- US stocks were lower, but off troughs heading into APAC trade, with weakness led by the Nasdaq and semiconductor names ahead of Nvidia (NVDA) earnings after-hours.

- US equity futures later dipped after NVIDIA earnings were not received well despite beats across the board. Some pinned the move on the stock not beating the highest estimates.

- The Dollar saw a notable upside on Wednesday, rising from a low of 100.59 to a peak of 101.17 with the Buck outperforming the G10 space.

- T-Notes meandered throughout the session while the 5-year auction tailed, but was well received in comparison to recent auctions.

- Looking ahead, highlights include Fed's Bostic, Japanese Foreign Investments, New Zealand ANZ Business, Japanese JGB Auction

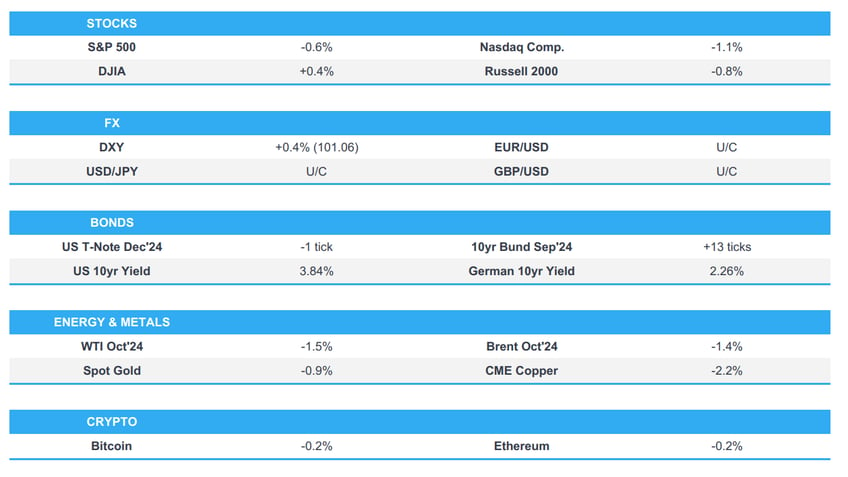

SNAPSHOT

US TRADE

- US stocks were lower, but off troughs heading into APAC trade, with weakness led by the Nasdaq and semiconductor names ahead of Nvidia (NVDA) earnings after-hours. However, US futures later dipped after NVIDIA earnings were not received well despite beats across the board.

- SPX -0.60% at 5,592, NDX -1.18% at 19,350, DJIA -0.39% at 41,091, RUT -0.57% at 2,190.

- Click here for a detailed summary.

NOTABLE HEADLINES

- NVIDIA Corp (NVDA) Q2 2025 (USD): Adj. EPS 0.68 (exp. 0.64), Revenue 30.04bln (exp. 28.68bln); approved an additional USD 50bln in share buyback. Revenue Breakdown: Data centre 26.3bln (exp. 25.08bln). Professional Visualization 454mln (exp. 451.1mln). Automotive 346mln (exp. 347.9mln). Key Metrics: Adj. gross margin 75.7% (exp. 75.5%). R&D expenses 3.09bln (exp. 3.08bln). Adj. operating expenses 2.79bln (exp. 2.81bln). Adj. operating income 19.94bln (exp. 18.85bln). Guidance: For FY, gross margins are expected to be in the mid-70% range. FY operating expenses are expected to grow in the mid- to upper-40% range. Q3 revenue view 32.5bln plus or minus 2% (exp. 31.9bln). Shares fell 3.6% after market.

- WSJ's Timiraos, in reference to Discount rate minutes, says "It is difficult to infer anything about NY Fed President John Williams's policy view from the fact that a majority of the directors of the bank supported a lowering of the discount rate in July".

DATA RECAP

- US MBA Mortgage Applications 0.5% (Prev. -10.1%)

- US MBA 30-Yr Mortgage Rate 6.44% (Prev. 6.5%)

FX

- The Dollar saw a notable upside on Wednesday, rising from a low of 100.59 to a peak of 101.17 with the Buck outperforming the G10 space.

- G10 FX (ex-Dollar) saw losses across the board as the firmer Greenback weighed, as opposed to much currency specific.

- The Euro and Pound were the laggards, with EUR/USD falling to lows of 1.1106, a level it hovered just above heading into overnight trade with the pair failing to fall sub-1.1100.

- EMFX were largely weaker vs. the Buck, although the MXN notably outperformed with strong gains as it attempts to recoup some of its recent heavy selling.

- Brazil President Lula nominates BCB Director Galipolo as the Brazil Central Bank chief.

FIXED INCOME

- T-Notes meandered throughout the session while the 5-year auction tailed, but was well received in comparison to recent auctions.

