- APAC stocks were ultimately mixed with most major indices in the green after further encouraging Chinese PMI data.

- The RBA decision provided little surprise and the SoMP included a reduction in GDP and household consumption forecasts.

- US equity futures were rangebound, DXY was flat, and UST futures traded sideways as all eyes now turn to the US Presidential Election.

- European equity futures are indicative of an uneventful cash open with the Euro Stoxx 50 future flat after the cash market closed lower by 0.5% on Monday.

- Looking ahead, highlights include UK Composite/Services Final PMI, US International Trade, Canadian Exports/Imports, US ISM Services, NZ HLFS Jobs, BoC Minutes, BoJ Minutes, US Election, Speakers including ECB President Lagarde & Schnabel, Supply from UK & US, Earnings from UniCredit, Ferrari, Oersted, Fresenius Medical Care, Hugo Boss, Zalando, Deutsche Post, Emerson Electric Co, Super Micro Computer & Global Foundries.

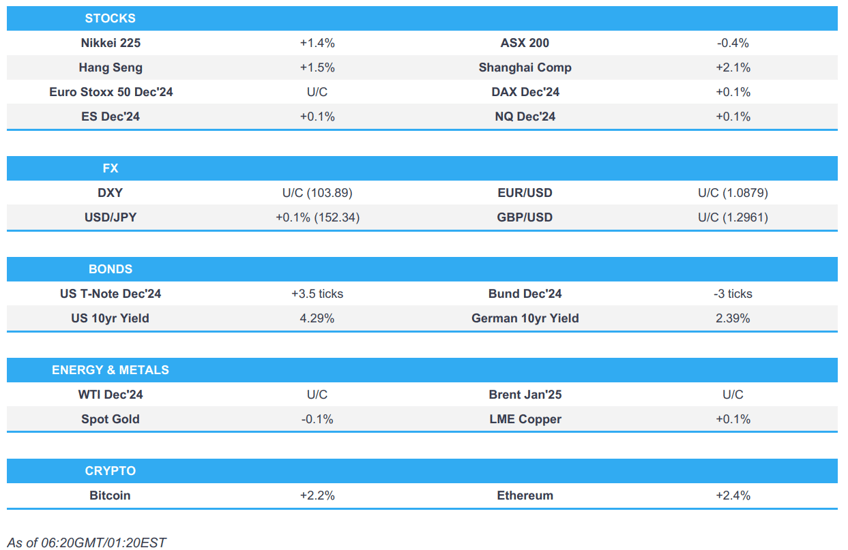

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks finished mostly lower in cautious trade heading into the US Presidential Election on Tuesday and with price action in markets primarily categorised as an unwinding of the 'Trump trade' after weekend polls and betting markets showed Trump losing momentum against Harris. This provided early headwinds for the dollar and underpinned bonds although price action was contained during the New York session with the contest for the battleground states seen very tight as the US prepares to vote.

- SPX -0.28% at 5,713, NDX -0.35% at 19,964, DJI -0.61% at 41,795, RUT +0.40% at 2,219.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Former US President Trump's tariff proposals could reportedly cost Americans USD 78bln in annual spending power, according to the NRF citing a study. It was separately reported that Trump said he would impose a tariff on Mexico unless they stop sending fentanyl into the US,

APAC TRADE

EQUITIES

- APAC stocks were ultimately mixed with most major indices in the green after further encouraging Chinese PMI data although some of the gains were capped as cautiousness lingered heading into the US Presidential Election coin toss.

- ASX 200 was dragged lower amid weakness across all sectors and underperformance in the top-weighted financial industry, while the RBA decision provided little surprise and the SoMP included a reduction in GDP and household consumption forecasts.

- Nikkei 225 rallied on return from the long weekend with some encouragement from earnings and strength in exporters.

- Hang Seng and Shanghai Comp benefitted following the better-than-expected Chinese Caixin Services PMI data, while Premier Li suggested a favourable outlook and optimism regarding economic prospects during his keynote speech at the CIIE.

- US equity futures were kept afloat in rangebound trade as all eyes now turn to the US Presidential Election.

- European equity futures are indicative of an uneventful cash open with the Euro Stoxx 50 future flat after the cash market closed lower by 0.5% on Monday.

FX

- DXY traded flat after recently giving up ground on the unwinding of the 'Trump trade' with price action now muted as the US prepares to vote in what polls suggest will be a very tight election.

- EUR/USD lacked direction after its return journey from a brief foray above the 1.0900 level.

- GBP/USD was uneventful after yesterday's pullback from resistance just shy of the 1.3000 handle as sterling watchers also await the BoE on Thursday where the central bank is expected to deliver a 25bps rate cut to the Bank Rate.

- USD/JPY marginally edged higher in a rebound from a brief dip beneath the 152.00 level amid light catalysts.

- Antipodeans slightly gained following encouraging Chinese PMI data, while there was a muted reaction to the RBA rate decision in which the central bank unsurprisingly kept rates unchanged at 4.35% and reiterated its hawkish rhetoric.

- PBoC set USD/CNY mid-point at 7.1016 vs exp. 7.1019 (prev. 7.1203).

FIXED INCOME

- 10yr UST futures traded sideways following recent bull flattening in an unwinding of the 'Trump trade'.

- Bund futures languished beneath the 132.00 level with little fresh catalysts to spur demand.

- 10yr JGB futures eked mild gains but with the upside limited amid the strength in Japanese stocks and the absence of tier-1 releases from Japan.

