After its 250% rally over the past 21 trading days, Super Micro (SMCI) is... umm... red!

It's been up 18 of those 21 days with the biggest daily decline being 0.6%, so this is notable. SMCI is back below $900 (from $1080 highs)

And it's 0-DTE options traders that are suddenly reversing. They started by aggressively selling calls and are now piling into puts...

It appears we were right this morning...

just one left... and it's about to snap pic.twitter.com/W8Yyqhx04g

— zerohedge (@zerohedge) February 16, 2024

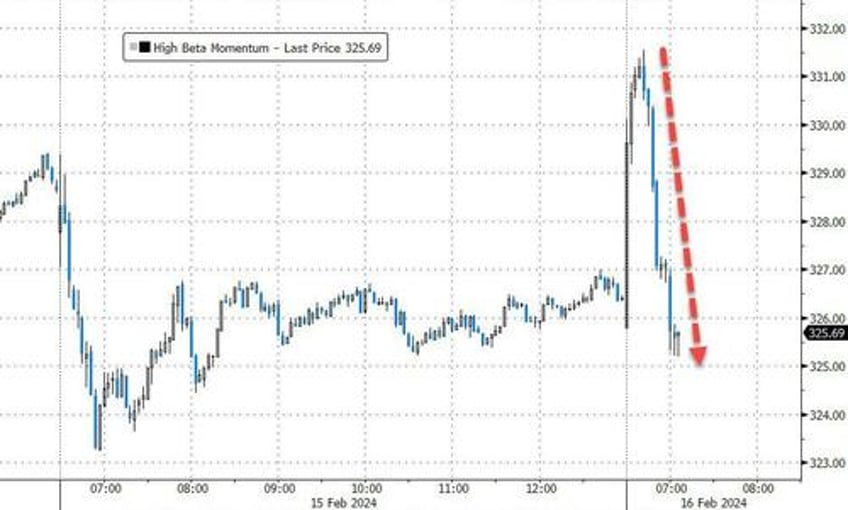

As high beta momentum is fading fast...

All of which, pro subs were warned about here, as today's $2.4 trillion OpEx means 90% of dealer gamma evaporates and the market can 'unclench'.