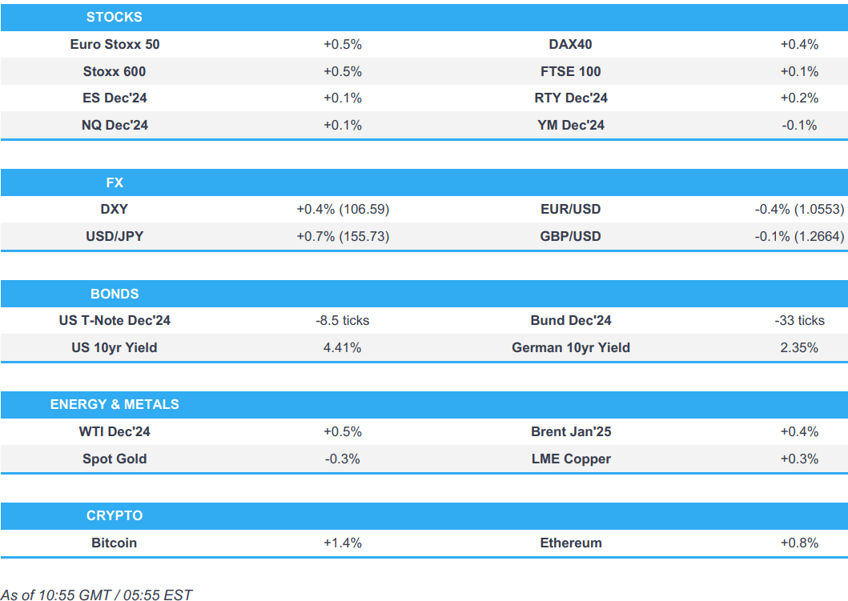

- Equities are entirely in the green as sentiment improves; NVDA earnings due after-hours.

- Dollar is back on a firmer footing, JPY underperforms and gives back the prior day’s haven-induced strength.

- Bonds are on the backfoot, and with clear underperformance in Gilts after the region’s hotter than expected CPI figures.

- Crude is incrementally firmer, XAU edges lower and base metals benefit from the risk tone.

- Looking ahead, ECB President Lagarde, de Guindos, BoE’s Ramsden, Fed's Barr, Cook, Bowman & Collins, Supply from the US. Earnings from NVIDIA, Snowflake, Palo Alto, NIO, TJX, Williams-Sonoma.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses opened the session entirely in the green and have generally traversed best levels throughout the morning.

- European sectors hold a strong positive bias, with only a couple of sectors found in negative territory. The breadth of the market to the upside is fairly narrow, with no clear outperformer. Construction & Materials tops the pile, joined by Tech and then Basic Resources; the latter pair buoyed by the positive risk tone. Real Estate is found at the foot of the pile, given the relatively higher yield environment.

- US equity futures (ES +0.2%, NQ +0.2%, RTY +0.2%) are modestly firmer across the board, attempting to build on the prior day’s gains and as traders remain laser-focused on NVIDIA (+0.3% pre-market) results after-hours.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

Newsquawk NVIDIA Preview

- The AI bellwether will report Q3 earnings on November 20th, at around 16:20EST/21:20GMT. Option Traders are pricing in a 9.9% move on earnings, and the stock has averaged a 9.8% move in recent quarters. NVIDIA is expected to report Q3 EPS of 0.74/shr on revenue of USD 32.87bln, with Data Centre sales expected at USD 28.51bln. For Q4, the street expects NVIDIA to guide EPS of 0.82/shr, on revenue of USD 36.78bln (and Data Centre sales of USD 31.96bln). For the FY25, the street looks for EPS to be guided at 2.85/shr, on revenue of USD 125.62bln (and Data Centre sales of USD 109.77bln). According to Refinitiv's data, 21 brokers rate NVDA as a 'Strong Buy', 36 rate it as a 'Buy', while six rate it as a 'Hold'; the street has a median price target of 165.00 (vs Tuesday's closing price of USD 147.01). Ahead of its earnings release, Morgan Stanley raised its H2 2025 projections for NVIDIA, but maintains cautious near-term expectations due to supply constraints on Blackwell and H200. the bank predicts strong revenue from Blackwell in January, but lower margins initially. MS expects NVIDIA's growth to continue in the latter half of 2025, with the Blackwell cycle driving upside. Despite being a transitional quarter, NVIDIA remains MS's top pick. At Tuesday's close, NVIDIA was the second largest S&P 500 component, with a 6.9% weight, and the largest stock in the Nasdaq-100, with a 8.7% weight.

FX

- After three sessions of losses, DXY is notably higher as the USD out-muscles all peers alongside a pick-up in US yields. Fed speak today includes Barr, Cook, Bowman & Collins. DXY is currently in touching distance of yesterday's 106.63 peak.

