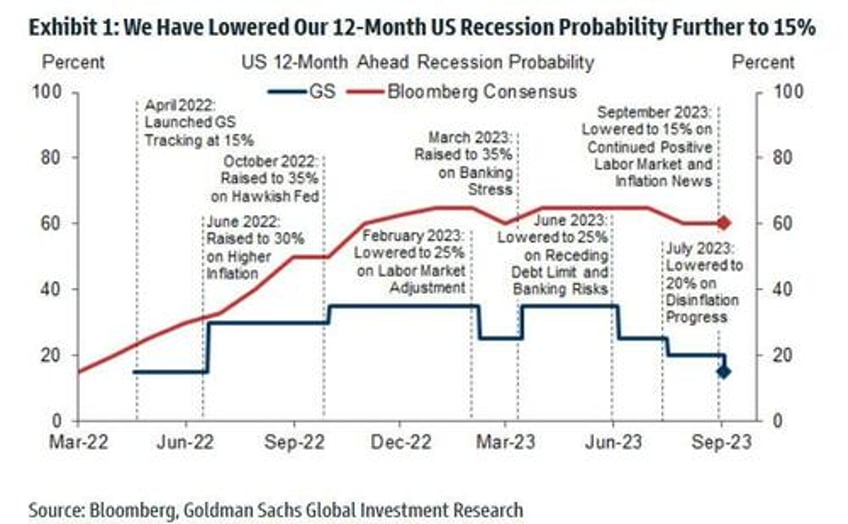

Goldman's economist team, which has an abysmal prediction hit-rate, is out with the worst possible news for the Biden admin: the team led by Jan Hatzius has once again slashed its subjective odds of a recession, and the bank - which last raised its recession odds back during the March bank crisis, just when the Fed's massive liquidity injection via Discount Windows and the BTFP made a recession less likely, and has been trimming its ever since - now sees the probability of a US recession at 15%, down from 20% previously and well below a Bloomberg consensus which has been stuck at 60% since 2022 largely thanks to the grotesquely inverted yield curve which has always correctly predicted an imminent recession.

For those confused, the reason why this is bad news for Biden is that Goldman's client-facing sellside research, unlike its FICC or Equity sales and trading desk whose notes and views are among the most accurate and sought after on Wall Street, is almost always dead wrong. Hence, one can say a recession is virtually assured.

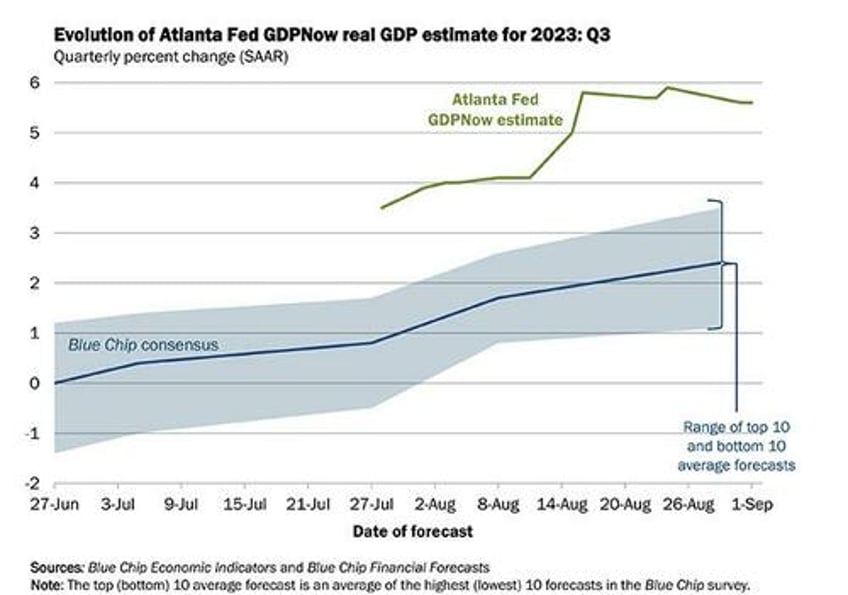

So why is Goldman so optimistic? Perhaps a better question is why is everyone so pessimistic when the Atlanta Fed's own GDPNow tracker sees US GDP rising (an absolutely idiotic) 5.6% in Q3?

Well, as even Goldman admits, the strength in Q3 GDP tracking "overstates the economy’s true momentum, given the still-soft business surveys and the much slower growth in real gross domestic income (which seems to be continuing in Q3 based on the July personal income data)." Indeed, as we first noted last week, the delta between the manipulated GDP number and the accurate, and depressed, GDI has never been bigger, which means that when reality finally hits, US economic growth will come thundering down as all the manipulation higher is revised away.

