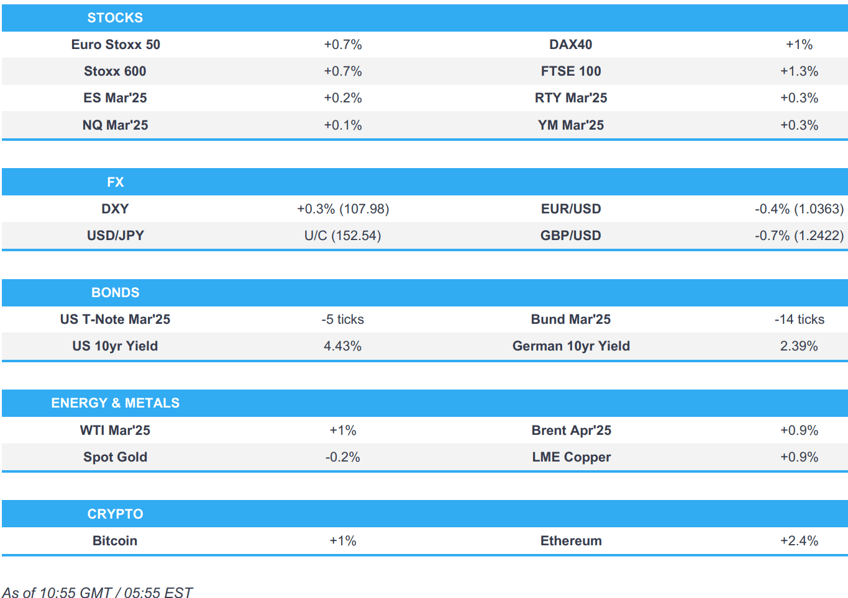

- European bourses at highs; US futures edge higher ahead of a slew of earnings.

- USD attempts to recoup lost ground, EUR/USD back below 1.04, GBP awaits BoE.

- Bonds in the red but off lows via a strong French auction & stagflationary UK data amid reports of a UK Cabinet reshuffle.

- Metals trade mixed amid the Dollar but crude holds an upward bias.

- Looking ahead, US Jobless Claims, BoE, CNB & Banxico Policy Announcements, BoE DMP, Speakers including BoE Governor Bailey, Fed’s Waller, Daly, Jefferson & BoC's Macklem, Earnings from Eli Lilly, Roblox, Amazon & Affirm.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

TARIFF/TRADE

- China initiated a WTO dispute complaint regarding US tariffs, while Hong Kong is also considering a WTO complaint related to Trump tariffs, according to SCMP.

EUROPEAN TRADE

EQUITIES

- European bourses (Stoxx 600 +0.7%) began the session modestly firmer across the board, and continued to climb higher as the morning progressed.

- European sectors hold a strong positive bias, with only a couple of industries in the red with losses minimal. Basic Resources is the clear outperformer in Europe today; Anglo American (+4%) after its Q4 Production Update. Healthcare is lifted by post-earning strength in AstraZeneca (+4.9%).

- US equity futures are modestly firmer (ES +0.2%) across the board, continuing to build on the prior day’s gains. Ahead, US Jobless Claims, Challenger Job Cuts and a slew of Fed speakers are due.

- China's Commerce Ministry, when asked about PVH Crop (PVH) and Illumina (ILMN) on the unreliable entity list, said it will take corresponding measures against the firms according to the law.

- Honeywell (HON) is preparing to split into three independent companies, according to the WSJ citing sources

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

EARNINGS

- Arm Holdings (ARM) -3.5%: Beat, Q4 guidance aligned with forecasts defying anticipation of a stronger guide.

- Ford (F) -4.7%: Q4 beat, 2025 guide cautious.

- Qualcomm (QCOM) -5.1%: Q1 beat, attention on slowing smartphone demand.

- ArcelorMittal (MT NA) +5.7%: Q3 soft Y/Y, expects higher demand in FY25 Y/Y.

