- APAC stocks began the new quarter mixed amid a slew of data releases and several key market closures with Mainland China, Hong Kong and South Korea closed

- Fed Chair Powell hinted at a return to 25bp rate cuts and noted that the Fed is not in a rush to cut rates quickly.

- Israeli military said it began limited, localised and targeted raids against Hezbollah targets in the border area of southern Lebanon.

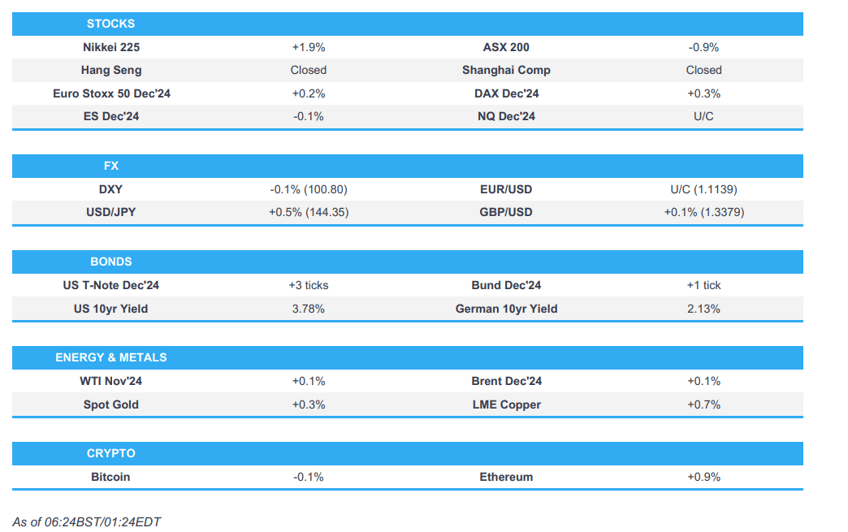

- European equity futures are indicative of a positive cash open with the Euro Stoxx 50 future +0.2% after the cash market closed lower by 1.3% on Monday.

- DXY is steady and holding onto yesterday's gains, JPY remains pressured vs. peers, EUR/USD sits on a 1.11 handle.

- Looking ahead, highlights include final EZ, US, Canadian Manufacturing PMIs, EZ HICP, US ISM Manufacturing PMI, JOLTS Job Openings, Riksbank Minutes, ECB’s de Guindos, Rehn & Schnabel, BoE’s Pill, Fed’s Bostic, Cook & Barkin, Supply from UK & Germany, Earnings from Paychex and Nike

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were choppy and ultimately closed slightly firmer on month/quarter end in which the S&P 500 led the gains and the majority of sectors closed in green with outperformance in Energy, Communication Services, and Real Estate, while Materials, Consumer Discretionary and Staples underperformed. The highlight of the session was comments from Fed Chair Powell who hinted at a return to 25bp rate cuts after the 50bp move in September as he noted that the Fed is not in a rush to cut rates quickly and if the economy evolves as expected, that would mean two rate cuts by year-end for a total of 50bps, implying 25bp in November and December. As such, the downplaying of another oversized 50bp cut saw stocks and bonds tumble while the Dollar rallied.

- SPX +0.42% at 5,762, NDX +0.26% at 20,061, DJIA +0.04% at 42,330, RUT +0.24% at 2,230.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed Chair Powell said policy will move over time towards a more neutral stance if the economy evolves broadly as expected, while he added that risks are two-sided and decisions will be meeting-by-meeting. Powell said the Fed is not in a hurry to cut rates quickly and will be guided by data, as well as noted that the rate cut process will play out 'over some time' with no need to go fast. Furthermore, he said the Fed will take everything into account in the November rate decision and if the economy evolves as expected that would mean two more cuts this year for a total of 50bps.

- Fed's Bostic (2024 voter) said he is open to another 50bp rate cut if the labour market shows unexpected weakness and stated the baseline case is for an 'orderly' easing with inflation expected to continue slowing and job market to hold up. Furthermore, he pencilled in just a single further 25bp rate cut this year beyond the 50bps in September and said his baseline outlook through the end of 2025 would see a policy rate of between 3.00-3.25% (vs Fed median of 3.40%).

- Fed's Goolsbee (2025 voter) is worried about a possible continued port shutdown and said the Fed is cutting rates because the economy has normalised, according to a Fox Business News interview. Goolsbee sees 'cautionary' indicators on the job market and said the Fed cannot wait for the job market to weaken before acting, while he added the most important thing about rate cuts is the process of easing, as well as noted there will be a lot of rate cuts and inflation is coming in close to target.

