The commercial real estate sector continues to experience elevated stress (see the state of the industry in charts). The latest crack to emerge is the increasing number of delinquencies on multifamily mortgages.

In April, about 8.6% of commercial real estate loans bundled into collateralized loan obligations were distressed, reaching the record high set in January, according to Bloomberg, citing new data from analytics firm CRED iQ.

The loans bundled into CRE CLOs were merged with funds from individual investors to acquire multifamily housing during the Covid era. After that, borrowing rates surged, catching many off guard. A significant portion of the deteriorating loans had floating-rate interest rates, putting massive pressure on landlords' cash flows, diminishing the market worth of the properties, and obliterating equity in a large number of investments.

According to data provider Trepp, $78.5 billion of CRE CLO loans are outstanding. This means many CRE CLO issuers are racing to find ways to prevent a tsunami of bad loans from defaulting or risk losing the fees they collect on the securities.

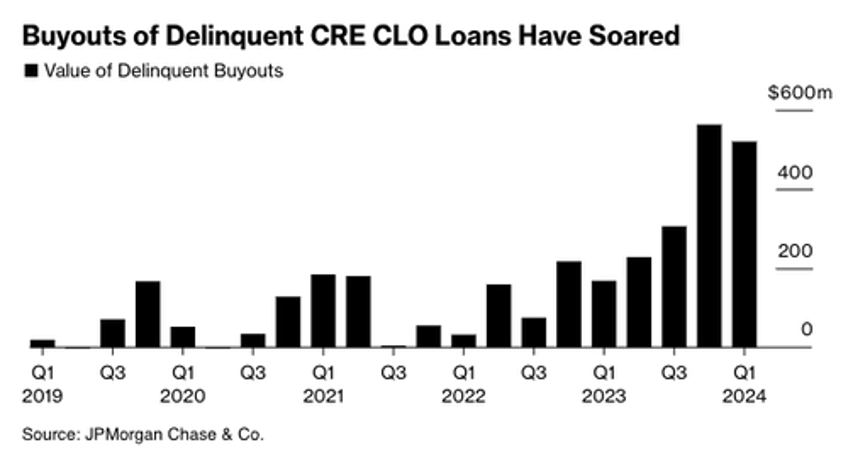

Recent estimates from JPMorgan show lenders purchased $520 million of delinquent loans in the first quarter of this year. Lenders have been ramping up the number of buyouts over the last four quarters because of mounting bad loans in a period of elevated rates.

JPMorgan strategist Chong Sin said he's surprised by lenders' ability to obtain warehouse lines to purchase bad debt, given tightening credit conditions.

"The reason these managers are engaged in buyouts is to limit delinquencies," Sin said, adding, "The wild card here is, how long will financing costs remain low enough for them to do that?"

Anuj Jain, an analyst at Barclays Plc, expects buyouts to continue as distress increases across the CRE CLO space.

"If the outlook for the Fed shifts materially to hikes or no rate cuts for a while, that might lead to a sharp increase in delinquencies, which can stifle issuers' ability to buy out loans," Jain said.

Bloomberg explains much of the CLO space derives from multifamily bridge loans originated around 2021-2022:

CRE CLO issuance surged to $45 billion in 2021, a 137% increase from two years earlier, when buyers of apartment blocks sought to profit from the wave of workers moving to the Sun Belt from big cities. Three-year loans would give them time to complete upgrades and refinance, the thinking went.

Fast forward to today and the debt underpinning many of the bonds is coming due for repayment at a time when there's less appetite for real estate lending, insurance costs have skyrocketed and monetary policy remains tight. Hedges against borrowing cost increases are also expiring and cost significantly more to purchase now.

Those blows helped increase multifamily assets classed as distressed to almost $10 billion at the end of March, a 33% rise since the end of September, according to data compiled by MSCI Real Assets.

