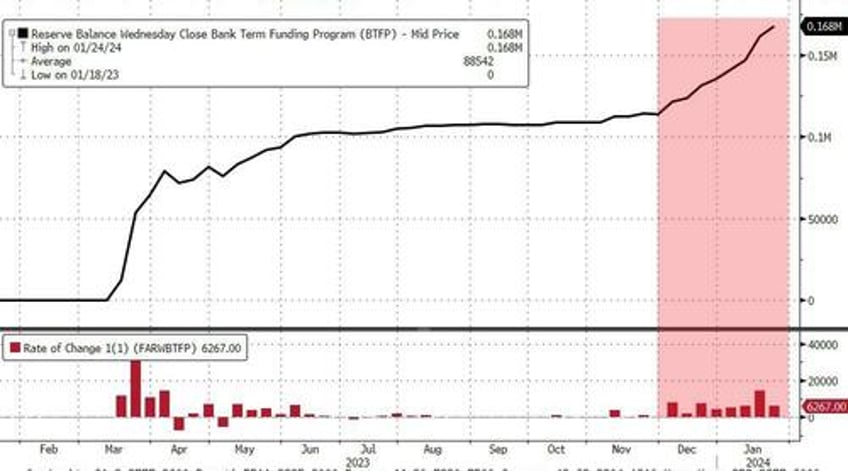

Banks usage of the Fed bailout fund as a free-money arb play ended this week with the BTFP facility ballooning to $168BN ($54BN of which could be in the 'arb')...

Source: Bloomberg

At the same time liquidity is being pulled from The Fed RRP facility (down $54BN this week), on target for the end of March as 'Zero-liquidity'-day...

Source: Bloomberg

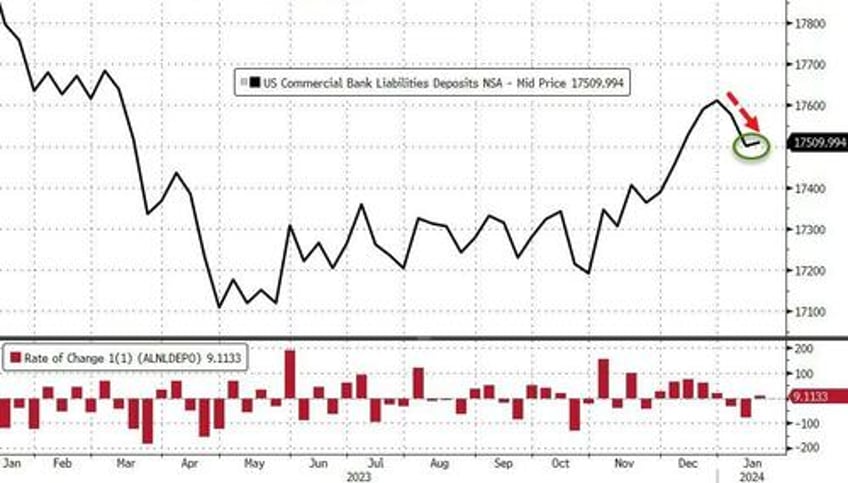

And after last week's huge domestic bank deposit outflow (NSA), all eyes are on tonight's Fed data for signals of stress.

Total bank deposits rose $51bn (on seasonally-adjusted basis) last week, pushing them to their highest since the SVB crisis...

Source: Bloomberg

On a non-seasonally-adjusted basis, total bank deposits also rose, but by just $9BN, leaving them still lower year-to-date...

Source: Bloomberg

But, and it's a big BUT...

Excluding foreign banks, Domestic banks saw a $2.4BN (NSA) deposit OUTFLOW (Large banks +$5BN NSA, Small Banks -$7.4BN NSA) - the 3rd weekly NSA outflow in a row. and here's the but - Domestic banks saw a $42BN (SA) INFLOW (Large banks +$33BN SA, Small Banks +$8.5BN SA)...

