By Michael Msika, Bloomberg Markets Live reporter and strategist

European stocks don’t have any upside left in the tank, according to strategists, who are adopting a wait-and-see stance ahead of elections in France that could bring big changes for economic policy.

The Stoxx Europe 600 will end the year at 517 points — around where it closed on Friday — according to the average estimate in a poll of 16 strategists. After an advance of about 8% this year, they’re wary of predicting more gains in a second half that includes the potential for political instability in France, a possible change in power in the UK and a US election where trade is a hot-button issue.

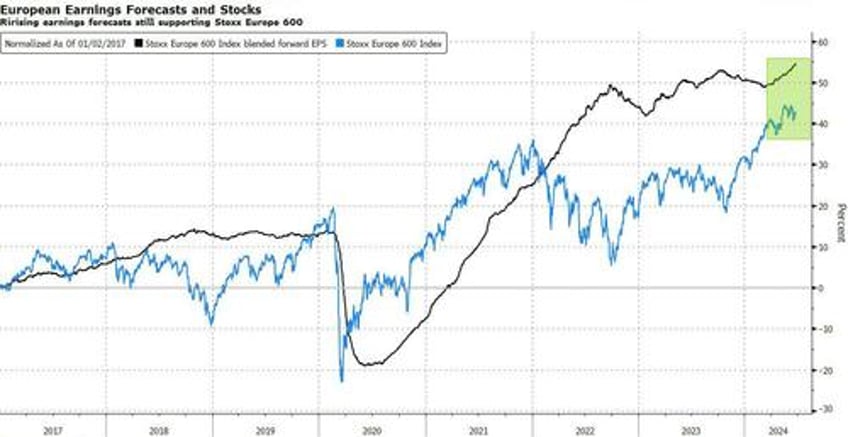

The average estimate has moved up a little from last month’s forecast of 503 points, with some strategists — including those at Pictet and UniCredit — raising their targets because of cheap valuations, better economic prospects in the region and rising earnings forecasts. A big hike from UBS’s Gerry Fowler has also helped push the poll’s median forecast to 533.

“Fundamentals support European equities, but they are highly sensitive to economic and policy risks,” say Goldman Sachs strategists led including Lilia Peytavin, who see the Stoxx 600 ending the year at 530 points.

The Goldman strategists don’t expect the region’s stocks to outperform the US as they won’t benefit as much from AI-related growth, while they are also more sensitive to international trade and policy uncertainty. They highlight the risk of additional tariffs following the US election in November, and say that the European equity risk premium may not recede until France gets a new government.

The regional benchmark posted its biggest weekly decline since October after French President Emmanuel Macron called the snap legislative election, sparking concerns about political gridlock and raising the risk premium on French bonds. The timing is particularly tricky as France’s sovereign debt rating was downgraded by S&P Global earlier this month.

Still, overall economic prospects for Europe have been improving this year, spurring analysts to raise their earnings forecasts. Most strategists seem to expect political uncertainty to last after France’s election but say it is unlikely to derail the longer-term case for European stocks. Monetary policy could also act as a buffer, with the European Central Bank having cautiously started its rate-cut cycle.

While near-term instability has hit sentiment, especially for French stocks, investors are still broadly bullish on European equities, according to the Bank of America European fund manager survey published last week. Respondents who expect near-term gains for European equities fell to a net 52% from 63% last month, but a net 67% still see upside over the next twelve months. Globally, a net 30% of respondents are overweight European equities, the highest since February 2022.

For BofA strategists, who remain among the most bearish in our survey, the consensus is way too positive on the broader economy and European stocks in general. Rather than politics, a slowdown in US consumer spending will put an end to the rally, which will outweigh the boost from falling interest rates, they say.

“Our macro projections imply a classical slowdown in which weakening growth momentum, driven by softening US consumption, leads to a rise in equity risk premia and declining earnings expectations,” say strategists led by Sebastian Raedler. They have a Stoxx 600 target of 460, implying around 11% downside.

Near-term risks have also kept bullish strategists on edge, with Citi’s Beata Manthey downgrading continental Europe to neutral last week and now preferring the US. “We remain constructive over the medium-term due to early-cycle macro dynamics in Europe and inflecting fundamentals,” she says.