Equity futures are pointing to a slight pullback in US stocks, which are on track for their best week in a year, as Apple’s disappointing outlook anmd weaker than expected China sales weighed on markets. At 7:40am, S&P 500 futures were down 0.1% but off the worst levels of the session while Nasdaq 100 futures lost 0.3%. The pullback follows US stocks’ best day since April in the wake of the Federal Reserve’s decision to hold rates steady. The subdued session is also due to nerves around the US nonfarm payroll data later today as traders look for further confirmation that the Federal Reserve’s tightening cycle is nearing an end.

In premarket trading, Apple shares fell more than 3% after the iPhone maker reported its fourth-quarter results, which featured weaker-than-expected revenue out of the greater China region. Other premarket movers include Coinbase shares falling as much as 4.2% after the cryptocurrency platform operator’s third-quarter retail trading volume fell short of estimates. By contrast, Block shares jump as much as 19% after the digital payments firm posted forecast-beating third-quarter results and boosted its full-year outlook. Here are the most notable premarket movers:

Bill Holdings shares tumble 35% after the financial software company cut its annual revenue forecast and tempered its full-year projection for adjusted EPS at the midpoint of the range.

Block Inc. shares jump 17%, set for their biggest gain in nearly a year, after the digital payments firm posted forecast-beating third-quarter results and boosted its full-year outlook.

Coinbase trade 4.3% lower after the cryptocurrency platform operator’s third-quarter retail trading volume fell short of estimates, overshadowing revenue that beat Wall Street expectations.

Confluent shares gain 3.3% after Guggenheim Securities raised the recommendation on the software company to buy from neutral. The company suffered its biggest single-session drop ever on Thursday after reporting results.

Expedia shares jump 8.9% after the travel-technology company reported third-quarter earnings that beat estimates and announced a $5 billion share buyback

Fortinet shares tumbled 24% as the cybersecurity firm cut its billings forecast for the year after its 3Q billings missed the average analyst estimate. At least four brokerages downgraded their rating on the stock after the company’s weak results and guidance.

Nio ADRs rise 3.3% as the Chinese EV maker said it’s cutting jobs and and may spin off non-core businesses to reduce costs and improve efficiency.

Bets are mounting that central banks are preparing to close the chapter on the steepest rate hikes since the early 1980s, reinforced by signs that economic growth and inflation are slowing. The monthly nonfarm payroll data due later from Washington, as well as the outlook from corporate America in corporate results, are key pieces of that narrative.

Salman Ahmed, global head of macro and strategic asset allocation at Fidelity International, said if US payrolls were to rise by more than 300,000, “then the question of hikes will start to come back on the table and that’s where good news will be bad news again for markets.”

The pace of hiring is expected to have slowed to 180,000 in October, less than half of September’s strong gain (see our full preview here). After pausing rate hikes this week, Fed Chair Jerome Powell said officials had made no decision about what they will do in December, adding that even if they pause again it won’t necessarily mean the tightening cycle is over.

“Today’s numbers are particularly important,” said Amelie Derambure, senior multi-asset portfolio manager at Amundi in Paris, noting that equity markets would most benefit if job creations suggest a soft landing is in sight for the US economy.

A strong reading would increase pressure on bond yields while a weak figure would fuel concerns for the economy, she said. “Anything in the middle is good enough for equities to continue to ride the current rates relief rally.”

A string of earnings disappointments may help reinforce thinking among policy makers that tighter policy has worked to dampen hiring and inflationary wage growth, giving them room to tap the brakes on higher rates.

“Keep an eye on earnings as the bellwether for the right economic conditions for Fed cuts,” Lewis Grant, senior portfolio manager for global equities at Federated Hermes, wrote in a note. “This earnings season is exposing the cracks as we are seeing a greater number of companies failing to deliver. This could hint to the slowdown the Fed needs to control the macro environment.”

European stocks extended gains for a fifth day, putting the region on track for its best week since March 2023. The Stoxx Europe 600 Index traded 0.2% higher with the travel and leisure and basic resources sectors leading gains, while the healthcare subgroup declined. Real estate stocks rose again and were on track for their best weekly performance since April 2020, helped by easing bond yields. Insurers are Europe’s biggest decliners on Friday after results from Axa and Swiss Re received a negative reception, while the Financial Times flagged IMF concerns over liquidity risks presented by life insurers linked to private capital groups. The Stoxx Europe 600 Insurance Index falls as much as 1.4%, the steepest decline in the broader benchmark.

