From "How to Listen When Markets Speak", the latest book by veteran Lehman Brothers trader and creator of the Bear Traps report Larry McDonald, available now for sale at Amazon and all other book sellers.

"The Crude Necessity"

Excerpted from Chapter 5, "Fossil Fuels Paving the Way to the Green Meadow"

“If Trudeau was here, I’d tell him this coffee is made of oil,” Rafi Tahmazian commented wryly as he poured a cup for each of us. I was sitting with Tahmazian, one of the world’s finest energy asset managers, in his office in Calgary in November 2021. “Machines to grow it and harvest it, vehicles to transport it, more machines to pack it, electricity to roast and grind the beans, heat to boil the water,” he continued. “It doesn’t happen with pixie dust, old pal. It happens with crude oil.”

I could hear emails chiming into his inbox as he spoke. He runs the investment division at Canoe Financial, a $2 billion management firm focused on oil, mining, and natural gas. He wasn’t political in his views, but he’d firmly maintained a single belief for many years: “The entire planet is run by crude oil. Everything we touch. Everything we consume. It’s nothing to do with politics. It’s pragmatism. And this war on the supply side of oil is the dumbest thing I’ve ever seen.”

The COVID-19 pandemic changed the oil sector, perhaps for a decade. In 2020, demand dried up like a drop of water on a hot copper pan. The oil markets crashed, sending West Texas Intermediate oil to $0 a barrel. Companies right across the industry switched off their wells, turned off their equipment, and sent their employees home to collect unemployment checks. Even the highways emptied, and Manhattan on a Saturday night didn’t have a car horn within earshot. The Gen Zers and millennials were convinced that the energy future was not in the dirty oil patch anymore, that it would be different somehow, free of carbon emissions in a new electrified world, and the gas-guzzling cars of the last hundred years would be towed, finally, to the junkyard of history. But this was a terrible misjudgment.

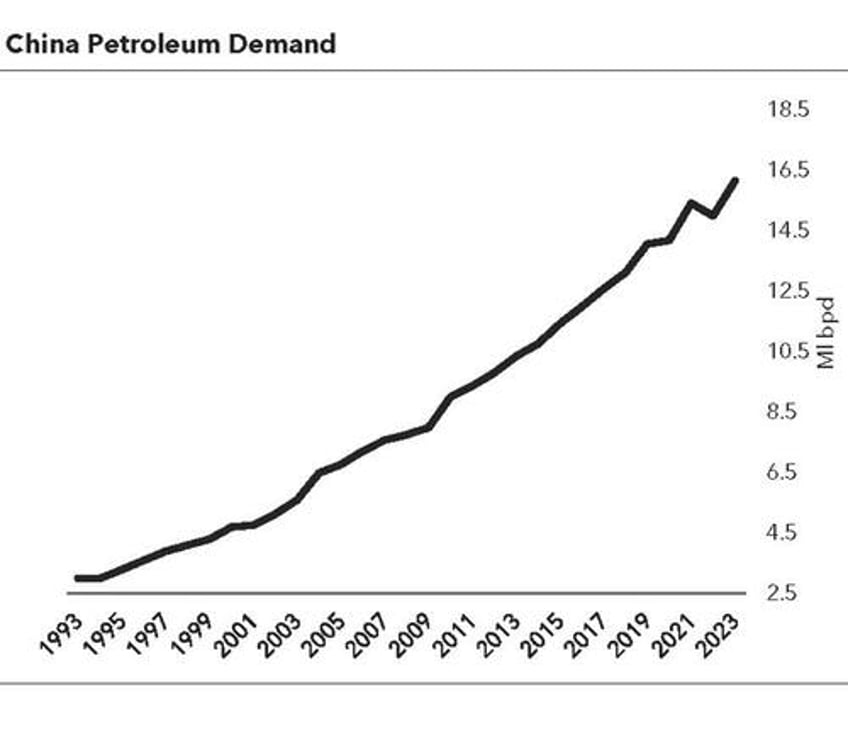

When the world reopened in 2021 after the COVID lockdowns, OPEC imposed a firm limit on supply, while U.S. production was slow to recover. Rhetoric about “killing shale” dominated Democratic Party debates in 2020, too, which scared a lot of participants away from the space, especially after Biden won the election. Why invest in a kill zone? Unsurprisingly, oil prices climbed higher and higher. Demand quickly outstripped supply, and inflation started to roll through markets as fleets of airlines turned on their massive kerosene- powered turbofans, diesel cruise ships for three thousand people cast off their lines, and highways steadily reloaded with gasoline-powered cars, buses, and trucks. And this was occurring not just in America but all over the world.

