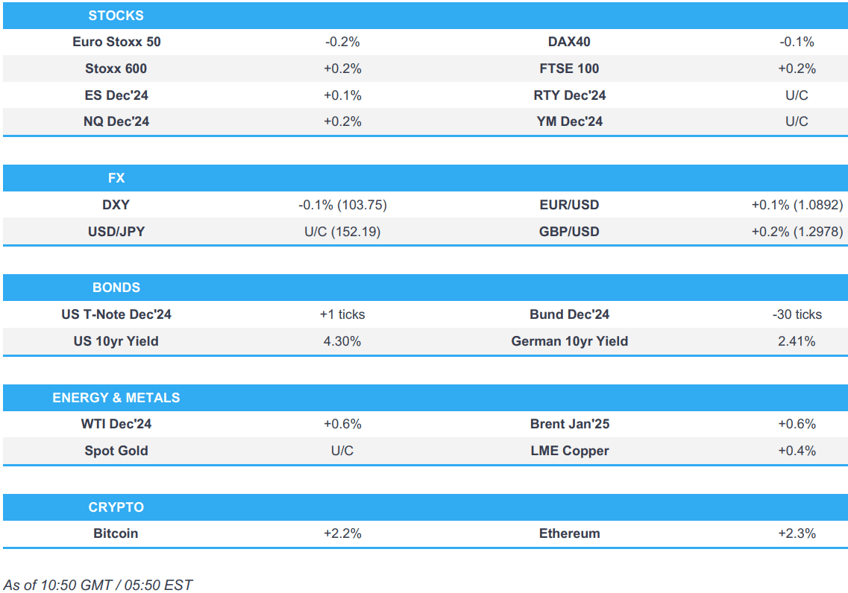

- European bourses are mixed and trading tentatively on either side of the unchanged mark; US futures are incrementally firmer/flat.

- Dollar is slightly softer on US election day, Antipodeans benefit from constructive Chinese PMIs and Aussie was fairly unreactive to an unsurprising hold at the RBA.

- USTs are essentially unchanged, Bunds are pressured alongside Gilts; the latter was weighed on by its 2034 auction.

- Upward bias across industrials amid geopolitics and encouraging Chinese PMI data.

- Looking ahead, US International Trade, Canadian Exports/Imports, US ISM Services, NZ HLFS Jobs, BoC Minutes, BoJ Minutes, US Election, Speakers including ECB President Lagarde & Schnabel, Supply from the US, Earnings from Emerson Electric Co, Super Micro Computer & Global Foundries.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (+0.2%) opened on a weaker footing, but sentiment did begin to improve into the European morning to display a more mixed picture across Europe.

- European sectors began the European session on a mixed footing, and with the breadth of the market fairly narrow; sentiment has since improved with sectors now holding a positive bias. Basic Resources leads whilst Energy lags.

- US Equity Futures (ES +0.1%, NQ +0.2%, RTY U/C) are mixed, with very modest outperformance in the NQ, attempting to pare back some of the losses seen in the prior session. Focus almost entirely on the US election.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is softer vs. peers on election day with price action for DXY dictated at the start of the week by a lowering in the odds of a Trump victory and a scaling back in "Trump trades". In terms of the order of play for the election, results won't start filtering out until the early hours of Wednesday (UK time) with the eventual outcome of the election potentially set to drag on for several days depending on how close the race is. DXY is currently sandwiched between Monday's low at 103.57 and the 200DMA at 103.83.

- EUR is a touch firmer vs. the USD but unable to make its way back onto a 1.09 handle after venturing as high as 1.0914 on Monday.

- GBP gains vs. the USD but with Cable still unable to make its way back onto a 1.30 handle after topping out yesterday at 1.2998.

- JPY is steady vs. the USD with macro drivers for the JPY on the quiet side. Direction for the pair this week will most likely be driven by the USD leg of the equation given events in the US with a Harris victory likely to be viewed as a negative for USD/JPY. USD/JPY is currently contained within a 152.10-55 range.

- Antipodeans both remain underpinned by the slight decline in odds of a Trump Presidency and the potential ramifications for the Chinese economy. On which, China reported encouraging Services PMI data overnight. Furthermore, AUD has also digested the RBA rate decision overnight, which further underscored its position as one of the more hawkish players in G10 FX.

- PBoC set USD/CNY mid-point at 7.1016 vs exp. 7.1019 (prev. 7.1203).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are essentially unchanged on US election day, yields are under very modest pressure and still within a few bps of the lows from Monday when the Trump Trade was unwinding after weekend updates. Aside from the election, ISM Services is scheduled and a 10yr Note auction is due. Holding at the 110-12 mark in a slim eight tick range which is entirely within Monday’s 110-07 to 110-21+ band.

