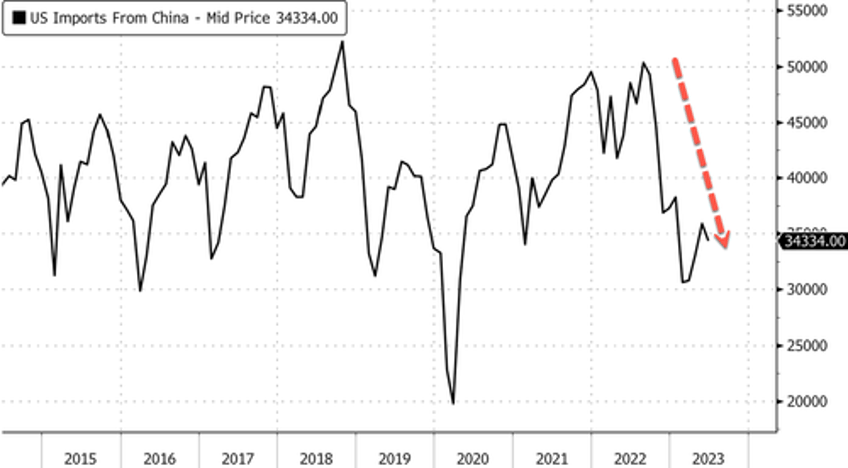

Weakening consumer demand for goods and waning inventory growth by companies have softened imports while the macroeconomic backdrop becomes more uncertain with interest rates at 22-year highs. Depressed trade flows, which appear to persist through summer, have sparked a cooldown in Southern California's warehouse market as vacancy rates for industrial real estate rise.

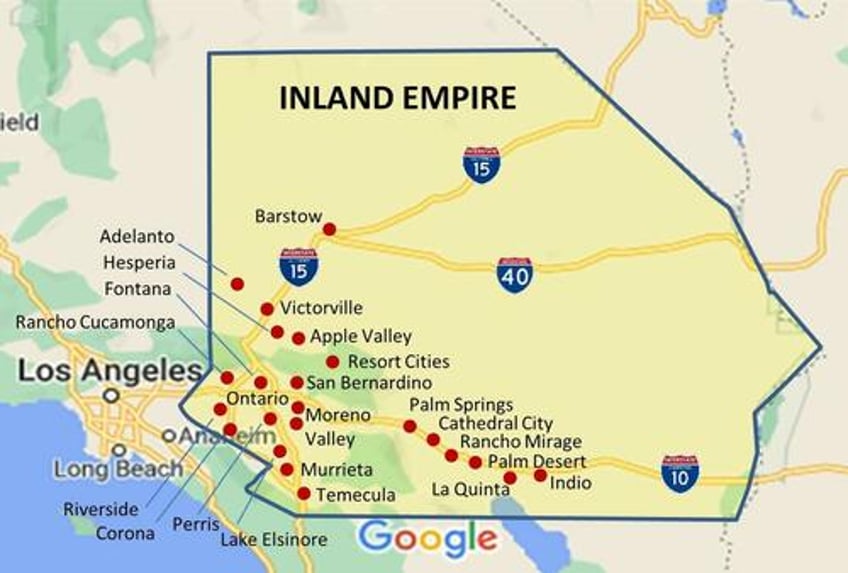

The warehouse vacancy rate in the "Inland Empire," an area with over a billion square feet of warehouses covering 40 square miles and servicing the nation's largest container ports (Los Angeles and Long Beach), topped 3.8% in the second quarter, up from 1.2% versus the same quarter last year, according to The Wall Street Journal, citing data from real-estate services firm Savills.

