Submitted by QTR's Fringe Finance

Almost daily, where I reside in Philadelphia, I jog or walk past the United States Mint and the Federal Reserve Bank of Philadelphia. Both institutions are merely a couple of blocks apart in Old City, housed in heavily guarded structures made of marble and cement that appear impervious, even to a Category 5 hurricane.

From the exterior, to the fortified loading ramps for incoming and outgoing 18-wheelers, to the police who diligently patrol on foot and passively survey sidewalk activity — everything about these buildings exudes a sense of security.

However, as tourists walk through the front doors to peruse carefully assembled exhibits explaining our monetary system, the back rooms in these buildings are busy generating pure inflation. There, PhDs in suits hand down flawed monetary policies that are, by mathematical certainty, setting our country down the wrong course.

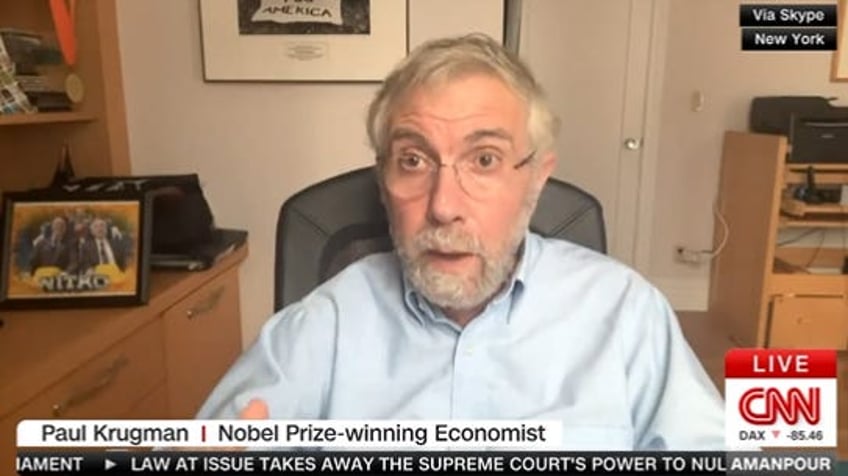

There are days, like one I experienced early this week, when I simply stand in awe of these buildings. Everything about them screams stability, and their inhabitants will passionately argue that stability is precisely their raison d'être. Yet, it's hard to ignore the facts. Income inequality is widening, and inflation is spiraling out of control, disproportionately affecting the middle and lower classes. Meanwhile, limousine-liberal economists like Paul Krugman take to the airwaves, confidently proclaiming an economic victory utilizing these institutions…for reasons they can't even clearly articulate.

“The economic data have been just surreally good. Even optimists are just stunned,” he recently said on CNN. “This is a goldilocks economy.”

He says inflation is coming down “quickly and painlessly”.

“We don’t really understand why this is happening. I can come up with multiple stories, but it’s important to point out that there’s a really profound and peculiar disconnect going on.”

You can say that again, Paul.

For a good portion of the population, this bullshit commentary cuts the mustard and this state of affairs is perfectly acceptable, as long as it doesn’t interrupt their planned weekend golf trip or doesn’t prevent their football team from kicking off on Sunday.

Many people continue to invest in their 401(k)s and have reaped benefits over the decades as the stock market ascends, seemingly defying gravity and common sense, all while leaving a trail of socio-economic casualties in its wake.

For me, the harsh reality of the situation is impossible to ignore. With more than two decades of investing experience, I've often considered my ability to anticipate market crashes or spikes in volatility as a gift. In the short term, my cautious nature usually puts me ahead of market fluctuations. Many of my followers started paying attention during the COVID-19 crisis, when I accurately predicted both the pandemic and the subsequent market crash. At that time, my pessimistic outlook was largely seen as an asset.

However, nearly two years into a rate-hiking cycle, the stock market is signaling that all is well, a notion that economically seems implausible. This has turned my once-valued caution into a liability.

