The latest money data from China shows its capital-outflow problem is worsening, pressuring policymakers to allow a further weakening in the currency.

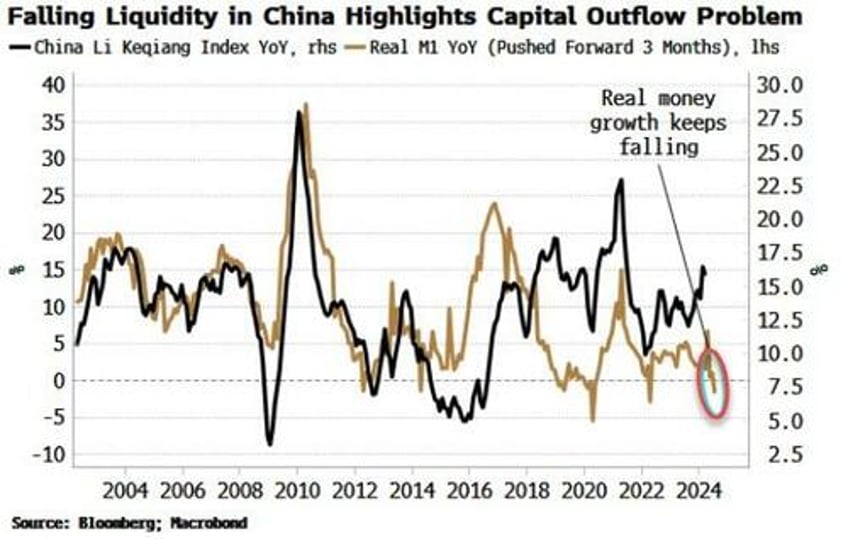

China released money and inflation data over the weekend. CPI and PPI were not great reading, but money supply data was even more downbeat: M2’s growth disappointed, while M1 growth is moldering, falling 1.4% year-on-year versus +1.2% expected.

Real M1 growth is now also contracting, which is ominous for China’s thus far gingerly-improving growth.

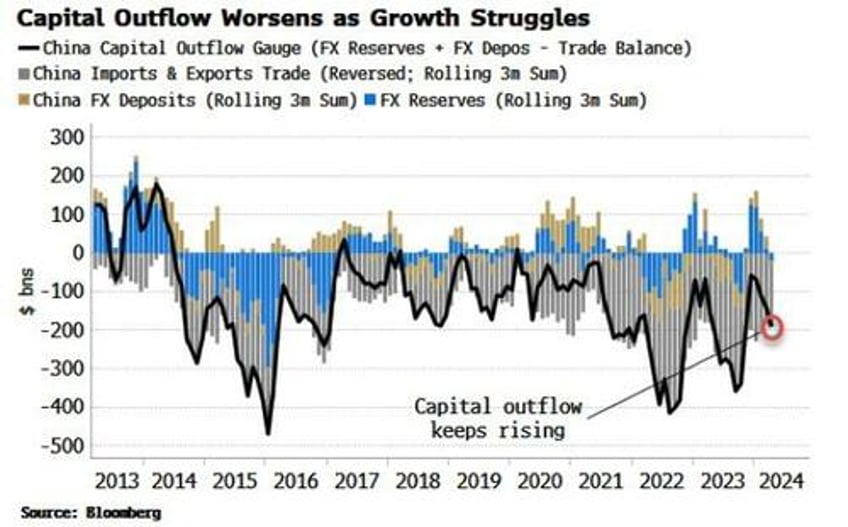

China has a capital-outflow problem that is putting pressure on liquidity.

It has a nominally closed capital account, but we can infer capital outflow by looking at the difference between the trade surplus and official reserves at the central bank, plus FX held at other banks.

Emerging markets typically have foreign reserves forming their monetary base due to the difficulty in reliably borrowing in their own currency cost efficiently. When capital leaves a country that can comfortably borrow in its own currency, the central bank can print money to replace the lost liquidity.

But in a country like China, capital outflow leads to a mechanical fall in domestic liquidity.

Cuts in the required reserve ratio, with another one expected next month, and interest-rate reductions can help alleviate this decline. Another lever is the currency. A weaker yuan eases the pressure on the fall in the monetary base as capital leaves.

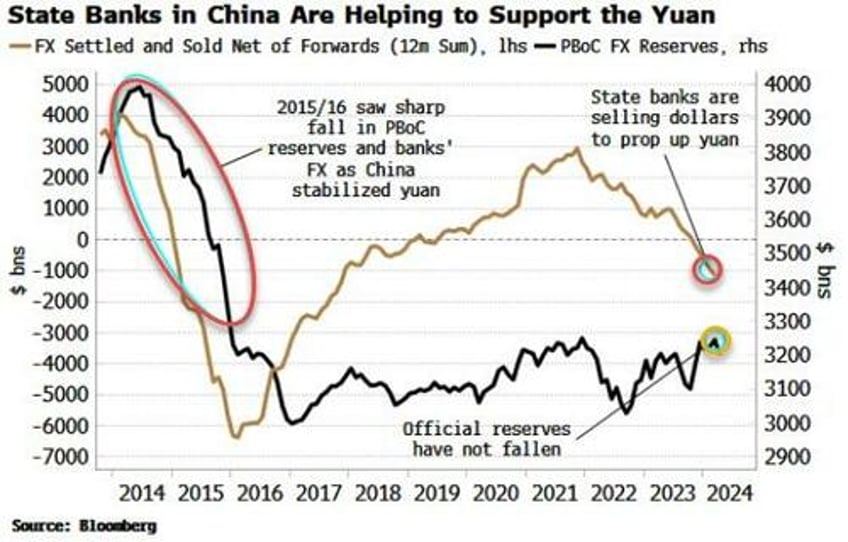

USD/CNY continues to bump up against the upper band of the yuan fix, signaling the pressure the currency is under.

Foreign FX at banks is falling. Some of this likely due to capital outflow, but some is also due to China directing state banks to intervene to prevent the currency from weakening too far.

China continues to incrementally ease to try to kickstart a post-Covid traumatized economy.

With a low debt-to-GDP ratio, the central government has scope to borrow more. That is happening, with the Ministry of Finance today announcing it would issue the first CNY 40 billion of ultra-long special sovereign bonds of a total of CNY 1 trillion between now and November.

Despite all this, the stock market has been recovering most of the year.

Oversold conditions hinted a bottom was near.

Excess liquidity (real money growth minus economic growth) is supportive for the advance to continue, as even though real money growth is weak, so is economic growth, implying there is enough “free” liquidity to find its way into the market.