WTI prices just closed at the second highest level of 2023, up 2.5% at $83.64...

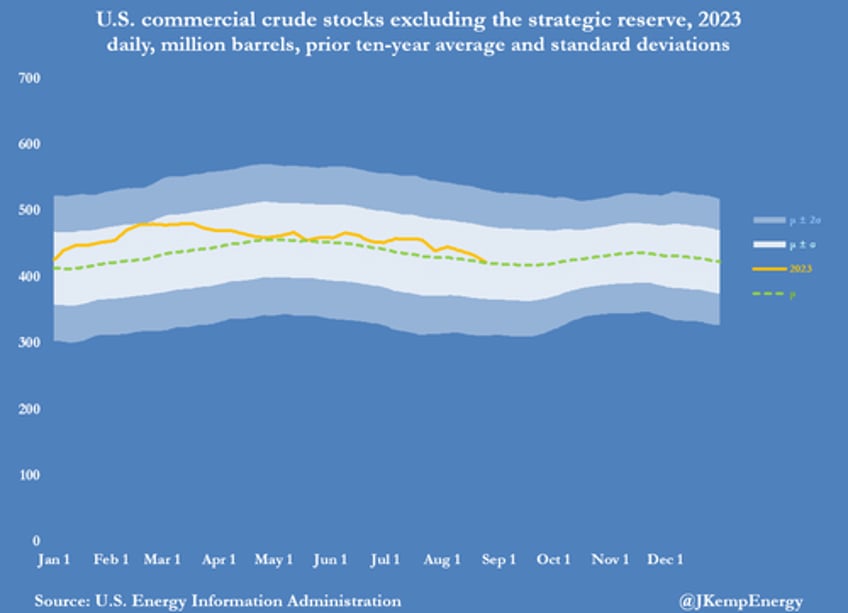

... because, as John Kemp notes, among other things U.S. commercial crude oil inventories have depleted by 34 million barrels since the middle of July, contributing to a sense the market is tightening and driving a recovery in spot prices and calendar spreads.

Some more details:

Commercial crude inventories have declined in five of the most recent six weeks, according to surveys conducted by the U.S. Energy Information Administration.

Commercial crude has accounted for all the drawdown in total inventories over the same period, which have fallen by just 19 million barrels since July 14, with products up by 12 million and strategic stocks up by 3 million.

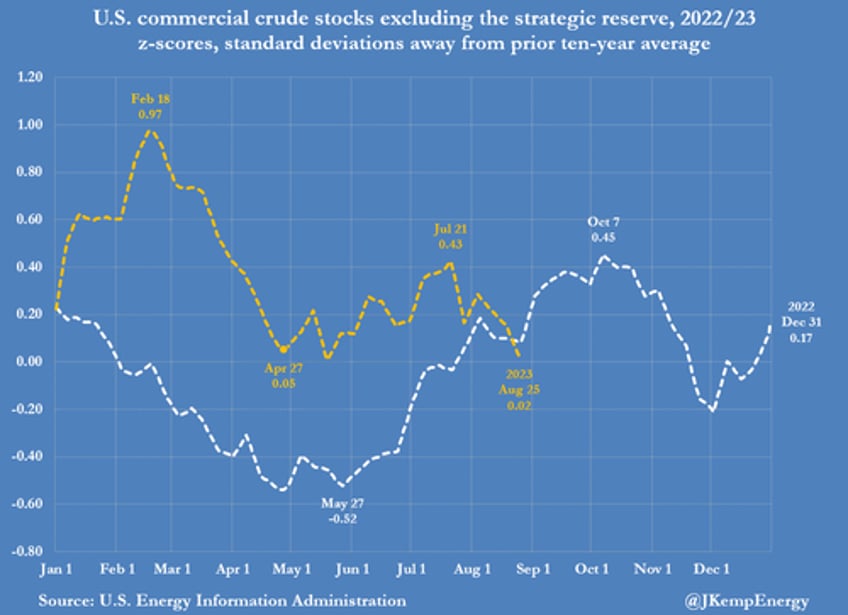

As a result, commercial crude stocks were just +1 million barrels (+0.3% or +0.02 standard deviations) above the prior ten-year seasonal average on August 25.

The surplus had narrowed from a recent high of +22 million barrels (+5% or +0.37 standard deviations) on July 14.

