The first great challenge to the Trump administration is controlling inflation. It is coming back already and we might face a second wave that emerges in the summer. Throughout the campaign, we’ve had almost no honest talk about the reasons for this devastation.

It cannot be stopped through “anti-gouging” legislation. No one ever believed that this would achieve anything. The message had no public resonance at all.

But just as crucially, the inflation was not kicked off by energy regulation and throttles on oil and gas production. That increased transportation costs, yes, but the oil price now is not high and inflation is still a menace.

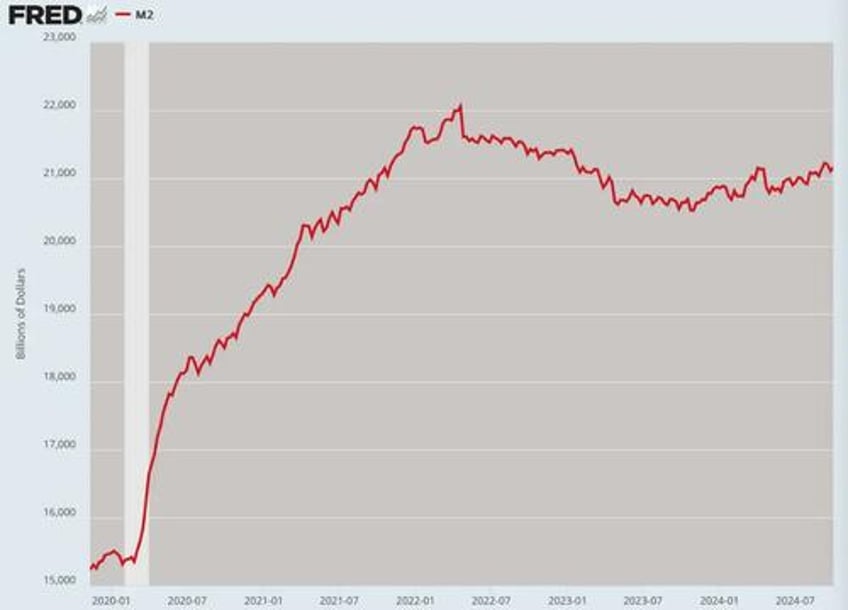

The root of the problem is so unbearably obvious, so much so that it feels pointless to point it out. For two years, the money stock grew $6 trillion on the backs of a wild spending bonanza by Congress, all of which was paid for by Fed purchases of new debt.

Because the new money was directly distributed to the population as if by helicopter, it watered down the value of the U.S. dollar in terms of goods and services. Growth stopped with rate increases but the Fed has reversed itself again in an attempt to forestall recession.

Right now, the money stock is growing again, thanks to a great deal of U.S. Treasury releases designed to prettify the GDP leading to the election.

(Data: Federal Reserve Economic Data (FRED), St. Louis Fed; Chart: Jeffrey A. Tucker)

There is no easy fix to this. Lowering energy prices with more supply can help but there is a point at which lower prices actually reduce supply, simply because it no longer pays the bills to drill and refine. By all means, deregulate but this much I can promise you: it will not fix the inflation problem.

Nor should the Trump administration be overly concerned about the boogeyman called “deflation.” The people always benefit from rising purchasing power. Producers can cope just fine, as the computer and software industry have proven for the better part of 30 years. Absolutely no policy choices should be made under the motive to stop deflation. That is no way a threat right now.

Ideally, the Trump administration would seek a fix to the problem of the Fed, such as ending open-market operations and debt support, permanently. The effect of such changes long-term would be glorious but it will not stop the problem that exists right now.

Price controls are anathema under all circumstances.

The best single strategy to deal with the immediate problem is to inspire investment via dramatic tax cuts (capital and income) plus huge and far-reaching deregulation of everything that lowers the costs of start-up and the operation of small businesses. That is essential.

Keep in mind that the usual suspects will scream that higher growth only makes inflation worse. This is wrong. There’s no other way to put it. It’s just bad analytics stemming from outdated models. Higher growth does not feed inflation. It mitigates it, burying its impact amidst more opportunities and great wealth creation.

Think of it as a race. Growth needs to rise well above inflation rates. The tax cuts also put more money in the hands of producers and consumers, granting more control over wealth in the hands of the public so that the ghostly tax increases of inflation have less impact.

That of course will reduce government revenue and increase the debt, which is inflationary too, so that is a major problem. Again, there is an answer in the form of far-reaching spending cuts. There really is no choice. Cutting $2 trillion out of the budget is a good start but it is not enough. These have to be real cuts, not fake cuts in the rate of growth.

Some revenue shortfalls can be covered by tariffs but there are potential pitfalls here. There are three reasons for tariffs: revenue, protection of industry, and rebalancing settlement systems. They work at cross purposes. The revenue comes from paying the tariffs. They are only paid when trade occurs. Protection happens when trade does not take place on the scale it otherwise would have.

The more protection, the less revenue. The more revenue, the less protection.

Do you see the problem? Relying on tariffs to make up revenue losses from tax cuts absolutely requires the continued existence of imports, especially on high-dollar capital goods. Seeking ever more revenue from this source perpetuates the problem of international industrial competition. As for rebalancing trade, that likely cannot happen so long as the dollar (and petrodollar) are the final means of payment.

My point is simply that there are real limits here. One cannot always know at the outset what they are.

There is also no way to know precisely when consumers and producers will revolt against high tariffs, which absolutely increase the prices of goods and services.

Another note on the price increases associated with tariffs: they do not cause inflation. Price increases on particular products is a relative change, not a general change. You will read floods of commentary in the coming months that Trump’s tariffs drive up inflation. That is absolutely untrue. They increase discreet prices but have zero effect on general prices. This fallacy will persist however as the whole of the financial press will blame the second wave of inflation on Trump. Not a word of it will be true.

In any case, sizing it all up, the best hopes that the Trump administration has for avoiding an obvious inflationary recession: massive regulatory changes and asset sales, dramatic spending cuts in discretionary spending, and huge capital and income tax cuts to inspire optimism and put more money back into people’s pockets.

The tariffs are going to come either way given Trump’s outlook but the most we can hope from them is to do the least-possible damage. They hope will be to reverse the red ink in trade deficits but that is highly doubtful. So long as the U.S. dollar is the world reserve currency, the balance sheets of foreign central banks will continue to stockpile them.

Remember that a strong dollar drives imports. That is at cross purposes with the trade agenda. The dollar’s value in terms of other currencies is rising now and will likely continue. There is no real threat to the dollar as reserve currency in the short run. It’s not a subject about which anyone should care for a long time to come.

That aside, a newly ebullient investment environment could provide energy for a new focus on growth, which in turn will grow revenue on its own. If the shift is serious enough, it could reverse investor psychology and bring about a transformative effect on the mood of the public and confidence. This is the biggest hope we have.

Doing nothing is not an option. Fortunately, the Trump transition knows this and seems prepared to act.

Views expressed in this article are opinions of the author and do not necessarily reflect the views of The Epoch Times or ZeroHedge.