The carbon credit con band plays on...

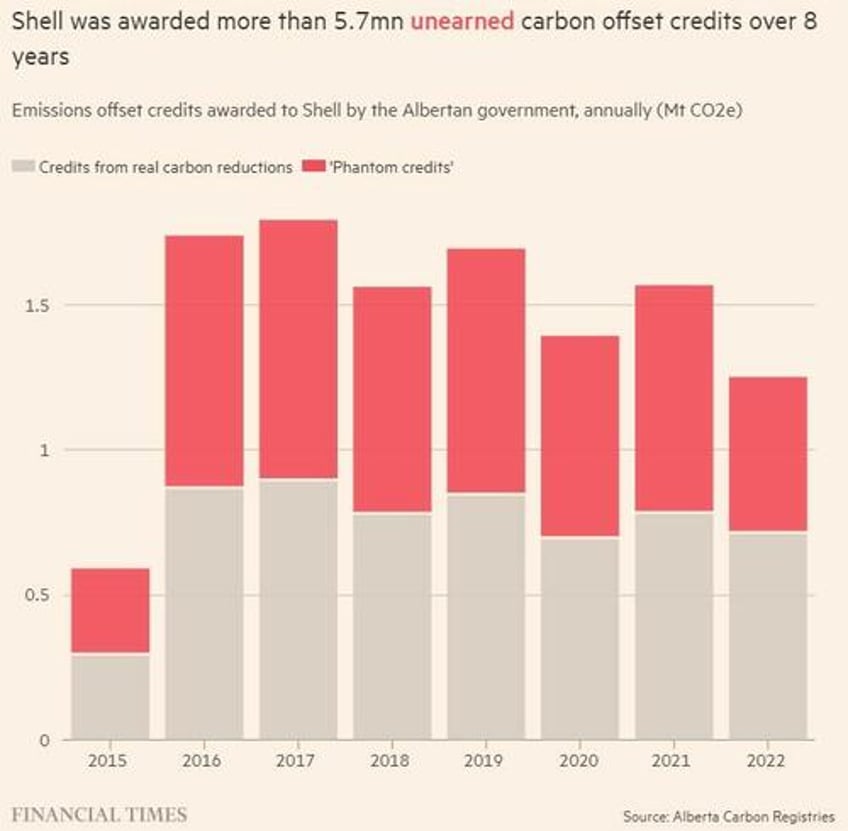

The most recent chapter in the 'green' initiative has been supermajor Shell being found to have sold 'phantom' carbon credits that were twice the volume of emissions the company actually avoided, according to FT.

Shell has reportedly sold millions of carbon credits, tied to CO₂ removal, to Canada’s main oil sands companies, despite doubts arising over the validity of the claimed emissions reductions.

Keith Stewart with Greenpeace Canada commented: “Selling emissions credits for reductions that never happened . . . literally makes climate change worse.”

Under a subsidy initiative by Alberta's provincial government to support the industry, Shell was permitted to register and sell carbon credits double the amount of emissions purportedly avoided by its Quest carbon capture facility from 2015 to 2021. However, this subsidy was phased out by 2022.

Consequently, Shell managed to register 5.7 million credits which were then sold to leading oil sands producers including Chevron, Canadian Natural Resources, ConocoPhillips, Imperial Oil, and Suncor Energy.

Alberta's environment ministry stated that the crediting support scheme did not lead to "additional emissions" by industrial polluters.

Energy firms globally, including those in Canada, are advocating for increased government backing for carbon capture and storage initiatives. Alberta, known for its vast and carbon-intensive oil resources, has seen a surge in production, hindering Canada's efforts to meet emission reduction goals.

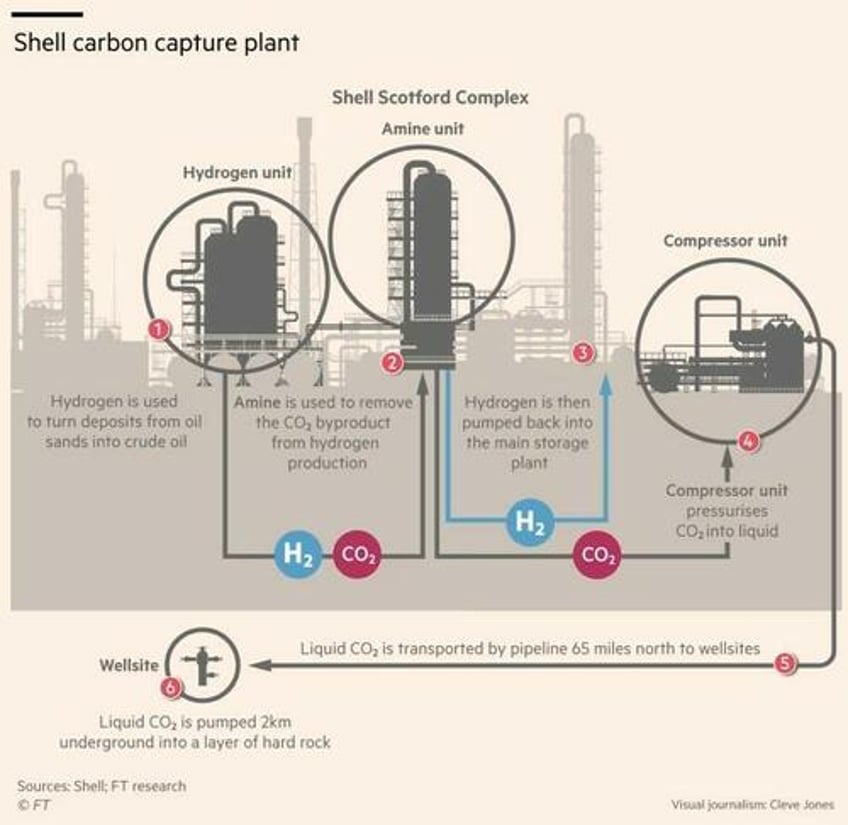

The Financial Times report noted that the Quest facility, operated by Shell Canada and co-owned by Canadian Natural Resources, Chevron, and Shell Canada, is integral to the Scotford processing and refining complex. At Quest, CO₂ is extracted during hydrogen gas production, crucial for converting bitumen from oil sands into synthetic crude oil.

Canada offers substantial incentives for CCS projects, yet the industry's profitability remains challenging. Quest's annual report revealed a total cost of $167.90 per tonne of carbon avoided in 2022, compared to Alberta's $50 carbon price for major industrial emitters.

Documents obtained by Greenpeace Canada, shared with the Financial Times, disclosed that Shell initially sought a three-for-one deal on carbon credits at Quest. Alberta introduced a two-for-one scheme in 2011, exclusively for plants operational by the end of 2015, such as Quest. The incentive decreased to three-quarters of a credit by 2022 and was eventually phased out with the rise in carbon prices.

“At the end of the day, the oil and gas sector and the oil sands firms in particular need to get going with respect to emissions reductions,” concluded Jonathan Wilkinson, Canada’s minister of energy and natural resources.