Submitted by QTR's Fringe Finance

The genesis of Donald Trump’s "no tax on tips" policy idea, which started gaining ground earlier this year, came after the former president had a discussion with a server in Las Vegas who complained about her taxes.

“We want to pay our fair share, but we also don’t want to be taken advantage of. I say it’s like the mob: They take what they want from us. We are pissed off about this,” Eileen Scott, a cocktail waitress on the floor of Harrah’s Las Vegas, told The New York Times, who commended Trump’s improvisational policy idea less than a month ago, on July 18th.

The idea has gained so much steam, that the Harris campaign and Democratic party are now trying to adopt this policy as their own:

Harris copying the Trump campaign on the idea sets off two alarm bells for me.

First, it says their campaign is obviously incapable of coming up with their own novel and well-liked policy ideas, so they are stealing Trump’s.

The second is that Harris’ out-of-the-blue stance against taxation stands in stark contrast to her record, and her party, which has focused excruciatingly on obsessing over tax revenue from the American public.

In fact, in February 2023, barely a year ago, Kamala Harris and Joe Biden’s IRS introduced the “Service Industry Tip Compliance Agreement (SITCA)”, which was specifically introduced to use electronic point of sale machines to “improve tip reporting compliance” — i.e. monitor employee tips and report them to the IRS.

In exchange for “protection from liability under the rules that define tips as part of an employee's pay”, the program asked employers to submit annual reports, compiled by their point of sale systems, on tip data.

The same New York Times piece from July reported same:

The I.R.S. has in recent years taken steps to try to collect more taxes owed on tipped income. The tax agency said that Americans appeared to underreport earnings in cash tips, and it started a new voluntary compliance program last year for employers. Americans reported roughly $38 billion in tipped income in 2018, according to I.R.S. data.

Those that listen to me and read me frequently know I have often taken exception to the fruitlessness of obsessing over taxes such as these on middle America. It isn’t because I have some beef with paying taxes — I don’t — it’s because common sense would indicate to anybody with a brain that that spending is far more of a problem than missing miniscule amounts from revenue collection in the country right now.

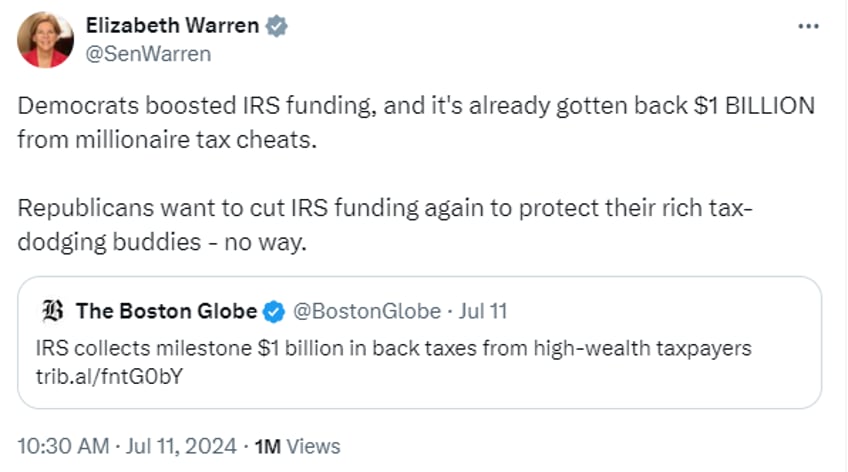

For example, last month — around the time the New York Times was complimenting Trump’s “no tax on tips” idea, Elizabeth Warren was celebrating collecting $1 billion more in taxes from the American people.

But the “boosted” funding she is referring to cost American taxpayers $80 billion.

Then, I step back from this and look at the tens of billions of dollars in foreign aid we are sending out the door — $66 billion in disbursements in 2023, $50 billion requested in 2024 — and and can’t help but think that if we just calm our spending addiction in the slightest, we could make far more progress than tightening the vice grip of taxation around American citizens. It’s a grip that had gotten so tight, they were coming after tipped employees last year.

On top of going after tipped employees, the Biden administration had floated the extraordinarily asinine idea of taxing unrealized gains, which is the ideological love child of authoritarianism, overreach and a socialist state planned economy that’s guaranteed to brutalize our quality of life, all in one. I wrote about how that would all but destroy our country’s economy earlier this year: Taxing Unrealized Gains Would Obliterate The U.S. Economy.

It’s an incredible morphing act that we are witnessing with Kamala Harris.

We have watched a woman who was about as popular as shingles within the Democratic Party, who won zero primaries and zero delegates in 2020 and 2024, somehow fall ass-backward into the Democratic nomination spot. And now we’re bearing witness to watching her entire platform undergo an all-expenses-paid facelift courtesy of the incessant spin job that the mainstream media is happy to perform.

Here’s the cover spot Time gave Harris this week without even interviewing her, saying she “pulled off the swiftest vibe shift in modern political history”. That’s a lot of words for “political coup”.

Look, it’s as simple as this: as of this writing, Kamala Harris has been vice president for 1,299 days. This should give pause to anybody who hears her say she’s going to change current policies "day one" in office.

Have we forgotten that she has been in office for nearly 27,000 hours already?

🔥 50% OFF FOR LIFE: Using the coupon entitles you to 50% off an annual subscription to Fringe Finance for as long as you wish to subscribe: Get 50% off forever

Is it not obvious to people that her call for changes is a tacit admission that the policies she helped institute over the last three years have already been failures?

The problem for Harris is that the policies on the right side of the aisle, with the exception of abortion, mostly fall in line with what the American people truly want: low taxes, privacy in their social lives, secure borders, price stability, energy independence, law and order, a strong military, and peace through strength. In order to try and secure the centrist vote in between both parties, the Democrats have to try to make their radical socialist agenda look as though it touches these bases, when it clearly does not.

This means they’re going to say one thing and do another once they get into office. Hence, we a “no tax on tips” policy from a woman who cast the deciding vote on $80 billion in new IRS funding months before they introduced a program to bring in more taxes from tips. Could it be any clearer?

Don’t let the Harris administration fool you into thinking they are on the side of everyday Americans — the record they’ve posted over the last three years starkly speaks otherwise.

Now read:

- George Gammon: Explains The Yen Carry Trade Chaos

- Matt Taibbi: Kamala, Trump & The Death Of Objective Truth

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author. This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.