The recent drawdown has reversed a previous accumulation that had seen the surplus swelling since the end of April.

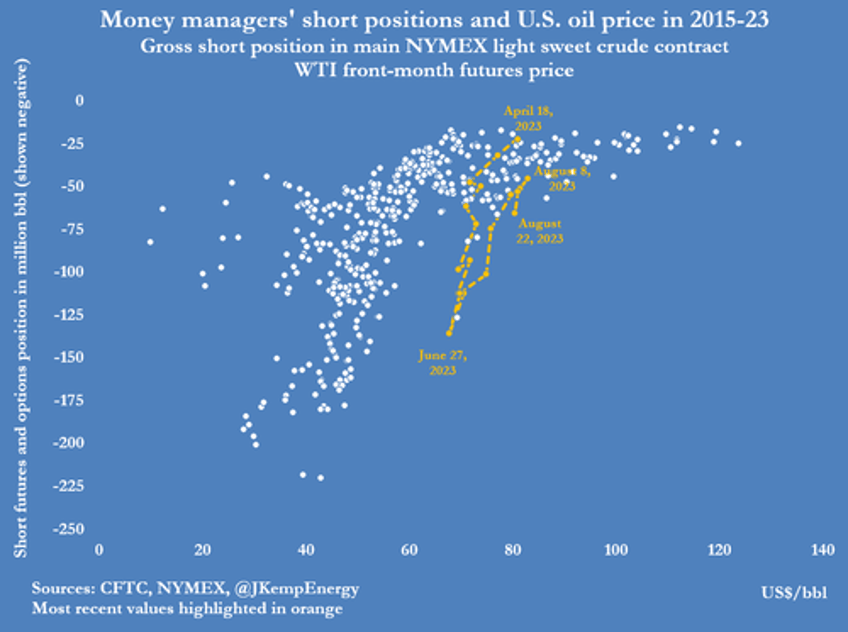

In consequence, front-month U.S. crude futures prices have risen by almost $7 per barrel (9%) since July 14 and almost $15 (22%) from the recent low on June 27.

Anticipating, accelerating and amplifying the decline in stocks and rise in prices, hedge funds increased their position in U.S. crude futures and options to 134 million barrels on August 22, up from just 46 million on June 27.

