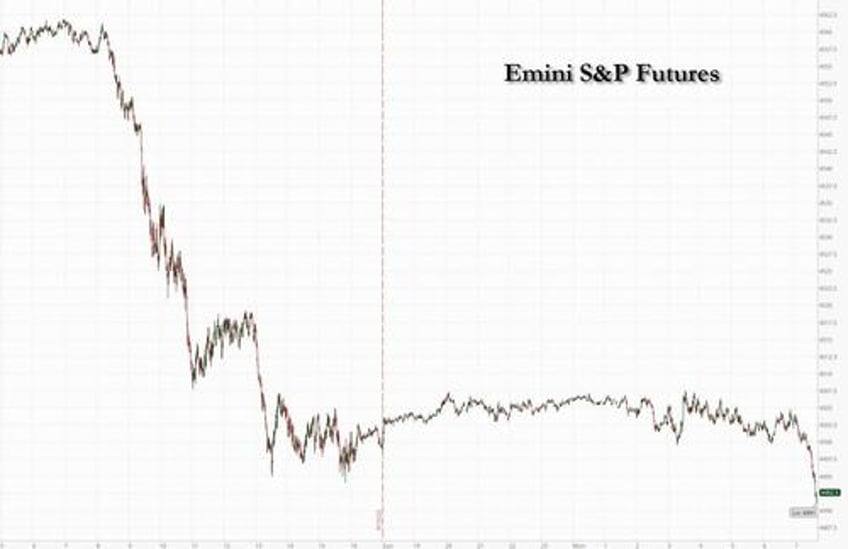

US equity futures were flat for much of the session before taking leg lower into the red with Treasury yields ticking higher, the USD flat, oil near $95, highlighting inflationary pressures just as policymakers prepare for interest-rate meetings, and bitcoin is surging as traders start pricing in the coming easing tidal wave. As of 7:45am, S&P and Nasdaq 100 futures were down -0.2%. In commodities, WTI and ags are the best performers with base metals and natgas the biggest laggards. Stocks in Europe and Asia dropped sharply, mirroring the decline that took the S&P 500 down more than 1% last Friday.

This week is a filled with multiple central bank decisions, including the Fed. JPM's market intel desk writes that with BBG reporting options markets are betting on faster than expected rate cuts in 2024; "let’s see the update from the DOTS" says JPM's Andrew Tyler. This week, the UAW strike may dominate headlines with about 10% of the 150k person union on strike, and the Biden admin may get involved. Meanwhile, the US government shutdown looms after Sep 30, currently a bi-partisan deal in the House has yet to materialize.

In premarket trading, mega cap Tech names are mostly in the green. Apple shares rise as much as 0.5% with analysts positive on the tech company’s pre-orders for the latest iPhone 15, saying data so far is surpassing expectations and could bode well for the shares if momentum is sustained. Societe Generale plunged as much as 11% after cutting profitability targets. Here are some other notable premarket movers:

- Alteryx shares jump 5.3% after the computer-software company was upgraded to overweight from equal-weight at Morgan Stanley, which said the current valuation undervalues its growth and profit potential.

- Micron shares gained 2.5% after the chipmaker was raised to buy from hold at Deutsche Bank, with the broker noting that prices for DRAM chips have started to improve faster than expected.

- Disney and Warner Bros Discovery (WBD US) rise after the two media and entertainment companies were initiated with outperform recommendations at Raymond James, which noted compelling cash-flow growth expectations. Paramount Global was rated new market perform.

- L3Harris Technologies shares rose 1.8% after the defense company was upgraded to overweight from equal-weight at Wells Fargo, which said the risk-reward has become more balanced.

A three-week rally in oil prices has pushed benchmark Brent higher by 11%, and back to the average price at which Joe Biden drained almost 200 million barrels from the SPR, complicating the task of central bankers around the world in their fight against inflation. The Federal Reserve’s policy announcement on Wednesday will be followed by those from the Bank of England on Thursday and the Bank of Japan a day later.

“This week will be bumpy,” said Francois Rimeu, a fund manager at La Francaise Asset Management in Paris. “Pretty tough messages are expected from central bankers.”

Monday’s subdued mood in stock markets matched the relentless bearish tone of a note from Morgan Stanley's Mike Wilson, who said investors have turned more cautious (which is amusing since he has been talling them to short the S&P since 3900 last December). “The majority of investors we’ve spoken with are in the ‘pushed out’ camp and are of the view that 2024 is now looking like a more challenging year for risk assets relative to 2023,” Wilson wrote in a note.