The difference between GDP and GDI is the biggest in US history. It should be identical, but it isn't. pic.twitter.com/erjWHysI1g

— zerohedge (@zerohedge) August 30, 2023

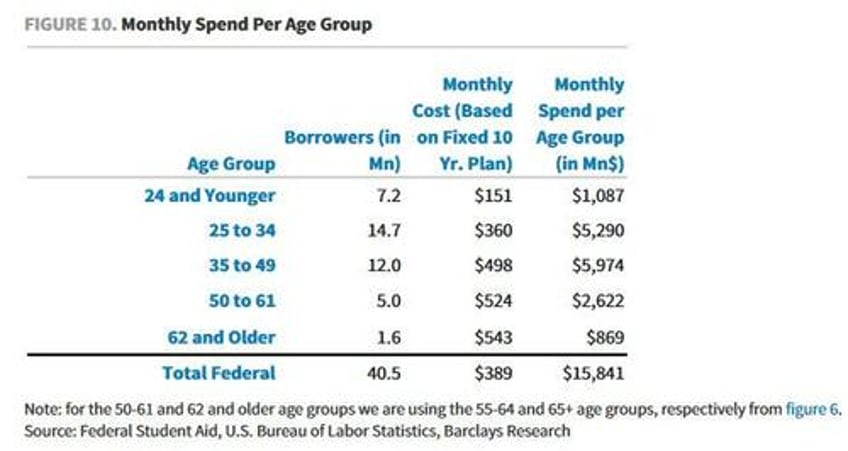

If that wasn't enough, Goldman also warns that while "there are some fundamental reasons to expect a deceleration in Q4, including the resumption of student loan payments and a near-term hit to housing from the recent increase in mortgage rates", the bank "expects the slowdown to be shallow and short-lived." We don't, since the resumption in student loan repayments will slash household spending by $16 billion per month...

... and will be larger than monthly mortgage payments for many households.

In light of all that, it seems that Goldman is actually rather gloomy on GDP and views the near-term outlook with skepticism; so why does the bank expect a recession to be avoided? For two rather laughable reasons:

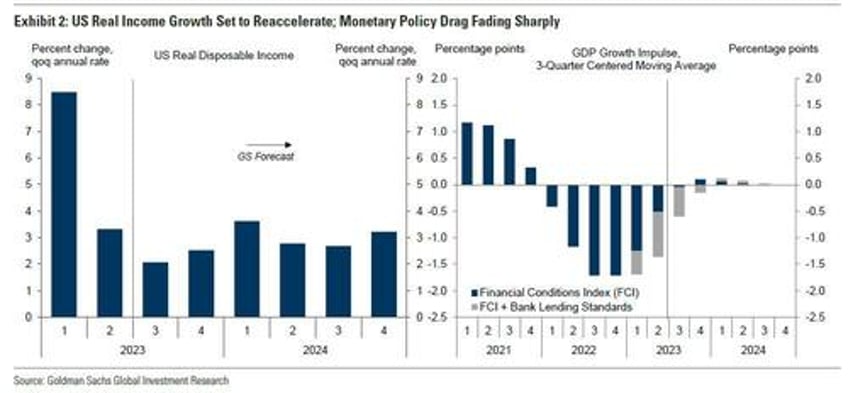

- First, real disposable income looks set to reaccelerate in 2024 on the back of continued solid job growth and rising real wages.

- Second, we still strongly disagree with the notion that a growing drag from the ‘long and variable lags’ of monetary policy will push the economy toward recession —in fact, we think that the drag from monetary policy tightening will continue to diminish before vanishing entirely by early 2024

Spoiler alert: none of that will happen, and here is why:

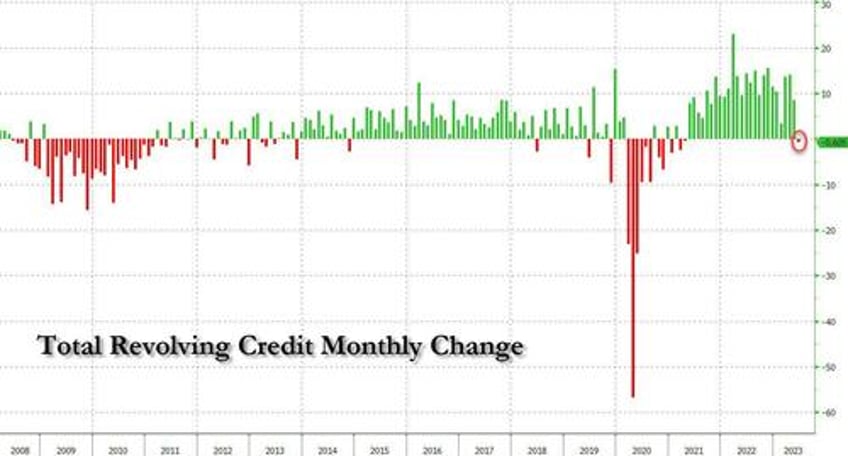

The only reason US consumer disposable income has been strong so far this year, is because of aggressive credit card spending and draining of excess savings. Unfortunately, as we detailed before, consumers are now tapped out with both credit card where we just saw the first decline since the covid crash as consumer now actively repay credit card debt ahead of the coming recession...

