Over the weekend, Goldman's prime brokerage published several remarkable charts showing the unprecedented revulsion toward Consumer Staples as the market (over)reacted to the "anti-obesity" GLP-1/wegovy/mounjaro mania which we warned would happen some two months ago in "Will America's Anti-Obesity Craze Lead To A Food Revolution", and which sent the Staples group tumbling again last week (it was the worst SPX sector week/week through Thursday), led lower by Food (-3.3%) and Beverage (-2.6%) stocks.

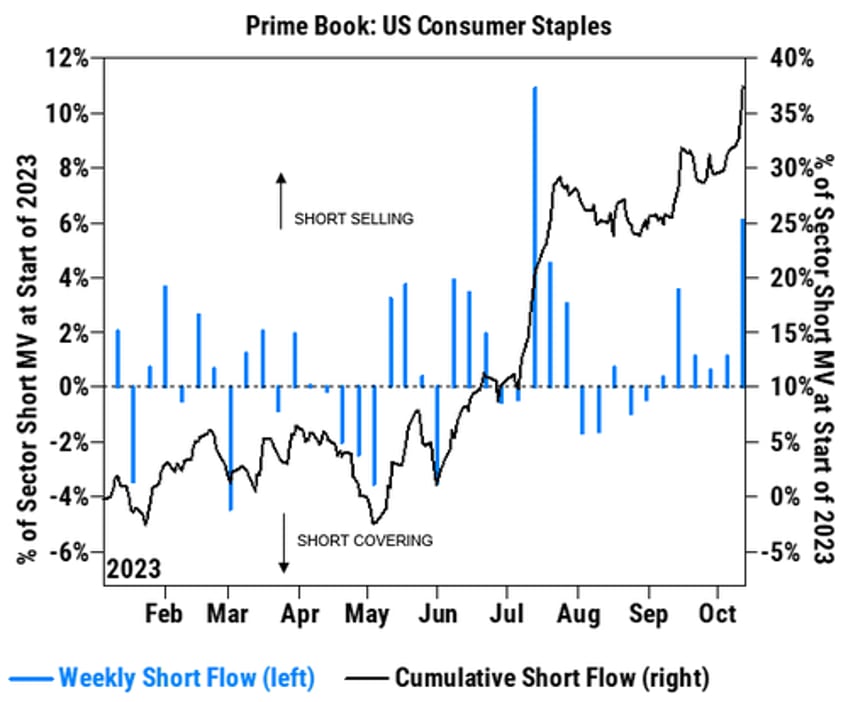

The first chart shows that Consumer Staples was the most notionally net sold US sector on the Prime book last week, driven by short sales outpacing long buys ~4 to 1, as hedge funds sold Staples at the fastest pace in 11 weeks amid the sector’s price underperformance. The hedge fund short flow in Staples increased for 6 straight weeks, and this week’s notional short selling was the largest in 3 months (in the 98th percentile vs. the past 5 years).