BMW AG rose after the company’s automotive operating margin exceeded expectations in the third quarter, with premium vehicle sales helping offset a weakened global outlook for the industry. Danish shipping and logistics company A.P. Moeller-Maersk A/S slid after announcing plans to cut at least 10,000 jobs in order to shield its profitability in the face of declining freight rates and increasing competition in marine transport. Here are all notable European movers:

Dino Polska shares jump as higher like-for-like sales growth Y/y and better-than-estimated Ebitda margin in 3Q signal that profitability at the Polish food retailer has started a recovery

Nexi shares jump as much as 6.7% on Friday after newspaper Corriere della Sera reports that Silver Lake hired Morgan Stanley to explore a potential investment in the payments firm

Siemens Healthineers shares rise as much as 4.7%, the most since Feb. 2, after Bloomberg News reported the German medical technology firm is reviewing its diagnostics segment

Maersk shares fall as much as 13%, the most since March, after the Danish shipping giant’s third-quarter figures included a worse-than-expected outlook as a sectorwide slump continues. Shipping stocks slide in Europe on the back of Denmark’s Maersk as the shipper warns of subdued demand, noting that overcapacity is triggering price drops

Brunel slumps as much as 12%, the most since March 2020, after forecasting that 4Q growth in will be at a lower level than expected, attributable to delays in the offshore wind industry

Axa shares fall as much as 4.4% after comments on personal lines pricing and on potential second-half headwinds spooked some analysts. Allianz and Zurich Insurance also slip

Accor dips as much as 3.2% after the hospitality company was downgraded to equal-weight at Barclays, which said the stock risks being a “value trap” over the coming months.

Earlier in the session, Asian stocks rose again, with the benchmark headed for its best week in two months, as sentiment improves on hopes that the Federal Reserve may be done with interest rate hikes. The MSCI Asia Pacific Excluding Japan Index rose as much as 1.5% Friday, with Tencent, AIA Group and Alibaba among the biggest contributors. The gauge was on track for a weekly gain of 2.3%, poised to snap two weeks of losses. All major markets in the region were in the green, with Hong Kong, Australia and Singapore leading the advance. South Korea’s Kospi Index was headed for its best week in almost four months. Markets in Japan were closed for a holiday.

Hang Seng and Shanghai Comp conformed to the broad upbeat mood and largely shrugged off weaker Chinese Caixin PMI data and another substantial liquidity drain by the PBoC.

Korea's Kospi was underpinned amid earnings releases including blockbuster results from SK Innovation.

Australia's ASX 200 was led higher again by tech and real estate as yields continued to ease, with sentiment also helped by the surprise expansion in quarterly retail trade.

Indian stocks also advanced, with the benchmarks registering their best week since mid-September, boosted by a broad rally in Asian equities. The S&P BSE Sensex rose 0.4% to 64,363.78 in Mumbai, while the NSE Nifty 50 Index advanced 0.5% to 19,230.60. For the week, both the indexes clocked gains of about 1% each. The MSCI Asia excluding Japan index climbed 2.6% during the five-day period.

In FX, the Bloomberg Dollar Spot Index eased 0.1% on Friday and is set for its biggest weekly drop in more than three months as traders weigh prospects for a halt in the Fed’s policy tightening while they await US jobs data later

In rates, treasuries are narrowly mixed, with 10Y TSY yields flat as the curve slightly steepens as long-end yields trade cheaper by around 2bp on the day into early US session. US 10-year yields around 4.65% nearly unchanged on the day, following a strong rally Thursday where yields dropped as low as ~4.62%; long-end lags slightly so far on the day, re-steepening 5s30s spread by 2.5bp to ~19bp and unwinding small portion of Thursday’s aggressive flattening move

Investors are waiting for the October jobs report release at 8:30 a.m. New York time. Four Fed speakers are also scheduled for Friday, who may offer additional policy outlook from Jerome Powell’s Wednesday press conference. Canadian jobs data is also due to be released the same time as US payrolls. Highlights of US session includes October jobs report at 8:30am where current whisper number of 201k for the headline print sits above the 180k survey number. We also get the S&P services PMI (9:45 a.m.) and ISM services index (10 a.m.)

