It appears that Biden's apparatchiks refuse to give up on the myth of a "strong labor market" just yet even as they admit to anyone who reads between the lines just how ugly things are getting.

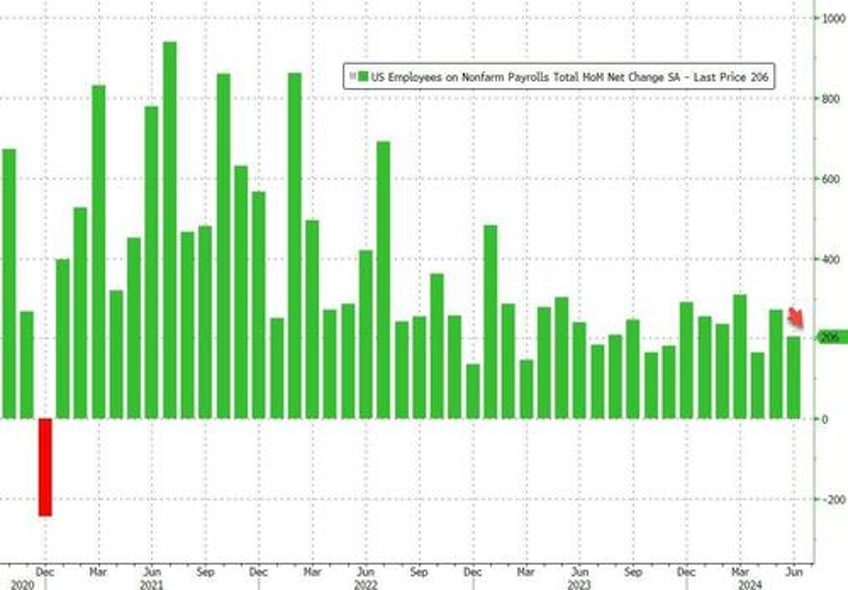

Moments ago the BLS reported that in June the US added 206K jobs, above the 190K expected.

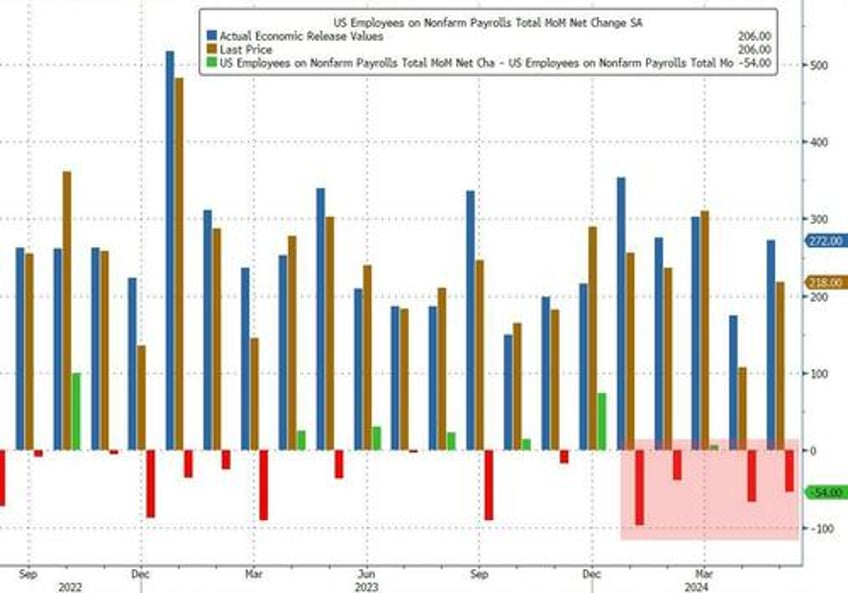

Not bad, especially with Goldman expecting 140K. Of course, a quick glance reveals where the "beat" came from: both previous months were revised sharply lower:

- May jobs revised from 272K, to 218K

- April jobs revised from 165K to 108K

With these revisions, employment in April and May combined is 111,000 lower than previously reported. So yes, it is easy to "beat" when you have a pool of 111K jobs that never existed to push into this month. And course, next month when the June data is revised lower, the 206K beat will be revised to a sub 190K miss but by then it will be too late. And as shown in the chart below, 4 of the past 5 months have seen payrolls revised lower.

Not only that but the composition of jobs was once again dismal and followed the same gimmick the BLS used for its "strong" JOLTS report this week: private sector workers came in at 136K, well below the 160K expected and down from a downward revised 193K (was 229K). The gap was filled by - what else- deep stater and other government workers, as government payrolls jumped from 25K to 70K!

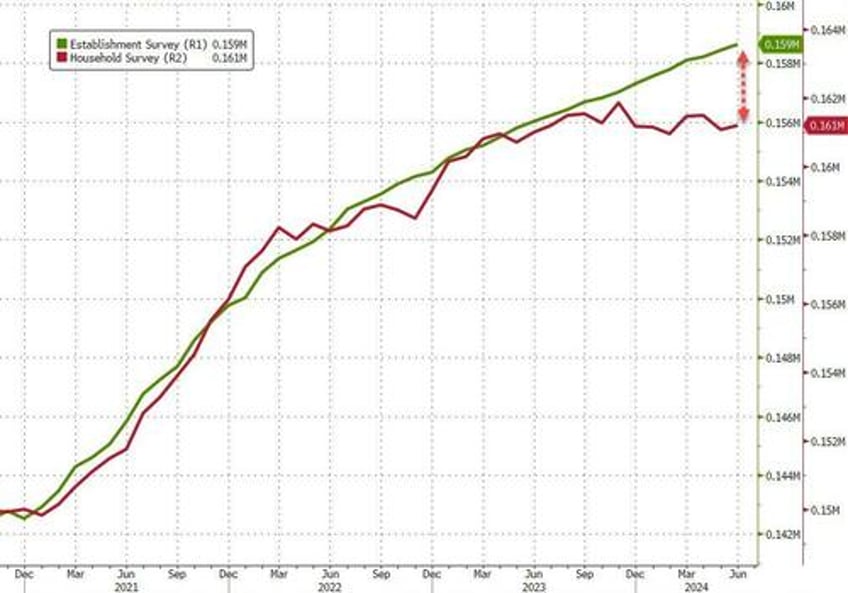

The good news is that unlike last month when the number of employed workers actually plunged again leading to a a record gap between the Establishment and Household Surveys, in June at least the number of employed workers rose by 116K. Which however means that the gap between the two series rose by another 90K!

