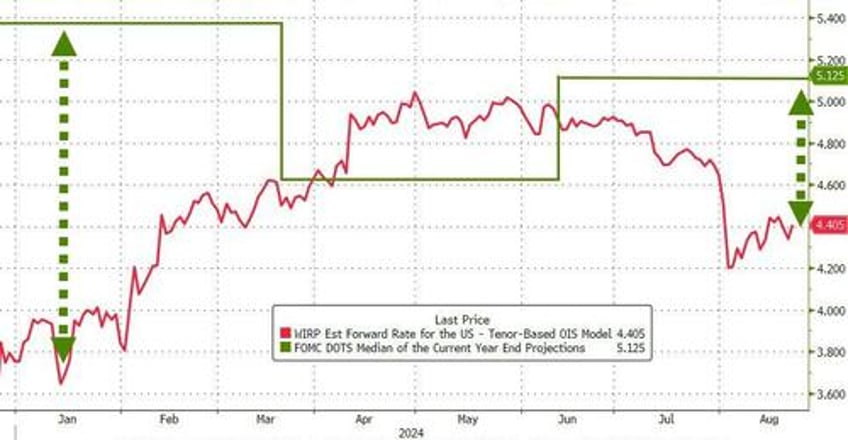

As the world and his pet-rabbit awaits tomorrow's words from Jay Powell (which is largely moot now given the FOMC Minutes), today's market action (stocks, bonds, and gold down; dollar up) was brought to you by notably less sanguine FedSpeak (walking the market back from four cut expectations) and disappointing macro data (reviving growth scares).

Continuing jobless claims hovering at multi-year highs (initial claims low), a blip higher in existing home sales (off record lows with new record high prices), a big puke in Chicago Fed's National Activity Index, a dismally weak manufacturing sentiment survey...

Source: Bloomberg

...combined with commentary from FOMC members (as reported by media) that while they believe it’s appropriate for the US central bank to begin lowering interest rates soon, the pace of subsequent cutting should be “gradual” and “methodical.”

Boston Fed President Susan Collins said she’s not seeing any “big red flags” in the economy.

That’s the context in which I do see it soon being appropriate to begin easing policy,” she added.

“I think a slow, methodical approach down is the right way to go,” Philadelphia Fed President Patrick Harker says about the pace of interest-rate cuts.

“For me, barring any surprise in the data we’ll get between now and then, I think we need to start this process,” Harker says in a Reuters interview published Thursday, referring to the central bank’s upcoming September policy meeting.

...both of which suggest the path to lower rates may be a more gradual one than some in the markets may have been hoping for...

Source: Bloomberg

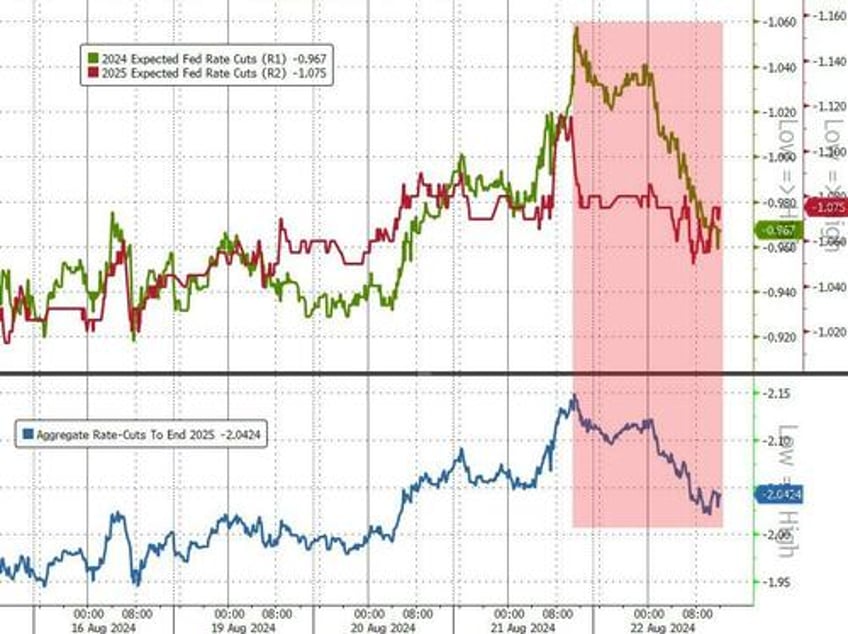

And sure enough, rate-cut expectations fell today (but remain considerably elevated still)...

Source: Bloomberg

The decline in 'dovishness' removed some of the Fed Put hype sent stocks lower today - most notably led by Nasdaq (as the selling started right as the US cash session opened). The Dow was the prettiest horse in the glue factory today (but all the majors were notably lower as tomorrow's Jackson Hole speech looms)...