Tahmazian had been around energy investments all his life, and he was born to trade the energy booms and busts. As we spoke, he leaned in intently: “Larry, think of India. Energy use has doubled there since 2000, and it’s going to grow at three times the global average because they’re urbanizing so fast. That’s going to mean a colossal surge in air-conditioning demand from 2021 to 2031. So we are in a climate crisis, and 1.4 billion people make up the fastest-growing swath of energy demand on planet Earth. That’s three to four times faster than the U.S., UK, Germany, and the rest of the developed world. Of the roughly 320 million households in India, fewer than 22 million have air-conditioning units right now.”

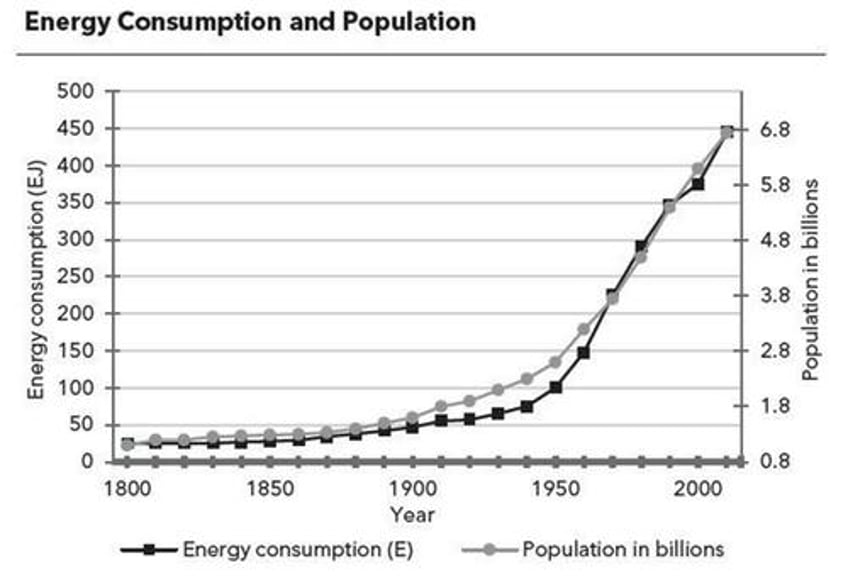

As I traveled back home to New York, I couldn’t stop thinking about the supply of energy in the foreseeable future or, rather, the lack of it. With the global population on an upward trajectory, planet Earth will have an unstoppable demand for energy in the coming years. Meanwhile, supply growth is under arrest. Western politicians are driving hard for alternative energies and run the other way if someone suggests a continuation of drilling, fracking, and mining. This has left a gaping chasm between the amount of energy and critical resources needed to continue raising our global standard of living and the amount on tap—a chasm that will only widen in the coming decades.

By my estimate, $2.4 trillion was cut from the fossil fuels and metals capex between 2014 and 2020. Over the same period, the global population grew by 800 million. Today, we might need $3 trillion in additional capital expenditure just to play catch-up. In other words, there have not been nearly enough good old-fashioned investments in coal, oil, gas, uranium, and metals exploration and production, especially in North America.

But aren’t we well on our way towards knocking out oil with wind farms, solar panels, and hydroelectric power? I largely support the push to adopt green energy, but we’re about twenty years too early. Knocking out oil with green energy right now is a mathematical impossibility, especially since some of the most populated countries in the world (such as India, China, and Russia) have no intention of being bound by Western emission standards. If governments really wanted to replace oil as a source of energy on planet Earth, it would currently take a wind farm a little bigger than France, 134 million acres of land. A solar field to replace oil would need to be the size of Spain, at 120 million acres, not to mention that it would need to experience at least 70 percent sunshine for eight hours a day, every day, every year. Now think about the amount of plastic that would be used, the fiberglass, the steel shafts and turbines, the endless maintenance, the millions of batteries and cabling. It simply cannot be done without bankrupting the planet. Maybe one day, over the course of many decades, but not today. Right now the top priority should be keeping the lights on, and keeping the gargantuan global economy rumbling forward in a responsible, low-inflationary fashion.