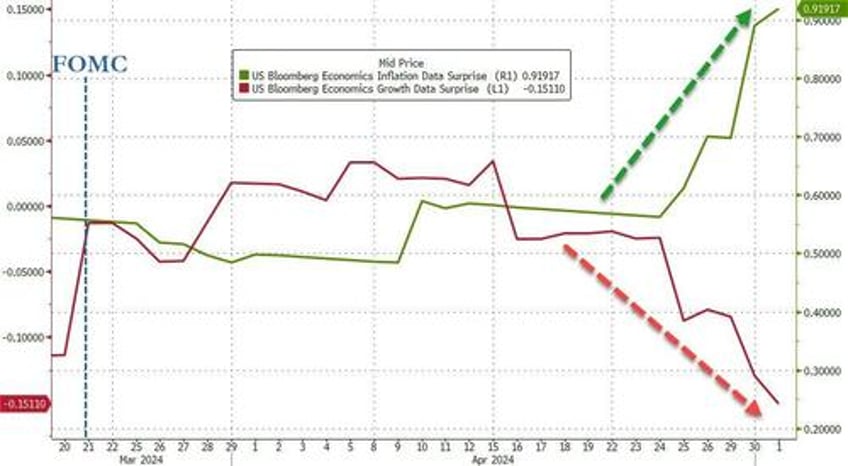

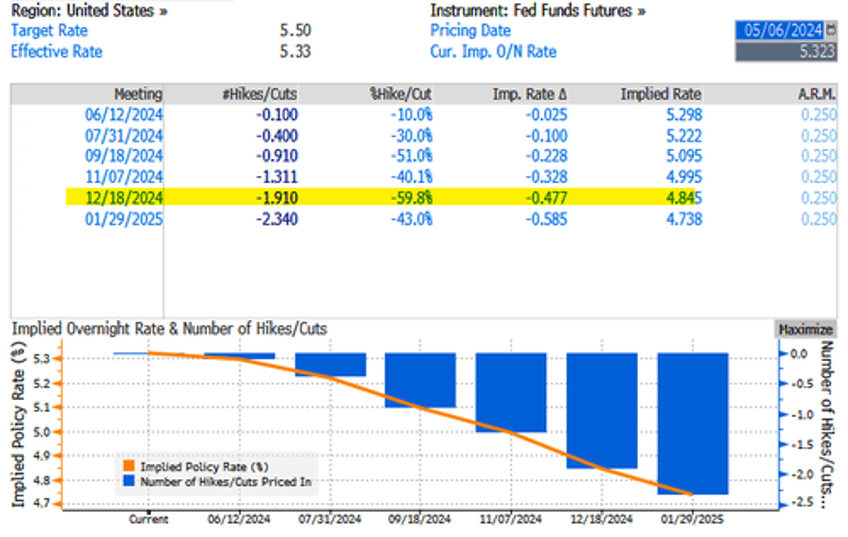

Last Wednesday, the Fed left interest rates unchanged at around 550bps as inflation data reaccelerates and economic growth tilts to the downside, stoking stagflation fears.

Fed swaps are pricing in just under two cuts - this is down from nearly seven earlier this year and about 1.14 before last week's FOMC.

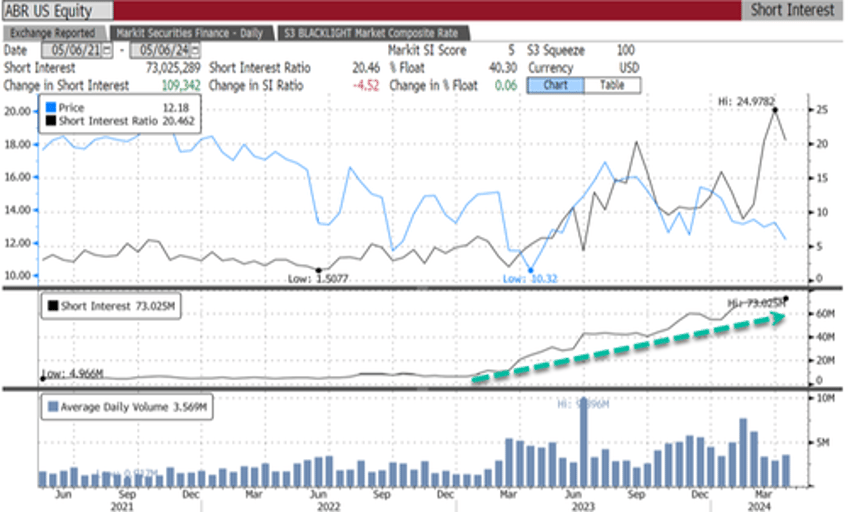

Meanwhile, bears are piling in on CRE CLO issuer Arbor Realty Trust Inc., with 40.3% of the float short, equivalent to 73 million shares short.

"The multifamily CRE CLO market was not prepared for rate volatility," said Fraser Perring, the founder of Viceroy Research, which has placed bear bets against Arbor, adding, "The result is significant distress."

The longer the Fed delays rate cuts, the worse the CRE mess will get.