In commodities, oil was set for a second weekly loss as the Israel-Hamas war remained contained and clouds appeared on the demand horizon. WTI was little changed near $82.50. Gold headed for its first weekly decline in four. Bitcoin fell Friday after Sam Bankman-Fried was convicted of a massive fraud that led to the collapse of his FTX exchange.

To the day ahead now, and the main highlight will be the US jobs report for October. Other data releases include the US ISM services index for October, along with the Euro Area unemployment rate for September. From central banks, we’ll hear from the Fed’s Bar and Kashkari, the ECB’s Centeno and De Cos, as well as the BoE’s Pill and Haskel.

Market Snapshot

S&P 500 futures down 0.1% to 4,330.00

MXAP up 1.1% to 156.04

MXAPJ up 1.7% to 487.54

Nikkei up 1.1% to 31,949.89

Topix up 0.5% to 2,322.39

Hang Seng Index up 2.5% to 17,664.12

Shanghai Composite up 0.7% to 3,030.80

Sensex up 0.6% to 64,474.86

Australia S&P/ASX 200 up 1.1% to 6,978.20

Kospi up 1.1% to 2,368.34

STOXX Europe 600 up 0.3% to 444.97

German 10Y yield little changed at 2.72%

Euro little changed at $1.0623

Brent Futures up 0.4% to $87.19/bbl

Gold spot up 0.1% to $1,987.06

U.S. Dollar Index little changed at 106.15

Top Overnight News

A private gauge of China’s services activity grew less than expected in October, adding to signs of fragility within the economic recovery. The Caixin services purchasing managers’ index edged up to 50.4 last month from 50.2 in September, Caixin and S&P Global said in a statement Friday. That was below the consensus estimate among economists of 51. Any reading over 50 indicates an expansion from the prior month, while a number below that suggests contraction. BBG

BOJ Governor Kazuo Ueda will continue to dismantle the central bank's ultra-easy monetary policy settings and look to exit the decade-long accommodative regime sometime next year, an inherently risky plan that would require skillful execution. RTRS

Antony Blinken arrived in Tel Aviv and meets with Benjamin Netanyahu after Israel ruled out a cease-fire. Israeli ground operations in Gaza continued alongside intense bombardment overnight. The death toll rose to 9,061, the UN said. Israel stepped up strikes against Iran-backed militias in Syria which have moved close to the Israeli border. BBG

The world’s largest asset manager sees benchmark US borrowing costs hovering around 5.5 per cent for the next five years as investors grapple with inflationary pressures. Ten-year yields are at 4.7 per cent, but Jean Boivin, head of the BlackRock Investment Institute and a former deputy governor of the Bank of Canada, said markets were heading for much higher long-term borrowing costs. These would come from ageing populations, fractious geopolitics and costs associated with the energy transition, he said. FT

The UAW is ready to take on Tesla and Elon Musk, President Shawn Fain said. Stellantis’s tentative deal to end the strike includes $19 billion in US investment. BBG

Janet Yellen pushed back against Stan Druckenmiller’s assertion the Treasury had made “the biggest blunder in history” by not taking advantage of near-zero rates to sell more longer-term bonds. She told CNN it had lengthened the average maturity to the longest “in decades.” BBG

Maersk shares tumble in Eurozone trading as mgmt. sees 2023 toward the low-end of guidance and warns the buyback could be curtailed given worsening industry fundamentals. RTRS

FTX founder Sam Bankman-Fried was convicted Thursday of stealing billions of dollars from customers of the doomed crypto exchange, in what prosecutors called one of the biggest financial frauds in U.S. history. WSJ

AAPL -1% .. services beat, but china miss … 7c EPS beat .. Services BEAT $22.31bn vs cos $21.37bn .. China Revs MISS at ~$15bn vs cons ~$17bn .. Total Revenues $89.5bn vs cons $89.35bn .. "Our active installed base of devices has again reached a new all-time high across all products and all geographic segments, thanks to the strength of our ecosystem and unparalleled customer loyalty" GS GBM

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded higher as regional bourses tracked the advances in global peers after the BoE kept rates unchanged and a surprise decline in US Labour Costs added to the dovish impulse, while the holiday closure in Japan and disappointing Caixin Services PMI did little to derail the momentum. ASX 200 was led higher again by tech and real estate as yields continued to ease, with sentiment also helped by the surprise expansion in quarterly retail trade. KOSPI was underpinned amid earnings releases including blockbuster results from SK Innovation. Hang Seng and Shanghai Comp conformed to the broad upbeat mood and largely shrugged off weaker Chinese Caixin PMI data and another substantial liquidity drain by the PBoC.

