By Marcel Kasumovich, Deputy CIO of Coinbase Asset Management

“We are not dependent on the ideas of a single person, but on the combined wisdom of thousands of people who are all thinking of the same problem, each doing their little bit to add to the great structure of knowledge that is gradually being erected.” Ernest Rutherford is recognized as the father of nuclear physics, and also for his appreciation that his contributions would be invisible over time if done right – others building on them would shine.

Perhaps this is the point of Satoshi Nakamoto’s anonymity. He doesn’t matter. For bitcoin and crypto asset technologies to work requires widespread adoption from technologists to regulators and users. We are all Satoshi if bitcoin rises to reach its full potential. Could the creators be bad operators? Yes, and transparency is the solution. Bitcoin started with a bit more than 1,000 lines of code and an open architecture for all to see. And it works, with nobody in charge.

3,847. Those are the number of consecutive days the bitcoin network has operated without interruption. It covers an eventful decade – a global recession, a collapse in commodity markets, a freezing of the US repo market, a global pandemic, the fastest US monetary tightening in four decades, country bans of bitcoin mining, and the crypto Great Depression. Over $100 trillion dollars have settled on the bitcoin protocol over its lifetime. Remarkable.

It’s also the type of data that earns bitcoin the reputation as the “gold standard” of crypto asset markets. Energy is a connective tissue between gold and bitcoin. Machines and energy are needed to produce gold. Devaluation of a currency that elevates the cost of production would be captured by the local price of gold. When central banks anchored monetary policy to gold, they were anchored to those real resource constraints.

The parallels to bitcoin mining – computers and power – are self-evident. Bitcoin’s nominal anchor, like gold, are real resources dominated by energy. Now, investors are keen to see whether the parallels of bitcoin to gold extend to the financial world. After all, the introduction of the gold exchange traded product (ETF) was coincident with a decade-long bullish trend. Even if just a coincidence, what’s clear is that the “bitcoin standard” has institutional engagement.

But there is one major difference – scarcity. When the price of gold is high relative to its cost of production, there is an incentive to hunt for new gold reserves to mine. Supply rises. It’s a law of any market. Bitcoin has no supply response. When profits are high, more computers enter the network, and the bitcoin algorithm makes mining more difficult. The energy cost of bitcoin rises, and profits fall to push weakest miners out of the network.

And difficulty has surged. It’s a sign of maturity. Bitcoin mining difficulty is up nearly 60% this year and is more than double from the 2022 highs in the price of bitcoin. The secular rise in bitcoin mining difficulty means the market is becoming more efficient, more institutional than previous cycles. Part of the surge in mining difficulty is computers entering the market in anticipation of “the halving,” collecting rewards before they are reduced by 50% next year.

Bitcoin inflation is cut by half every four years or so. There will only ever be 21 million in bitcoin supply, and 92% is already in circulation. April 16, 2024 is the approximate date of the next bitcoin halving, which will reduce the bitcoin inflation rate to less than 1%. Bitcoin miners and investors are excited by the historical precedent – the price of bitcoin rose 25% on average starting from two months before past halvings and 60% three months after the event.

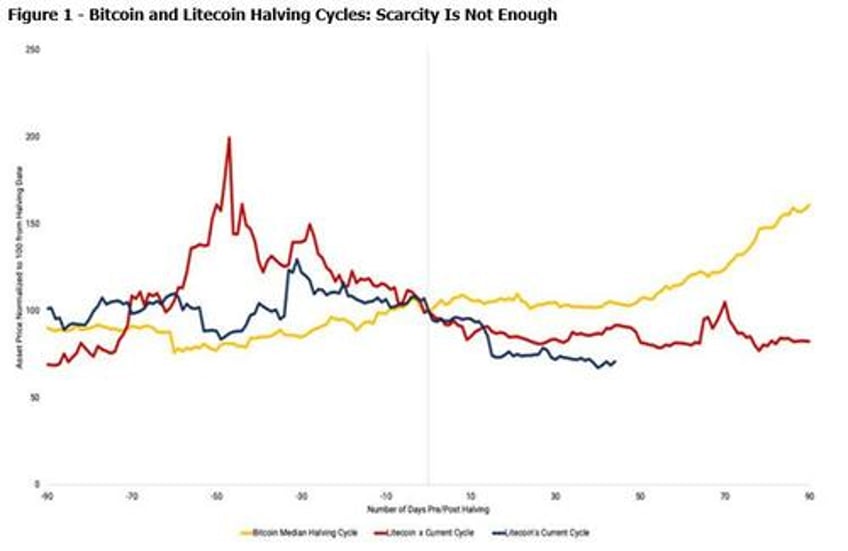

Not bad. But this is only the fourth cycle – it’s a small sample. Figure 1 illustrates halving cycles for bitcoin and her “silver equivalent”, litecoin. The data are a visual reminder that scarcity isn’t enough to make prices rise. Litecoin enjoyed a sharp price spike before its most recent halving on August 2, 2023, then fizzled out. Scarcity without being useful is pointless. I produce plenty of music that is scarce…and valueless. There needs to be demand.

Where’s the demand for bitcoin? The most natural is as a payment rail. The numbers are staggering. The top 100 bitcoin transactions in the past 24 hours sum to nearly $10 billion at an average cost of less than 2 basis points. Spectacular technology. What’s built on top of the bitcoin protocol will define its user experience, like the Lightning Network that allows for virtually costless micro transactions. But similar to gold, its store of value could detract it from its utility.

Gold is a remarkable conductor of electricity – it’s not afraid of oxygen, unlike copper. But gold’s price has largely destroyed its industrial use-case. Could bitcoin see the same fate? Long-term holders of bitcoin are at record highs – reluctant sellers for all of the right reasons. But how can bitcoin become ubiquitous when the top 100 of owners control 15% of its value? It can’t. But it can play the role of gold in the crypto ecosystem – the standing benchmark. And that’s the top of the heap in crypto asset markets. Halving or not.