Headline CPI for Canada printed a hotter than expected 4.0% YoY in August (a huge jump from the 3.34% YoY in July)...

Source: Bloomberg

Coming on the heels of the hotter than expected US inflation data, it appears this triggered some more fear in US markets that rates will be 'higher for longer' (as we noted was evident in rate-expectations changes yesterday)...

Source: Bloomberg

This sent TSY yields screaming higher (up around 5-6bps)...

Source: Bloomberg

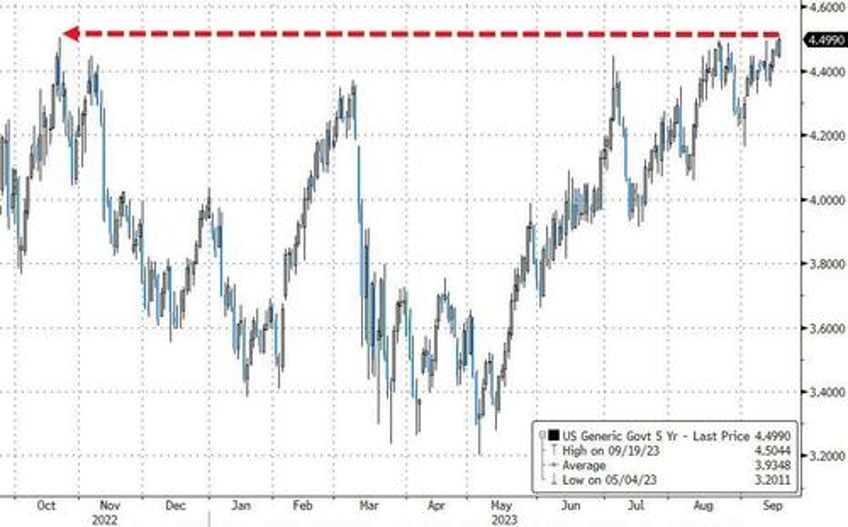

With 5Y yields breaking above the 2022 highs - back to their highest since 2007...

Source: Bloomberg

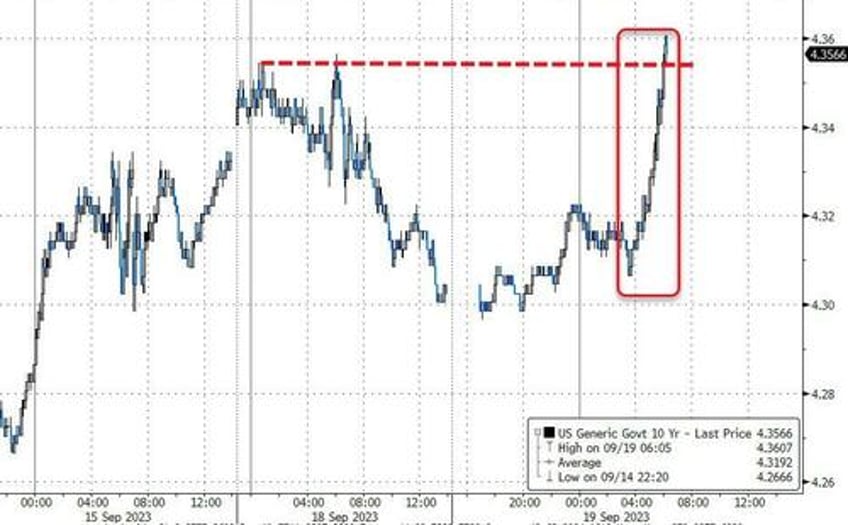

Some context for the 10Y Yield move (testing yesterday's highs)...

Source: Bloomberg

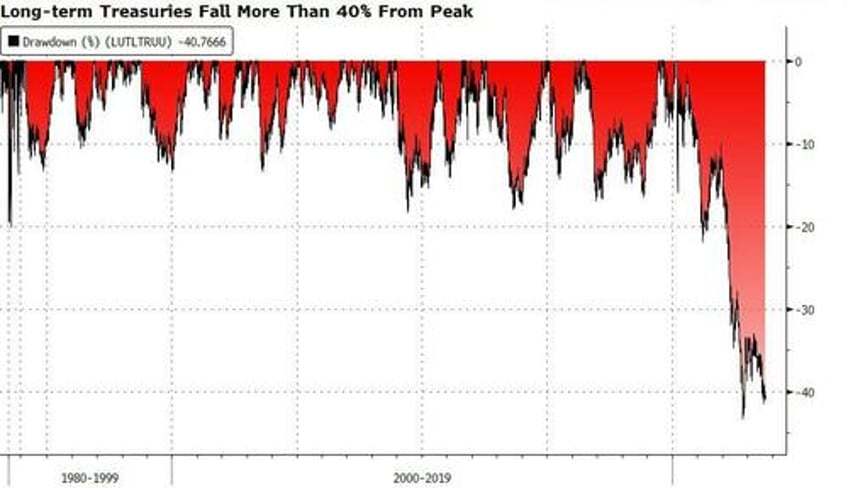

Bear in mind that Treasuries maturing in 10 or more years - which have the highest price sensitivity to changes in interest rates, or duration - have slumped 4% this year, following a record 29% plunge in 2022, according to data compiled by Bloomberg. That’s more than double losses across the broader Treasury market, the data show.

Source: Bloomberg

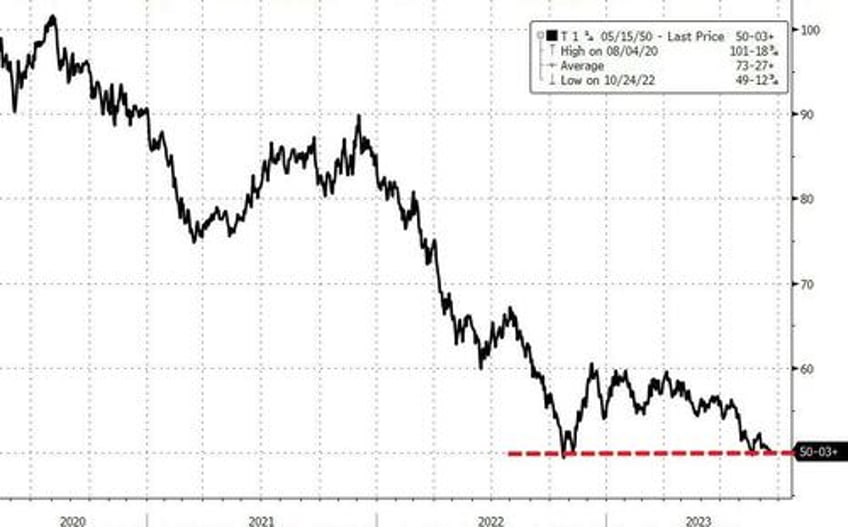

Feeling like now is the time to step in and buy? Bloomberg notes that the May 20250 TSYs are once again trading below 50c...

“Those bonds have below market coupons and investors need to get compensated for it,” said Nancy Davis, founder of Quadratic Capital Management.

The Treasury initially sold $22 billion of the 2050 securities at about 98 cents (it subsequently did two so-called reopenings, adding to the amount outstanding.)

“They have very positive convexity, and that make them very interesting bonds, although liquidity is probably very low,” said Mustafa Chowdhury, chief rates strategist at Macro Hive Ltd.

Double your (notional) money in 27 years?

And while cause and effect may be hard to discern, oil prices are exploding higher alongside bond yields with WTI above $92...

...which will drag gasoline prices higher... and CPI hotter... and so the vicious circle continues.