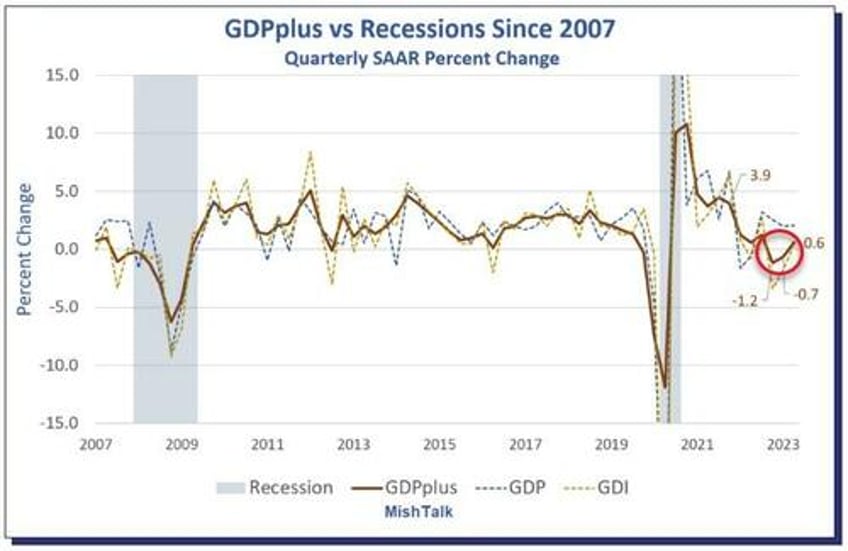

The Philadelphia Fed GDPplus measure, a blend of GDP and GDI, is flashing a signal that recession has already started...

Data from Philadelphia Fed, chart by Mish

GDPplus is a measure of the quarter-over-quarter rate of growth of real output in continuously compounded annualized percentage points.

It’s a blend, but not an average, of Gross Domestic Product (GDP) and Gross Domestic Income (GDI). It is much smoother than either GDP or GDI as the above chart show.

Improving GDP Measurement: A Measurement-Error Perspective

Please consider a 2013 working paper on GDPplus, Improving GDP Measurement: A Measurement-Error Perspective

Aggregate real output is surely the most fundamental and important concept in macroeconomic theory. Surprisingly, however, significant uncertainty still surrounds its measurement. In the U.S., in particular, two often-divergent GDP estimates exist, a widely-used expenditure-side version, GDPE [widely called GDP], and a much less widely-used income-side version, GDPI [GDI].

Nalewaik (2010) and Fixler and Nalewaik (2009) make clear that, at the very least, GDPI deserves serious attention and may even have properties in certain respects superior to those of GDPE. That is, if forced to choose between GDPE and GDPI , a surprisingly strong case exists for GDPI. But of course one is not forced to choose between GDPE and GDPI, and a GDP estimate based on both GDPE and GDPI may be superior to either one alone.

The rest of the paper is for Geeks only. The important points are as follows.

A strong case can be made for accepting GDI as a better measure of GDP than GDPE but a blend, not an average, would be even better.

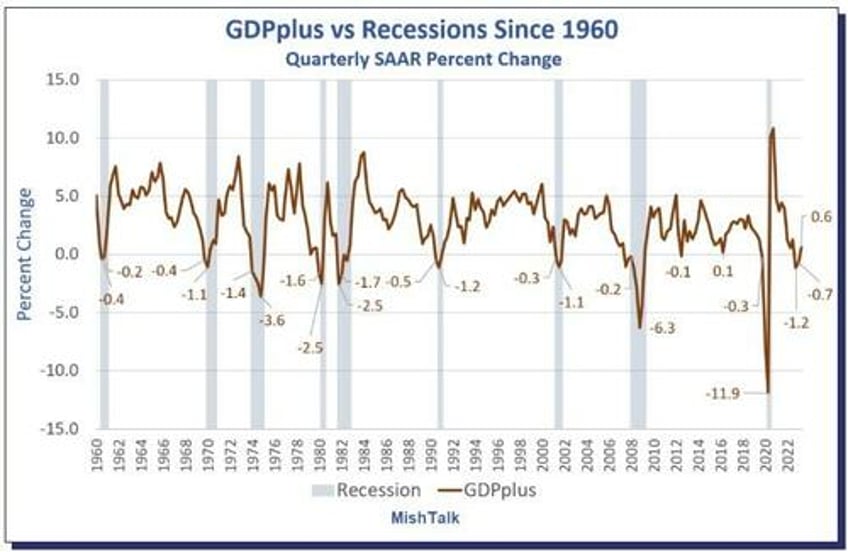

I put that theory to test by looking at every recession since 1960, 9 cases in all.

