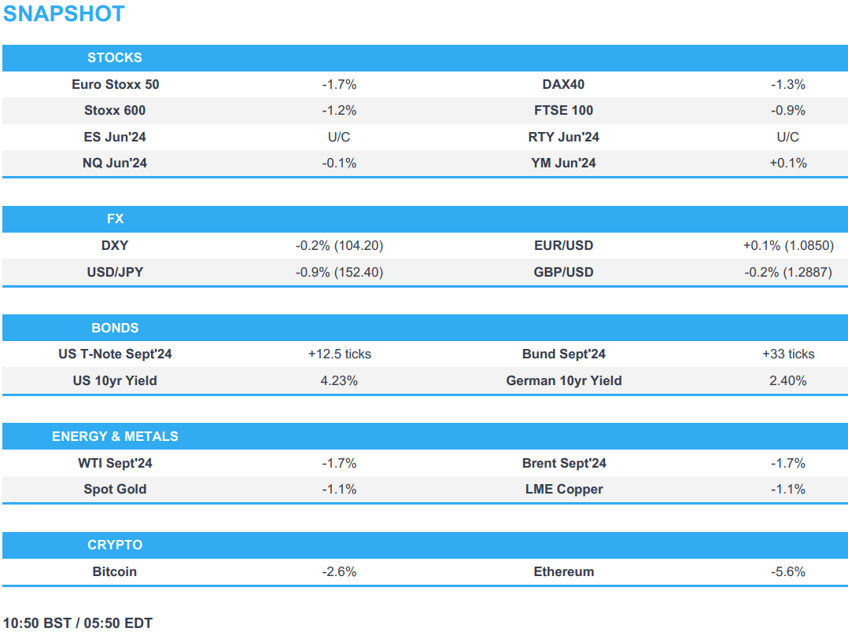

- European bourses are entirely in the red after a slew of poor earnings; US equity futures are mixed and currently taking a breather from the prior day’s hefty losses

- Dollar is weaker vs safe haven currencies, whilst the high beta Antipodeans continue to lag

- Bonds benefit from the risk-averse mood, Bunds took a leg higher following weaker-than-expected German Ifo data

- Crude is at lows, XAU back below USD 2400/oz & base metals slump

- Looking ahead, US Durable Goods, GDP Advance (Q2), PCE Prices Advance (Q2), US IJC, ECB President Lagarde, Supply from the US, Earnings from AbbVie & Willis Towers

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (-1.2%) opened the session on the backfoot in fitting with the risk-averse mood seen across markets overnight. A slew of poor earnings only fuelled the pressure seen in Europe with indices heading lower since the cash open, where they currently reside.

- European sectors are entirely in the red. Healthcare fares better than the rest, given some of the post-earning strength in Sanofi, Roche and Lonza. Tech follows closely behind, after poor BE Semiconductor and STMicroelectronics results, but also in a continuation of the prior day’s price action. Autos are also hampered by significant losses in Renault and Stellantis.

- US equity futures (ES U/C, NQ -0.2%, RTY U/C) are mixed, seemingly taking a breather following the hefty losses seen in the prior session. In terms of pre-market movers, Ford (-13.5%) slips after significantly missing on the bottom line, whilst IBM (+4%) gains after strong earnings and improving guidance.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

EARNINGS

- Ford Motor Co (F) Q2 2024 (USD): Adj. EPS 0.47 (exp. 0.68), Revenue 47.8bln (exp. 44.02bln). FY adj. EBIT view 10-12bln (exp. 11.23bln). FY CapEx view affirmed between USD 8.0-9.0bln. Shares -13.5% pre-market

- International Business Machines Corp (IBM) Q2 2024 (USD): Adj. EPS 2.43 (exp. 2.20), Revenue 15.77bln (exp. 15.62bln). Shares +4% pre-market

- Nissan Motors (7201 JT) Q1 (JPY): Recurring profit 65.13bln (-60.9% Y/Y), Net profits 28.56bln (-72.9%); Cuts FY guidance; Cuts FY24/25 China sales forecast to 777k (prev. 800k), cuts US forecast to 1.41mln (prev. 1.43mln) Shares -6.9% in Asia trade

- STMicroelectronics (STM FP) Q2 (EUR): Revenue 3.232bln (exp. 3.204bln), Q2 gross margin 40.1% (exp. 40%). Sees Q3 gross margin 38% (exp. 40.9%), sees Q3 net revenue 38% (exp. 40.9%). Cuts FY24 revenue guidance to between EUR 13.2-13.7bln (exp. 14.3bln). Shares -12.5% in European trade

