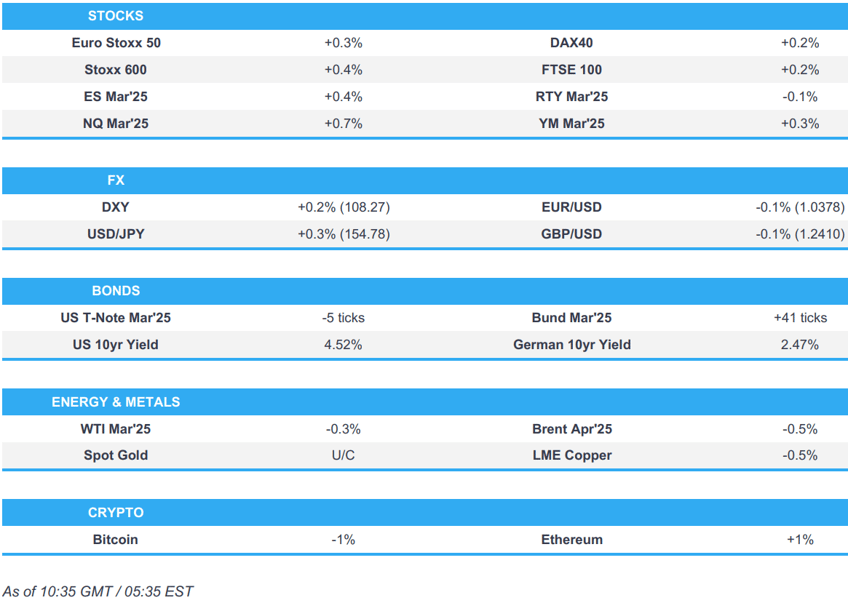

- European bourses gain, NQ outperforms with AAPL +3.5% in the pre-market after strong growth in services segment.

- USD mixed vs. peers ahead of core PCE; JPY underperforms.

- Fixed benchmarks bounce on cool German State CPIs, which has led to outperformance in Bunds.

- Crude pares initial premia awaiting updates from Trump regarding tariffs on Canada/Mexico oil.

- Looking ahead, German CPI, US PCE, Employment Costs, Canadian GDP (Q4), German Credit Rating, Comments from Fed's Bowman, Earnings from Exxon, AbbVie, Colgate-Palmolive, LyondellBasell & Phillips 66.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses (Stoxx 600 +0.5%) opened modestly firmer and continued to edge higher as the session progressed, with indices generally near highs. Overnight, a turnaround in futures began around the time the WSJ posted an article which suggested that the US administration could announce new tariffs by Saturday, but with a grace period to allow for negotiations (the grace period was not initially touted).

- European sectors opened mixed but now hold a strong positive bias. Tech is the outperformer today, with sentiment in the sector lifted by post-earning strength in Apple, which is higher by around 3.5% in US pre-market trade. Healthcare takes the second spot, lifted by post-earning strength in Novartis (+3.3%).

- US equity futures are mixed, with the RTY (-0.1%) marginally in the negative territory whilst the tech-heavy NQ (+0.6%) outperforms following results from Apple and Intel (details below).

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

EARNINGS SUMMARY

- Apple (AAPL) +3.5% pre-market: Q1 revenue rose 4%, but iPhone sales missed expectations, and China sales fell; Mac and iPad sales improved, while wearables declined. The strong growth in its services segment supported its rise afterhours

- Intel (INTC) +1.4% pre-market: Better-than-expected Q4 earnings, though it issued weak guidance, citing seasonality and competition.

- Chevron Corp (CVX) -0.1% pre-market: Q4 EPS missed though revenue beat, announced USD 1.115bln impairment.Announces a 5% increase in Quarterly dividend

- Novartis (NOVN SW) +3.1%: Beat, lifts dividend, requests extended buyback authorisation.

- Samsung Electronics (005930 KS) -2.4%: Forecast slow sales for its AI chips in Q1 due to US export restrictions on China, and struggles to meet Nvidia's (NVDA) requirements, while also forecasting limited earnings growth amid weak memory chip demand.

FX

- DXY is extending on the upside seen yesterday following comments from US President Trump that he will put a 25% tariff on Canada and Mexico because of fentanyl, and stated that China is going to end up paying a tariff as well. It is worth noting that there was a more conciliatory piece overnight in the WSJ noting that the US Administration could announce new tariffs by Saturday, but with a grace period before implementation to allow for negotiation. For today's docket, focus will be on monthly PCE metrics for December, which follows yesterday's quarterly print. DXY has been as high as 108.37 with the next target coming via the 23rd Jan high at 108.51.

