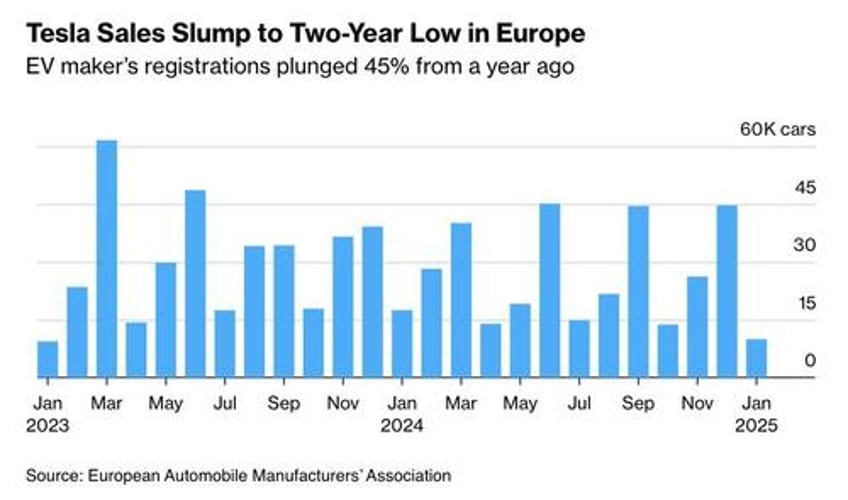

Tesla Inc.’s European sales plummeted 45% in January, with just 9,945 registrations, down from 18,161 a year ago, according to the European Automobile Manufacturers’ Association and Bloomberg.

At the same time, overall EV sales surged 37%, with rival carmakers making strong gains in Germany and the UK.

In the UK, Tesla trailed China’s BYD for the first time, with sales falling nearly 8% in a market that grew 42%.

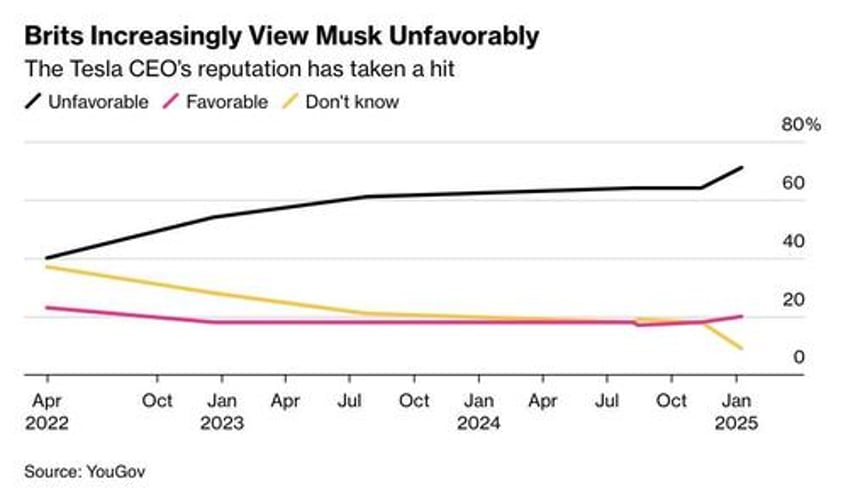

Tesla is overhauling production lines for its top-selling Model Y SUV while its CEO, Elon Musk, grows more politically divisive.

The Bloomberg report says that a YouGov poll in mid-January found Musk viewed unfavorably in Germany and the UK, where his political involvement was largely unwelcome. On Jan. 9, he hosted Alternative for Germany leader Alice Weidel on his platform X, backing the anti-immigration, pro-Russian party, which finished second in this week’s election.

After backing Donald Trump in the U.S. election cycle, Musk has turned to Europe, supporting far-right parties and criticizing incumbents. He has also joined Trump in attacking Ukraine’s President Zelenskiy, despite polls showing continued domestic support for the leader.

At an AfD rally in January, Musk urged Germans to embrace their culture and downplay historical guilt, a remark that sparked controversy ahead of the 80th anniversary of Auschwitz’s liberation. He also called for UK Prime Minister Keir Starmer’s imprisonment while advocating for jailed far-right activists.

Meanwhile, Tesla likely faced inventory shortages after an end-of-year sales push, compounded by Model Y assembly line changes. CFO Vaibhav Taneja warned that redesigning Tesla’s best-selling model would cause weeks of lost production.

Competition in Europe is intensifying, with Volkswagen, Stellantis, and Renault under mounting pressure to sell more EVs. Stricter EU emissions targets and the UK’s ramp-up to zero-emission sales by 2035 add to the challenge.

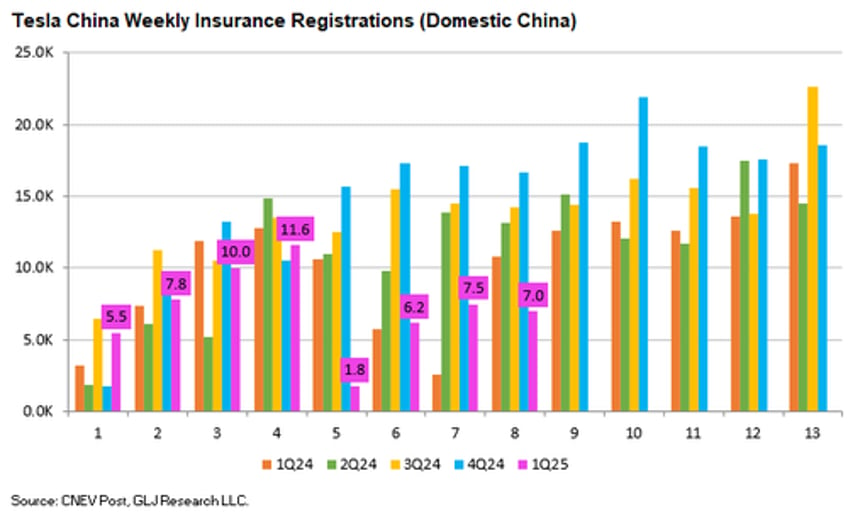

Gordon Johnson of GLJ Research said in a note out Tuesday morning that Q1 is "shaping up as an absolute disaster of a delivery quarter".

Johnson argues that Tesla's stock is poised to be one of the best short opportunities in 2025, citing a combination of business struggles and a lack of external factors that could artificially support the stock price. He believes Tesla faces a challenging year because it must finally deliver on promises related to its Full Self-Driving (FSD) technology and Optimus robot without any political or financial lifelines to prop up investor sentiment.

Johnson is particularly skeptical of Tesla's driverless technology, predicting that its rollout in June 2025 will either be a failure or face significant delays due to fundamental flaws in its camera-only approach. He insists that without LiDAR and radar, Tesla's system remains highly error-prone. Additionally, he criticizes the Optimus robot, arguing that it lags behind industry standards and is inferior even to robotics technology developed decades ago.

More importantly, he points to the deterioration of Tesla's core automotive business, which accounted for nearly 90% of its revenue in the fourth quarter of 2024, as a sign of deeper troubles. He asserts that Tesla's brand is losing its appeal globally, with many consumers viewing its vehicles negatively.