But an increase in oil supply doesn’t just happen with a snap of the fingers. First, there are multiyear regulatory loopholes to jump through. Then governments need to incentivize the companies to do it, instead of slapping windfall taxes on them. Next, the exploration phase has to be carried out, finding the most oil-rich patches of land to drill. That’s an expensive game. Phase four is moving the equipment, a multimillion-dollar problem. Then comes the hiring of qualified people, and then the drilling, infrastructure, transportation, and logistics. It will take about seven to ten years to flood the market once again with oil and gas after the ESG drive eventually fails. And it will.

With the global population growing, energy demand surging, and supply growth under arrest, I believe higher energy and metals prices will be sustained for the next decade. From the COVID lows to the end of 2022, as inflation raged higher, the Energy Select Sector SPDR ETF (XLE) was up 325 percent, the Sprott Uranium Miners ETF (URNM) was up 318 percent, the Global X Copper Miners ETF (COPX) was up 260 percent, and the SPDR S&P Metals and Mining ETF (XME) was up 260 percent. The oil stocks are still in the early innings, and I predict that in the next few years billions of dollars will flow into these companies.

Juicing Inflation

Energy prices are the root cause of inflation, when you get right down to it. Think of every drop of gasoline and energy used in something simple like our Calgary cup of coffee. Add high oil prices to that, and suddenly that $4 cup of coffee at Starbucks costs $6.

But there’s a second layer to the relationship between energy and inflation. Not only will higher energy costs drive other costs up along with it, but it will make inflation harder to fight. If inflation normalizes in this cycle at 3 to 4 percent instead of 1 to 2 percent as in previous decades, trillions of dollars are misallocated across the investment asset ecosystem, as most portfolios are still massively overweight growth stocks.

Usually, during a time of recession, the prices of energy and oil drop dramatically due to lower demand, which acts as a major deflationary force. But going forward, the price of energy will likely stay relatively high even during recessions. Through chronic underinvestment in the oil and gas industries, the United States and Canada handed over valuable market share to the Saudis, the Russians, and OPEC, giving them way more control over the global price of oil. In a multipolar world, these not-so-friendly players can now coordinate supply cuts during recessions to keep the price high.

If the U.S. had eight thousand drilled but uncompleted wells (DUCs), we could just ramp up production and steal market share back from them. But we don’t. DUCs are at a ten-year low, and this dynamic sets us up for a longer-term battle with higher and stickier inflation. We saw this during the minor energy crisis in 2022, and it is going to be the norm in the years ahead.