- EUR/USD is lower for a fourth consecutive session as the dust settles on yesterday's widely-expected 25bps rate cut from the ECB. Sources in the wake of the meeting revealed that if the GC delivers another 25bps cut in March,it will likely drop the “restrictive” reference to rates. Additionally on the inflation front, French CPI came in softer-than-expected whilst the regionals from Germany appear to be cooler than consensus for the mainland print at13:00GMT. EUR/USD has been as low as 1.0366; lowest since 21st January.

- JPY is softer vs. the USD with havens generally lagging vs. the USD. Overnight saw a deluge of data from Japan whereby headline Tokyo CPI came in firmer than expected, core in-line, IP and retail sales Y/Y beat. USD/JPY currently sits within yesterday's 153.78-155.23 range.

- GBP is slightly softer vs. the USD as UK-specific newsflow remains light in the run up to next week's BoE rate decision and MPR. GBP/USD has just slipped below the bottom end of yesterday's 1.2407-67 range with the next downside target coming via the 1.2392 low.

- Antipodeans are both firmer vs. the USD and attempting to claw back some of the losses from Trump's aforementioned tariff rhetoric yesterday.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are in the red, weighed on by the latest Trump-tariff rhetoric. Action which has propped up yields stateside with the short-end leading ever so slightly given the potential near-term tariff implications of any measures. Action which took USTs to a 108-31 trough in the early European morning. However, the complex began to make its way gradually off lows as no late-Thursday announcement came from POTUS as some had guided us towards. Additionally, a WSJ sources piece implied that officials are working to find a way to dial-back the tariff rhetoric/situation. US PCE due.

- EGBs derived a bid from the Prelim. French HICP figures which came in cooler than expected. Thereafter, cooler German State CPIs than implied by the forecasts for the 13:00GMT mainland release alongside a cut to the growth view in the ECB SPF sparked a dovish reaction, though perhaps somewhat capped by a jump in EBC SCE inflation views. Specifically, Bunds lifted from just below the 132.00 handle to a 132.45 session high over the course of five/six minutes vs current 132.30.

- Gilts moved in tandem with peers throughout the morning. Began the session with very modest upside, as the dovish impulse from the French data and general UST pickup off lows served to offset bearish pressure from the Trump tariff updates. Gilts currently around 92.60.

- Click for a detailed summary

COMMODITIES

- Crude benchmarks find themselves at session lows though the pressure is only modest thus far, WTI and Brent at the trough of USD 72.63-49/bbl and USD 75.69-76.44/bbl bands. Focus of course on the tariff situation and in particular Trump’s remark that he would be deciding by Thursday (i.e. yesterday) on whether or not to impose tariffs on oil on Canada and Mexico.

- Gold made fresh record highs above the USD 2800.00/oz mark. Thus far, has eclipsed the figure by exactly one dollar. Upside which has been driven despite the USD strength and overnight yield advances.

- Base metals are mixed, albeit with a slight downward bias; price action has been relatively rangebound with 3 LME copper within a USD 9,068-9108.80/oz range.

- Russian gas supplies to Europe via Turkstream pipeline have reached record monthly high of more than 50mcm per day in January

- Oman Crude OSP calculated at USD 80.26/bbl for March, up USD 7.10 vs Feb

- Kaztransoil says Kazakhstan plans to supply 22,000 T of oil from Kashagan field via Baku-Tbilisi-Ceyhan pipeline in January.

- Ukraine's Military says it struck an oil refinery in Russia's Volgograd region, causing a fire.

- Commerzbank sees upside potential for Palladium prices, expects it to rise to USD 1150/oz by end-2025

- Click for a detailed summary

NOTABLE DATA RECAP

- German State CPIs were cooler than the than implied forecasts for the 13:00GMT mainland release.