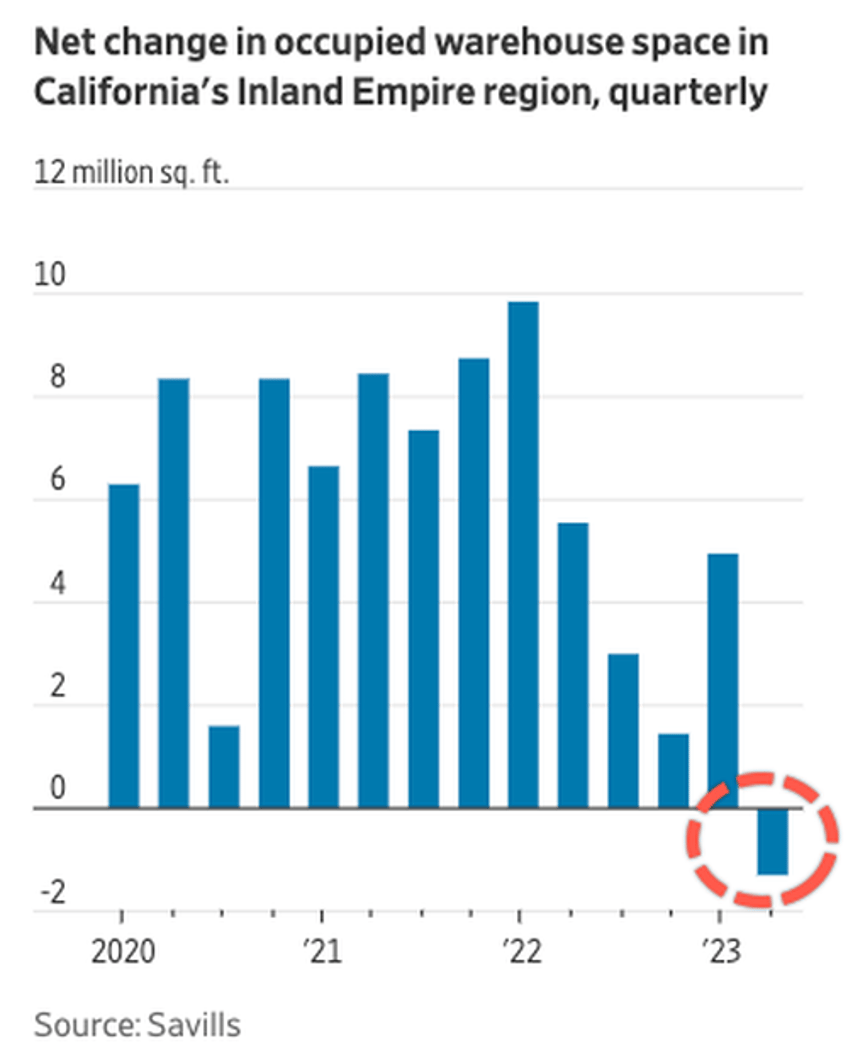

Mark Russo, head of industrial research at Savills, explained Inland Empire has some of the tightest industrial real estate markets in the US, but data now shows more warehouse space is becoming available than leased. He said this is the first time in two decades and could be an ominous sign.

"We're seeing a cooling and normalizing of demand levels in Southern California, particularly Inland Empire, at the same time that a significant amount of new supply is hitting the market," Russo said.

WSJ noted, "The uptick in warehouse vacancy in the region comes as the industrial real-estate market nationwide is cooling off after three years of feverish leasing and development driven by skyrocketing imports of goods to meet strong e-commerce demand during the pandemic."

In June, FreightWaves discussed the Bullwhip Effect Cracking US Imports' Peak Season (Again) ... and warned:

The lingering effects of the "bullwhip effect" on inventories, along with the considerable downside risks that exist to consumer spending, the upcoming months are likely to witness an unprecedented level of caution among importers during this year's peak season. This caution, combined with a weakening global macroeconomic backdrop, only heightens the risks of declining import volumes.

Also, consumers are tapped out, as we learned earlier this week (read: Consumers Finally Crack: Shocking Drop In June Credit Card Debt Marks End Of Spending Binge). So they have had to slash discretionary purchases, such as computers, televisions, and home goods.

With fewer televisions, sofas, and appliances in the pipeline, companies are no longer rushing to take in storage space and have put their leasing decisions in the region on hold, casting a cloud over industrial real-estate markets heading into what is normally the busy fall shipping season. -WSJ

Regarding trade, US imports from China are plunging... Yet another sign the consumer is tapped out.

So Russo is correct: "SoCal is the canary in the coal mine for the US industrial market to some extent."

But-but-but what about 'Bidenomics'?