Top Asian News

- China's Commerce Minister met with the Micron (MU) President on November 1st and said that China will continue to optimise the investment environment for foreign companies. China's Commerce Minister also told Micron's President they welcome Micron to deepen its footprint in the Chinese market and welcome the Co. to have better development on the premise of abiding by Chinese laws and regulations, according to Reuters.

European bourses are marginally firmer, Euro Stoxx 50 +0.2%, with fresh catalysts limited ahead of Tier 1 events/data. Sectors are mainly in the green with earnings dictating: Autos in the driving seat after BMW & Volvo Cars, Real Estate lifted by Vonovia while Insurance breaks from the tone and is pressured after Axa results. Stateside, futures are a touch softer ahead of the US jobs data and numerous Fed speakers, ES -0.1%; pressure filtering through on the back of Apple after-hours earnings.

Top European News

- ECB's Schnabel said they expect inflation to return to the target by 2025 with their current monetary policy stance and that the disinflation process during the last mile will be more uncertain, slower and bumpier. Schnabel added they cannot close the door to further rate hikes and that the Euro area economy is not in a deep recession but stagnating.

FX

Dollar depressed ahead of US payrolls and services ISM as DXY slips back under 106.00 within a 106.22-105.93 range.

Kiwi 'outperforms' amidst AUD/NZD tailwinds, with NZD/USD mostly above 0.5900 and AUD/USD capped sub-0.6450.

Euro consolidates on 1.0600 handle vs Greenback and flanked by another bank of big option expiries.

Yen contained below 150.00 against Buck on Culture Day and also bookmarked by expiry interest.

Loonie cautious either side of 1.3750 against US rival ahead of Canadian LFS and US NFP face-off.

PBoC set USD/CNY mid-point at 7.1796 vs exp. 7.3119 (prev. 7.1797)

Fixed Income

Debt divergent pre-NFP/ISM after early upside momentum waned.

Bunds and Gilts both towards bottom of 129.67-99 and 94.23-61 ranges, but T-note afloat between 107-18+/12+ band and curve a tad flatter.

Commodities

Crude benchmarks are modestly firmer on the session, in-fitting with the cautiously upbeat risk tone going into US NFP; currently, WTI Dec'23 and Brent Jan'23 are around USD 82.50/bbl and USD 86.75/bbl respectively.

Though, the space awaits remarks from Hezbollah's Nasrallah in the Hamas-Israel war, particularly for any indication around whether they will join the conflict against Israel - newsquawk primer available here.

Spot gold is firmer but closer to the unchanged mark and the tone serves as a headwind but ongoing USD softness provides some support. Base metals are performing better, with LME Copper benefitting from the tone and particularly the strong APAC session despite Chinese data.

Russian Deputy PM Novak said there are no plans to lift restrictions on fuel exports from Russia yet but added liberalisation will be possible when some volumes have nowhere to go, according to RIA.

Kazakhstan's Energy Minister said 2024 oil output is seen at 90mln tons, while Kazakhstan is to export 4.5 BCM of gas to China this year and up to 11 BCM annually in the coming years, according to Reuters.

Geopolitics: Israel-Hamas

Iran's Supreme Leader commented via social media platform X that the "...occupying entity is helpless and confused now, and without American support will be silenced within days".

Iraqi armed factions say, from next week, they will begin a new phase of escalation against US bases within the region, via Sky News Arabia.

US State Department says Blinken will emphasize in Israel the need to prevent the expansion of the conflict, via Sky News Arabia.

Geopolitics: Other

Russian attack hit civilian targets and a fire broke out in Ukraine's city of Kharkiv with casualties being clarified, according to the Mayor cited by Reuters.