- German Retail Sales MM Real (Dec) -1.6% vs. Exp. 0.2% (Prev. -0.6%); YY 1.8% vs. Exp. 2.5% (Prev. 2.5%)

- German Unemployment Chg SA (Jan) 11.0k vs. Exp. 14.0k (Prev. 10.0k); Unemployment Rate SA (Jan) 6.2% vs. Exp. 6.2% (Prev. 6.1%); Unemployment Total SA (Jan) 2.88M (Prev. 2.869M); Unemployment Total NSA (Jan) 2.993M (Prev. 2.807M)

- Italian Producer Prices MM (Dec) 0.6% (Prev. 1.2%); Producer Prices YY (Dec) 1.1% (Prev. -0.5%)

- UK Lloyds Business Barometer (Jan) 37 (Prev. 39)

- UK Nationwide House Price MM (Jan) 0.1% vs. Exp. 0.3% (Prev. 0.7%); YY 4.1% vs. Exp. 4.3% (Prev. 4.7%)

- French CPI (EU Norm) Prelim YY (Jan) 1.8% vs. Exp. 1.9% (Prev. 1.8%); MM (Jan) -0.2% vs. Exp. 0.00% (Prev. 0.20%)

- French CPI Prelim YY NSA (Jan) 1.4% vs. Exp. 1.50% (Prev. 1.30%); MM -0.1% vs. Exp. 0.00% (Prev. 0.20%)

NOTABLE EUROPEAN HEADLINES

- ECB's Muller says rates are nearing the point where they will not curb investment, via Bloomberg

- ECB's Rehn says "we are confident that inflation will stabilise at its target as projected and monetary policy will cease to be restrictive in the near future"; estimates during the spring and summer.The pace and magnitude of rate cuts will be decided separately at each meeting

- ECB Consumer Expectations Survey (Dec): See inflation in next 12 months at 2.8% vs. Exp. 2.7% (prev. 2.6%); 3y ahead sees 2.4% (prev. 2.4%)

- ECB Survey of Professional Forecasters; sees 2025 inflation at 2.1% (prev. 1.9%); 2026 1.9% (prev. 1.9%), 2027 2.0%

NOTABLE US HEADLINES

- US Administration could announce new tariffs by Saturday, but with a grace period before implementation to allow for negotiation, via WSJ citing sources; advisors are considering several offramps to avoid enacting universal tariffs on Canada and Mexico.

- US President Trump said China is going to end up paying a tariff as well.

- US President Trump posted on Truth Social that the US will require commitment from BRICS countries to neither create a new BRICS currency nor back any other currency to replace the mighty US Dollar or they will face 100% tariffs.

- US is probing whether DeepSeek sourced NVIDIA (NVDA) chips through Singapore, with the White House and FBI investigating the use of Singapore intermediaries by DeepSeek, according to Bloomberg. It was also reported that US Congressional offices are being warned not to use DeepSeek, according to Axios.

GEOPOLITICS

MIDDLE EAST

- Lebanese media Al Mayadeen posted on X that Israeli warplanes struck several areas on Lebanon's eastern border with Syria which it stated marked another set of blatant violations of the ceasefire agreement.

- US military said it killed a senior operative of Al-Qaeda affiliate terror group Hurras Al-Din in northwest Syria.

- Israeli PM Netanyahu "will hold security consultations today to discuss the possibility of stopping the deal and the possibility of returning to fighting immediately", according to Al Jazeera.

CRYPTO

- Bitcoin is a little lower and back closer towards USD 104k; Ethereum is a little firmer and around USD 3.2k.

APAC TRADE

- APAC stocks were mostly higher but with gains capped at month-end and as participants digested earnings and tariff threats.

- ASX 200 printed a fresh all-time high with the index led by strength in gold miners and tech although the defensive sectors lagged.

- Nikkei 225 remained afloat albeit with momentum restricted by a choppy currency and a slew of earnings.

- KOSPI underperformed on return from the holiday closure with tech names pressured as SK Hynix got its first opportunity to react to the DeepSeek debacle and Samsung Electronics was also negative despite better-than-expected earnings for Q4 as it provided a pessimistic view for the current quarter.

DATA RECAP

- Tokyo CPI YY (Jan) 3.4% vs. Exp. 3.1% (Prev. 3.0%)

- Tokyo CPI Ex. Fresh Food YY (Jan) 2.5% vs. Exp. 2.5% (Prev. 2.4%); Ex. Fresh Food & Energy YY (Jan) 1.9% vs. Exp. 1.9% (Prev. 1.8%)

- Japanese Industrial Production MM (Dec P) 0.3% vs. Exp. 0.3% (Prev. -2.2%); YY (Dec P) -1.1% vs. Exp. -2.2% (Prev. -2.7%)

- Japanese Retail Sales MM (Dec) -0.7% vs. Exp. -0.1% (Prev. 1.8%, Rev. 1.9%); YY (Dec) 3.7% vs. Exp. 3.2% (Prev. 2.8%)