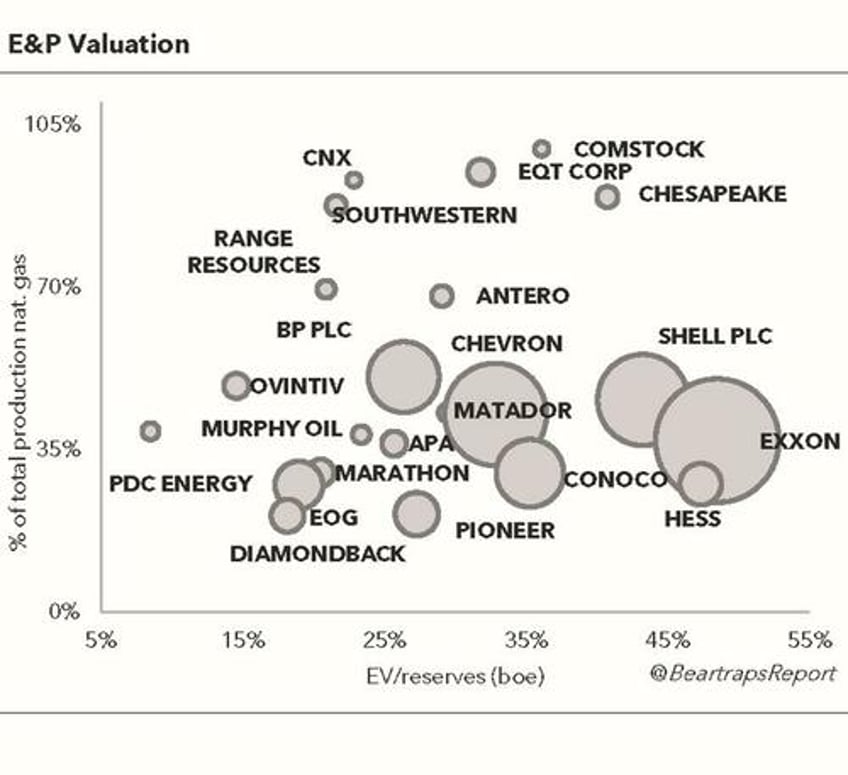

With the endless issues hanging over the global energy markets, you might be asking how an investor can capitalize on this knowledge. And my advice is simple: Get long oil. The energy ETFs XLE and XOP are great places to start, along with Chevron, Shell, and ExxonMobil. In particular, Exxon is interesting because of its massive new reserves in Guyana, right on the northeastern tip of South America. The company has an operating office in Guyana’s capital, Georgetown, with numerous ongoing exploration and development operations offshore. At its Stabroek oil field, in operation since May 2015, it has made significant discoveries, and the company expects production capacity to reach 1.2 million barrels per day in 2027, up from 375,000 barrels in 2022. This implies that in four years Guyana will represent approximately 25 percent of Exxon’s worldwide production.

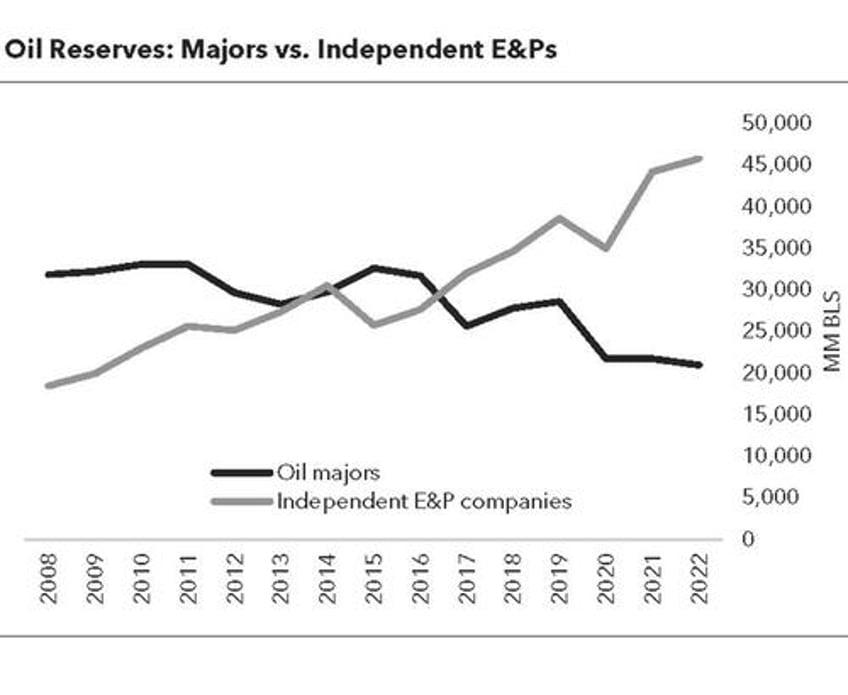

This chart also highlights several smaller oil and gas producers with an attractive valuation and the potential to be acquired by one of the oil majors.

One way to value a company in the energy sector is to compare its enterprise value (the sum of its debt and its market capitalization) with the value of the oil and gas reserves it has in the ground. This comparison measures what the value of the company is per “barrel of oil equivalent,” which is the oil and the natural gas converted into barrels of oil. The lower a company’s enterprise value is compared with the reserves it has in the ground, the cheaper the company’s valuation is. PDC Energy, for example, is very cheap. Chevron thought so, too: It made an offer for the company in May 2023. (The chart shows PDC’s valuation before Chevron’s offer.)

In 2022, BlackRock CEO Larry Fink penned a letter outlining his vision of a decarbonized future, calling those working to help knock out oil with green energy “phoenixes,” the immortal birds from Greek mythology that rise from the ashes of their predecessors, and suggesting that those who resist the net-zero transitions are “dodos,” a kind of flightless bird that went extinct in the seventeenth century.

The dodos of the future will be those who cling to their ailing growth stocks. The phoenixes will be invested in hard assets and the still-unloved energy stocks. Borrowing costs will be high, the $2 trillion capex hole will take years to plug, and low prices for fossil fuels—oil, gas, and coal—will soon be a distant memory.

Much more in the full book