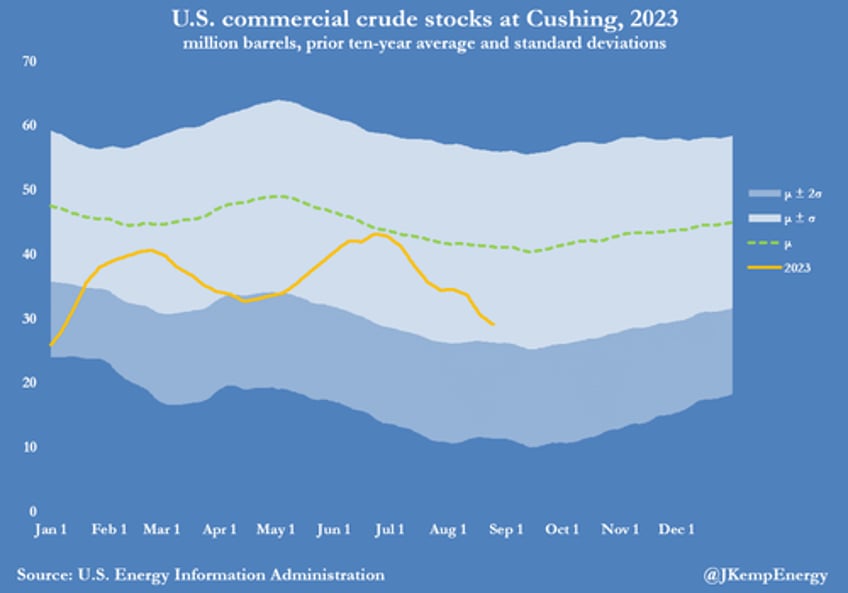

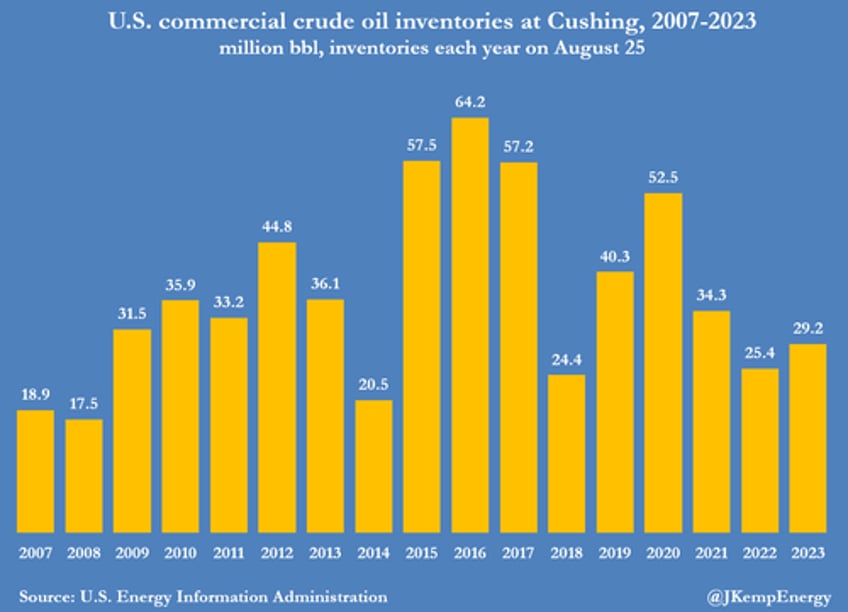

CUSHING DRAINED

The drawdown in inventories has especially drained stocks from tank farms clustered around Cushing in Oklahoma, the delivery point for the NYMEX U.S. crude futures contract.