- EUR is swept up by the broadly firmer USD with EUR/USD's brief foray above 1.06 overnight very much in the rear-view mirror. The latest EZ wage data saw a jump in Q3 to 5.42% from 3.54% but this had little follow-through for EUR. EUR/USD is currently holding above yesterday's low at 1.0523. ECB's Lagarde and de Guindos due to speak later in the session.

- Yesterday's geopolitically-induced support for JPY has proved to be short-lived with USD/JPY resuming its trend seen since the US election. USD/JPY has printed a fresh WTD peak at 155.84.

- Cable vaulted higher in early trade following across-the-board hotter-than-forecast inflation metrics. GBP/USD rose from sub 1.27 levels to a peak of 1.2714. Note, the Y/Y services print was in-fitting with MPC forecasts.

- Antipodeans are both softer vs. the broadly stronger USD and trimming recent gains with fresh macro drivers on the light side.

- PBoC set USD/CNY mid-point at 7.1935 vs exp. 7.2386 (prev. 7.1911).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- A softer start for USTs as they continue to unwind Tuesday’s Russia-driven haven bid, taking USTs below Tuesday’s 109-19 base but still over 10 ticks clear of Monday’s 109-04+ base. Benchmark was largely unreactive to UK data or most recently EZ negotiated wages. Fed speak ahead include Barr, Bowman, Collins & Cook.

- Bunds were directionally in-fitting with peers, but magnitudes slightly more contained going into the release of the EZ Negotiated Wage Rates (Q3); a release which saw Bunds slip back to the 132.00 mark but pared almost immediately to pre-release levels. A well received German outing had little impact on Bunds.

- Gilts gapped lower by 48 ticks and then slipped another 23 to a 93.44 trough after hotter than expected inflation data for October. A release which has further reduced the odds of a December cut. It is worth noting that whilst the Services Y/Y figure surpassed the consensus, it matched the BoE's own forecast.

- Germany sells EUR 0.804bln vs exp. EUR 1bln 1.80% 2053 Bund and EUR 0.818bln vs exp. EUR 1bln 0.00% 2052 Bund.

- Click for a detailed summary

COMMODITIES

- WTI and Brent are in the green, having climbed to session highs in early European trade; more recently, the complex has edged off worst levels. Reuters reported that President Putin is open to talking about a ceasefire with President-elect Trump; news which ultimately had little impact on price action.

- Gold is in the red though only modestly so, and still comfortably clear of Tuesday’s USD 2610/oz base and by extension significantly above Monday’s USD 2562/oz base.

- Copper is firmer, but only modestly so. Benefitting from the general rebound in risk sentiment. 3M LME copper is in the green but only modestly so holding in a narrow USD 9.12-9.17k band.

- Trading Hub Europe announces the gas storage neutrality charge from January 2025 is EUR 2.99/MWh

- Equinor's (EQNR NO) Johan Sverdrup oilfield (775k BPD peak) output capacity is fully restored following a power outage. Producing steadily at normal levels.

- Private inventory data (bbls): Crude +4.8mln (exp. +0.1mln), Distillate -0.7mln (exp. -0.02mln), Gasoline -2.5mln (exp. +0.9mln), Cushing -0.3mln.

- Click for a detailed summary

NOTABLE DATA RECAP

- EU EZ Negotiated Wage Rates (Q3). 5.42% (Prev. 3.54%).

- UK CPI YY (Oct) 2.3% vs. Exp. 2.2% (Prev. 1.7%); MM 0.6% vs. Exp. 0.5% (Prev. 0.0%)

- UK Core CPI YY (Oct) 3.3% vs. Exp. 3.1% (Prev. 3.2%); MM 0.4% vs. Exp. 0.3% (Prev. 0.1%)

- UK CPI Services YY (Oct) 5.0% vs. Exp. 4.90% (Prev. 4.90%); MM 0.4% vs. Exp. 0.20% (Prev. -0.30%)

- UK ONS House Prices (Sep): 2.9% Y/Y (prev. 2.8%)

NOTABLE EUROPEAN HEADLINES

- UK PM Starmer is to visit Saudi Arabia and UAE to try to secure investment, according to FT.

- The Resolution Foundation think tank says the UK's ONS may be underestimating the number of people in employment by almost 1 million and overstating the extent of the country’s inactive workforce problem, according to The Times.

- ECB warns of bubble in AI stocks, low cash buffers at funds.

- ECB's de Guindos says current low growth scenario has to more with structural policy; monetary policy is not almighty.

- ECB's Escriva says floods in Spain to impact the Spanish economy by 0.2% in Q4.

NOTABLE US HEADLINES

- Economists expect Trump to impose 38% tariffs on Chinese goods early next year, according to a Reuters poll. Trump's proposed tariffs may cut China's 2025 growth by around 0.5-1%. China are likely to roll our more stimulus to counter these tariffs

GEOPOLITICS

MIDDLE EAST

- Hezbollah's Qassem to speak in today's session (time TBC). In response to the announcement that US Envoy Hochstein will arrive in Israel this evening

- Israeli army said Hezbollah fired 75 rockets from Lebanon towards Israel on Tuesday, according to Asharq News.