- Port of Houston Authority said in the event of a work stoppage, Port Houston container terminal gates will be closed beginning October 1st. It was reported shortly after that the United States Maritime Alliance said USMX and ILA exchanged counter offers around wages, while it is hopeful to fully resume collective bargaining around other outstanding issues in an effort to reach an agreement. However, the union later rejected the latest USMX Ports contract offer which it called unacceptable, according to a Reuters source.

APAC TRADE

EQUITIES

- APAC stocks began the new quarter mixed amid a slew of data releases and several key market closures with markets in Mainland China, Hong Kong and South Korea closed, while participants also reflected on Fed chair Powell's recent comments and Israel's ground offensive in Lebanon.

- ASX 200 was pressured as underperformance in the mining, materials and financial sectors overshadowed the resilience in tech and defensives, while data releases were mixed as Retail Sales topped forecasts but Building Approvals showed a sharper-than-feared contraction.

- Nikkei 225 rallied after the recent heavy selling with the recovery facilitated by a weaker currency amid mixed Tankan data and varied BoJ opinions.

- US equity futures (ES -0.1%) traded little changed after the prior day's choppy performance and recent Fed speak, while participants now look towards ISM data.

- European equity futures are indicative of a positive cash open with the Euro Stoxx 50 future +0.2% after the cash market closed lower by 1.3% on Monday.

FX

- DXY trades steadily and holding on to recent spoils which were facilitated by remarks from Fed Chair Powell who noted the Fed is not in a hurry to cut rates quickly and if the economy evolves as expected, that would mean two more cuts this year for a total of 50bps, implying 25bps moves in November and December.

- EUR/USD attempted to recoup some lost ground after its slip from the 1.1200 level although the rebound was limited as EU CPI data looms.

- GBP/USD was rangebound after yesterday's indecision and downward Q2 GDP revisions, while UK BRC shop prices fell by the most in 3 years.

- USD/JPY extended its gradual recovery from the post-LDP vote slump as the BoJ Summary of Opinions suggested some views against hiking.

- Antipodeans were mixed with AUD/USD briefly supported following better-than-expected Retail Sales although the upside was limited by disappointing Building Approvals, while NZD/USD trickled lower following a contraction in Building Approvals and with BNZ forecasting a 50bps cut at next week's RBNZ meeting.

FIXED INCOME

- 10yr UST futures nursed some losses after having bear flattened amid Fed Chair Powell's comments who leaned back against another oversized rate cut in 2024.

- Bund futures continued to oscillate around the 135.00 level with price action contained ahead of EU CPI and German Bobl supply.

- 10yr JGB futures eked slight gains in rangebound trade after mixed Tankan data and the BoJ's Summary of Opinions from the September meeting where there were some views suggesting caution in raising rates amid uncertainties.

COMMODITIES

- Crude futures were little changed following the prior day's indecision and despite the geopolitical escalation in which Israel began a ground offensive in Lebanon, with prices contained as Libya's halted oil output is expected to commence today.

- US buys 6mln bbls of oil for SPR with 1.5mln bbls of oil per month for delivery from February to May 2025, according to the Energy Department.

- Russia doesn't rule out extending the OPEC+ agreement beyond 2025 if the market situation requires it, according to TASS citing Russian Deputy PM Novak. It was also stated that OPEC+ countries are purposefully temporarily ceding oil market share to prevent shortages that could be 5 years from now.

- Spot gold attempted to nurse some of the prior day's losses after suffering alongside the recent dollar strength.

- Copper futures lacked direction with demand lacklustre after yesterday's price swings and amid a week-long absence of its largest buyer.

CRYPTO

- Bitcoin mildly gained overnight and traded both sides of the 63,500 level before eventually extending northward.

NOTABLE ASIA-PAC HEADLINES

- BoJ Summary of Opinions from the September meeting stated that a member said there is no change to the stance of adjusting the degree of monetary support if the economy and prices move in line with forecast although they must be vigilant to factors behind still unstable markets, while there was an opinion from a member that there is no need to raise rates when markets are unstable because they are not behind the curve on inflation and a member also said that given economic and market uncertainties, it is undesirable to make further changes to policy rate in a way that give markets impression they are moving to full-fledged policy tightening. Furthermore, a member said there is no change to the view that the BoJ must raise rates without waiting too long, but the rate hike must not be purpose in itself, while a member also thought that the rate path should move policy rate to 1.0% in the latter half of fiscal 2025 at earliest.