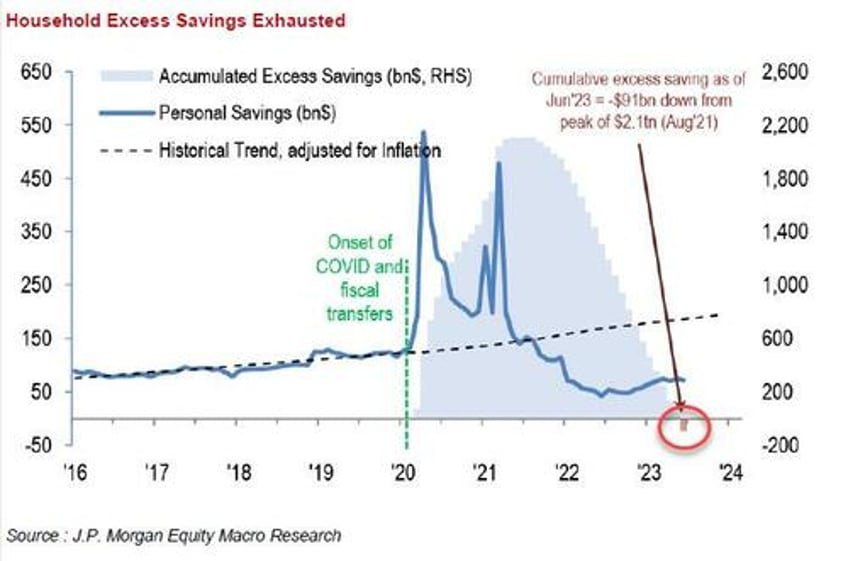

... while not only have all covid excess savings have been used up...

... but the latest personal income and spending data revealed that personal savings from current income just tumbled by the most since January 2022 to the lowest level in 2023.

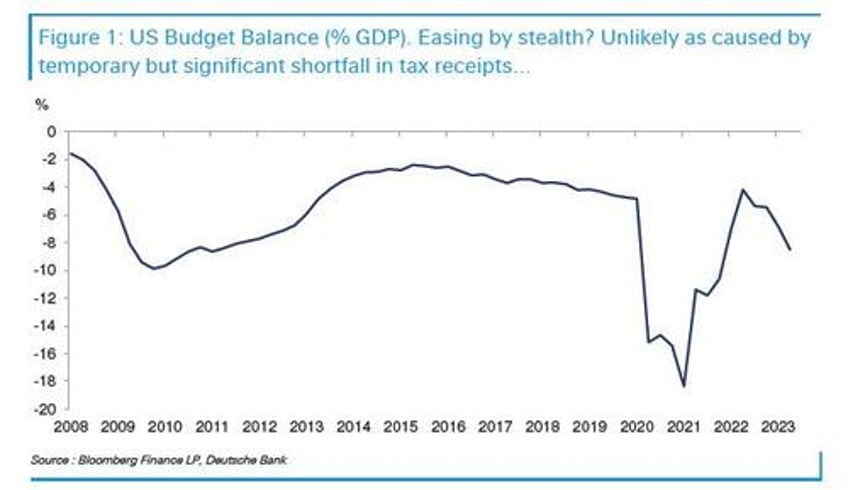

In short i) US consumers' credit cards are maxed out and ii) their savings are now spent, but there is another reason why the miracle of "Bidenomics" is about to come crashing to a halt. The favorable fiscal tailwind, which DB and JPM called a "stealth stimulus" courtesy of $1 trillion in excess government spending which has ballooned the US budget deficit to wartime levels, is about to hit a brick wall, and send the US economy tumbling off a cliff...

... just as credit cards are maxed out, savings are spent, and households resume paying down hundreds of billions in student loans.

And just in case if these three weren't enough, there is another reasons why the US economy is about to go into a tailspin: as Hatziues himself admits, "our confidence that the Fed is done raising rates has grown in the past month. We view Chair Powell’s promise at Jackson Hole to “proceed carefully” as a signal that a September hike is off the table and the hurdle for a November hike is significant.... And if the committee skips not only September but also November, the hurdle for restarting the hikes at a later point would probably rise, all else equal."

Goldman is right here that the Fed is done, what the bank fails to grasp is the reflexive nature of the Fed-market-economy relationship, and once it become a fact that the last Fed hike is in the history book, the question will turn to "what does the Fed know that nobody else does, and why is it done hiking?" A good question, and one which BofA's Michael Hartnett answered over the weekend when he simply said to "sell the last Fed hike." And if anyone needs confirmation to do just that, Goldman's bullish assessment should seal it.

Much more in the full Goldman note available to pro subscribers.