White House spokeswoman Karoline Leavitt told reporters on Tuesday that President Donald Trump still plans to slap tariffs of about 25% on imports from Canada and Mexico on Saturday unless the countries halt the illegal alien invasions and fentanyl flows into the US. The president has also warned that China faces 10% tariffs.

Yesterday, right before the close, Trump reiterated his threat about tariffs on Mexico and Canada.

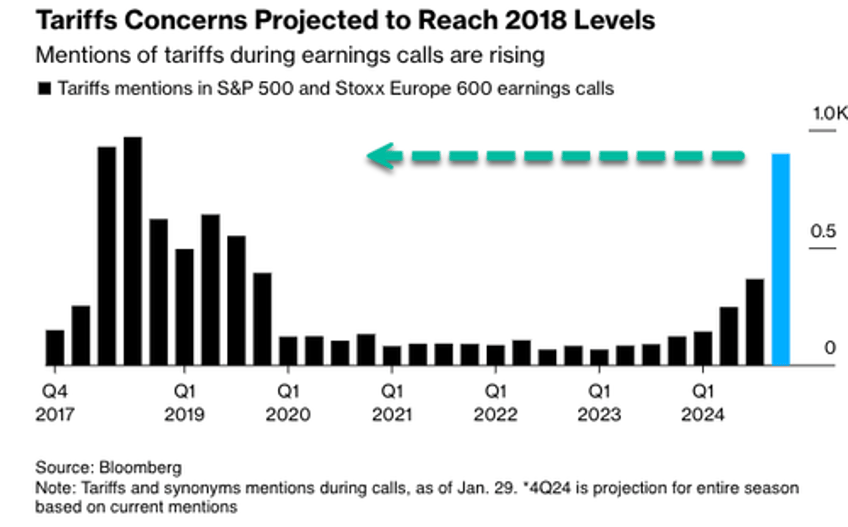

This trade uncertainty has pushed tariff mentions on earnings calls by management teams of S&P 500 and Stoxx Europe 600 companies to their highest level since 2018—when Trump first launched the trade war.

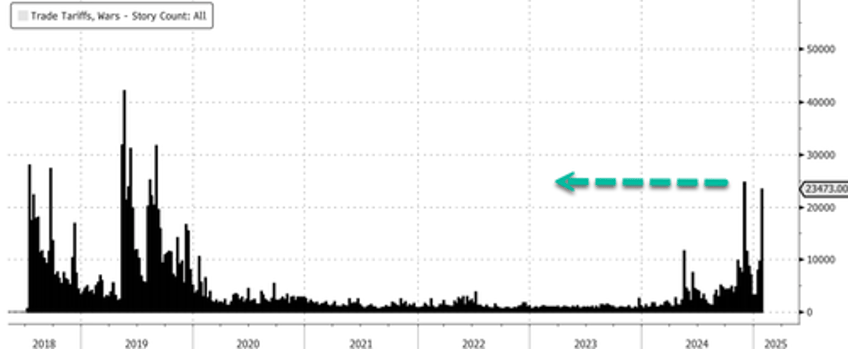

It's no secret that Trump's 'America First' agenda includes imposing across-the-board tariffs on top trading partners. The story count of "tariff" articles in corporate media began surging in mid-2024.

When reporters asked Leavitt about Trump's Saturday deadline for Canada and Mexico, she said the president "still holds" the line.

"The president has also put out specific statements in terms of Canada and Mexico, when it comes to what he expects in terms of border security." Leavitt added, "We have seen a historic level of cooperation from Mexico. But again, as far as I'm still tracking, and that was last night talking to the president directly, Feb. 1 is still on the books."

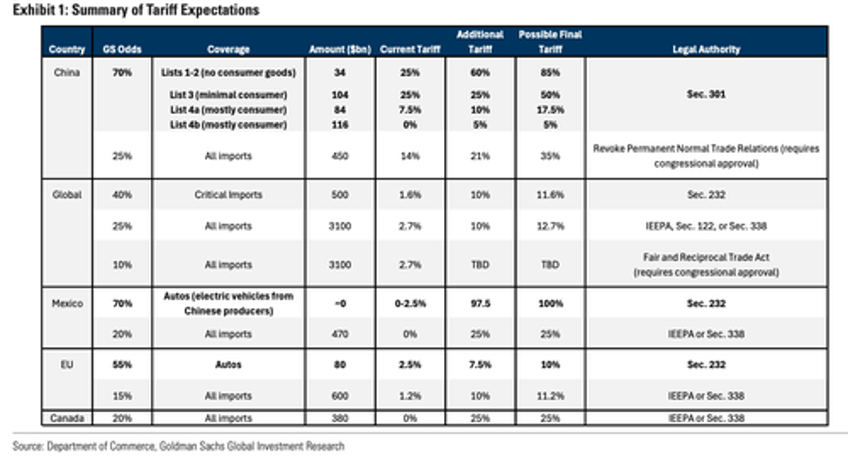

Adding more color on the trade situation, Goldman Sachs Chief Economist Jan Hatzius told clients last week after Trump's series of executive orders that initial trade policy coming from the Trump-Vance administration was "more benign than expected," adding, "the president's comments on China were notably less hawkish than during the presidential campaign or even his more recent comments since the election."

Hatzius noted, "And while we viewed a "universal tariff" as a clear risk, the president's comments suggest that, for now, it is a lower priority than we would have expected."

Goldman's tariff expectations:

Suppose Trump's tariffs on Canada or Mexico take effect on Saturday. In that case, a sharp increase in tariff and all other trade mentions during future earnings calls between analysts and management teams is expected.

Trump's stance on tariffs has remained the same since the campaign trail.