DATA RECAP

- Japanese Tankan Large Manufacturing Index (Q3) 13.0 vs. Exp. 13.0 (Prev. 13.0)

- Japanese Tankan Large Manufacturing Outlook (Q3) 14.0 vs. Exp. 12.0 (Prev. 14.0)

- Japanese Tankan Large Non-Manufacturing Index (Q3) 34.0 vs. Exp. 32.0 (Prev. 33.0)

- Japanese Tankan Large Non-Manufacturing Outlook (Q3) 28.0 vs. Exp. 30.0 (Prev. 27.0)

- Japanese Tankan Large All Industry Capex Estimate (Q3) 10.6% vs. Exp. 11.9% (Prev. 11.1%)

- Japanese Unemployment Rate (Aug) 2.5% vs. Exp. 2.6% (Prev. 2.7%)

- Australian Building Approvals (Aug) -6.1% vs. Exp. -4.3% (Prev. 10.4%, Rev. 11.0%)

- Australian Retail Sales MM (Aug F) 0.7% vs. Exp. 0.4% (Prev. 0.0%)

GEOPOLITICS

MIDDLE EAST

- Israel conducted artillery shelling on southern Lebanese towns in preparation for the launch of the ground operation, while the ground offensive is expected to start from the eastern sector in southern Lebanon, according to Sky News Arabia citing their correspondent. There were reports shortly after that Israeli tanks infiltrated the village of Rmeish in southern Lebanon, according to Al Arabiya citing a correspondent.

- Israeli military said it began limited, localised and targeted raids against Hezbollah targets in the border area of southern Lebanon, while it said the targets are located in villages near the border and pose an immediate threat to northern Israeli communities. Furthermore, Axios reported that officials also confirmed that the Israeli ground operation in southern Lebanon has started.

- Israeli military warned residents in Beirut suburbs to evacuate due to imminent strikes on Hezbollah targets, while a large blast was heard after warnings of an Israeli strike on Beirut's southern suburbs, according to a Reuters witness.

- An Israeli strike was reported on a building in Ain Al-Hilweh Palestinian Camp near Lebanon's Sidon and Lebanese sources noted an Israeli raid targeted the house of Major General Munir Al-Maqdah inside the Ain al-Hilweh camp, according to Sky News Arabia.

- Israeli officials earlier said they were preparing for a limited group operation in villages in southern Lebanon, according to Al Arabiya. It was also reported that Israel informed Washington it is planning a limited ground operation in Lebanon that could start imminently, according to the Washington Post. Furthermore, a senior US official told Fox that Israel will launch a "limited" ground incursion into South Lebanon, while the official added that an incursion is imminent and will be smaller in scale than in 2006 and last a shorter period of time.

- Israeli Security Cabinet approved the war’s next phase and ministers slammed US leaks about ground operations, according to Times of Israel.

- Israel was reportedly preparing for a significant expansion of the war including an "exchange of blows" with Iran soon, according to Israel's Channel 13 correspondent Moriah Ashraf via Telegram.

- Hezbollah said it is countering Israeli ground military movements and it targeted Israeli troop movements across from Lebanese border towns.

- Hezbollah has not asked for any help from Iran but they are at their side, according to Reuters citing Hezbollah lawmaker Hassan Fadlallah.

- Israel's Channel 12 reported that about 10 rockets were fired from Lebanon and landed in open areas in Miskaf in northern Israel, according to Sky News Arabia. It was separately reported that the IDF said it monitored the launch of 3 rockets from Lebanon towards Safed and it intercepted two rockets while the other landed in an open area, according to Al Jazeera.

- Lebanese troops pulled back to 5km north of the border, according to Reuters citing Lebanese security sources.

- Syrian state media reported that explosions were heard over Syria's capital Damascus with Syrian air defences intercepting hostile targets.

- Yemen's Houthis said they will escalate military operations in response to Israeli attacks.

- Media outlets close to the Houthis noted talk about the Houthis launching a ballistic missile towards Tel Aviv, according to Sky News Arabia. Israel's Channel 12 reported shortly after that residents in central Israel heard an explosion in the Tel Aviv area.

- A military base hosting US forces near Iraq's Baghdad International Airport was targeted by a rocket attack.

- The Pentagon said the US is to send a 'few thousand' additional troops to the Middle East to boost security and defend Israel if needed, according to AP.

OTHER

- North Korea criticised the US deployment of nuclear assets in South Korea with a US B-1B bomber potentially to participate in a planned military parade on Tuesday.

EU/UK

DATA RECAP

- UK BRC Retail Shop Price Index YY (Sep) -0.6% vs Exp. -0.3% (Prev. -0.3%)

- French PM Barnier is planning to announce additional tax increases of EUR 15-18bln in an attempt to gain back control of the nation's finances, according to Le Parisien.