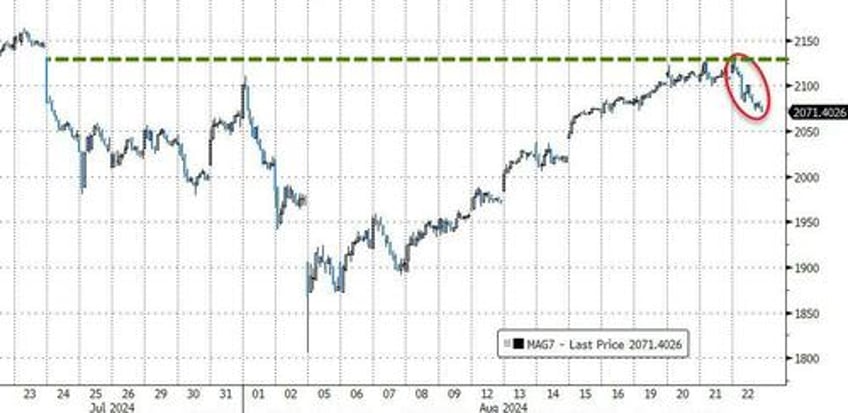

After two days of treading water at key resistance, Mag7 stocks tumbled today (the first down day since Aug 5th)...

Source: Bloomberg

For context, Nasdaq rallied up to its pre-plunge levels and has stalled...

VIX rallied up to 18 today but more notably '0-DTE VIX' exploded higher ahead of tomorrow's event risk at J-Hole...

Source: Bloomberg

Treasury yields were all higher today (+6-8bps across the curve), lifting the whole curve back above pre-CPI yield lows from last week. The 2Y yield is back up to 4.00%.

Source: Bloomberg

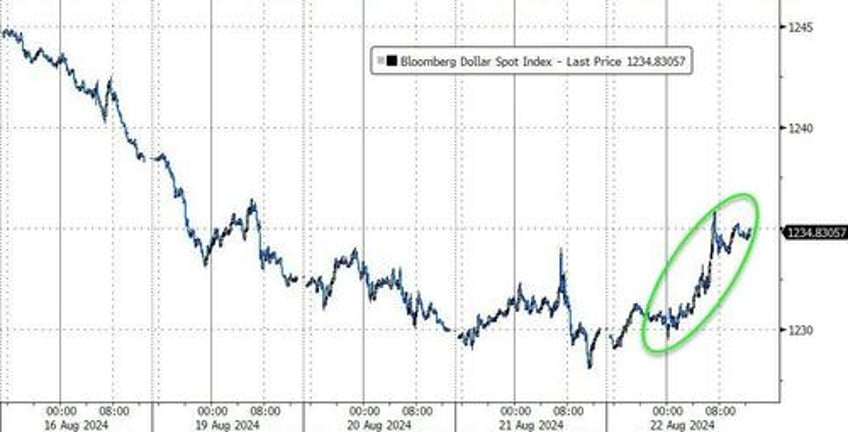

The dollar rebounded on the less than dovish talk...

Source: Bloomberg

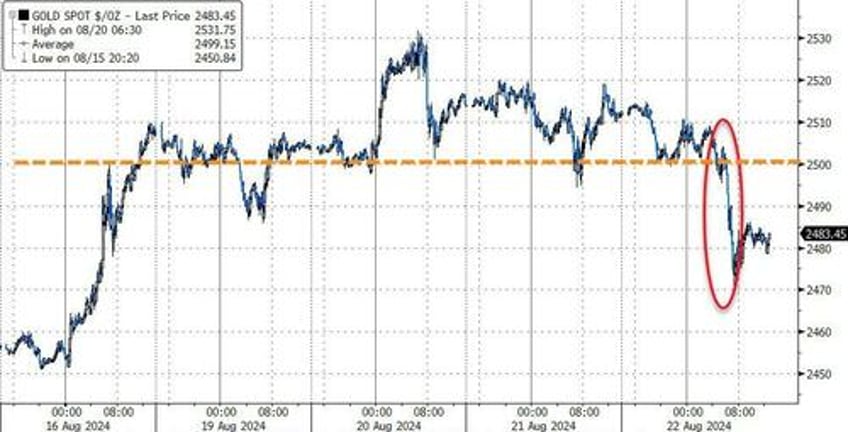

...and that sent gold prices back below $2500...

Source: Bloomberg

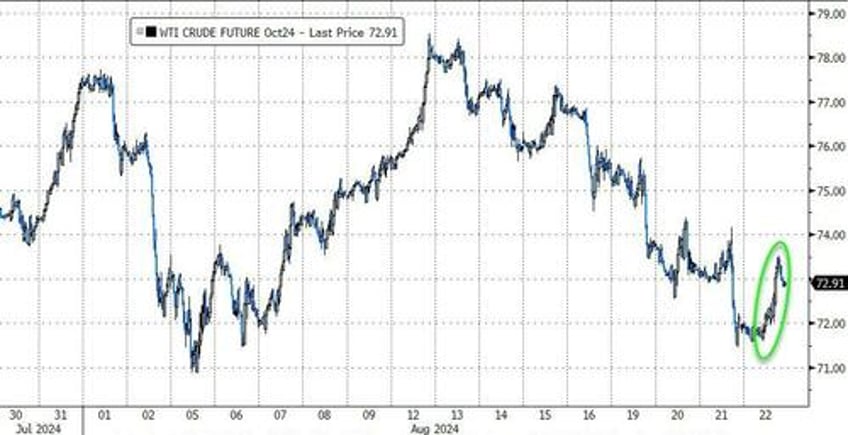

Oil prices rebounded off early August lows today with WTI back to a $73 handle...