- Bunds are pressured and slumped at the European cash open though this seems coincidental with the cause of pressure seemingly a breach of support at 131.50 after a handful of overnight lows gave way. After slipping to a 131.33 trough the move ran out of steam and Bunds have since bounced back to 131.50, but remain lower on the session.

- Gilts are underperforming, gapped lower by 26 ticks and continued to slip ahead of the region's auction. Today's 2034 tap was fairly robust, but demand was the weakest since Dec'23, taking Gilts back towards the earlier 93.53 trough. Traders now look towards the BoE on Thursday.

- UK sells GBP 3.75bln 4.25% 2034 Gilt Auction: b/c 2.81x (prev. 3.25x), avg yield 4.475% (prev. 4.17%) & tail 0.8bps (prev. 0.9bps)

- Click for a detailed summary

COMMODITIES

- Mild upward bias across the crude complex as prices hold onto yesterday's gain which was facilitated by the delay of the OPEC+ output increase. Constructive Chinese Services PMIs and reports that Israel is considering a pre-emptive strike on Iran has helped to prop up the complex. Brent Jan sits in a USD 74.80-75.60/bbl parameter.

- Precious metals are holding an upward bias amid the softer Dollar on the eve of the US Presidential Election coin toss. Spot gold trades in a USD 2,724.76-2,745.06/oz range.

- Base metals are firmer across the board, following the better-than-expected Chinese Caixin Services PMI data, while Premier Li suggested a favourable outlook and optimism regarding economic prospects during his keynote speech at the CIIE. 3M LME copper sits in a 9,666.50-9,760.50/t range.

- Iran approved a plan to increase oil production by 250k BPD, according to the Iranian Oil Ministry website.

- Citi expects copper to rally temporarily to USD 10k/ton over the coming week on the back of China easing, Fed easing and US election outcomes.

- Click for a detailed summary

RBA

- RBA kept the Cash Rate unchanged at 4.35%, as expected, while it stated the board will continue to rely upon the data and evolving assessment of risks, as well as noted that inflation remains too high and is not expected to return sustainably to the midpoint of the target until 2026. RBA said policy will need to be sufficiently restrictive until the board is confident that inflation is moving sustainably towards the target range and the board is not ruling anything in or out. Furthermore, the SoMP stated that core inflation remains elevated with service inflation expected to decline only gradually and that policy in Australia is not as restrictive as in most peer countries, even after recent rate cuts abroad, while RBA lowered its GDP, household consumption, trimmed CPI and core inflation forecasts.

- RBA Governor Bullock said in the post-meeting press conference that the last part of bringing inflation down is not easy and rates need to stay restrictive for the time being, while she thinks there are still risks on the upside for inflation and will be ready to act if the economy turns down more than expected but also noted they have the right settings at the moment. Bullock said there were no discussions on specific scenarios for rate changes and the current Cash Rate path priced by the market is as good as any.

- RBNZ Financial Stability Review said financial systems remain resilient amidst economic downturn and that risks to New Zealand's financial system remain contained, while debt servicing costs are nearing their peak and starting to decline with advertised mortgage rates falling over the last 6 months. RBNZ noted that domestic economic challenges remain and many households and businesses are feeling financial pressure with rising unemployment posing challenges for some borrowers. RBNZ Governor Orr later commented that the real economy is lagging a reduction in interest rates which is a concern and climate change is an existential threat.

NOTABLE DATA RECAP

- UK BRC Total Sales YY (Oct) 0.6% (Prev. 2.0%)

- UK S&P Global Service PMI (Oct) 52.0 vs. Exp. 51.8 (Prev. 51.8); S&P Global PMI: Composite Output (Oct) 51.8 vs. Exp. 51.7 (Prev. 51.7)

- Swiss Unemployment Rate Adj (Oct) 2.6% vs. Exp. 2.6% (Prev. 2.6%)

- French Industrial Output MM (Sep) -0.9% vs. Exp. -0.6% (Prev. 1.4%, Rev. 1.1%); Budget Balance (Sep) -173.78B (Prev. -171.91B)

NOTABLE EUROPEAN HEADLINES

- Barclaycard stated UK October consumer spending rose 0.7% Y/Y vs Prev. 1.2% Y/Y increase in September.

- UK OBR Chair says gilt market response to the budget was in part due to higher volumes, and also front-loading of spending; OBR had expected the gilt market to be surprised by the market; gilt yields have settled broadly in line with OBR expectations.