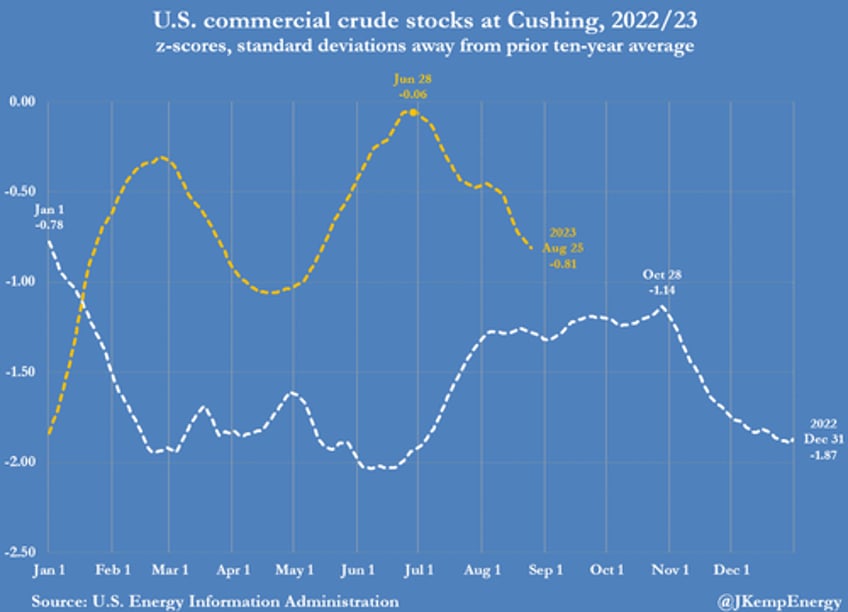

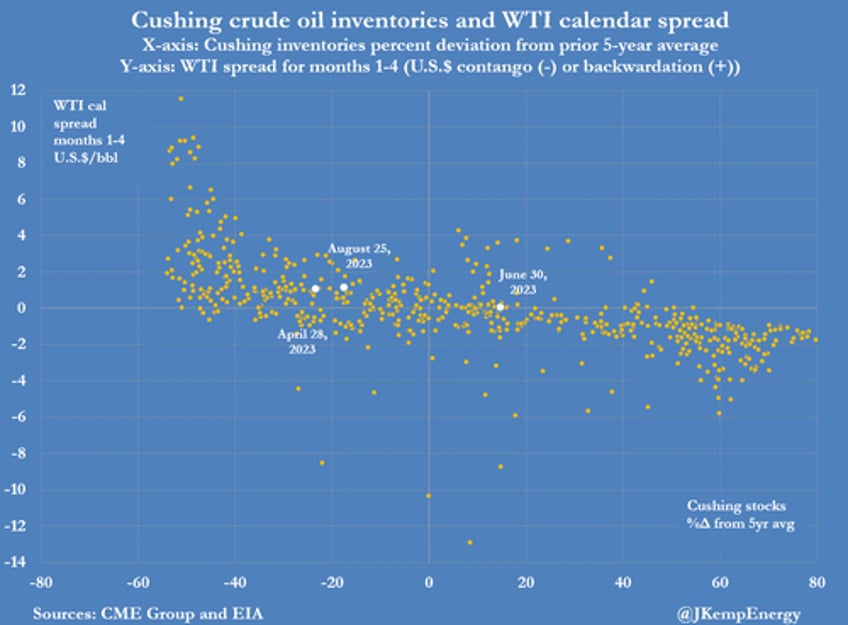

Cushing crude inventories have declined in five of the most recent six weeks by a total of 9 million barrels (-24%) since July 14. Cushing stocks were -12 million barrels (-29% or -0.81 standard deviations) below the prior 10-year average on August 25 having been less than -1 million barrels (-2% or -0.06 standard deviations) below on June 30.

Reflecting the lower level of stocks, the three-month calendar spread in U.S. crude futures tightened to a backwardation of $1.14 per barrel on August 25 up from a small contango in late June.

The drawdown in U.S. crude inventories has coincided with additional production cuts by Saudi Arabia and Russia totalling around 75 million barrels during July and August.

Saudi Arabia has also been steering its crude exports away from North by raising official selling prices for buyers in the United States much higher than for refiners in Asia.

GLOBAL MARKET PROXY

U.S. crude and other petroleum inventories are the most visible part of the global oil market because they are reported weekly with a minimal delay compared with monthly reporting with much longer lags for other countries.

Traders and investors often treat changes in U.S. inventories as a proxy for changes in the production-consumption balance at global level.

Persistent inventory depletion in the United States is usually interpreted as a sign the global market is running a deficit, causing spot prices and spreads to rise.

For the same reason, any oil producer, trader or investor wanting to initiate a rapid increase in prices and spreads is likely to focus on reducing visible inventories in the United States rather than less visible stocks in Europe and Asia.