Other disagree: according to economists surveyed by Bloomberg News, a resilient US economy will prompt the Fed to pencil in one more interest-rate hike this year and stay at the peak level next year for longer than previously expected,

“A number of Fed speakers have taken a slightly more cautious tone recently, mentioning that risks have become more two-sided and talking of the ability to ‘proceed carefully,’” said Credit Agricole strategists led by Jean-François Paren. “That said, it is far too early to declare victory, and the Fed will want to keep the possibility of further tightening on the table.”

European stocks slumped; the Stoxx 600 is down 0.6%, led by declines in the construction and consumer product sectors. Major European markets are all lower with France the biggest laggard. UK rents increases 12% YoY in Aug, the largest increase on record. In EMEA, 3M Momentum is leading, Cyclicals are lagging; Value over Growth. UKX -0.2%, SX5E -0.7%, SXXP -0.5%, DAX -0.5%. Here are the most notable movers:

- Pendragon shares rise as much as 32% after the new and used car seller agreed to sell its UK motor and leasing business to Lithia Motors Inc. and form a strategic partnership with the US company in a deal that promises a cash dividend of about £240 million to its shareholders.

- PGS shares rise as much as 16% after the Norwegian geophysical data company’s sector peer TGS agreed to an all-share merger. TGS shares slide as much as 7%, with DNB analysts seeing the deal as less favorable to its shareholders.

- Cofina shares gain as much as 13% after the Portuguese company said on Friday night that it’s analyzing the two offers it received for its Cofina Media unit; no decision has been taken about whether it will sell Cofina Media or not.

- Drax shares rise as much as 5.3%, rebounding from a 10% drop on Friday that came after the UK’s National Audit Office said it will produce a report about the nation’s current biomass strategy and the fuel’s contribution to the UK’s net zero target.

- International Distributions Services shares gain as much as 5.2% after JPMorgan upgraded its recommendation on the the Royal Mail owner to overweight from neutral, citing an attractive entry point.

- Societe Generale shares drop as much as 7.9% after the lender announced a new strategic plan. KBW called the strategy “disappointing,” while Bloomberg Intelligence said it lacked major proposals to restructure its struggling investment banking division.

- S4 Capital shares tumble as much as 28% to a record low after the digital advertising agency reduced full-year guidance for a second time in two months. The company said its clients are cautious in spending due to fears of a recession, and its current client activity levels are weaker than expected. Jefferies and Peel Hunt cut price targets.

- Nordic Semiconductor shares slide as much as 16% after the chipmaker reduced quarterly revenue and margin forecasts, citing weak demand across its core markets and no signs of improvement amid an industry downturn.

- ALD LeasePlan shares slump as much as 15%, the most since March 2020, after the operational leasing and fleet management company that’s majority owned by Societe Generale announced a new strategic plan for 2023-2026.

- Lonza shares fall as much as 10.5%, the most since July, after the Swiss bioprocessing company announced the departure of CEO Pierre-Alain Ruffieux. The uncertainty will lead shares to underperform ahead of capital markets day next month, according to Morgan Stanley.

Earlier in the session, Asian stocks fell, with the tech sector leading the declines in a busy week for central bank decisions. A lack of positive developments from China also kept sentiment in check. The MSCI Asia Pacific ex-Japan Index dropped as much as 0.9%, dragged lower by information tech and financials. Among individual stocks, TSMC and Samsung Electronics contributed the most to the benchmark’s loss. Japanese markets were closed for a holiday, while the central bank there is due to meet later this week. Optimism spurred by nascent signs of stabilization in China’s economy has been offset by lingering concerns over the property crisis, with some distressed developers facing more debt payment deadlines.

- A gauge of Chinese stocks traded in Hong Kong fell about 1%, while the onshore CSI 300 Index touched its lowest level this year before trading higher. Hang Seng and Shanghai Comp retreated at the open with the declines in Hong Kong led by tech and property stocks including Evergrande shares which slumped by more than 20% in early trade after some of its wealth management employees were detained by Chinese authorities. Conversely, the losses in the mainland were later reversed in the aftermath of the PBoC’s firm liquidity efforts and the previously unannounced meeting between Chinese Foreign Minister Wang Yi and US National Security Adviser Sullivan.