- US Envoy Hochstein will stay in Lebanon until Wednesday and then go to Israel, while the new wording of the proposal stated that each side has the right to self-defence if attacked, provided the US guarantees that Israel does not carry out pre-emptive strikes. However, Israel's Channel 13 noted Hochstein's visit to Tel Aviv may be delayed due to large gaps between Israel and Lebanon, while the main dispute at the moment is Israel's demand to maintain freedom of military action in southern Lebanon, according to Al Jazeera.

- Saudi representative to the Security Council said they condemn Israeli military actions against Lebanon and reject the threat to its security and stability, according to Asharq News.

- Iranian Foreign Minister Araqchi told French Minister for Europe and Foreign Affairs Barrot that Tehran warns France, Germany and Britain about submitting a resolution against Iran at the IAEA Board of Governor's meeting, while Araqchi added the European resolution draft contradicts the 'positive atmosphere' created between Iran and the UN nuclear watchdog and will complicate matters.

RUSSIA-UKRAINE

- Russia's Kremlin says Putin constantly states that he is ready for contacts and negotiations on Ukraine; also says the option of freezing the conflict will not suit Russia.

- Ukrainian air defence units attempted to repel a Russian air attack on Kyiv, according to Ukraine's military.

- US State Department said the US embassy in Kyiv received specific information of a potential significant air attack on November 20th, while the Kyiv embassy will be closed and it recommended that US citizens be prepared to immediately shelter in the event an air alert is announced, according to a post on X cited by Reuters.

- North Korean troops participated in some battles as part of Russia's airborne unit and marines in the Ukraine war, according to News1. It was also reported that North Korea shipped howitzers and multiple rocket launchers to Russia, while a South Korean lawmaker said South Korea's spy agency is still trying to determine any North Korean troop casualties and surrenders in the Ukraine war, according to Reuters.

- Russian President Putin is reportedly open to talking about a Ukraine ceasefire with US President-elect Trump, via Reuters citing sources; but rules out making any major territorial concessions. Russia could broadly agree to freeze the front-line conflict in any deal; insists Ukraine abandons ambitions to join NATO; could be open to withdrawing from patches of territory in the Kharkiv and Mykolaiv regions. Finally, there could be negotiating room over dividing up Donetsk, Luhansk, Zaporizhzhia and Kherson.

CRYPTO

- Bitcoin continues to climb higher and holds above USD 93k.

APAC TRADE

- APAC stocks traded mixed following the price swings seen across global markets on Tuesday in which the US indices staged a recovery from the initial risk-off conditions triggered by the Ukraine-Russia escalation, while participants now await NVIDIA's earnings.

- ASX 200 pulled back from recent record highs but with losses contained by a quiet calendar and light macro newsflow.

- Nikkei 225 traded indecisively despite the mostly better-than-expected Japanese trade data, while there were firm gains seen in Seven & I Holdings and media powerhouse Kadokawa following respective M&A-related headlines.

- Hang Seng and Shanghai Comp swung between gains and losses with price action indecisive following the lack of fresh major catalysts in the region, while there were also no surprises from the PBoC's announcement of the benchmark Loan Prime Rates which were maintained at their current levels following last month's 25bp cuts.

NOTABLE ASIA-PAC HEADLINES

- Japanese gov't to invest JPY 200bln in Rapidus (chipmaker) in FY-2025, via Nikkei.

- China's GDP growth seen at 4.8% in 2024, 4.5% in 2025 (unrevised from October), according to a Reuters Poll

- Chinese Loan Prime Rate 1Y (Nov) 3.10% vs. Exp. 3.10% (Prev. 3.10%); 5Y 3.60% vs. Exp. 3.60% (Prev. 3.60%)

- China's SCIO is reportedly to hold a briefing on Friday to outline measures for stabilising foreign trade growth, while the Vice Commerce Minister and officials from MOFA, MIIT, PBoC and Customs will attend the briefing, according to source on X.

- US vowed more sanctions on Hong Kong officials after 45 pro-democracy activists were recently jailed, according to SCMP.

- US Democratic Senator Blumenthal said Elon Musk's China ties are a profound threat to US national security and his business interests could be exploited by Beijing, according to SCMP.

- China's smartphone sales -9% Y/Y during Singles' Day 2024, via Counterpoint Research. Huawei sales +7% Y/Y. Apple (AAPL) and Honor both declined by double-digit %.

DATA RECAP

- Japanese Trade Balance Total (JPY)(Oct) -461.2B vs. Exp. -360.4B (Prev. -294.3B, Rev. -294.1B)

- Japanese Exports YY (Oct) 3.1% vs. Exp. 2.2% (Prev. -1.7%)

- Japanese Imports YY (Oct) 0.4% vs. Exp. -0.3% (Prev. 2.1%, Rev. 1.8%)