Source: Bloomberg

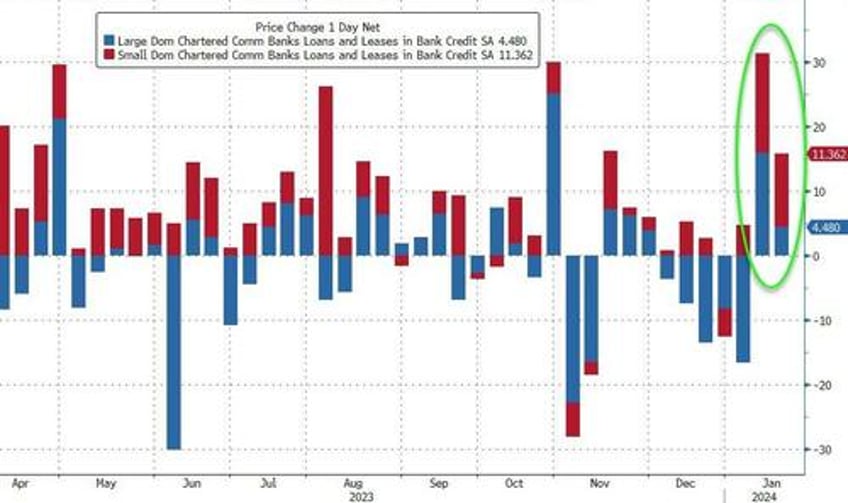

On the other side of the ledger, bank loan volumes increased for the second week in a row (Large banks +$4.5BN, Small banks +11.4BN)...

Source: Bloomberg

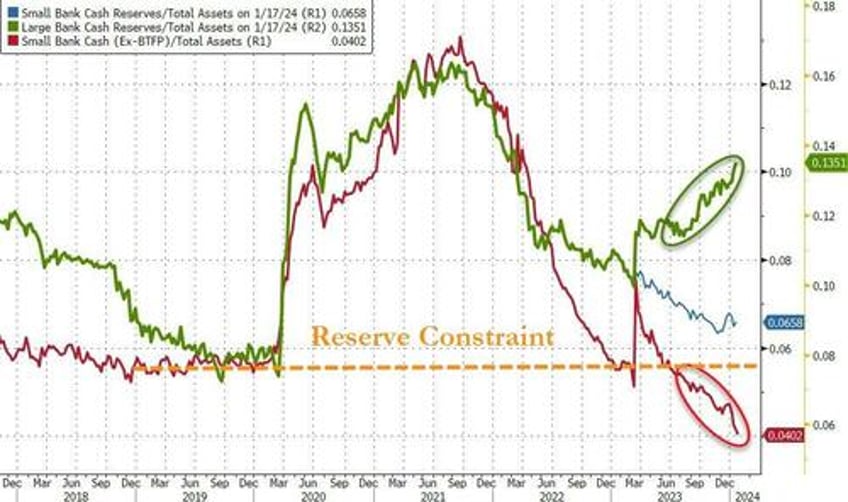

Finally, we note that without the help of The Fed's BTFP, the regional banking crisis is back bigly (red line), and large bank cash needs a home - green line - like picking up a small bank from the FDIC...

Source: Bloomberg

And now you know why The Fed will cut rates in March - no matter what jobs or inflation is doing.

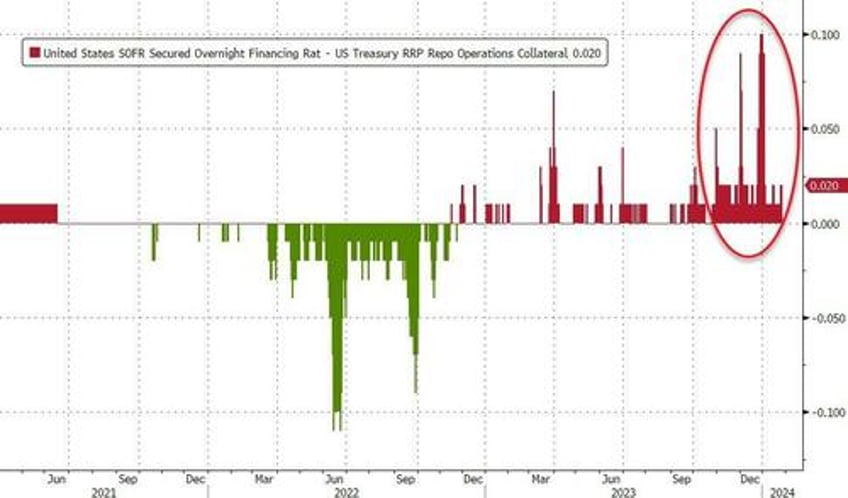

As we warned yesterday, watch the SOFR-O/N RRP Spread for signs of stress...

Key things to keep an eye on are re-increases in the RRP, indicating extra reserves are being taken back out of the system, or a rising take-up in the Fed’s standing repo facility, which would point to potential funding problems. All said and done, don’t put your spanner away yet, knowing how to plumb remains an essential skill.