- Australia's ASX 200 was pressured with underperformance in tech and telecoms and with the handover of leadership at the RBA met with little fanfare.

- The Nikkei 225 remained closed as Japanese participants observed the Respect for the Aged Day holiday.

In FX, the Bloomberg Dollar Spot was is down 0.1%. The Norwegian krone is the worst performer among the G-10’s, falling 0.6% versus the greenback. Spot gold rises 0.1%.

In rates, treasuries drop, with US 10-year yields rising 1bps to 4.34%. Bunds and gilts are also lower; regional yields are higher in this heavy central bank week, which sees decisions from the Fed (pause), BOJ (no change but may hint at tightening) and BoE, which is expected to hike 25bps to 5.5%, ending the hiking cycle; The ECB warns on additional hikes, but market expects the CB to have already completed.

In commodities, oil prices gained with US crude futures rising 0.6% to trade near $91.30. On the outlook for oil, traders will be monitoring clues on prospects for global supply when Saudi Energy Minister Prince Abdulaziz bin Salman addresses an industry conference later Monday. Hedge funds last week boosted their bullish wagers on Brent and US crude to a 15-month high. Brent has gained 11% in three weeks.

Looking at today's calendar, it's a slow start to the week, with the New York Fed Services Business index due, followed by the NAHB Housing Market Index, and the latest TIC data after the close.

Market Snapshot

- S&P 500 futures up 0.1% to 4,504.00

- MXAP down 0.6% to 162.97

- MXAPJ down 0.9% to 504.11

- Nikkei up 1.1% to 33,533.09

- Topix up 0.9% to 2,428.38

- Hang Seng Index down 1.4% to 17,930.55

- Shanghai Composite up 0.3% to 3,125.93

- Sensex down 0.2% to 67,671.61

- Australia S&P/ASX 200 down 0.7% to 7,230.37

- Kospi down 1.0% to 2,574.72

- STOXX Europe 600 down 0.5% to 459.72

- German 10Y yield little changed at 2.68%

- Euro little changed at $1.0658

- Brent Futures up 0.3% to $94.17/bbl

- Brent Futures up 0.2% to $94.16/bbl

- Gold spot up 0.1% to $1,926.10

- U.S. Dollar Index little changed at 105.34

Top Overnight News

- Biden’s national security advisor secretly met with China’s foreign minister in Europe over the weekend, a “significant step” toward stabilizing relations between the two countries (the weekend discussion could pave the way for Biden and Xi to meet later this year on the sidelines of the APEC summit in November). NBC News

- China’s economy is showing some green shoots (the latest evidence being Aug retail sales and industrial production Thurs night), but FDI (foreign direct investment) remains a big problem (FDI slumped 5.1% YTD through Aug, a larger drop than the -4% YTD as of Jul). SCMP

- SoftBank is on the hunt for deals in artificial intelligence, including a potential investment in OpenAI, after the blockbuster listing of UK chip designer Arm bolstered Masayoshi Son’s multibillion-dollar war chest. FT

- Brent edged closer to $95 for the first time since November after a three-week run of gains. Growing supply tightness and eroding inventories suggest the rally may have further to run after hedge funds boosted bullish bets to a 15-month high last week. Saudi Energy Minister Prince Abdulaziz bin Salman speaks at the World Petroleum Congress in Calgary later. BBG

- The US and Iran are set to complete an exchange of prisoners after months of negotiations, a breakthrough that Washington hopes will open the door to a de-escalation of tensions between the arch-foes. In a carefully sequenced process, five American-Iranian dual nationals will be released on Monday by the Islamic republic and flown to Qatar, while the US will also free five Iranians from American prisons. FT

- U.S. COVID infections are hovering near levels of the pandemic’s first peak in 2020, and approaching the Delta peak of late 2021, according to wastewater surveillance and modeling by forecasters. It’s yet another sign that while the official pandemic state may be over, the days of COVID are far from it. Fortune

- The restart of student-loan payments could divert up to $100 billion from Americans’ pockets over the coming year, leaving consumers squeezed and some of the nation’s largest retailers fearing a spending slowdown. WSJ

- Auto strike latest: The UAW's Shawn Fain rejected an offer of a 21% raise from Stellantis. "It's definitely a no-go," Fain told CBS. His comments signal the union and Detroit execs are still far apart. The union also rejected what Stellantis called a "compelling offer" that would protect jobs at an idled Jeep plant in Illinois. BBG