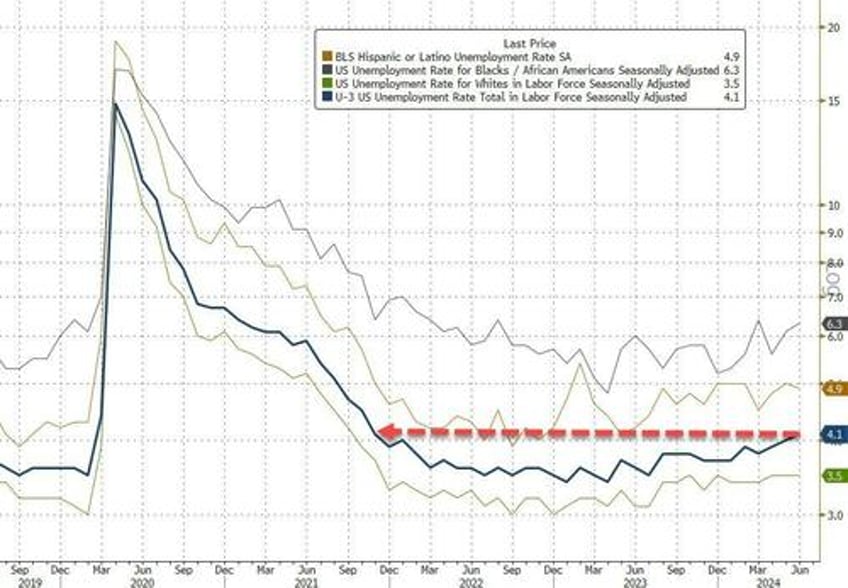

Turning to the unemployment rate, there was a big surprise here because contrary to expectations of a flat print, the number rose to 4.1%, up from 4.0% in May and the highest print since November 2021!

Among the major worker groups, the unemployment rates for adult women (3.7 percent) and Asians (4.1 percent) increased in June. The jobless rates for adult men (3.8 percent), teenagers (12.1 percent), Whites (3.5 percent), Blacks (6.3 percent), and Hispanics (4.9 percent) showed little or no change over the month.

Some more stats from the latest jobs report:

- The number of long-term unemployed (those jobless for 27 weeks or more) rose by 166,000 to 1.5 million in June. This measure is up from 1.1 million a year earlier. The long-term unemployed accounted for 22.2 percent of all unemployed people in June.

- The labor force participation rate changed little at 62.6 percent in June, and the employment-population ratio held at 60.1 percent. These measures showed little or no change over the year.

- The number of people employed part time for economic reasons, at 4.2 million, changed little in June.

- The number of people not in the labor force who currently want a job declined by 483,000 to 5.2 million in June. These individuals were not counted as unemployed because they were not actively looking for work during the 4 weeks preceding the survey or were unavailable to take a job.

- Among those not in the labor force who wanted a job, the number of people marginally attached to the labor force, at 1.5 million, was essentially unchanged in June. These individuals wanted and were available for work and had looked for a job sometime in the prior 12 months but had not looked for work in the 4 weeks preceding the survey. The number of discouraged workers, a subset of the marginally attached who believed that no jobs were available for them, edged down to 365,000 in June.

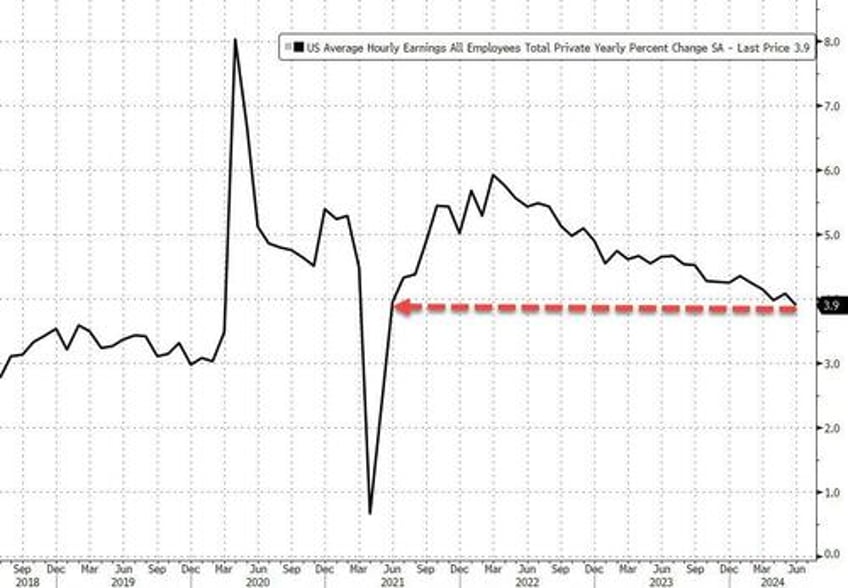

Turning to hourly earnings, here too there was continued slowing with the average hourly earnings number rising 3.9% YoY, down from 4.1% in May and in line with expectations. On a monthly basis, the print also slower to 0.3%, down from 0.4% in May.

Developing