The slump in 'soft' survey data continues this morning with disappointments from the Philly and Richmond Feds.

The flashing red signals for US manufacturing flashed redder-er this morning as the Richmond Fed survey showed manufacturing activity plummeted to -15 (considersably worse than the -8 exp) to its lowest since the COVID lockdowns...

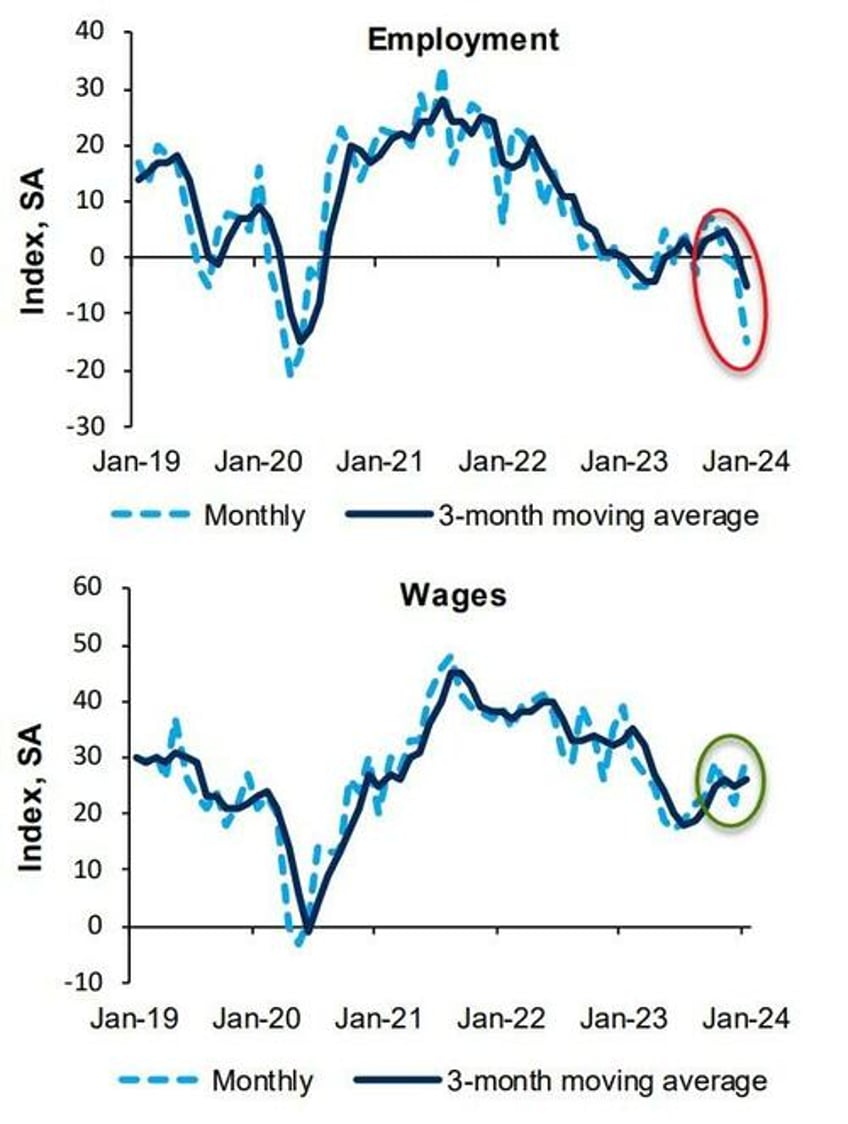

Under the hood was a shitshow with new orders sliding further into contraction (from −14 to −16), and employment collapsing from −1 to −15... but wages jumped...

The capacity utilization index plunged from −8 to −27 in January, with about one-third of respondents reporting a decline in capacity utilization since December.

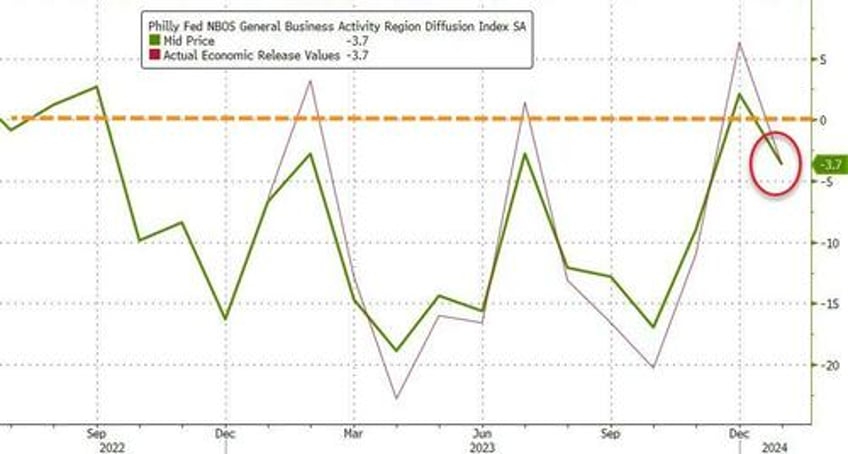

And while a manufacturing recession is not breaking news, the narrative-shapers can't just claim 'well, services will support it... and 70% of economy etc....' as the Philly Fed Services survey slumped back into contraction in January.

The red line is the original survey prints (which were entirely revised today)...

Under the hood, it was not as ugly as Richmond but we do note the part-time employment index increased from -0.5 to 10.2 this month, its highest reading since June 2022.

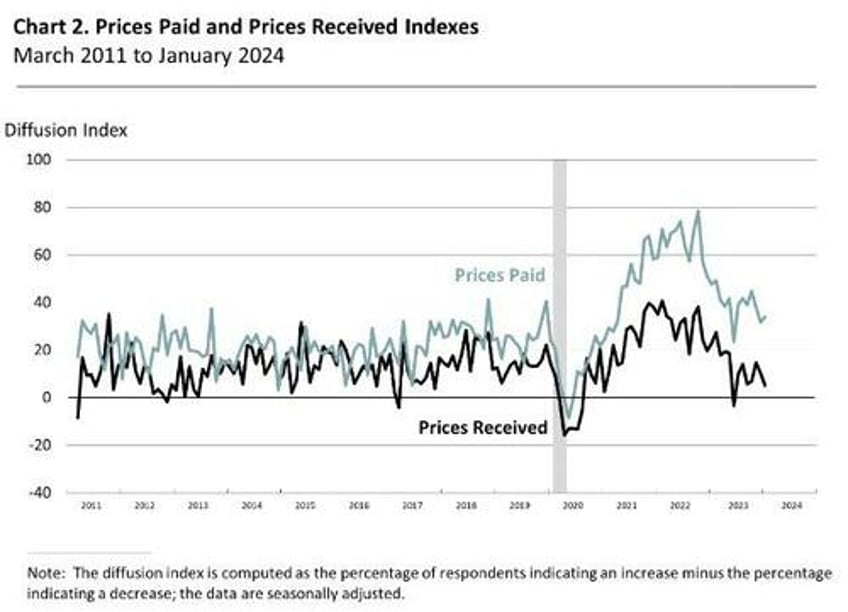

Additionally, price indicator readings suggest continued increases in prices for inputs and prices for the firms’ own goods and services. The prices paid index moved up 2 points to 33.8. Over 36 percent of the respondents reported higher input prices

And so, 'soft' survey data is crashing as 'hard' economic data has been outperforming recently...

Isn't is interesting how the survey data is so heralded by the optimists, commission-rakers, and asset-gatherers when it's up and rising, but not so much when it's down and falling?