

COMMODITIES

- WTI and Brent are firmer on the session, benefitting from the tense geopolitical backdrop as updates out of Russia continue to weigh on general risk sentiment. Benchmarks posting gains of just under USD 1/bbl on the session and in proximity to respective highs of USD 69.84/bbl and USD 73.87/bbl.

- Dutch TTF printed a fresh YTD high of EUR 48.15/MW, benefitting from the above with magnitudes more pronounced than in the crude space. The next point of resistance comes into play at EUR 49.81/MWh from early-December 2023.

- Spot gold is firmer, benefitting from the tense geopolitical environment and the generally soft risk tone on this and after NVIDIA’s results. Action which has seen havens generally benefit across the board with the DXY, JPY and fixed income bid.

- Base metals struggled for direction overnight, but have since slipped into mostly negative territory given the dip in risk sentiment owing to geopolitical updates out of Russia/Ukraine.

- US President-elect Trump's team is reportedly planning to revive the Keystone XL oil pipeline, according to POLITICO.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK PSNB Ex Banks GBP (Oct) 17.4B GB vs. Exp. 12.3B GB (Prev. 16.613B GB); PSNCR, GBP (Oct) 19.7B GB (Prev. -20.484B GB)

- French Business Climate Mfg (Nov) 97.0 vs. Exp. 95.0 (Prev. 92.0, Rev. 93)

NOTABLE EUROPEAN HEADLINES

- ECB's Villeroy said inflation could sustainably be at 2% in early 2025 and the economy remains resilient, while stated that victory against inflation is in sight in Europe but added the balance of risks on growth and inflation is shifting to the downside. Villeroy said it is possible that US tariffs are not expected to alter significantly the inflation outlook in Europe and the degree of monetary policy restriction should continue to be reduced in which the pace must be determined by agile pragmatism, with full optionality maintained for upcoming meetings.

- ECB's Stournaras says "25bps December rate cut is the right response; should cut every meeting until we reach 2%; neutral rate on average is about 2%", via Bloomberg TV.

- Bundesbank says a significant number of German corporate insolvencies are likely next year with corporate default risk to remain elevated

NOTABLE US HEADLINES

- US President-elect Trump's search for a Treasury Secretary remains "in flux", via Bloomberg; Trump is yet to be entirely sold on the candidates he has interviewed thus far.

- Fed's Barkin (2024 Voter) says "Fed should not pre-emptively adjust monetary policy ahead of possible changes in economic policy; US is more vulnerable to inflation shocks", via FT. "Forthcoming rate decision would depend on data.". "If you got inflation staying above out target, that makes the case to be more careful about reducing rates. If you got unemployment accelerating, that makes the case to be more forward-leaning."

- Fed's Collins (2025 voter) said some additional rate cuts are needed as policy is still restrictive but she doesn’t want to cut rates too quickly and warned that overly slow rate cuts could hurt the labour market. Collins also stated that the final destination of rate cuts is unclear and monetary policy is well positioned for the economic outlook, while she added monetary policy is not on a preset course and Fed policy decisions will be made meeting-by-meeting.

- Fed's Williams (voter) says sees inflation is cooling and interest rates falling further, adds 2% is the rate that can best balance the central bank's employment and price stability goals, according to Barron's

- Marty Makary is reportedly seen as the leading candidate for US President-elect Trump's FDA nomination, according to Bloomberg.

- US Justice Department proposed remedies in the Google (GOOG) search monopoly case and asked the judge to make Google divest its Chrome browser and said it should not be allowed to re-enter the browser market for five years, while the DoJ asked the judge to make Google divest its Android operating system if other remedies fail to restore competition. Furthermore, it asked the judge to order Google to syndicate search results and information to competitors for 10 years, while it seeks an end to Google's multibillion-dollar payments to Apple (AAPL) that ensure it is the default search engine on Apple devices and seeks to prohibit Google from buying or investing in any search rivals, query-based AI products, or ad tech.

GEOPOLITICS

Middle-East

- Israel conducted raids on southern suburbs of Beirut, according to Al Jazeera.

- Israeli air strikes on several houses in Beit Lahiya in the northern Gaza Strip killed and wounded dozens, according to medics.

- US Senate blocked measures that would have halted sales of tank rounds and joint direct attack munitions to Israel.

- Israel's Channel 14 quoting an Israeli political official reports "It is likely that no agreement with Lebanon will be announced during Hochstein's visit to Israel" but there is optimism that an agreement to end the war could be reached within a week.

Russia-Ukraine

- Western Official tells CNN news that Russia did not use an ICBM last night, Ukraine air force said it was a ballistic missile and declined to characterise it further. Ukraine air force declined to comment, saying the impact was still being assessed. Prior to this, Ukrainian media Ukrainska Pravda say a RS-26 ballistic missile was used to hit Dnipro. The original report was via Ukraine's Airforce which announced Russia launched intercontinental ballistic missiles from the Astrakhan region in the morning.

- Ukraine's airforce announces ballistic missile attack alert, via Bloomberg; explosions heard in Ukraine's Kryvyi Rih, via RBC Ukraine.

- Kremlin Spokesperson says storm shadow attack on Russia is a new escalation, according to TASS.

- Russia's Foreign Ministry says Russia is open to talks on Ukraine, ready to look at realistic initiatives.

- Russian Foreign Ministry spokesperson, on the US missile base in Poland, says this results in an increase to the overall level of nuclear danger. The base has long been a priority target, which can be hit with "Russian new weapons". Adds, Russia is open to talks on Ukraine, ready to look at realistic initiatives.

CRYPTO

- Bitcoin is on a firmer footing and holds firmly above USD 97k to a current record high at USD 97.9k.

- Coinbase (COIN) CEO Brian Armstrong sold 52.3k shares on November 18th for a total USD 19.1mln.

APAC TRADE

- APAC stocks were mostly subdued after the indecisive lead from the US where geopolitics and Nvidia earnings were in the spotlight.

- ASX 200 lacked firm direction amid weakness in the consumer-related sectors and after Westpac pushed back its forecast for when the RBA will begin cutting rates to May next year from a prior forecast of February.

- Nikkei 225 underperformed and tested the 38,000 level to the downside as the Japanese currency nursed some of its recent losses and despite a report that Japan is planning an economic package of around JPY 21.9tln.

- Hang Seng and Shanghai Comp were uninspired as participants digested recent earnings releases although support was seen in automakers after a MOFCOM official said they are planning the continuation of car trade-in incentives for next year to stabilise market expectations.

NOTABLE ASIA-PAC HEADLINES

- Four Chinese government advisers advocate for a 2025 growth target of around 5% which is similar to this year, while one adviser presses for a growth target of above 4% and another recommends a 4.5%-5% range, while advisers suggested a higher budget deficit could mitigate the impact of expected US tariffs, according to Reuters.

- China MOFCOM official said they are planning the continuation of car trade-in incentives for next year to stabilise market expectations.

- Chinese banks are seen cutting lending rates in 2025 but may leave lending rates unchanged next month, according to analysts cited by China Securities Journal.

- Japan reportedly plans an economic package of around JPY 21.9tln, according to NHK. It was later reported that Japanese Deputy Chief Cabinet Secretary Aoki said the LDP-led coalition is introducing measures to reflect DPP requests as much as possible.

- Baidu (9888 HK) Q3 (CNY) adj. EPS 16.6 (prev. 20.4), Revenue 33.65bln (exp. 33.3bln)