- TSLA has already won, regardless of how the UAW talks turn out – the company’s manufacturing lead is only widening vs. the legacy OEMs as the firm drives down the cost of building an EV. WSJ

- Utilities was among the most net sold sectors on the Goldman Prime Book last week, driven by long sales and to a much lesser extent short sales (~8 to 1). Last week’s net selling in US Utilities was the largest in 11 weeks and ranks in the 92nd percentile vs. the past five years. The US Utilities long/short ratio fell -4.9% on the week and now stands at 1.44, in the 12th percentile vs. the past year and in the 9th percentile vs. the past five years. GSPB

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly lower following last Friday’s declines on Wall St and with the region cautious in a holiday-thinned start to a busy week of central bank policy announcements. ASX 200 was pressured with underperformance in tech and telecoms and with the handover of leadership at the RBA met with little fanfare. Nikkei 225 remained closed as Japanese participants observed the Respect for the Aged Day holiday. Hang Seng and Shanghai Comp retreated at the open with the declines in Hong Kong led by tech and property stocks including Evergrande shares which slumped by more than 20% in early trade after some of its wealth management employees were detained by Chinese authorities. Conversely, the losses in the mainland were later reversed in the aftermath of the PBoC’s firm liquidity efforts and the previously unannounced meeting between Chinese Foreign Minister Wang Yi and US National Security Adviser Sullivan.

Top Asian News

- US National Security Adviser Sullivan and Chinese Foreign Minister Wang Yi met in Malta over the weekend in an unannounced meeting to maintain open lines of communication with the discussions said to be candid, substantive and constructive, while they discussed security issues, Russia’s war in Ukraine and cross-Taiwan-Strait issues, according to the White House. Furthermore, a US official said the US sees some limited signs China may re-establish military communications with the US and the US raised concerns about Chinese assistance to Russia, as well as expressed concerns about China crossing the median line in the Taiwan Strait, according to Reuters.

- China’s Foreign Ministry said following the meeting between Chinese Foreign Minister Wang and White House’s Sullivan that both sides agreed to continue to maintain high-level exchanges and hold consultations on Asia-Pacific affairs, maritime affairs and foreign policy, while it added that the Taiwan issue is the first insurmountable line on Sino-US relations, according to Reuters.

- China's Foreign Minister Wang Yi said in a meeting with Malta's Foreign Minister that the two sides will work together to promote China-EU cooperation and China hopes Malta would continue to play a positive role in the development of China-EU relations. Furthermore, he said China-EU cooperation outweighs differences and China has consistently supported the EU's strategic independence and European integration, according to Reuters.

- Chinese Foreign Minister Wang Yi will visit Russia from September 18th-21st for the China-Russia strategic security consultations.

- IMF’s Georgieva said China’s ageing population and declining productivity are suppressing growth and Beijing should work to boost domestic consumption, while she urged China to address the weakness in the real estate sector and build-up of local government debt. Furthermore, she stated the IMF must carefully monitor the outflow of investments from China and said that some sectors still offer opportunities, according to Reuters.

- German Foreign Minister Baerbock said Europe must reduce its dependence on China and the EU should de-risk from China but not decouple, according to Bloomberg.

European bourses are in the red, Euro Stoxx 50 -0.8%, with participants cautious ahead of a Central Bank frenzy. Sectors have Health Care at the bottom weighed on by Lonza while pressure on LVMH's Champagne brands has put Consumer Products & Services on the backfoot. Stateside, futures are essentially unchanged on the session after Friday's pressure, ES +0.1%, with the US docket light until Wednesday's FOMC. JP Morgan on EZ Equity Strategy: stays cautious on the region and expects defensive sectors to trade better into year-end.

Top European News

- UK opposition Labour Party leader Keir Starmer pledged to seek a major rewrite of the Brexit deal in 2025 if the party wins the next general election, according to FT.

- ECB’s Holzmann said that they definitely cannot say this was the final hike but the likelihood of another hike is not that big and noted that inflation risks haven’t receded lately. Furthermore, he stated that there is a risk more tightening will be needed and it wasn’t an easy decision at the last meeting where they had to weigh all arguments very carefully in order to come to an agreement.

- ECB’s Muller sees a good case that no further rate hikes are needed and noted a strong case to quicken the balance sheet roll-off, while he added that the ECB should discuss an earlier end of PEPP reinvestment.