- AstraZeneca (AZN LN) +5.3%: Q4 Beat.

- Hannover Re (HNR1 GY) -1.2%: FY mixed, confirms guidance.

- ING (INGA NA) -2.5%: Q4 mixed, NII beat.

- Maersk (MAERSKB DC) +8.5%: Q4 & FY24 beat.

- Pernod Ricard (RI FP) +2.6%: H1 miss, cuts FY guidance given China and US challenges.

- Siemens Healthineers (SHL GY) +5.9%: Q1 beat, affirms guidance.

- SocGen (GLE FP) +9.4%: Q4 beat, EUR 872mln buyback.

- Volvo Car (VOLCARB SS) -8.7%: Q4 Revenue beat, expects a continued weak market in 2025.

- Linde PLC (LIN) Q4 2024 (USD): adj. EPS 3.97 (exp. 3.93), Revenue 8.3bln (exp. 8.4bln)

FX

- DXY is firmer vs. all peers after a run of three negative sessions for the DXY, spurred on by greater optimism on the trade front, which brought US yields lower. Today sees the release of weekly claims figures and remarks from Fed's Waller, Daly and Jefferson. DXY holds around the 108 handle with a session high at 108.05.

- EUR/USD has made its way back onto a 1.03 handle after venturing as high as 1.0442 yesterday. ECB's Cipollone highlighted that US tariffs on China could force the dumping of goods in Europe, weighing on growth and inflation. 1.0357 is the current session low with not much in the way of support until the 1.03 mark.

- JPY is on the backfoot vs. the USD but to a lesser extent than peers on account of hawkish comments from BoJ hawk Tamura overnight who put forward his view that the Bank needs to raise rates to at least around 1% in the latter half of fiscal 2025. USD/JPY went as low as 151.82 overnight (lowest since 12th Dec) but has since returned to a 152 handle.

- GBP is softer vs. the USD and to a lesser extent the EUR in the run-up to today's BoE policy announcement. Expectations are for a 25bps rate cut via an 8-1 vote split. Attention will be on any tweaks to forward guidance and how macro projections in the accompanying MPR indicate how loose/tight the MPC views current policy. Cable has made its way back onto a 1.24 handle and back below its 50DMA at 1.2498.

- Antipodeans are both on the backfoot vs. the USD in quiet newsflow as a run of three consecutive sessions of gains comes to a halt.

- PBoC set USD/CNY mid-point at 7.1691 vs exp. 7.2535 (prev. 7.1693).

- Reuters Poll: Short bets on the KRW, MYR & THB at lowest since October 31st, bearish bets on INR at highest since mid-July 2022.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are in the red, weighed on overnight in tandem with JGBs on hawkish commentary from BoJ’s Tamura (hawk) who stated they must raise rates to at least around 1% in the latter half of FY25. More broadly, the benchmark is trimming some of the upside seen on Wednesday with yields picking back up after their pullback. Thus far, USTs down to a 109-16 base vs Wednesday’s 109-29 peak; if the move extends, support factors at 109-02 before the figure and then 108-25+. US Jobless Claims, Challenger Layoffs and a few Fed speakers due.

- Bunds are in the red and spent much of the morning towards the 133.14 session low. Pressure which comes as the complex unwinds some of the pullback in yields that was a feature of yesterday’s session for global benchmarks. Aside from Construction PMIs, docket has been light; currently trading around 133.41 vs peak at 133.53.

- Gilt downside in-fitting with peers, but to a much lesser extent as we count down to the BoE, Newsquawk preview available. A poor set of data and general lifting in the fixed income complex has brought Gilts just into the green. Gilts were pulled off lows by a particularly dire UK Construction PMI for January. A release which saw Gilts jump from 93.55 to 93.70 and thereafter to a 93.84 peak, which then continued to make a session high at 93.93. Thereafter, it was reported that PM Starmer is said to be considering removing Chancellor Reeves and replacing her with current Home Secretary Cooper.