- Nestle (NESN SW) H1 (CHF): Sales 45bln (exp. 45.58bln), Net 5.6bln (exp. 6.08bln), EPS 2.16, +1.8%. In H1, repurchased CHF 2.4bln shares as part of the three-year CHF 20bln buyback which began in 2022. FY Guidance: Organic revenue growth of at least +3% (prev. guided +4%). Shares -4% in European trade

- Roche (ROG SW) H1 (CHF): Revenue 29.8bln (exp. 29.911bln), Net Income 6.697bln (exp. 7.523bln); Outlook for 2024 earnings raised; Roche expects to further increase its dividend in CHF. Shares +2.5% in European trade

- Anglo American (AAL LN) H1 (USD): Adj. EBITDA 4.9bln (exp. 4.51bln). Adj. EPS 1.06 (exp. 0.90). Adj. Profits 1.29bln (exp. 1.07bln). Decision to temporarily slowdown Woodsmith Crop nutrients project resulted in a USD 1.6bln impairment. Expect to substantially reduce overhead and other non op. costs in phases. Shares -1% in European trade

- AstraZeneca (AZN LN) Q2 (USD): Revenue 12.452bln (12.628bln), Core EPS 1.98 (exp. 1.9595); Guidance for FY 2024 increased, with Total Revenue and Core EPS anticipated to grow by a mid teens % (prev. a low double-digit to low teens percentage). Shares -3% in European trade

- BE Semiconductor Industries (BESI IM) Q2 (EUR): Revenue 151mln (exp. 152mln), Orders 313mln, Net 41mln. Q3 Guidance: Revenue seen flat, Gross Margin between 64-66% (prev. 65%). CEO estimates that around 50% of orders over the last 12-months were AI-related. Shares -11.5% in European trade

- TotalEnergies (TTE FP) Q2 (USD): Net Income 4.7bln (exp. 4.9bln), adj. EBITDA 11.1bln (exp. 11.6bln), adj. EPS 1.98 (exp. 2.06). Refining utilisation rate is expected to be in excess of 85%. Start up of Anchor, within the Gulf of Mexico, expected in Q3. "Sales of petroleum products in the second quarter 2024 were down year-on-year by 2%, mainly due to lower diesel demand in Europe that was partially compensated by higher activity in the aviation business." Shares -1.5% in European trade

- Unilever (ULVR LN) H1 (EUR): Sales 31.3bln (exp. 32.9bln), adj. Operating Profit 6.1bln. Q2: Underlying Sales +3.9% (exp. +4.3%), quarterly dividend +3%. Commences the EUR 1.5bln share buyback programme. Shares +5.5% in European trade

FX

- Similar price action for the USD as Wednesday with the dollar softer against havens such as CHF and JPY but firmer against risk-sensitive currencies such as AUD and NZD.

- EUR is a touch firmer vs. the USD but only marginally so. 1.0825 from Wednesday marks the recent base for the pair. There is a slew of DMAs to the downside in the pair with the 200 DMA at 1.0817.

- GBP is seeing shallow losses vs. the USD but off worst levels after briefly breaching Wednesday's low at 1.2878.

- JPY has extended its upside vs. the USD to a 4th consecutive session with the Yen benefitting from risk-aversion, efforts by officials to guide the currency lower, an unwind of carry trades and mounting expectations of a hawkish BoJ at next week's meeting.

- AUD/USD has now extended its downtrend to a 10th consecutive session as global risk sentiment continues to suffer and questions remain over the health of the Chinese economy.

- CNH edgins out gains vs. the USD in a market which is characterised by a reversal in recent popular trades with long USD/CNH having been one of them. From a fundamental standpoint, the PBoC surprised markets with a 20bps reduction to the 1yr MLF rate overnight.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are benefitting from the tepid risk tone with the sell-everything/deleveraging narrative not yet extending to the fixed income space. Thus far, as high as 111-04 to within half a tick of yesterday’s best. Data slate is busy today with focus on US IJCs and Q2 PCE, with a 7yr auction thereafter.

- Bunds are bouncing from the US auction-induced dip that occurred late on Wednesday and benefitting from the broader macro tone. The German Ifo survey for July was weaker-than-expected, which helped to lift Bunds to a 132.78 high.

- Gilts are towards session highs of 98.21; specifics for the UK light and instead Gilts have been caught up in the broader risk-off tone that is continuing from the Wall St. handover.

- Click for a detailed summary

COMMODITIES

- A downbeat morning for the crude complex amidst the broader risk aversion seen across markets, and in a continuation of the weakness seen in prices on the back of sluggish Chinese demand, with prices unfazed by the surprise PBoC MLF rate cut overnight. Brent Sep in a USD 80.95-81.60/bbl range.

- Precious metals are lower across the board despite the softer Dollar and risk aversion amid a broader downturn in metals in what is seemingly an unwind of winning trades. Spot gold slipped from a USD 2,401.31/oz high, through the psychological figure and to a current USD 2,365.91/oz low.