COMMODITIES

- Crude futures took a breather after rallying yesterday by 3% owing to the delay of the OPEC+ output increase and geopolitical tensions with Iran planning a strong and complex response to Israel, while Israeli media also reported that Israel's response to any Iranian attack would be stronger than the previous time.

- Iran approved a plan to increase oil production by 250k BPD, according to the Iranian Oil Ministry website.

- Libya's oil production was reportedly nearing 1.5mln BPD.

- Shell (SHEL LN) said it has safely paused some drilling operations and moved non-essential personnel to shore at the Appomattox, Vito, Ursa, Mars, Auger, & Enchilada/Salsa assets.

- Spot gold was choppy overnight after the prior day's indecision heading into this week's major risk events.

- Copper futures advanced alongside the optimism in its largest buyer China after Caixin Services and Composite PMI data conformed to the recent encouraging signals seen in China's Manufacturing PMIs.

- Citi expects copper to rally temporarily to USD 10k/ton over the coming week on the back of China easing, Fed easing and US election outcomes.

CRYPTO

- Bitcoin ultimately gained after oscillating around the USD 68,000 level.

NOTABLE ASIA-PAC HEADLINES

- Chinese Premier Li said unilateralism is on the rise and globalisation is impacted by volatility which they must guard against with further opening up, while he added China will upgrade free trade zones and explore free trade and investment agreements with other countries. Li said China will continue to open telecommunications, internet, healthcare, and other sectors for investment, as well as noted that many positive developments in China's economy indicate a favourable outlook. Furthermore, he said China has fiscal and monetary tools at its disposal and he is confident of meeting this year’s growth target and optimistic about economic prospects in the coming years.

- RBA kept the Cash Rate unchanged at 4.35%, as expected, while it stated the board will continue to rely upon the data and evolving assessment of risks, as well as noted that inflation remains too high and is not expected to return sustainably to the midpoint of the target until 2026. RBA said policy will need to be sufficiently restrictive until the board is confident that inflation is moving sustainably towards the target range and the board is not ruling anything in or out. Furthermore, the SoMP stated that core inflation remains elevated with service inflation expected to decline only gradually and that policy in Australia is not as restrictive as in most peer countries, even after recent rate cuts abroad, while RBA lowered its GDP, household consumption, trimmed CPI and core inflation forecasts.

- RBA Governor Bullock said in the post-meeting press conference that the last part of bringing inflation down is not easy and rates need to stay restrictive for the time being, while she thinks there are still risks on the upside for inflation and will be ready to act if the economy turns down more than expected but also noted they have the right settings at the moment. Bullock said there were no discussions on specific scenarios for rate changes and the current Cash Rate path priced by the market is as good as any.

- RBNZ Financial Stability Review said financial systems remain resilient amidst economic downturn and that risks to New Zealand's financial system remain contained, while debt servicing costs are nearing their peak and starting to decline with advertised mortgage rates falling over the last 6 months. RBNZ noted that domestic economic challenges remain and many households and businesses are feeling financial pressure with rising unemployment posing challenges for some borrowers. RBNZ Governor Orr later commented that the real economy is lagging a reduction in interest rates which is a concern and climate change is an existential threat.

DATA RECAP

- Chinese Caixin Services PMI (Oct) 52.0 vs. Exp. 50.5 (Prev. 50.3)

- Chinese Caixin Composite PMI (Oct) 51.9 (Prev. 50.3)

GEOPOLITICS

MIDDLE EAST

- Israel's response to any Iranian attack will be stronger than the previous time, while it was also reported that security institutions are preparing for a multi-front Iranian attack, according to Israel's Channel 12.

- Iranian Foreign Minister said their response to Israel will be appropriate without emotional decisions and that the result of the US elections will not affect their policy, according to Asharq News.Israeli Air Force announced it struck Hezbollah intelligence assets near Damascus, targeting key infrastructure in Syria.

- Hezbollah said it targeted with a rocket barrage a gathering of Israeli enemy forces on the southwestern outskirts of the town of Maroun al-Ras, according to Al Jazeera.

- US Secretary of State Blinken and Israeli Defence Minister Gallant discussed the dire humanitarian conditions in Gaza, while Blinken urged further actions by Israel to increase and sustain humanitarian aid, according to the State Department

- US Secretary of State Blinken said Hamas once again refused to release a limited number of hostages to secure a ceasefire and relief for the people of Gaza, according to Sky News Arabia. It was also reported that Blinken discussed with his Egyptian counterpart the importance of establishing a post-war path that provides governance, security, and reconstruction in Gaza, as well as discussed efforts to promote a diplomatic solution in Lebanon that would enable civilians on both sides of the border to return home.

- US and Saudi Arabia are discussing a possible security agreement that wouldn't involve a broader deal with Israel, according to Axios.

OTHER

- North Korea fired what was thought to be a ballistic missile which appeared to have landed outside of Japan's EEZ, while Japanese Defence Minister Nakatani said North Korea fired at least 7 missiles which flew to an altitude of 100km and covered a range of 400km.

- North Korea's UN envoy told the Security Council that Pyongyang will accelerate a build-up of its nuclear force to counter "any threat presented by hostile nuclear weapons states".

EU/UK

NOTABLE HEADLINES

- Barclaycard stated UK October consumer spending rose 0.7% Y/Y vs Prev. 1.2% Y/Y increase in September.

DATA RECAP

- UK BRC Like-for-Like Retail Sales YY (Oct) 0.3% vs Exp. 1.4% (Prev. 1.7%)

- UK BRC Total Sales YY (Oct) 0.6% (Prev. 2.0%)