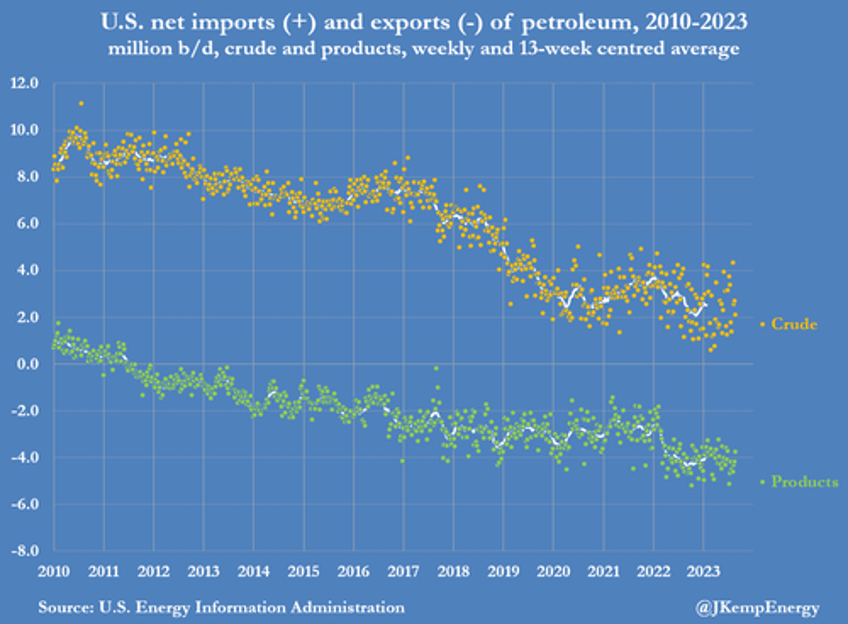

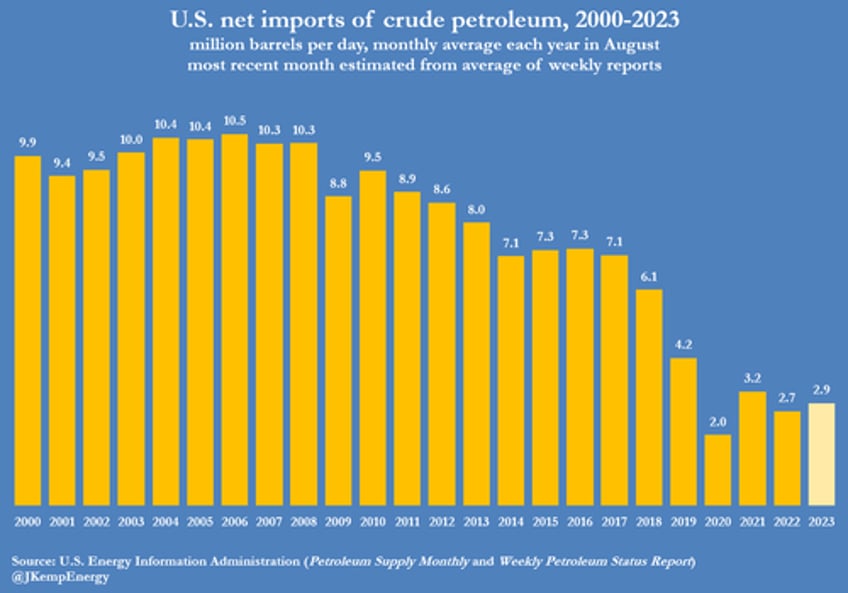

U.S. NET CRUDE IMPORTS

U.S. net crude oil imports remain subdued despite the depletion of inventories with exports continuing to run at a relatively fast rate while imports stay low.

Net crude imports averaged just 2.9 million barrels per day in August based on an average of the preliminary weekly data during the month.

Net imports had increased slightly from 2.7 million b/d in the same month in 2022 but were down from 3.2 million b/d in 2021 and 4.2 million b/d in 2019.

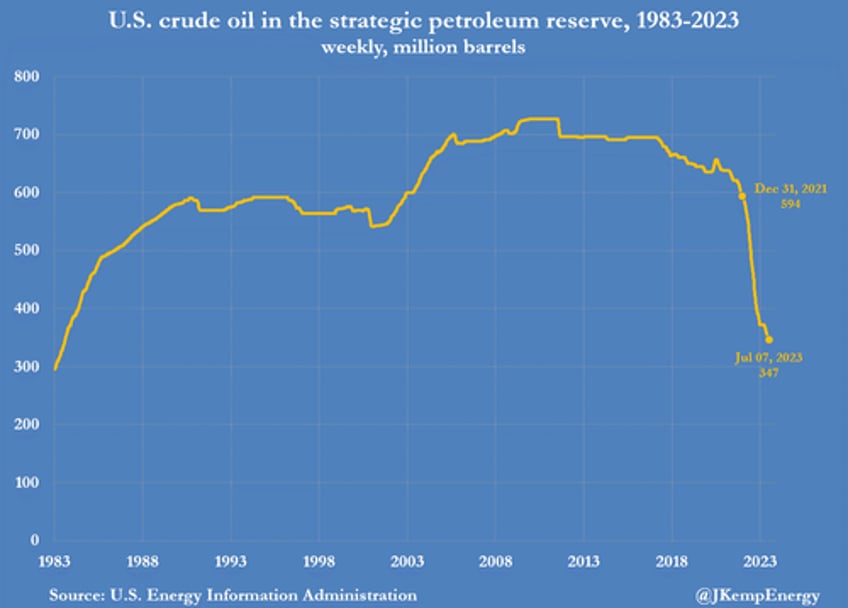

U.S. STRATEGIC RELEASES

The U.S. Department of Energy released almost 26 million barrels of crude from the Strategic Petroleum Reserve (SPR) in the first six months of 2023 and had released total of 247 million barrels since the start of 2022.

Releases contributed to downward pressure on both spot prices and calendar spreads by increasing the amount of oil readily available to traders and refiners.

The Biden administration directed them to offset any shortage of oil and upward pressure on prices as a result of Russia's invasion of Ukraine and the U.S. and EU sanctions imposed in response.

But the releases were essentially completed by the end of June and the department has since added almost 3 million barrels to the SPR, part of its plan to gradually refill the stockpile when prices are relatively low.

The shift from strategic inventory liquidation to accumulation has further tightened the availability of crude in the commercial market and added to upward pressure on prices and spreads.