Source: Bloomberg

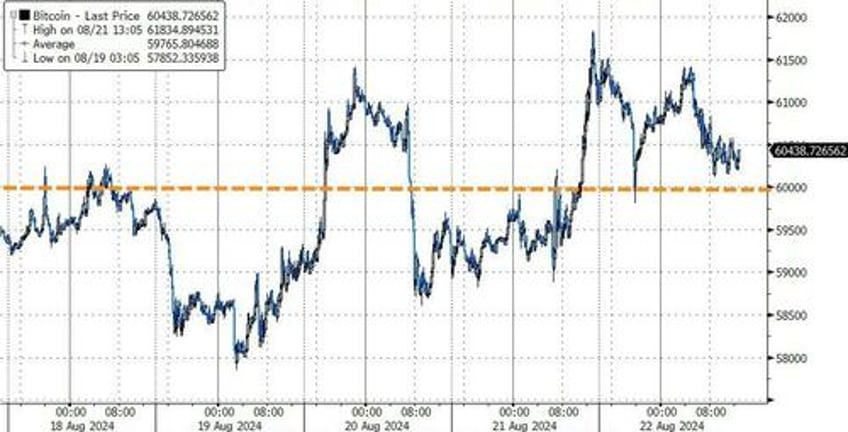

Bitcoin faded from yesterday's highs near $62,000, but held above the $60,000 Maginot Line for now...

Source: Bloomberg

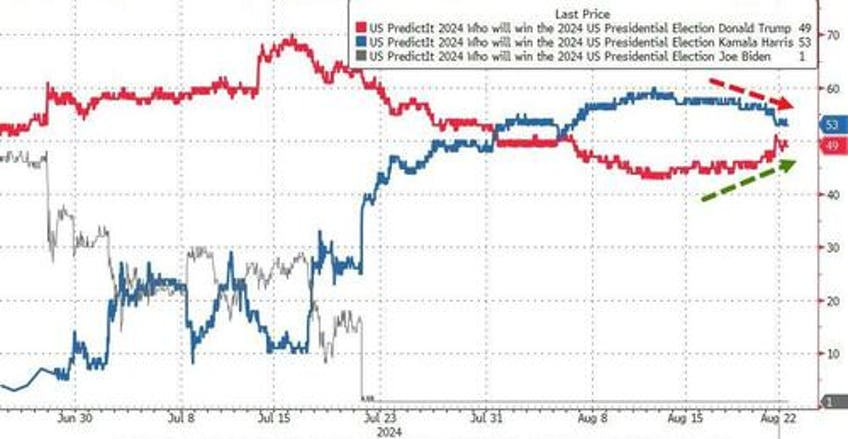

Finally, Kamala's honeymoon is fading as PredictIt shows the gap over Trump is now at its lowest since Aug 5th...

Source: Bloomberg

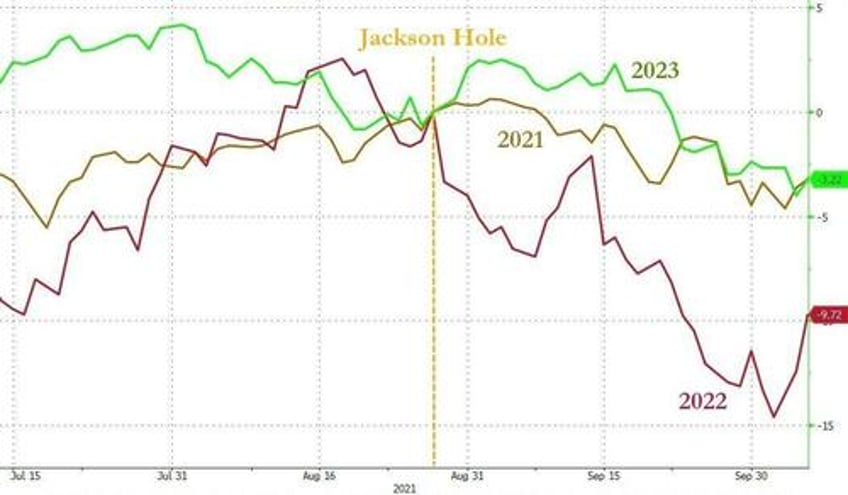

And one more thing... a reminder that the last few years has seen buying into J-Hole and a 'sell the news' event after...

Source: Bloomberg

...did that start today?