- ECB’s Stournaras said governments must do their part in reining in consumer prices after borrowing costs reached a level that could be their peak, while he stated that monetary policy has done its part to fight inflation and it is up to fiscal policy to take off some of the heat, according to Bloomberg.

- ECB's Kazimir said he wishes the September rate hike was the last but cannot rule out further rate increases; only the March forecast can confirm that ECB is heading towards inflation goal; end of rate hikes to open debate on how to adjust PEPP and APP. Once clear that no more rate hikes are needed, debate should start on speeding up QT. Premature to place bets on the first-rate cut.

- ECB's de Guindos says parts of underlying inflation are moderating.

- Bundesbank Monthly Report (September): expects the German economy to shrink in Q3 on weak industry and muted private consumption.

- Moody’s raised Greece’s sovereign rating by two notches from Ba3; Outlook Stable from BA1; Outlook Positive and S&P affirmed Spain at A; Outlook Stable, while Fitch affirmed Germany at AAA; Outlook Stable and affirmed Malta at A+; Outlook Stable.

FX

- DXY sits on a 105.000 handle within tight range ahead of NAHB on a quiet agenda before this week's Central Bank-fest.

- Kiwi and Aussie marginally outperform against Greenback above 0.5900 and 0.6400 respectively in the absence of anything specific.

- Other majors relatively contained vs Buck as Franc, Yen, Pound, Loonie and Euro keep afloat of 0.9000, 148.00, 1.2350, 1.3550 and 1.0650.

- PBoC set USD/CNY mid-point at 7.1736 vs exp. 7.2707 (prev. 7.1786)

- Czech Central Bank Governor Michl said let’s forget about near-term rate cuts and that there will be no rate cuts in September and October, while they expect higher rates in the longer term and want to be a hawkish central bank. Furthermore, Michl said core inflation does not allow a rate cut now and they will wait for data in November and January, according to Reuters.

Fixed Income

- Debt futures remain depressed and defensive awaiting inflation data, a swathe of September policy meetings and flash PMIs.

- Bunds and Gilts teeter mostly above 130.00 and 95.00 between 130.24-129.97 and 95.23-94.96 respective parameters.

- T-note hovers within 109-09/16 range pre-NAHB.

Commodities

- WTI October and Brent November futures are firmer intraday, although off best levels with support emanating from Central Bank expectation, demand side support via China and ongoing Saudi/Russia curbs.

- WTI trades around USD 91.30/bbl and towards the top end of a 90.86-91.70/bbl parameter thus far, while its Brent counterpart oscillates around USD 94.30/bbl in a USD 93.93-94.78/bbl band.

- TTF is softer intraday despite Offshore Alliance members starting another 24-hour stoppage while Norway's Troll field has begun to increase output after its prolonged shutdown.

- Spot gold is rangebound between the 50- and 200-DMAs while base metals are more mixed given the cautious tone.

- Australia’s Offshore Alliance union said members began another 24-hour stoppage on Sunday at Chevron’s (CVX) Australian LNG facilities.

- French PM Borne said the government plans to permit gas stations to sell fuel at a loss for a limited period of a few months to help contain inflation.

- Troll field in Norway to start ramping up output on Monday following the prolonged shutdown, according to Bloomberg's Stapczynski.

- Kuwait KNPC says power was cut at the Al Ahmadi (25k BPD) and Abdallah (270k BPD) refineries last night but work continues; working towards full production capacity, exports remain unaffected, according to a KNPC statement.

- Kazakhstan raised its daily oil and gas condensate production by 10% on Sunday from Saturday to 250.4k tons following the completion of maintenance at the Karachagnak and Tengiz fields.

- China August refined copper output +16.4% Y/Y to 1.12mln metric tons; Lead output +5.5% Y/Y to 619k tons, according to the stats bureau.

- Ukraine intends to sue Hungary, Poland and Slovakia due to their refusal to drop a ban on Ukrainian agricultural products, via Politico.

Geopolitics

- Ukraine’s general in command of ground forces announced that Ukrainian forces recaptured the eastern village of Klishchiivka on the southern flank of Bakhmut, according to a Telegram post cited by Reuters.

- North Korean leader Kim met with Russian Defence Minister Shoigu in Vladivostok who showed Kim Russia’s hypersonic Kinzhal missiles and three nuclear-capable strategic aircraft, according to Russian media.

