I am focused on crypto and potential risk to stocks from further crypto declines.

A decent percentage of inflows into Bitcoin ETFs has occurred since the election and they are all underwater (see chart).

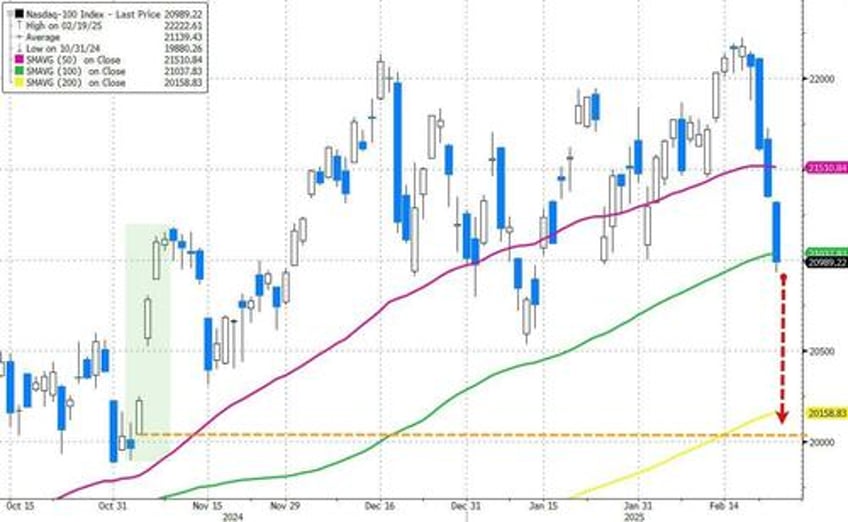

This is important because not only are the ETFs now linking stocks more closely to crypto, MSTR is in the Nasdaq 100 (only 0.4% weighting but in there).

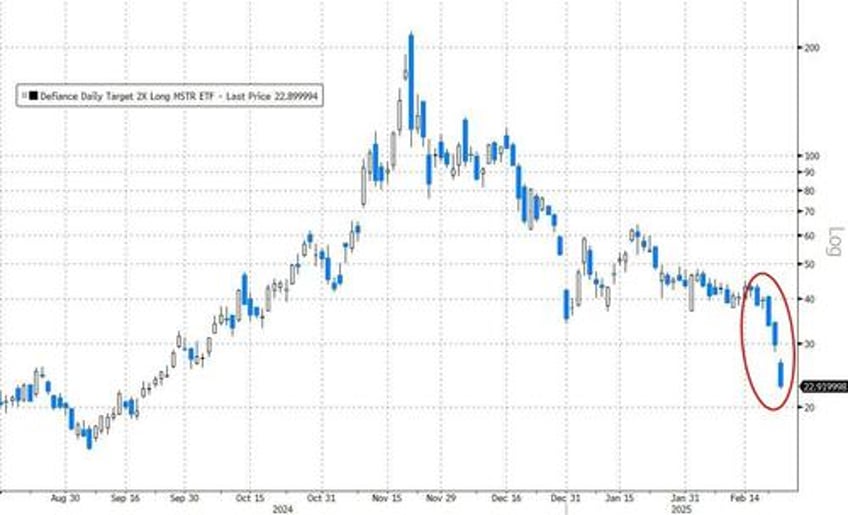

MSTX is a double leveraged ETF on MSTR (representing almost 3% of the float).

The single stock leveraged ETFs are not a product I understand the need for, but it can be dangerous on a big move to the downside.

MSTR trades at a significant premium to its value in Bitcoin.

I think the crypto world is more tied to equities than at any previous time and that is increasingly scary...

Between the ETFs and MSTR, we are seeing a lot more correlation and impact on daily trading.

We will see what the market cap for the two big stable coins USDT and USDC look like.

They added over $40 billion since the election, which should have helped at the front of the yield curve.

I think, like many other things, and as mentioned in this weekend's T-Report – All Roads Lead to Mar-a-Lago, the Nasdaq 100 gets back to pre-election levels.

Finally, the "Mexico and Canada tariffs are still on" message from the president yesterday seemed odd and brings up my big concern of "re-trading" - making me more convinced that wherever we wind up in the end (and a lot of rosy scenarios are still in play), there is going to be a hiccup.

Extra finally, the rate move is concerning because it is now much more about de-risking and fears about the economy, than cuts to boost an otherwise ok economy.

I now regret being bearish on treasuries, and think we might need to see 3 to 4 cuts this year, rather than the 2 priced in so far.

Working on more specifics, but the Citi Econ Surprise index tells a good enough (or bad enough) story for now!