By Michael Msika, Bloomberg Markets Live reporter and analyst

Markets are showing signs of consolidation after a powerful four-month rally on both sides of the Atlantic. Stretched positioning means a breather may be in order, but major reasons to sell are still absent.

Investors have been increasing their exposure to stocks, yet market breadth looks ok, with a still-narrow rally leaving scope for equity gains to broaden out. While the Stoxx 600 is hovering near overbought levels, only about 15% of individual members are actually overbought.

According to Goldman Sachs, this narrow breadth isn’t a worry when looking at history, as the rest of the market tends to catch up with the handful of stocks that have led the rally. Yet, it could trigger some episodes of volatility.

“Investors sometimes worry that this may pave the way to a market drawdown, but it does not always,” say Goldman strategists including Lilia Peytavin. Twelve-month aggregate equity returns are positive in 71% of instances following narrow rallies, with an average return of about 8%. Still, “when there is a drawdown, it tends to be deeper.”

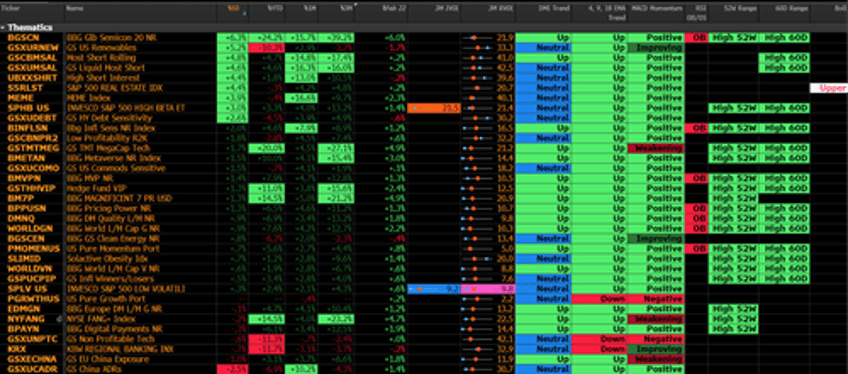

Looking at our thematics dashboard, there’s been a bit of rotation away from the hedge fund crowded trades and the Magnificent 7 recently, and toward higher risk themes like most shorted, debt sensitivity and high beta. The overall picture is of high upward momentum with more overbought flags appearing.

Things are looking a bit more stretched in futures, with Citi quant strategist Chris Montagu saying investors have a “complete disinterest in taking a bearish view.” Futures positioning reflects markets “that are both extended and turning increasingly one-sided,” he says, adding that bullish positioning in Nasdaq futures is near the highest in three years, while high levels of profit on Euro Stoxx 50 and DAX long positions creates an elevated risk of profit taking.

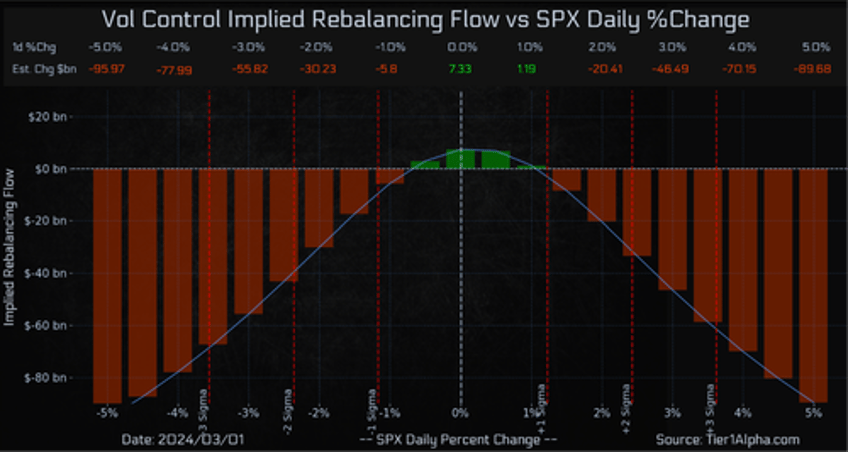

For Deutsche Bank strategists, equity positioning is “well above average but not yet extreme.” Gains are supported by strong data and rising economic forecasts, while big buyback announcements are spurring demand for stocks, they say. Meanwhile, volatility control funds have continued to increase exposure to equities, something that Tier1Alpha strategists say has been a tailwind.

“Vol control funds added an additional $7 billion in buying requirements to their books last Friday, bringing the two-day total to just over $30 billion,” the strategists say, noting this has created an upward bias in a low volatility regime. They expect favorable conditions to remain in place for at least the first half of this week as vol control funds catch up on their residual rebalancing. After that, there may be some modest selling before fresh inflows around the middle of March.

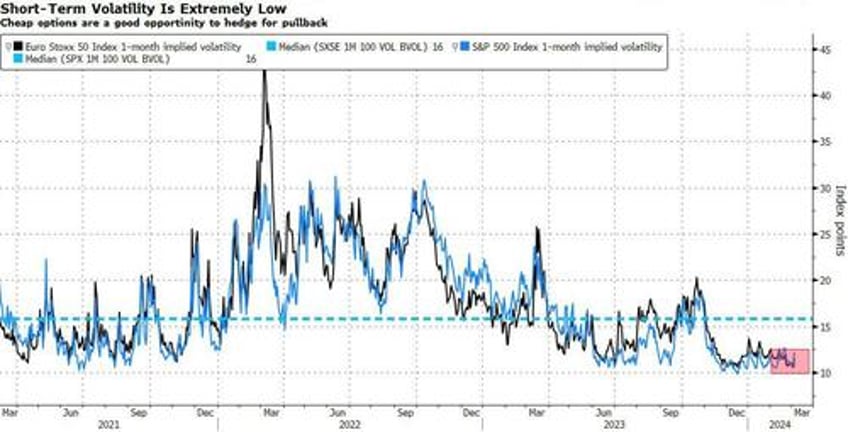

While there’s no panic out there, risks of a short-term pullback have increased, so thinking about hedging may not be a bad idea, especially as volatility continues to be sold in both the US and Europe. What’s more is that hedging opportunities look attractive, both on a short and longer-term basis.

“One-month ATM volatility on both the Stoxx 600 and the S&P 500 is low vs. the past 5-year history, providing cheap hedges in case of a reversal,” according to Goldman strategist Cecilia Mariotti. Meanwhile, Bank of America strategists recommend that investors “lock in long-term lows in US and EU equity volatility where derivatives most underprice markets’ ability to drift.”