- IAEA said Tehran took a disproportionate and unprecedented measure in barring a third of IAEA’s most experienced inspectors in Iran and noted that these inspectors are among the most experienced energy experts with unique knowledge of enrichment technology, according to Reuters.

- Israel PM Netanyahu said Iran is violating all its commitments to the international community after Tehran moved to ban multiple inspectors, according to Reuters.

- Saudi Arabia reportedly informed the Biden admin of its decision to halt all discussions of normalising ties with Israel on Sunday, citing Israeli PM Netanyahu's "extremist" government, according to unconfirmed reports cited by The Jerusalem Post.

- Taiwan's Defence Ministry said during the past 24 hours, 40 Chinese air force planes crossed Taiwan's air defence zone and said China's continuous military harassment can easily lead to a sharp increase in tensions and worsen regional security, while it urged Beijing authorities to immediately stop destructive actions, according to Reuters. Furthermore, AFP reported that Taiwan said it detected 103 Chinese warplanes around the island.

- Turkish President Erdogan said Turkey could part ways with the EU if necessary following a report which criticised Turkey’s democratic shortcomings, according to Bloomberg.

- Social media reports, citing Bulgarian radio, state that an unidentified drone with an 82mm mortar mine has crashed on the coast of Bulgaria (NATO member).

US Event Calendar

- 08:30: Sept. New York Fed Services Business, prior 0.6

- 10:00: Sept. NAHB Housing Market Index, est. 49, prior 50

- 16:00: July Total Net TIC Flows, prior $147.8b

DB's Jim Reid concludes the overnight wrap

The FOMC on Wednesday will highlight a busy week for markets with central banks at the fore. Outside of the Fed, the BoE (Thursday), and the BoJ (Friday) are the other main events on this front. Central banks in Norway, Sweden, Switzerland and Turkiye (all Thursday) all have policy meetings too.

The CPI inflation data for both the UK (Wednesday) and Japan (Friday) will also be out this week. The global flash PMIs due Friday will be another big focus. The latest manufacturing PMI for Germany printed at 39.1 (43.5 in the Eurozone), much lower than the still soft 47.9 in the US and 49.6 in Japan. Momentum in the services gauge, especially in the US (50.5) where it’s only just above 50, will also be in focus after stronger comparable prints in other US surveys.

Also in the US we have the monthly housing week data dump even if it will be tough to learn something new. US housing affordability is around the worst on record for buyers, and activity is at around 30 year low, but for the vast majority of existing homeowners there is no stress. We have today's NAHB homebuilder index (DB forecast 50 vs. 50 previously), Tuesday's housing starts (1.478mn vs 1.452mn) and building permits (1.460mn vs. 1.443mn) and Thursday's existing home sales (4.25mn vs. 4.07mn). Elsewhere in the US, Thursday's Philadelphia Fed survey (-5.0 vs. +12.0) will be of some interest. Elsewhere the UAW autoworkers strike that started on Friday will gain more macro attention the longer it lasts. Some may say this is an idiosyncratic risk to the economy but with inflation having been high and corporate profits coming back, this sort of thing is a genuine consequence of the macro environment.

Anyway, let's dive into a brief FOMC preview. A fuller one from our economists can be found here. You'd be hard pressed to find someone who thinks they'll hike this week but our expectation is that they keep the door open for another hike later this year which the dot plot will continue to reflect. Our economists believe other parts of the SEP are likely to undergo meaningful revisions, particularly for 2023. Stronger growth (2023 could double to 2%, 2024 could increase around 25bps to 1.3%) and lower unemployment should counterbalance softer inflation (2023 revised down but core forecasts for 2024 likely to be unchanged). So the meeting is likely to see a confident pause but one where further tightening is seen as the risk.

After the Fed, the focus will shift to the BoE on Thursday. Our UK economist previews the meeting here and expects another +25bps hike that would take the Bank Rate to 5.5% and sees another, potentially final, hike in November. The market were pricing in around a 70% chance of a hike at the close on Friday. Perhaps a swing factor on the outlook could be the UK CPI the day before where headline is expected to rise from 6.8% to 7.2% due to energy costs but core is expected to dip 0.1pp to 6.8%. A big fall in October's headline release should occur alongside a big fall in energy bills as bad YoY comps drop out. Retail sales on Friday completes a busy week for the UK. Retail sales will also be due on Thursday in France. Highlights in Germany include the PPI out on Wednesday.