US Event Calendar

08:30: Oct. Change in Nonfarm Payrolls, est. 180,000, prior 336,000

Change in Manufact. Payrolls, est. -10,000, prior 17,000

Change in Private Payrolls, est. 145,000, prior 263,000

Unemployment Rate, est. 3.8%, prior 3.8%

Underemployment Rate, prior 7.0%

Labor Force Participation Rate, est. 62.8%, prior 62.8%

Average Weekly Hours All Emplo, est. 34.4, prior 34.4

Average Hourly Earnings YoY, est. 4.0%, prior 4.2%

Average Hourly Earnings MoM, est. 0.3%, prior 0.2%

09:45: Oct. S&P Global US Services PMI, est. 50.9, prior 50.9

10:00: Oct. ISM Services Index, est. 53.0, prior 53.6

Oct. ISM Services New Orders, est. 51.5, prior 51.8

Oct. ISM Services Employment, est. 53.5, prior 53.4

Oct. ISM Services Prices Paid, est. 56.6, prior 58.9

DB's Jim Reid concludes the overnight wrap

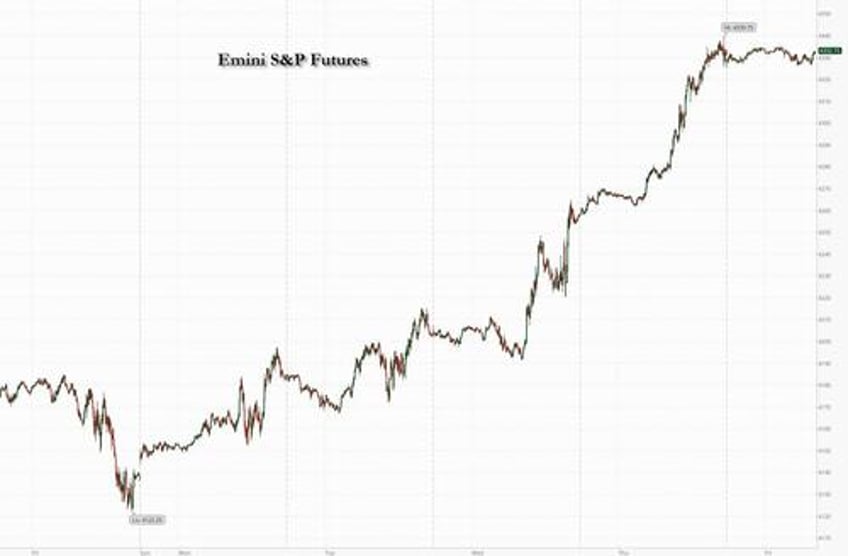

The market rally has continued to power ahead over the last 24 hours, with the S&P 500 now on track for its best week of 2023 so far. Several factors have been behind the rally, and now that the Fed, ECB and BoE have all kept rates on hold at their latest meetings, there’s been growing speculation among investors that this is now it for the current hiking cycle. Time will tell as to whether that’s right, but that conviction has been supported by multiple weak data releases over the course of the week. Indeed, we found out yesterday that US continuing jobless claims had risen for a 6th consecutive week and were now at their highest level since April, just as German unemployment also rose by more than expected. So that all added to the sense that central banks were set to remain cautious moving forward.

Looking at the various moves yesterday, it was quite extraordinary how broad the rally was, with widespread gains across all the major asset classes. In equities, the S&P 500 (+1.89%) put in its best daily performance since April, and is now up by +4.87% over the week so far. The gains were incredibly broad-based, with 448 of the S&P 500’s constituents up on the day. Likewise in Europe, the STOXX 600 (+1.58%) posted a very strong advance, and the gains were evident across all the major sector groups.

After the close, we then heard from Apple, which beat expectations for earnings and, more marginally, for revenue ($89.5bn vs $89.4bn expected on the latter). However, this marked a fourth consecutive quarter of negative year-on-year revenue growth and with guidance that next quarter revenue will be similar to that a year earlier. With this cautious outlook, Apple’s shares fell by as much as -3.46% in after-hours trading (+2.07% yesterday). That’s added some caution to the more positive market mood overnight, and US equity futures have lost ground this morning, with those on the S&P 500 down -0.07%, whilst those on the NASDAQ 100 are down by a larger -0.27% .