For roughly the past 18 months, I've been betting on increased market volatility, a position that hasn't paid off. As I reflect on this, I can't help but question, on a broader, existential level, whether my market perspective is fundamentally flawed. It's not the unsuccessful trades that concern me; rather, it's the thought that my view of the market might be more trouble than it's worth. What has this two-decade vigil for a system collapse yielded? A few profitable moments, certainly, but nothing that has defined my career or life. And here I am again, in a situation where I believe the economic indicators are dire, yet the market steadfastly disagrees.

At what point does the daily struggle become too much? I do maintain dividend-earning and long-only portfolios that stand to benefit from the current situation, but when does it stop being worth the mental toll of feeling like I'm constantly swimming against the current?

50% OFF ALL SUBSCRIPTIONS: Subscribe and get 50% off and no price hikes for as long as you wish to be a subscriber.

Setting the trade aside, it's about outlook. On Wednesday, the Consumer Price Index (CPI) surpassed estimates—albeit slightly—but also still came in at a level nearly twice what the Fed is targeting. The stark reality is that inflation is still not under control, despite narratives about a "soft landing" or the notion that the Fed has everything in hand. Guided by the CPI, there's scant evidence to suggest the Fed will shift course anytime soon.

Even if the Fed changed their policy tomorrow, the die is cast for the economy. Credit card debt is soaring, personal savings are dwindling, mortgage rates are at two-decade highs, and the excess liquidity from the pandemic era is drying up. The current trajectory is unsustainable. Maybe the Fed will once again engineer a market bailout, sending gold prices skyrocketing. Or perhaps they'll let the market crash to combat inflation. The unpredictability of government reactions and market directions creates a volatile mix.

As certain as I am about this chaotic calculus incoming, I also know it won't be long before the government finds another way to manipulate the system. They'll scapegoat market crashes on non-sequiturs that the commonfolk will accept without question, blaming volatility on foreign leaders and bombing Syria as a result — or they’ll blame inflation on gold enthusiasts using cash instead of credit cards at gas pumps. They might even escalate their bond-buying programs or brazenly start purchasing stocks under the guise of a new way to help obese Americans burn fat—a maneuver I suspect they've been conducting covertly for years (the government buying stocks, not Americans losing weight).

Point is: when the government and the Federal Reserve set the rules, they have carte blanche to rig the game as they see fit.

This puts me in an intellectual quagmire. Why even decry a monetary policy that I find morally abhorrent and ethically dubious? Why bother challenging modern monetary theorists when so many just set their concerns on autopilot and enjoy a leisurely weekend? I question whether I'm expending too much mental energy on this, but I can't stay silent when global monetary policy defies reason.

Despite uncertainties about market volatility, the most recent CPI numbers were met with celebration, and the NASDAQ continues to perform well. If I had just invested passively, I'd be comfortably counting my gains for the year. But that's not me.

Over the last 18 months, I've often felt worn out—disheartened by my own skepticism and tired of seeing a flawed system perpetuate indefinitely. It's particularly concerning that the real consequences of this system disproportionately impact the middle and lower classes—yet this is seldom discussed or understood.

As we move towards year-end, market volatility seems unusually subdued, almost inviting disaster when least expected. Have I lost my touch in offering a reality check? Am I the one who's out of touch? These questions are louder in my head now than ever before.

I feel like Peter Gibbons from Office Space waiting to change lanes on his way to work. He thinks he’s finally found an open lane, switches, and before he knows it is waiting in an even longer line of cars watching the line he used to be in go flying by him.

The day I capitulate and declare that all is well—when it's clearly not—will be the day before chaos reigns. It makes it a lose/lose scenario for me when contemplating switching to ‘the dark side’. If I give the ‘all clear’ the day before the market wrecks 15% and I knew why and how it was going to happen all along, I’ll never forgive myself.

But swimming upstream isn’t always easy, and gets tiring after a while.

“You never need patience more than when you’re about to lose it.”

- Sign hanging at my local Korean deli, where they are notoriously slow making sandwiches.

Now read:

- 100 Sigma Events?

- Fed Rate Cuts Should Scare The Shit Out Of You

- Peter Schiff: Fed Money Magicians Running Out of Rabbits

- Joe Rogan Will Interview Donald Trump

- The Unforgivable Ivermectin Swindle

- This Popular Stock Could Be An Unexpected Land Mine

QTR’s Disclaimer: I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.