GDPplus vs Recessions Since 1960

Data from Philadelphia Fed, chart by Mish

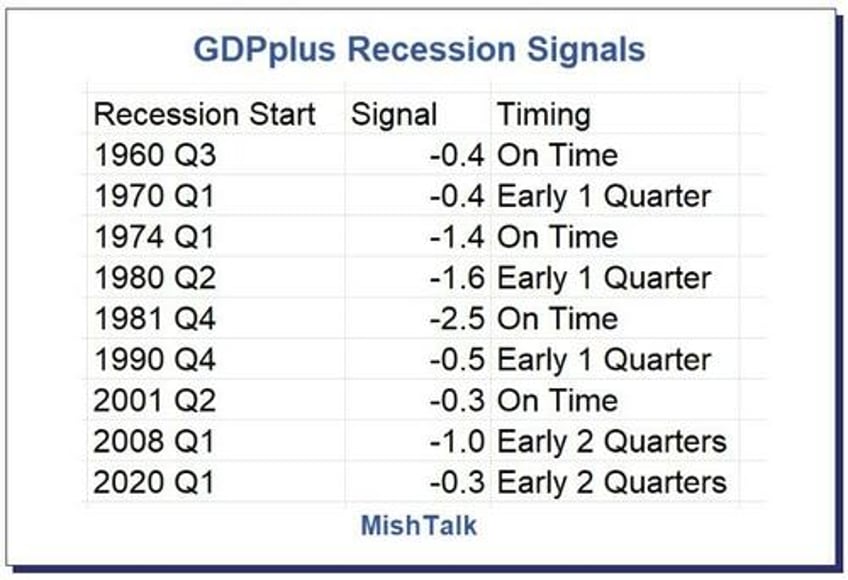

In 100 percent of the cases, with no false signals, no misses, and no lead times more than two quarters, every time GDPplus had two consecutive quarters of negative growth, the economy was in recession.

GDPplus Recession Signals

Mish compilation of recession lead times based on DGPplus data

GDPplus Recession Signals Synopsis

GDPplus signaled every recession

GDPplus was on time 4 times, early by a quarter 3 times, and early by 2 quarters twice.

This makes it appear as if GDPplus is a leading indicator. It isn’t because the data is heavily revised.

The BEA makes revisions frequently, especially on GDI. And since GDPplus is more reliant on GDI, it also has significant swings.

Also, the BEA does not release GDI in the first estimate of GDP, but somehow the Philadelphia Fed projects GDPplus anyway.

Recent Revisions

Yesterday, the GDPplus numbers for the past three quarters starting with 2022 Q4 were, in order, -1.1 percent, -0.4 percent, +1.5 percent.

Today, those quarters are -1.2 percent, -0.7 percent, and +0.6 percent.

Over time, the strength of revisions decreases greatly.

Thus, the first two numbers are increasingly likely to stay negative now given the decline from -0.4 percent to -0.7 percent for 2023 Q1.

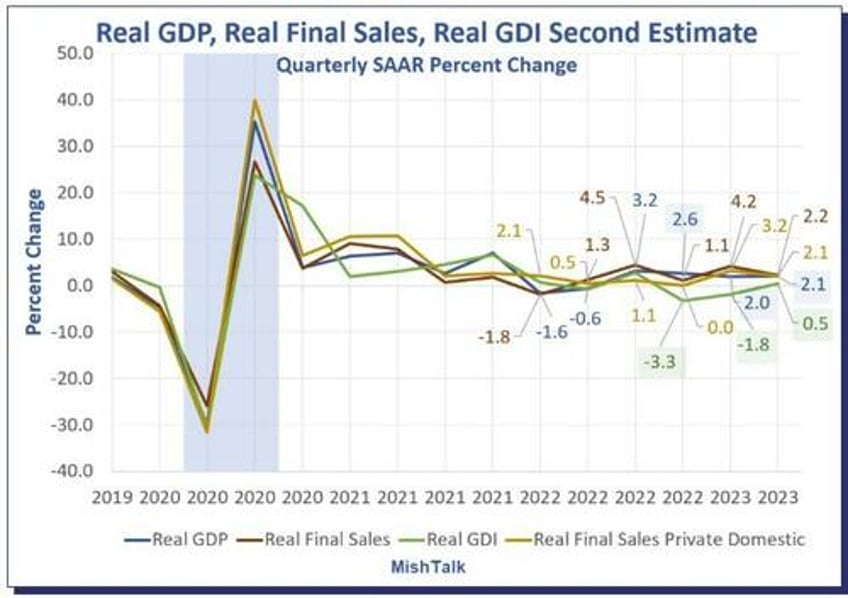

Negative Revision to 2nd Quarter GDP, Huge Discrepancy with GDI Continues

Earlier today I commented Negative Revision to 2nd Quarter GDP, Huge Discrepancy with GDI Continues

GDI is still consistent with a recession starting 2022 Q4. GDP isn’t. The NBER, the official arbiter of recessions, averages the two measures. The result is inconclusive for Q4 and Q1 combined.

Don’t be surprised if the NBER declares we had a recession and it is already over. It’s happened before.

Last Three Quarters Comparison

GDP: +2.6 percent, +2.0 percent, +2.1 percent

GDI: -3.3 percent, -2.8 percent, +0.5 percent

Average of GDP and GDI: -0.4 percent, +0.1 percent, +1.3 percent

GDPplus: -1.2 percent, -0.7 percent, and +0.6 percent.

The Averages of GDP and GDI are from the St Louis Fed.

Of those, I strongly suggest based on past performance GDPplus offers the best recession signal.

* * *