- On Wednesday, PM Bayrou survived (as expected) the two censure motions against him which means the 2025 Budget has now passed the National Assembly. However, there are still numerous hurdles to parts of the budget ahead. The passing was well received with the OAT-Bund 10yr yield spread dipping below 70bps yesterday evening and again this morning. However, OATs thereafter found themselves the modest EGB underperformer with the spread widening back to near 73bps ahead of chunky supply, which was well received and sparked an EGB rally with the spread narrowing back to 70bps.

- Spain sells EUR 6.19bln vs exp. EUR 5.5-6.5bln 2.40% 2028, 3.10% 2031, 4.00% 2054 Bono & EUR 0.57bln EUR 0.25-0.75bln 1.15% 2036 I/L.

- France sells EUR 13bln vs exp. EUR 11-13bln 3.20% 2035, 1.25% 2036, 1.25% 2038, and 3.25% 2055 OAT Auction.

- Click for a detailed summary

COMMODITIES

- Modest upside in crude benchmark after the sell-off yesterday. Action this morning wasn't dictated by any fresh macro headlines, although crude experienced a few upticks and broke out of overnight ranges in the first half of the European session as volumes picked up. Brent Apr resides in a USD 74.60-74.98/bbl parameter.

- Soft trade across precious metals amid a more constructive risk tone but also alongside a surging dollar. Spot gold resides in a USD 2,848.97-2,873.34/oz range.

- Mixed trade across base metals despite the firmer Dollar but amid the mostly constructive risk sentiment across the broader market. 3M LME copper resides in a USD 9,267.85-9,356.00/t.

- Qatar sets March marine crude OSP at Oman/Dubai + USD 2.9/bbl; land crude OSP at Oman/Dubai + USD 2.75/bbl

- Citi lifts its 2025 average forecast for Gold to USD 2900/oz (prev. 2800/oz); 0-3month target upgraded to USD 3000/oz, 6-12 target maintained at USD 3000/oz.

- Oil and gas traders likely to seek waivers from China over tariffs that Chinese govt plans to impose on US crude and LNG, according to Reuters sources.

- Japan is reportedly seeking exemptions from steel import tariff being considered by India, according to Reuters sources, citing Chinese overcapacity.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK S&P Global Construction PMI (Jan) 48.1 vs. Exp. 53.4 (Prev. 53.3)

- EU Retail Sales YY (Dec) 1.9% vs. Exp. 1.9% (Prev. 1.2%, Rev. 1.6%); Retail Sales MM (Dec) -0.2% vs. Exp. -0.1% (Prev. 0.1%, Rev. 0.0%)

- EU HCOB Construction PMI (Jan) 45.4 (Prev. 42.9)

- Italian HCOB Construction PMI (Jan) 50.9 (Prev. 51.2)

- French HCOB Construction PMI (Jan) 44.5 (Prev. 42.6)

- German HCOB Construction PMI (Jan) 42.5 (Prev. 37.8)

- German Industrial Orders MM (Dec) 6.9% vs. Exp. 2.0% (Prev. -5.4%)

- Swedish CPIF Ex Energy Flash YY (Jan) 2.7% vs. Exp. 2.10% (Prev. 2.00%); CPIF Flash YY (Jan) 2.2% vs. Exp. 1.60% (Prev. 1.50%)

NOTABLE EUROPEAN HEADLINES

- UK PM Starmer wants to "axe Rachel Reeves in bombshell reshuffle", according to Express. "In a shock move, the Prime Minister is considering moving Home Secretary Yvette Cooper to the Treasury to boost the country’s economic fortunes". "Insiders say an 'active process is going on' as Sir Keir considers how and when to execute a reshuffle, which is most likely to happen in the Spring".

- ECB's Cipollone says there is still room for adj. rates downward. US tariffs on China could force the dumping of goods in Europe, weighing on growth and inflation. Soft landing remains the main scenario, no recession seen.

