It’s been a bit of a bonanza for financial assets in recent days, with both stocks and bonds putting in a good performance.

Treasury’s decision to skew issuance away from longer maturities relative to expectations triggered a rally in bonds. Stocks joined in, buoyed by lower yields, and we saw the side of positive stock-bond correlation that multi-asset investors like.

Bonds, though, had the upper hand, and the stock-bond ratio fell.

That’s normally reflective of a weakening economy. But there are good reasons to think it won’t last.

While the economy is likely to show some signs of weakening in the near term, leading data shows a recession should be narrowly avoided. The stock-bond ratio should then soon resume its rise.

Take payrolls today. Month-to-month data is very noisy (expectations are for 180k change in October versus 336k last month), but its annual growth-rate has been steadily falling all cycle.

Jobless claims, however, give a three-to-six month lead on payrolls and their recent stabilization points to payrolls also stabilizing early next year. Other leading data, such as the Conference Board’s Leading Index, confirm this anticipated trend.

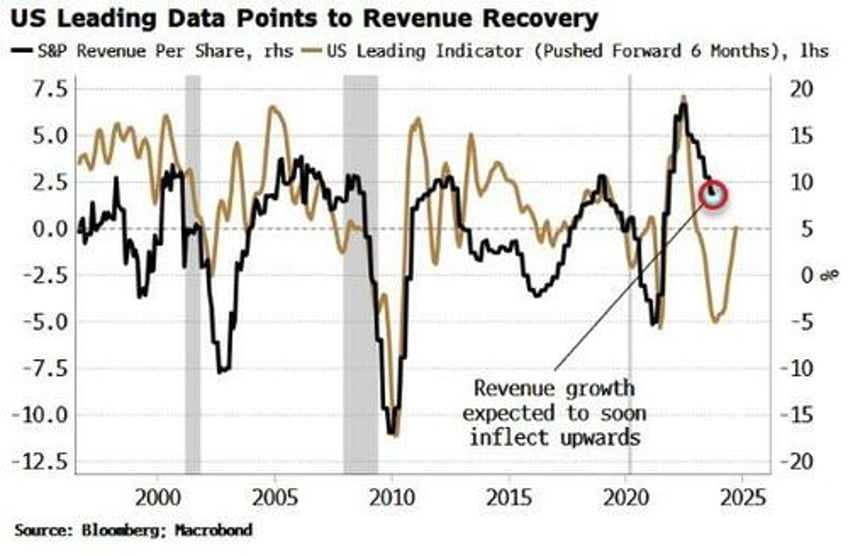

Apple’s results late Thursday showed a fall in sales for the fourth quarter in a row, the longest slowdown since 2001. S&P revenue growth overall has been dropping, and this will form a building headwind for stocks – returns are currently being driven by sales and multiple expansion.

But here again the future looks more positive than the present indicates, and leading data shows that revenue growth should soon inflect and start turning back up.

The stock-bond ratio generally tracks the inverse of the unemployment rate – i.e. when unemployment rises, the ratio falls. It’s therefore likely to face some more resistance in the near term, but if a recession is avoided as leading data anticipate, it will resume its upwards trend.