- US sells USD 70bln of 5yr notes; tails 0.3bps. High Yield: 3.645% (prev. 4.121%, six-auction average 4.370%). WI: 3.642%. Tail: 0.3bps (prev. 1.1bps, six-auction avg. 0.4bps). Bid-to-Cover: 2.41x (prev. 2.4x, six-auction avg. 2.38x). Dealers: 13.2% (prev. 14.0%, six-auction avg. 15.2%). Directs: 16.3% (prev. 18.8%, six-auction avg. 17.9%). Indirect: 70.5% (prev. 67.2%, six-auction avg. 66.8%).

COMMODITIES

- The crude complex was lower on Wednesday, continuing on its weakness seen on Tuesday, as the firmer Dollar weighed amid a lack of geopolitical updates.

DATA RECAP

- US EIA Weekly Crude Production 13.3M (Prev. 13.4M)

- US EIA Weekly Refining Util w/e 1.0% vs. Exp. 0.2% (Prev. 0.8%)

- US EIA Weekly Gasoline Stk w/e -2.203M vs. Exp. -1.5M (Prev. -1.606M)

- US EIA Weekly Dist. Stocks w/e 0.275M vs. Exp. -0.55M (Prev. -3.312M)

- US EIA Weekly Crude Stocks w/e -0.846M vs. Exp. -3.0M (Prev. -4.649M)

- US EIA Wkly Crude Cushing w/e -0.668M (Prev. -0.56M)

- US EIA Weekly Crude Production Change, bbl -100k (Prev. +100k)

- US EIA Weekly Crude Production Change, % -0.75% (Prev. +0.75%)

GEOPOLITICAL

- Israeli, US, Egyptian and Qatari negotiators were meeting in Doha on Wednesday for "technical/working level" Gaza ceasefire talks, via Reuters citing sources.

- China's Foreign Minister, following a meeting with US NSA Sullivan, says the US should not speculate on China and should stop suppressing China in commerce/trade.

- White House National Security Adviser and China officials held "candid, substantive, and constructive discussions on a range of bilateral, regional and global issues, via White House statement.

ASIA-PAC

NOTABLE HEADLINES

- Meitu (1357 HK) H1 (CNY) Revenue 1.62bln (exp. 1.72bln), Gross Profit 1.05bln, Gross Margin 64.9%, adj. Net 0.27bln. Did not recommend dividend distribution.

- BYD (0285 HK) H1 (CNY) Revenue 78.58bln (exp. 74.35bln), Gross Profit 5.38bln, EPS 0.67. Does not recommend the distribution of an interim dividend.

- Li Auto (2015 HK) Q2 (USD): Revenue 4.4bln, +10.6% Y/Y, Vehicle Sales 4.2bln; total deliveries 108,581 vehicles. Expects Q3 deliveries of between 145-155k; sees - Q3 total revenue to be between USD 5.4-5.8bln.

- Meituan (3690 HK) Q2 (CNH): Revenue 82.25bln (exp. 80.42bln), adj. EBITDA 14.99bln (exp. 12.15bln), adj. Net 13.6bln (exp. 10.94bln)

CENTRAL BANKS

- Israeli Interest Rate Decision (Aug) 4.5% vs. Exp. 4.5% (Prev. 4.5%)

- BCB Chief Neto says disinflation in Brazil has slowed down, and inflation expectations have gone through additional unanchoring recently; in much of the world, work of disinflation is not yet complete

EU/UK

NOTABLE HEADLINES

- EUROPEAN CLOSES: DAX: +0.57% at 18,789, FTSE 100: flat at 8,344, CAC 40: +0.16% at 7,578, Euro Stoxx 50: +0.27% at 4,912, AEX: +0.31% at 911, IBEX 35: flat at 11,332, FTSE MIB: +0.30% at 33,880, SMI: +0.37% at 12,348, PSI: -0.41% at 6,718

DATA

- EU Money-M3 Annual Growth (Jul) 2.3% vs. Exp. 2.7% (Prev. 2.2%); Loans to Non-Fin (Jul) 0.6% (Prev. 0.7%); Loans to Households (Jul) 0.5% (Prev. 0.3%)

To download the report, please click here If you would like to subscribe to receive the research sheets directly in your inbox, you can now do so under the Research Suite section of the portal. To subscribe simply check the box next to "Email these reports" under the desired category.

- US stocks were lower, but off troughs heading into APAC trade, with weakness led by the Nasdaq and semiconductor names ahead of Nvidia (NVDA) earnings after-hours.

- US equity futures later dipped after NVIDIA earnings were not received well despite beats across the board. Some pinned the move on the stock not beating the highest estimates.

- The Dollar saw a notable upside on Wednesday, rising from a low of 100.59 to a peak of 101.17 with the Buck outperforming the G10 space.

- T-Notes meandered throughout the session while the 5-year auction tailed, but was well received in comparison to recent auctions.

- Looking ahead, highlights include Fed's Bostic, Japanese Foreign Investments, New Zealand ANZ Business, Japanese JGB Auction