While at this point pretending that one can somehow stop or deflect the civilization-ending meteor that is the US debt load, rising by $30 billion every day on its way to a terminal reserve currency crisis, is at best rearranging the deck chairs on the titanic, Wednesday the largest caucus of House Republicans called for an increase in the Social Security retirement age up a clash with President Joe Biden over spending on popular entitlement programs.

According to Bloomberg, the Republican Study Committee, which comprises about 80% of House Republicans, called for the Social Security eligibility age to be tied to life expectancy in its fiscal 2025 budget proposal. As a reminder, the social security pension system was created in 1935 when the average life expectancy was 61 for white males and 65 for white females, about 20 years below where it is today. The proposal also suggests reducing benefits for top earners who aren’t near retirement, including a phase-out of auxiliary benefits for the highest earners.

The proposal sets the stage for an election-year fight with Biden, who accused Republicans of going after popular socialist entitlement programs during his State of the Union address.

“If anyone here tries to cut Social Security, Medicare, or raise the retirement age, I will stop you,” Biden said in his March 7 address to Congress. Spoiler alert: he won't.

Amusingly, the Republican document notes that Biden previously supported increasing the retirement age from 65 to 67 after bipartisan negotiations in 1983.

Rep. Kevin Hern (R-Okla.), the caucus’s chairman, said the president’s opposition to Social Security policy changes would lead to automatic benefit cuts when the program’s trust fund is set for insolvency in 2033. A phased-in retirement age change was a standard feature of past negotiations, he said.

“Anytime there’s been any reforms in history – President Clinton, President Reagan – had a slow migration of age changes for people that are 18, 19 years old,” Hern told reporters Wednesday.

The caucus’s budget proposal is more aggressive than the recent proposal by House Budget Committee Chairman Jodey Arrington (R-Texas), who advanced a budget resolution earlier this month that called for a bipartisan commission to negotiate Social Security and Medicare solvency but didn’t make specific policy recommendations. The Republican Study Committee, meanwhile, called for policy changes that would reduce spending on Social Security by $1.5 trillion and Medicare by $1.2 trillion over the next decade.

Republicans have said their proposals aren’t truly cuts and wouldn’t affect those at or near retirement. But Biden and congressional Democrats such as Rep. Brendan Boyle (D-Pa.), ranking member of the Budget Committee, have said they won’t support an increase in the age of eligibility, which currently sits at 67 (and can start as early as 62 with penalties).

The caucus’s proposal leaves some details out. It calls “modest changes to the primary insurance amount” for those who aren’t near retirement and “earn more than the wealthiest” benefit level. It also proposes “modest adjustments to the retirement age for future retirees to account for increases in life expectancy.” And it would “limit and phase out auxiliary benefits for high income earners.”

The proposal projects to balance the federal budget by 2031, outlining $16.6 trillion in spending cuts over a decade, hardly the stuff a society addicted to fringe welfare benefits will be delighted to hear.

The proposal calls for Medicare spending reductions by implementing a “premium support model” in which private Medicare Advantage plans would compete with the federal Medicare plan. It proposes moving graduate medical education payments, which go to teaching hospitals for their residency programs, into a trust fund separate from Medicare.

As reported previously, Biden’s fiscal 2025 budget proposal, released March 11, called for an increase in the tax rate to support Medicare on those earning more than $400,000 a year, from 3.8% to 5%. It also broadly called for top earners to pay more to support Social Security, but didn’t make specific proposals. White House Office of Management and Budget Director Shalanda Young told reporters the Biden administration doesn’t like the current structure of the payroll tax — which only applies to the first $168,600 of an individual’s income.