The BoJ will wrap up the busy week on Friday and a preview from our Chief Japan economist is available here. He expects the central bank to stick to its current policy stance but revise the MPM statement to point to policy normalisation. Further out, our economist sees the YCC and negative interest rate policy ending at the October and January meetings, respectively. Japan's latest nationwide CPI will also be out that day. Our Chief Japan economist sees the headline gauge at 2.9% YoY (+3.3% in July), core inflation excluding fresh food at 2.9% (+3.1%), and core-core inflation excluding fresh food and energy (+4.3%).

Asian equity markets are generally tracking down to Friday's DM losses, especially in the tech sector but S&P 500 (+0.18%) and NASDAQ 100 (+0.12%) futures have rebounded a little. The Hang Seng (-1.03%) is the biggest underperformer followed by the KOSPI (-0.87%) and the S&P/ASX 200 (-0.60%). Elsewhere, mainland Chinese stocks are trading up with the CSI (+0.39%) slightly higher while the Shanghai Composite (+0.03%) is just above the flatline. Meanwhile, markets in Japan are closed for a holiday with cash treasuries closed.

In energy markets, oil prices are extending gains with Brent crude (+0.42%) inching towards $95/bbl amid Russian and Saudi Arabian production cuts.

Now, looking back on last week. On Friday, we had the preliminary results of the University of Michigan’s September survey of consumer sentiment. The headline missed expectations, falling to 67.7 (vs 69.0 expected). On the other hand, the inflation expectations section of the survey saw one-year inflation expectations hit their lowest level since 2021 after falling from 3.5% to 3.1% (vs 3.5% expected). Inflation expectations at the long-run horizon, 5 to 10 years, also surprised to the downside, falling from 3.0% to 2.7% (vs 3.0% expected). So more encouragement that disinflation is being felt by US consumers which is surprising for the last month given the notably higher gas prices of late. The first release is often revised so we will see. At face value though this will be very good news for the Fed.

With a week of former US data though, markets moved to price in a higher for longer Fed funds rate. The rate priced for December 2024 rose +10.8bps last week, and +4.2bps on Friday. Off the back of this, US 10yr Treasury yields gained +4.5bps on Friday, and +6.7bps in weekly terms. Similarly, 2yr yields rose +4.2bps week-on-week (and +2.1bps on Friday).

In Europe, on Friday, the day after the ECB’s 25bps hike to 4.00%, comments by the ECB’s Muller that higher inflation in the Eurozone could “yet warrant another hike” saw 10yr bund yields rise +8.2bps to 2.67%. So the hawks leaving the door open to another hike. This was followed by comments from President Lagarde that interest rate cuts were not yet on the table for policymakers. The move on Friday erased the fall in 10yr yields that had occurred earlier in the week, as yields rose +6.5bps to 2.67%, their highest weekly close since the first week of March. Of note, German 30yr yields gained +9.0bps on Friday (and +8.2bps week-on-week) to 2.81%, their highest level since 2011.

Turning back to the US, equities pared back their weekly advance as tech giants like Amazon and Nvidia fell on Friday. The S&P 500 slipped -1.22%, erasing its earlier weekly gains (-0.16%). The decline was led by technology stocks, with the tech-heavy NASDAQ falling -1.56% on Friday (-0.39% on the week). Within the technology sector, semiconductors had a more than lacklustre day, down -3.01% after a report that the largest chip manufacturer, TSMC, had requested its major supplier to delay shipments of high-end equipment. Nvidia fell -3.69% on Friday (-3.67% week-on-week), while Amazon declined -2.99% on Friday (though still up +1.56% in weekly terms). Things were sunnier in European equities. The STOXX 600 gained +0.23% on Friday, wrapping the week up with gains of +1.60%, its best weekly performance since mid-July. The FTSE 100 also outperformed, up +3.12% over the week (and +0.50% on Friday) in its strongest weekly run since January.

Finally, in commodities, oil had a formidable run last week, hitting a new 10-month high. This came as supply continues to tighten following production cuts by Saudi Arabia and Russia alongside OPEC’s warning last week that the oil market would likely be in large deficit by the end of 2023. WTI crude futures were up +3.73% week-on-week (and +0.68% on Friday), breaking through the $90/bbl to level to finish at $90.77/bbl, ticking off a third consecutive week of gains. Brent similarly gained on the week, up +3.62% (and +0.25% on Friday) to $93.93/bbl.