After yesterday's stellar 3Y auction kickstarted refunding week, moments ago the Treasury sold a 10Y paper in an auction that left a bit to be desired.

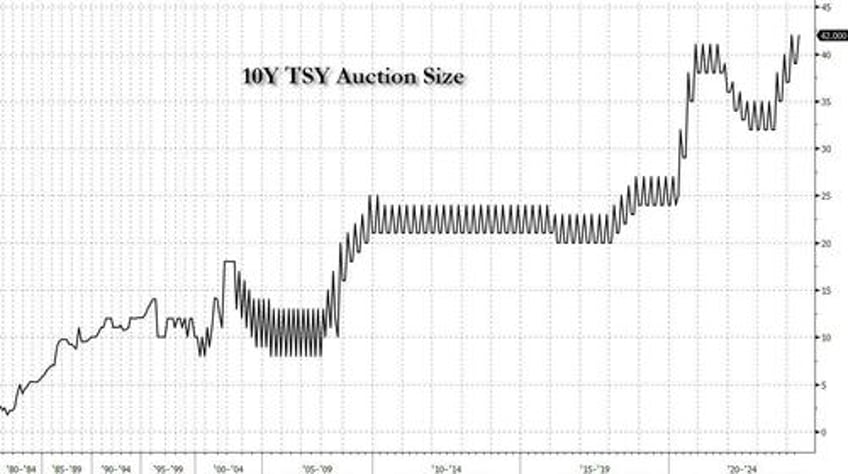

Starting at the top, the 10Y auction size rose from $39BN in April to a record-matching $42BN in May, and surpassing the record auction sizes sold during the peak of the covid crisis.

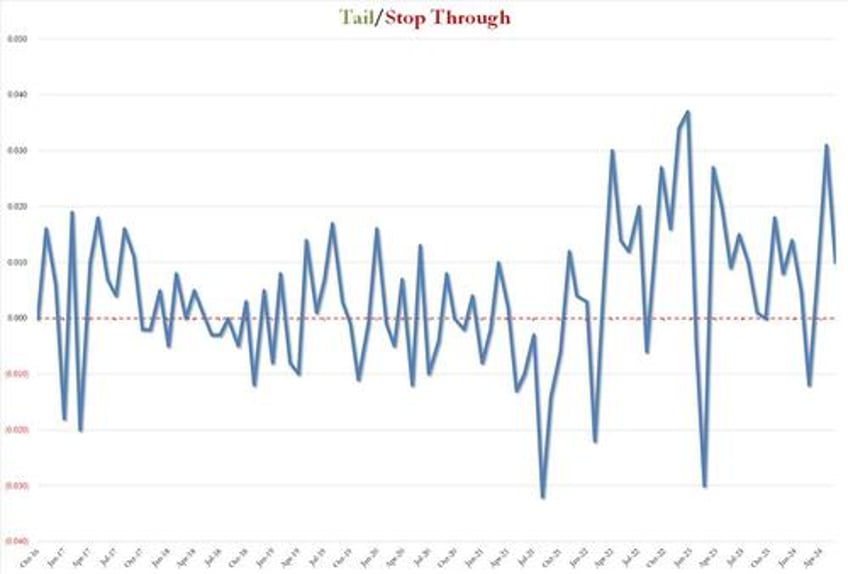

The high yield was 4.483%, down modestly from last month's 4.56% but tailing the 4.473% When Issued by 1basis point, the third consecutive tail in a row.

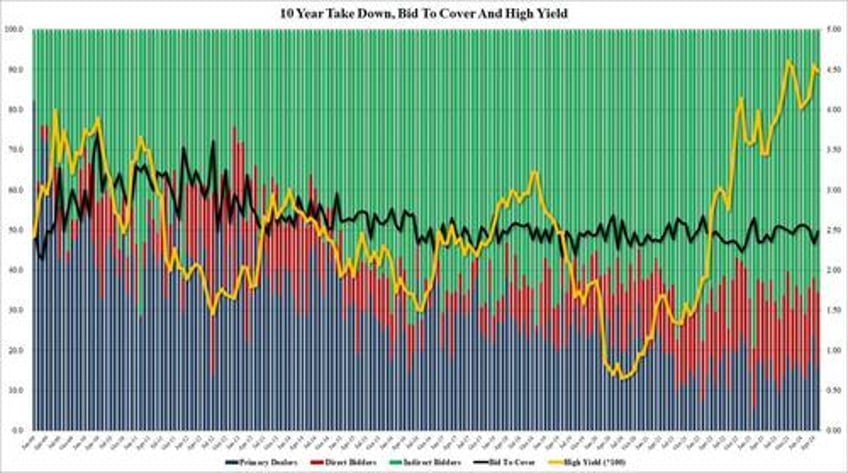

The bid to cover rose from 2.336 to 2.486%, right on top of the 2.49% six-auction average.

The internals were also ok, with Indirects awarded 65.5%, up from 61.8%, if below the 66.1% recent average. And with Directs taking down 18.7%, modestly above the 17.0% recent average, Dealers were left with 15.7% of the auction, the lowest since February.

Overall, this was a solid if slightly soggy auction, where the biggest negative was the modest tail, although in retrospect, there have been 13 tails in the past 15 10Y auctions, so the top-line disappointment is now pretty much standard, and the fact that internals were an improvement from last month is probably why yields did not spike after the auction.