Yesterday’s rally was also evident among sovereign bonds, where long-dated yields built on their declines following the FOMC decision. For instance, the 10yr Treasury yield was down a further -7.3bps to 4.66%, whilst yields on 10yr bunds (-4.6bps), OATs (-6.2bps) and BTPs (-9.8bps) all moved lower as well. The rally was even more dramatic for 30yr Treasuries, with the yield down -12.7bps to 4.80%. In fact, the fall in 30yr yields over the past two sessions (-29.2bps) is now the largest since the first Covid lockdowns in March 2020, so this is a sizeable adjustment. By contrast, there was more weakness at the front end of the curve, and yields on 2yr Treasuries were back up +4.9bps to 4.99%, which pared back some of the -14.4bps decline on Wednesday following the Fed. These moves marked the sharpest daily inversion of the 2s10s slope since the March banking stress, which is now back at -33bps (having closed at -16bps on Tuesday).

The rally wasn’t just confined to equities and bonds, with credit experiencing a very strong day as well. Among others, US HY spreads tightening by -32bps, which is the biggest daily move tighter since early February. Oil prices also rallied back somewhat after their losses earlier in the week, with Brent crude back up +2.62% to $86.85/bbl. Meanwhile the dollar was a notable underperformer yesterday, and the risk-on sentiment elsewhere saw the broad dollar index (-0.71%) experience its worst day since early July .

The biggest outperformer on the sovereign bond side were UK gilts, which followed the Bank of England’s latest monetary policy decision. They left rates on hold at 5.25% as expected, but it was a split 6-3 vote, with 3 preferring to have another 25bp hike. In his recap here, our UK economist writes that the decision struck a slightly more hawkish tone on paper, since the new forecasts showed CPI landing slightly above 2% in two years' time (based on the MPC's mean projection using market expectations for interest rates). But markets moved to price out the chances of another hike in this cycle, with the probability down from 36% on Wednesday to 30% by the close yesterda y. In turn, yields on 10yr gilts fell -11.5bps, whilst the 2yr gilt yield (-6.7bps) fell to its lowest level since June.

Looking forward now, the main highlight today will be the US jobs report for October at 12:30 London time. Last month the report was very strong, with nonfarm payrolls growth at an 8-month high of +336k, along with positive revisions to previous months. But this time around, our US economists are expecting that to come down to a +140k reading, with the unemployment rate remaining at 3.8%. One indicator we’ll be keeping an eye out for are the Temporary Help Services category of payrolls, which have now fallen for 8 consecutive months and have been a leading indicator of recessions in previous cycles. Click here for the full preview from our US economists and to register for their webinar afterwards.

Ahead of that, yesterday brought a few releases that painted a more downbeat picture on the labour market. In the US, the continuing claims over the week ending October 21 rose to 1.818m (vs. 1.8m expected), which is their highest level since April. Alongside that, the initial jobless claims over the week ending October 28 also rose to a 7-week high of 217k (vs. 210k expected). Moreover, that trend wasn’t just confined to the US, since German unemployment rose by +30k in October (vs. +14k expected), which pushed the registered unemployment rate up to 5.8%, marking its highest level since June 2021.

Overnight in Asia we’ve seen equity markets follow those in the US higher. However, there does seem to be some loss of momentum since last night, with US equity futures now pointing slightly lower. Nevertheless, all the major indices in Asia are positive, with gains for the Hang Seng (+2.12%), the KOSPI (+0.97%), the CSI 300 (+0.75%) and the Shanghai Comp (+0.66%). Meanwhile, markets in Japan are shut for a public holiday. Separately overnight, the Caixin PMIs showed that China’s services activity expanded at a slightly faster pace in October, although the 50.4 reading was still below the 51.0 reading expected by the consensus. Furthermore, the composite PMI fell to a 10-month low of 50.0 in October, having now fallen for 5 consecutive months now.

Finally, we had a few other data prints yesterday, with the US nonfarm productivity for Q3 coming in higher than expected at +4.7% (vs. +4.3% expected), which was the strongest growth in 3 years. Unit labour costs also saw a -0.8% decline (vs. +0.3% expected). Our US economists note that the lead from recent strong wage growth is consistent with a continued uptrend in productivity growth over the next two years – see their note here. Meanwhile, factory orders in September grew by +2.8% (vs. +2.3% expected), which was the fastest pace since January 2021.

To the day ahead now, and the main highlight will be the US jobs report for October. Other data releases include the US ISM services index for October, along with the Euro Area unemployment rate for September. From central banks, we’ll hear from the Fed’s Bar and Kashkari, the ECB’s Centeno and De Cos, as well as the BoE’s Pill and Haskel.