- Base metals also trade on the backfoot amid the broader risk aversion and ongoing pessimism regarding Chinese demand.

- Russian Deputy PM Novak expects the JMMC meeting on August 1st to be constructive, aims to fulfil OPEC+ deal, will compensate for overproduction OPEC+ partners are satisfied with compensation schedule. Russia aims to fulfil OPEC+ deal, will compensate for overproduction. Constantly in touch with OPEC+ partners, talked with OPEC+ representative last week. Russia has no friction with OPEC+ over exceeding production quotas. Not planning additional measures to normalize the situation with AI-95 petrol supplies, difficulties are temporary. Russia is not going to ban diesel exports, its production is extensive, the situation is stable.

- Click for a detailed summary

NOTABLE DATA RECAP

- German Ifo Expectations New (Jul) 86.9 vs. Exp. 89.0 (Prev. 89.0); Ifo Business Climate New (Jul) 87 vs. Exp. 88.9 (Prev. 88.6); Ifo Current Conditions New (Jul) 87.1 vs. Exp. 88.5 (Prev. 88.3)

- EU Money-M3 Annual Growth (Jun) 2.2% vs. Exp. 1.8% (Prev. 1.6%); Loans to Non-Fin (Jun) 0.7% (Prev. 0.3%); Loans to Households (Jun) 0.3% (Prev. 0.3%)

NOTABLE US HEADLINES

- US President Biden said America is to choose between hope and hate, optimism and negativity, while he added that he needs to unite the party and it is time to pass the torch but will continue his duties as President for the remainder of his term. Furthermore, he also commented that Vice President Harris is experienced, tough and capable.

- China smartphone shipments +10% in Q2; Apple (AAPL) China sales fell 2% Y/Y in Q2, Huawei sales +41%; according to Canalys.

GEOPOLITICS

MIDDLE EAST

- US senior official said Gaza ceasefire negotiations appear to be in their closing stages and negotiators have worked out a pretty detailed text of the arrangements for how a Gaza hostage deal would work in which the initial phase of the hostage deal would see women, men aged over 50 and the sick and wounded hostages released over a 42-day period. Furthermore, the official said the remaining obstacles to a Gaza hostage deal are bridgeable and there will be activity on this issue in the coming week, while US President Biden and Israeli PM Netanyahu will talk about how to close final gaps holding up a Gaza hostage deal during their meeting on Thursday.

OTHER

- Ukrainian Navy spokesman said Russia has pulled all its vessels out of the Sea of Azov, according to Reuters.

- Russian Foreign Ministry says experts from Russia and the US have met to discuss Ukraine although the ministry does not see such contacts as practical because the US side is biased, according to RIA

CRYPTO

- Bitcoin is on the backfoot, suffering from the broader risk tone seen across the markets; BTC currently sitting below USD 64.5k.

APAC TRADE

- APAC stocks were negative following the sell-off on Wall St where the S&P 500 and Nasdaq suffered their worst declines since late-2022 owing to disappointment following some mega-cap earnings and a surprise contraction in US Manufacturing PMI.

- ASX 200 was dragged lower by notable losses in tech, while miners also suffered after several quarterly production updates and lower underlying commodity prices.

- Nikkei 225 underperformed and briefly dipped beneath the 38,000 level after shedding over 1,000 points with pressure from currency strength and prospects of a BoJ rate hike at next week’s policy meeting.

- Hang Seng and Shanghai Comp. conformed to the broad selling in the region and fell towards the 17,000 level where support held, while the mainland index also retreated albeit to a lesser extent than regional peers after the PBoC’s surprise MLF operation and 20bps rate cut to the 1-year MLF rate with markets seemingly unimpressed by China’s piecemeal stimulus efforts.

NOTABLE ASIA-PAC HEADLINES

- PBoC injected CNY 200bln via 1-year MLF loans with the rate lowered to 2.30% vs prev. 2.50%.

- Japan's Chief Cabinet Secretary Hayashi says will not comment on daily share moves; will not comment on FX moves; reiterates it is important for currencies to move in stable manner reflecting fundamental; closely watching FX moves.

- China's State Planner says it is to lower the threshold for the use of ultra-long special bond for investing in equipment upgrade projects. Issuing a notice to increase support for equipment upgrades and consumer good trade-ins. Lifts subsidies for car trade ins to up to CNY 20k/vehicle. Allocating CNY 300bln in ultra-long-term treasury bonds.

DATA RECAP

- Japanese Services PPI (Jun) 3.00% vs. Exp. 2.60% (Prev. 2.50%)

- South Korean GDP QQ Advance (Q2) -0.2% vs. Exp. 0.1% (Prev. 1.3%); YY 2.3% vs. Exp. 2.5% (Prev. 3.3%)