GEOPOLITICS

MIDDLE EAST - EUROPE

- Israel's Channel 14 reports that "Authorities are considering the possibility of a pre-emptive attack against Iran or waiting for US elections", via Sky News Arabia; "Indications are growing that Iran may soon attack Israel, perhaps on US election day".

- Israel's Channel 12 reports that Iran is likely to attack from several arenas, not just from its territory, via Al Jazeera.

- "Tel Aviv is considering a pre-emptive strike on Iran if there are signs of imminent attack", according to Cairo News.

- "Prime Minister Benjamin Netanyhu will convene his national security cabinet on Thursday at 7:00 p.m. (17:00GMT) at the Kirya IDF headquarters in Tel Aviv", according to Times of Israel Berman.

- "The IDF is gradually completing the objectives set for it in ground operations in Lebanon, and Israel is already preparing for the day after the arrangement", according to N12.

- "Iranian Foreign Minister: We will respond to Israeli attacks in a timely and appropriate manner", according to Cairo News

MIDDLE EAST - APAC

- Iranian Foreign Minister said their response to Israel will be appropriate without emotional decisions and that the result of the US elections will not affect their policy, according to Asharq News.

- Hezbollah said it targeted with a rocket barrage a gathering of Israeli enemy forces on the southwestern outskirts of the town of Maroun al-Ras, according to Al Jazeera.

- US Secretary of State Blinken and Israeli Defence Minister Gallant discussed the dire humanitarian conditions in Gaza, while Blinken urged further actions by Israel to increase and sustain humanitarian aid, according to the State Department

- US Secretary of State Blinken said Hamas once again refused to release a limited number of hostages to secure a ceasefire and relief for the people of Gaza, according to Sky News Arabia. It was also reported that Blinken discussed with his Egyptian counterpart the importance of establishing a post-war path that provides governance, security, and reconstruction in Gaza, as well as discussed efforts to promote a diplomatic solution in Lebanon that would enable civilians on both sides of the border to return home.

OTHER

- North Korea fired what was thought to be a ballistic missile which appeared to have landed outside of Japan's EEZ, while Japanese Defence Minister Nakatani said North Korea fired at least 7 missiles which flew to an altitude of 100km and covered a range of 400km.

- Russia's Defence Ministry says Ukraine has no technical potential to make nuclear weapons but is able to make a 'dirty bomb', according to IFAX.

CRYPTO

- Bitcoin climbs above USD 68k and sits just beneath the USD 69k level.

APAC TRADE

- APAC stocks were ultimately mixed with most major indices in the green after further encouraging Chinese PMI data although some of the gains were capped as cautiousness lingered heading into the US Presidential Election coin toss.

- ASX 200 was dragged lower amid weakness across all sectors and underperformance in the top-weighted financial industry, while the RBA decision provided little surprise and the SoMP included a reduction in GDP and household consumption forecasts.

- Nikkei 225 rallied on return from the long weekend with some encouragement from earnings and strength in exporters.

- Hang Seng and Shanghai Comp benefitted following the better-than-expected Chinese Caixin Services PMI data, while Premier Li suggested a favourable outlook and optimism regarding economic prospects during his keynote speech at the CIIE.

NOTABLE ASIA-PAC HEADLINES

- Chinese Premier Li said unilateralism is on the rise and globalisation is impacted by volatility which they must guard against with further opening up, while he added China will upgrade free trade zones and explore free trade and investment agreements with other countries. Li said China will continue to open telecommunications, internet, healthcare, and other sectors for investment, as well as noted that many positive developments in China's economy indicate a favourable outlook. Furthermore, he said China has fiscal and monetary tools at its disposal and he is confident of meeting this year’s growth target and optimistic about economic prospects in the coming years.

- Former BoJ member Sakurai says the BoJ could hold until January given political and market uncertainty. A renewed JPY fall could spark a hike as soon as December 2024. BoJ will raise rates again in the coming months, with January emerging as the most likely. BoJ will aim to raise short-term rates to 1.5% or 2.0% by the end of Ueda's term, early in 2028. Debt issuance could prevent a QT acceleration.

- Foxconn (2317 TW) October Revenue +8.59% Y/Y (September +10.9% Y/Y). Looking to Q4, operations are anticipated to show quarterly and yearly growth.

DATA RECAP

- Chinese Caixin Services PMI (Oct) 52.0 vs. Exp. 50.5 (Prev. 50.3); Composite PMI (Oct) 51.9 (Prev. 50.3)