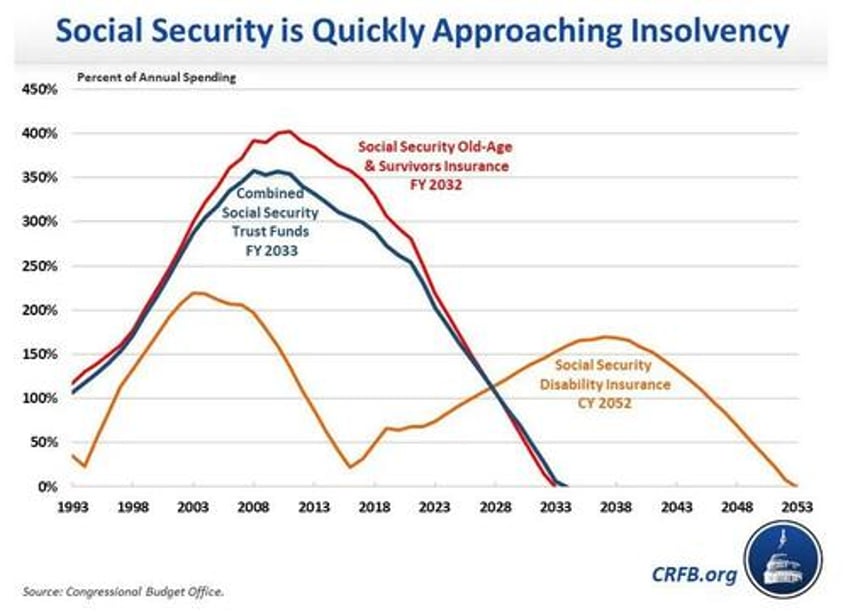

One of the trust funds that supports Social Security is projected for insolvency in 2033, the program’s board of trustees said their most recent estimate in March 2023.

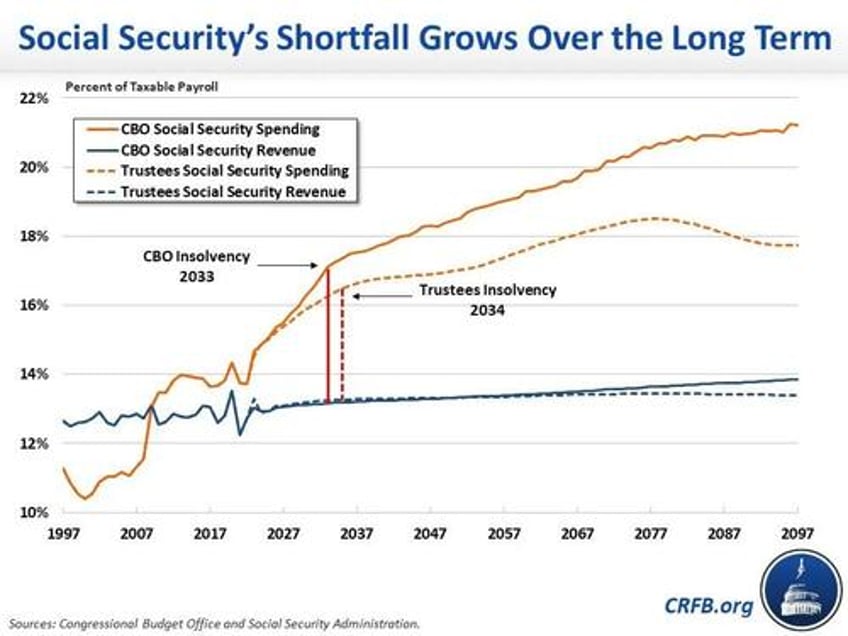

CBO projects that Social Security will run chronic deficits over both the short- and long-term. It will run a cash flow deficit of $154 billion in 2023, which is 1.6 percent of taxable payroll or 0.6 percent of Gross Domestic Product (GDP). Over the subsequent decade, Social Security will run $3.5 trillion (2.9 percent of taxable payroll or 1.0 percent of GDP) of cumulative cash flow deficits.

Over the long term, CBO projects Social Security's cash shortfall will grow to 3.9% of taxable payroll (1.4% of GDP) by 2033, to 5.1 percent of payroll (1.7 percent of GDP) by 2050, to 6.8 percent of payroll (2.3 percent of GDP) by 2075, and to 7.4 percent of payroll (2.4 percent of GDP) by 2097.

CBO projects earlier insolvency dates and a larger 75-year actuarial shortfall than the Social Security Trustees estimated in their 2023 report. While CBO projects OASI insolvency in 2032 and SSDI depletion in 2052, the Trustees expect the OASI trust fund to run out by 2033 and the SSDI trust fund to remain solvent over the next 75 years. And while CBO expects the theoretically combined trust funds to deplete their reserves by 2033, the Trustees expect them to run out a year later, in 2034.

The CBO warns that "as Social Security's trust funds rapidly approach insolvency, the necessary adjustments to restore solvency will become harder and the burden on beneficiaries more pronounced the longer policymakers wait to act. Enacting trust fund solutions sooner rather than later would help prevent abrupt, across-the-board benefit cuts, allow for targeted adjustments to those who can most afford them, spread the burden of tax and benefit changes across generations, and give today's workers more time to plan for retirement."

Unfortunately, raising the retirement age is only the easiest and most palatable of all adjustments. It also delays insolvency by a few years at most. What comes next is far more painful.