- UK Citi/YouGov inflation survey: 12-month ahead 3.5% (prev. 3.7%), 5-10 years ahead 3.7% (prev. 3.9%)

NOTABLE US HEADLINES

- US lawmakers are reportedly pushing to ban Chinese AI start-up's DeepSeek app from US government devices over security concerns, according to WSJ sources.

- US President Trump's USTR nominee Greer says US needs an active and pragmatic trade policy to foster growth; resilient supply chains are critical; US needs robust manufacturing base.

- Fed's Jefferson (voter) said they need to look at the totality of the net effect of the Trump administration's influence on policy goals and he is happy to keep policy at the current level of restrictiveness until there is a better sense of the totality of impacts. Jefferson also stated that even with a 100bps decline, the Fed's rate is still restrictive, which allows the Fed to be patient and wait to see the net effect of policy changes.

- US Fed released 2025 stress test scenarios which include heightened stress in commercial and residential real estate, as well as corporate debt markets.

- US Treasury Secretary Bessent said the Trump administration wants to make the 2017 tax cut permanent, while he added that Trump wants lower interest rates and is focused on the 10-year treasury yield. Furthermore, he said Trump is not calling for the Fed to lower interest rates and interest rates will take care of themselves if they get energy costs down and deregulate economy.

GEOPOLITICS

MIDDLE EAST

- Israeli occupation forces stormed Balata refugee camp east of Nablus in the West Bank, according to Al Jazeera.

- Israeli PM Netanyahu questioned what was wrong with the idea of allowing Gazans to leave, while he added that the idea should be pursued and done.

OTHER

- US Defense Secretary Hegseth held a call with Panama's President Mulino and they agreed to expand cooperation between the US military and Panama's security forces. It was separately reported that the State Department announced that US government vessels can now transit the Panama Canal without charge fees although the Panama Canal Authority later said it has not made any changes to charge fees.

CRYPTO

- Bitcoin is a little firmer and holds just shy of USD 98k; Ethereum also gains and back above USD 2.8k.

APAC TRADE

- APAC stocks followed suit to the gains on Wall St where sentiment was underpinned amid a softer yield environment and the lack of trade war escalation.

- ASX 200 outperformed with the index led higher by strength in financials, consumer discretionary and gold-related stocks.

- Nikkei 225 advanced at the open and reclaimed the 39,000 level but then briefly pared the majority of the gains owing to yen strength and comments from hawkish BoJ board member Tamura.

- Hang Seng and Shanghai Comp conformed to the constructive mood in the region amid a lack of major escalation on the trade front with the US Postal Services flip-flopping on suspending parcels from Hong Kong and China, while China initiated a WTO dispute complaint regarding US tariffs although this was as previously announced.

- SK Innovation (096770 KS) - Expects about KRW 6tln in capex this year, adds a delay in EV market demand growth recovery is expected in the short term due to the Trump administration and automakers recalibrating their electrification business.

NOTABLE ASIA-PAC HEADLINES

- BoJ Board Member Tamura said they need to raise rates in a gradual and timely manner and that a 0.75% rate would still be negative in real terms, while he added the BoJ must raise rates to levels deemed neutral on a nominal basis which is at least around 1% and must raise rates to at least around 1% in the latter half of fiscal 2025. Tamura said he personally does not think BoJ's past massive monetary easing had a positive effect as a whole given its strong side effects and they must scrutinise whether prolonged monetary easing could cause problems such as excessive yen falls and housing price spikes. Furthermore, he said the BoJ shouldn't persist in achieving 2% inflation as long as Japan is experiencing moderate price rises, as well as commented that he has no preset idea about the pace of interest rate hikes and the pace of interest rate hikes may not necessarily be once every half year.

DATA RECAP

- Australian Balance on Goods (AUD)(Dec) 5.1B vs. Exp. 7.0B (Prev. 7.1B)

- Australian Goods/Services Exports (Dec) 1.10% (Prev. 4.80%); Imports (Dec) 5.90% (Prev. 1.70%)